Thermal Paper Market Size, Share, Trends and Forecast by Technology, Application, and Region 2026-2034

Thermal Paper Market Size and Share:

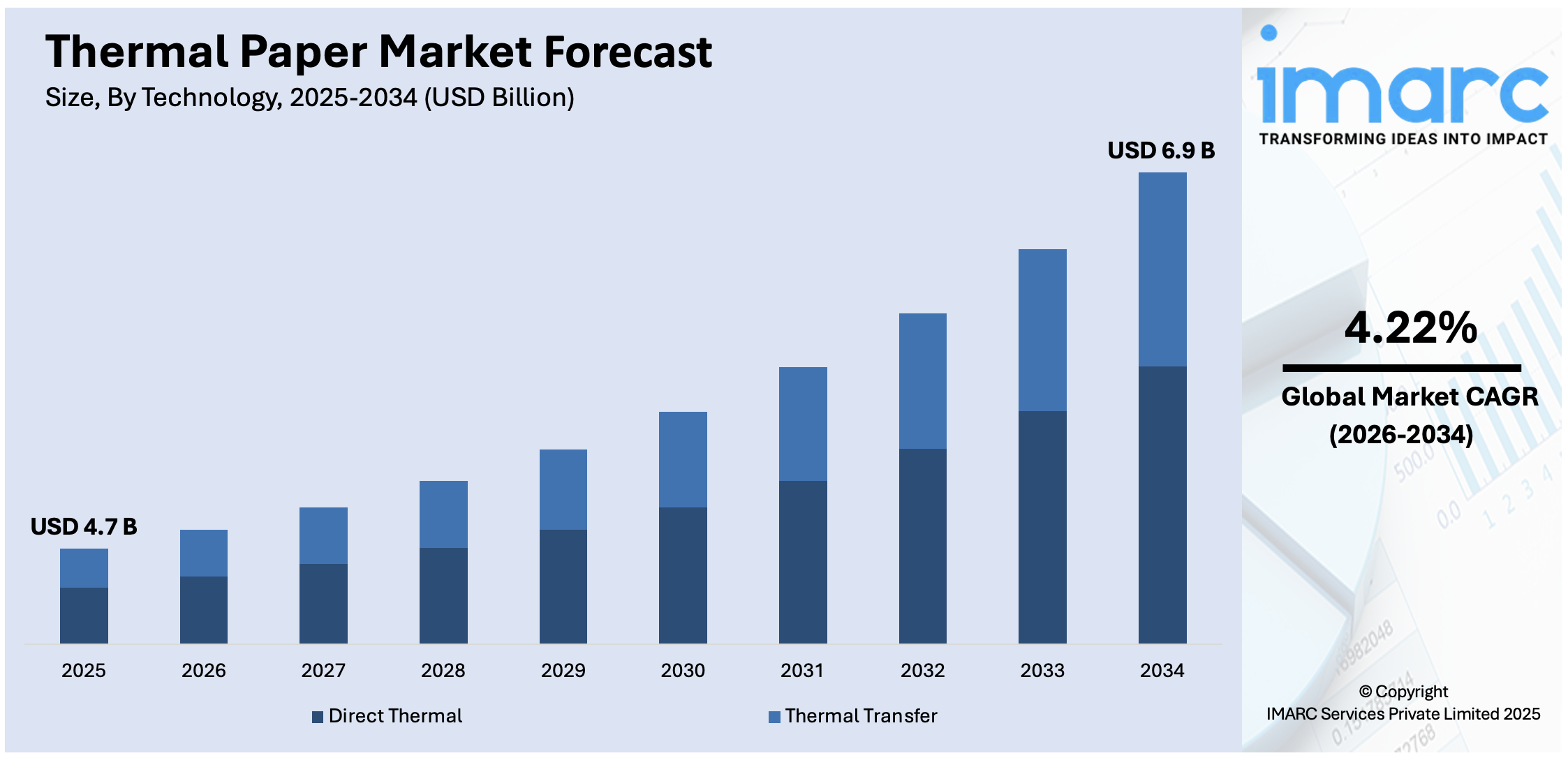

The global thermal paper market size was valued at USD 4.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.9 Billion by 2034, exhibiting a CAGR of 4.22% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 42.2% in 2025. The region leads the market due to its high retail transaction volume, rapid expansion of e-commerce, and growing demand for point-of-sale systems. Additionally, large-scale manufacturing and favorable government policies support regional production and cost efficiency.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.7 Billion |

|

Market Forecast in 2034

|

USD 6.9 Billion |

| Market Growth Rate 2026-2034 |

4.22%

|

The thermal paper market is experiencing growth due to the expansion of automated and contactless transaction systems across industries. The increasing use of self-service kiosks in the transportation, entertainment, and banking sectors is propelling the demand for high-performance thermal paper. Regulatory emphasis on digital record-keeping and traceability in logistics and food packaging is further encouraging adoption. Thermal printing's energy efficiency and compatibility with portable printers support its use in field services and mobile point-of-sale terminals. Moreover, the growing popularity of e-commerce and courier services requires consistent labeling and shipping documentation, boosting thermal paper usage. Advances in chemical coatings and longer image life also enhance product appeal across applications requiring durability and legibility. For instance, in April 2024, Lecta launched Termax TCLLX, a new phenol-free thermal paper designed for linerless label applications. Certified by Ineris, the facestock supports barcode and variable data printing, especially for logistics and retail. It offers strong moisture and grease resistance, making it suitable for food packaging, retail scales, and take-out services.

To get more information on this market Request Sample

In the United States, the thermal paper market is driven by the robust retail sector and widespread implementation of electronic payment systems. The country's emphasis on rapid checkout solutions and evolving consumer preferences for digital receipts contribute to sustained thermal paper demand. For instance, in November 2024, Canadian paper manufacturer Domtar announced the acquisition of Iconex Paper, a U.S.-based thermal paper producer, from Atlas Holdings. This acquisition reinforces Domtar’s leadership in the U.S. thermal point-of-sale (PoS) paper segment. Additionally, the healthcare industry’s reliance on printed medical records and prescription labels supports stable consumption. Growth in warehousing and fulfillment centers, due to the e-commerce surge, necessitates efficient labeling solutions, enhancing thermal paper utility. Regulatory requirements for detailed transaction logs in banking and hospitality further drive adoption. The demand for sustainable alternatives is also shaping the market direction, prompting innovation in phenol-free and recyclable thermal paper products across various sectors.

Thermal Paper Market Trends:

Thriving e-commerce sector

The rising demand for thermal paper due to the thriving e-commerce sector is propelling the growth of the market. According to reports, with over 33% of the world’s population shopping online, eCommerce is now a USD 6.8 Trillion industry and will reach the USD 8 Trillion mark by 2027. In line with this, people are increasingly preferring online shopping on account of its enhanced convenience, doorstep delivery, and wide accessibility to a variety of products. Moreover, the growing need for shipping labels, packing slips, and invoices is offering a positive market outlook. Apart from this, thermal paper offers improved speed and efficiency in generating these essential documents. Furthermore, e-commerce companies rely on thermal printing technology to ensure accurate order fulfilment and shipping while enhancing the satisfaction of buyers. Additionally, thermal paper is resistant to smudging and fading, making it a preferred choice for printing shipping labels, which need to withstand various environmental conditions during the logistics process. As a result, thermal paper provides a vital link in the supply chain of the digital shopping era, which is strengthening the market growth.

Favorable government initiatives

Governing agencies of various countries are encouraging the adoption of thermal paper to maintain environmental sustainability, which is propelling the growth of the market. In addition, traditional carbon-based paper often contains chemicals like bisphenol-A (BPA) that are harmful to the environment. Moreover, governing authorities are imposing stringent regulations and guidelines promoting the use of eco-friendly paper alternatives. They are also incentivizing the recycling of thermal paper to reduce waste and encourage responsible disposal, which is impelling the market growth. According to reports, 177 Million American adults are eco-friendly shoppers in 2024, up 7.44% year-over-year (YoY). Apart from this, thermal paper is usually free from the chemicals found in traditional paper, making it an eco-friendly option. It aligns with sustainability goals by reducing the carbon footprint associated with paper production and disposal. As a result, organizations across industries are seeking thermal paper to comply with these regulations and demonstrate their commitment to eco-friendly practices. In line with this, these regulations encourage companies to maintain sustainability goals and meet legal requirements.

Advancements in printing technology

Advancements in printing technology assist in offering improved quality, efficiency, and versatility. These technological developments encompass various aspects of the printing process, ranging from hardware to software, resulting in several notable advancements. In addition, digital innovations allow for on-demand printing with minimal setup and cost. It enables the production of high-quality prints with precision, consistency, and customization. This technology is widely used for marketing materials, personalized documents, and short-run production. Besides this, inkjet technology offers faster printing speeds, higher resolutions, and broader color gamuts. Moreover, three-dimensional (3D) printing, also known as additive manufacturing, creates 3D objects layer by layer. For instance, in the design industry, 9% were using 3D printing for aesthetic parts, more than double the average. It finds applications in various industries, including aerospace, healthcare, and automotive, enabling rapid prototyping and customization. Furthermore, ultraviolet (UV)-curable ink technology improves print durability and versatility. UV printers can print on a wide range of surfaces, including glass, metal, and plastics, making them valuable for signage, promotional products, and packaging. Besides this, offset printing reduces setup time and waste while maintaining high-quality output.

Thermal Paper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thermal paper market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on technology and application.

Analysis by Technology:

- Direct Thermal

- Thermal Transfer

Direct thermal stands as the largest component in 2025, holding around 70.0% of the market. Direct thermal technology involves a simple and cost-effective process where thermal paper is coated with a heat-sensitive layer. When heat is applied through a thermal printhead, the paper changes color, creating images, text, or barcodes without the need for ribbons or ink. This technology is commonly used for applications like receipt printing, shipping labels, and point-of-sale (POS) systems due to its ease of use and cost efficiency. It is preferred for applications where short-term print durability is sufficient, as direct thermal prints may fade over time when exposed to heat, light, or friction.

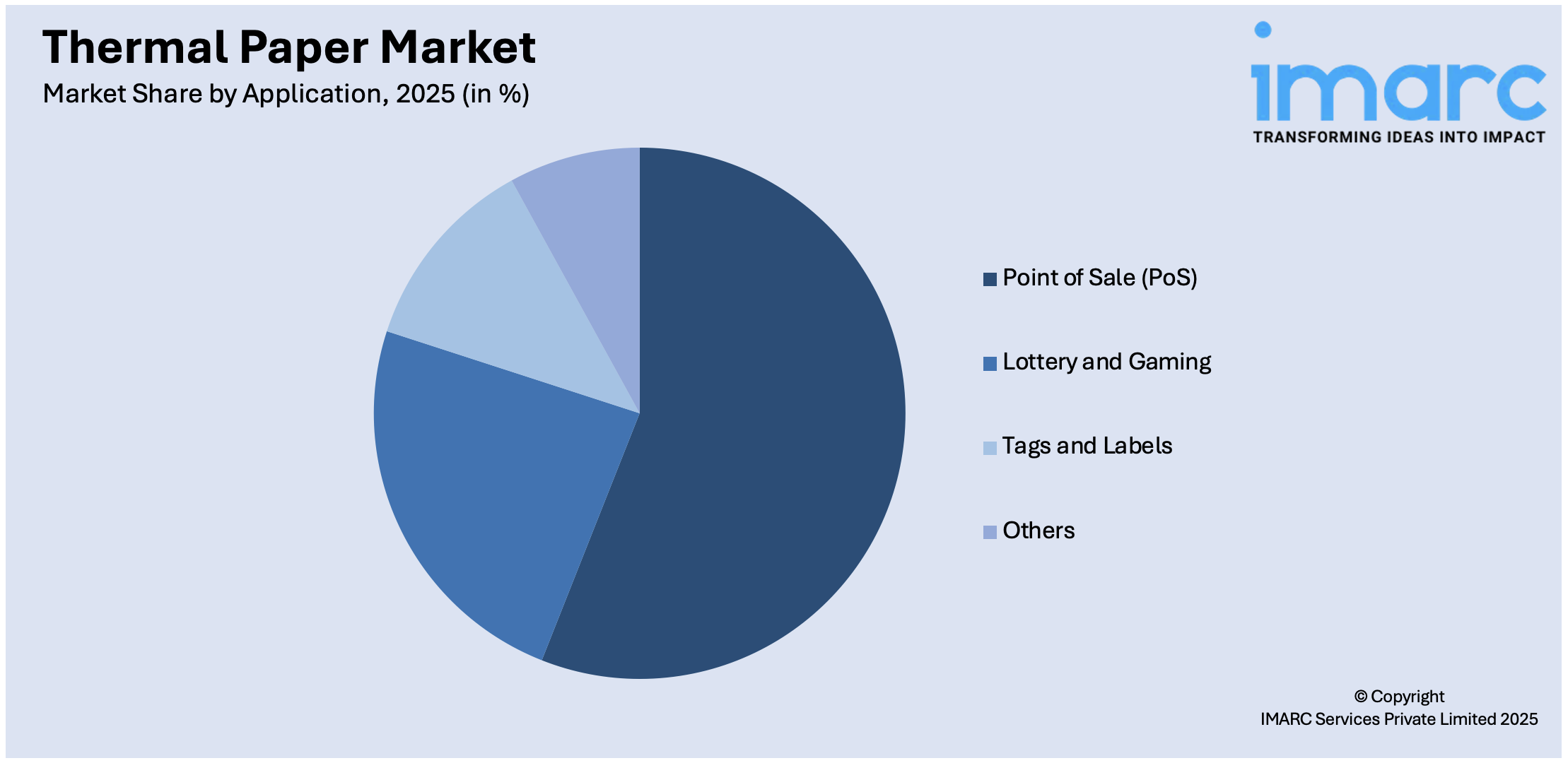

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Point of Sale (PoS)

- Lottery and Gaming

- Tags and Labels

- Others

Point of sale (PoS) leads the market with around 55.2% of market share in 2025, driven by the technology’s speed, reliability, and low operational cost. Thermal paper is extensively used in printing receipts, transaction logs, and invoices across retail chains, supermarkets, restaurants, hospitality, and service sectors. With the rapid expansion of organized retail and digital payment infrastructure in developing economies, the demand for PoS terminals is surging. This, in turn, is boosting thermal paper consumption. Additionally, businesses prioritize thermal printing for its quiet operation and minimal maintenance needs, reinforcing its dominance in transaction-intensive environments and sustaining long-term growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 42.2%. This dominance can be attributed to its strong manufacturing base, rapid urbanization, and expanding retail and logistics sectors. Countries such as China, India, Japan, and South Korea are witnessing increased deployment of Point-of-Sale (PoS) terminals across retail outlets, fueling consistent demand for thermal receipts. The rise in e-commerce transactions and widespread adoption of ATMs, billing counters, and ticketing machines further support market growth. Additionally, lower production costs, availability of raw materials, and favorable trade policies make the region a global hub for thermal paper production and export. Growing digital payments, organized retail penetration, and governmental push toward cashless economies also contribute to the sustained demand, positioning Asia Pacific as the dominant player in the global thermal paper market. For instance, industry reports highlight that as of 2024, digital payments in the Asia-Pacific region have reached a transaction value of USD 4.37 Trillion. Digital wallets dominate the payment landscape, accounting for 69% of e-commerce transactions and 44% of point-of-sale (POS) payments. By 2025, these shares are projected to rise to 75% for e-commerce and over 50% for POS.

Key Regional Takeaways:

United States Thermal Paper Market Analysis

In 2024, United States hold a market share of around 87.8% in North America. United States experiences increasing thermal paper adoption as the growing need for shipping labels, packing slips, and invoices drives demand in the expanding e-commerce sector. For instance, in 2024, US eCommerce sales increased 2.8% from the previous quarter and a 7.2% increase compared to the same quarter last year. Rising online retail transactions contribute to higher consumption of direct thermal printing solutions, ensuring efficient order processing and tracking. Businesses emphasize cost-effective and high-speed printing technologies to streamline logistics, enhancing operational efficiency. Expanding warehousing networks and fulfilment centres further propel the requirement for thermal receipts and labels. Consumer preference for seamless order fulfilment accelerates reliance on durable and smudge-resistant paper, supporting supply chain continuity. The surge in small and medium enterprises leveraging online marketplaces amplifies label printing needs. Technological advancements in thermal printing improve print quality and longevity, reinforcing widespread industry adoption. Market participants focus on sustainable production practices to align with evolving environmental standards, shaping the future of direct thermal paper applications across various business operations.

Asia Pacific Thermal Paper Market Analysis

Asia-Pacific is witnessing growing thermal paper adoption due to growing Point of Sale (PoS) usage driven by the expanding middle class. For instance, the middle class now represents 31% of India’s population. It is projected to hit 38% by 2031 and 60% by 2047. The increasing consumer spending and rapid urbanization have fuelled the demand for seamless and efficient retail transactions. As businesses upgrade their payment infrastructures, PoS systems requiring thermal paper have become indispensable in supermarkets, convenience stores, and hospitality establishments. The shift toward digital payment solutions, integrated with PoS terminals, has further propelled demand for high-quality thermal receipts. The surge in small and medium-sized enterprises adopting modern payment methods has intensified reliance on thermal paper solutions. Furthermore, government initiatives promoting digital transactions contribute to increased PoS installations, necessitating a steady supply of thermal paper. With businesses focusing on enhancing customer experience through faster and more reliable billing processes, the expansion of thermal printing technology continues to shape the retail and service sectors across the region.

Europe Thermal Paper Market Analysis

Europe is experiencing rising thermal paper adoption due to growing governing authorities imposing stringent regulations and guidelines promoting the use of eco-friendly paper alternatives to reduce carbon emissions. For instance, the EU has a set target for 2030 of a 55 % net reduction in greenhouse gas emissions. As environmental concerns intensify, industries are transitioning toward sustainable and BPA-free thermal paper to align with regulatory frameworks. Businesses are prioritizing compliance with mandates promoting recyclable and biodegradable paper solutions, driving innovation in thermal printing technologies. The push for reduced environmental impact has led manufacturers to develop chemical-free coatings, ensuring safer and more sustainable printing options. Growing awareness among enterprises about the advantages of eco-conscious thermal paper further accelerates its market penetration. Moreover, the increasing emphasis on corporate sustainability goals has fueled demand for responsible thermal paper sourcing.

Latin America Thermal Paper Market Analysis

Latin America is witnessing increasing thermal paper adoption due to growing Lottery and Gaming activities fuelled by rising disposable income. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. The expansion of gaming establishments and lottery operators has driven demand for high-performance thermal printing solutions to ensure seamless ticket issuance and transaction recording. With consumers allocating more discretionary income toward gaming and entertainment, the reliance on durable, high-speed thermal paper has intensified. Businesses within the sector prioritize efficient and cost-effective printing technologies to enhance operational efficiency.

Middle East and Africa Thermal Paper Market Analysis

Middle East and Africa is experiencing a surge in thermal paper adoption due to growing supermarkets and hypermarkets seeking efficient and durable receipt printing solutions. For instance, BinDawood Holdings’ plan to open 10 stores between 2022 and 2027, in addition to opening five to six stores a year until end of 2024; Lulu Group plans to open 21 new hypermarkets and express stores. The expansion of retail infrastructure, driven by rising consumer demand, has increased dependence on reliable PoS systems that utilize thermal paper. Supermarkets and hypermarkets prioritize high-speed and smudge-resistant printing technologies to ensure seamless transactions. The transition toward cashless payments and digital receipt issuance has further reinforced the need for high-quality thermal paper solutions.

Competitive Landscape:

The thermal paper market features a moderately consolidated competitive landscape with several key global and regional players. Major companies dominate through extensive distribution networks, advanced R&D capabilities, and diversified product portfolios. These firms focus on product innovation, eco-friendly formulations (e.g., BPA-free thermal paper), and strategic mergers or capacity expansions to gain market share. Meanwhile, regional players from Asia Pacific and Europe are intensifying competition by offering cost-effective solutions and localized supply chains. Price competitiveness, environmental compliance, and quality standards are critical differentiators. The rise in demand from sectors like retail, logistics, and banking is pushing companies to enhance production efficiency and ensure consistent supply. For instance, in October 2024, Appvion launched Alpha® 185 E, a phenol-free, non-top-coated direct thermal label facestock under its EarthChem™ sustainability portfolio. Designed for distribution, logistics, and cross-docking, it offers enhanced resistance to heat, water, and alcohol, and can be recycled with packaging materials without label removal. Appvion's EarthChem™ line includes top-coated and non-top-coated eco-friendly thermal products for varied applications.

The report provides a comprehensive analysis of the competitive landscape in the thermal paper market with detailed profiles of all major companies, including:

- Appvion Operations Inc

- Gold Huasheng Paper Co. Ltd.

- Hansol Paper Ltd.

- Henan JiangHE Paper CO. LTD

- Jujo Thermal Ltd. (Nippon Paper Industries Co. Ltd)

- Koehler Group

- Lecta Group

- Mitsubishi Paper Mills Limited

- Nakagawa Manufacturing Inc.

- Oji Holdings Corporation

- Ricoh Company Ltd.

- Thermal Solutions International Inc.

Latest News and Developments:

- July 2025: Wampolet announced it will showcase its expanded thermal product solutions portfolio at Labelexpo Europe 2025. The lineup includes thermal papers, BOPP films, PSA materials, and specialty in-mold labels designed for various printing and labeling applications.

- May 2025: Ricoh Industrie France announced it will showcase a world-first tree-free, top-coated thermal paper made from sugar cane agricultural residue at Labelexpo Europe 2025. The paper is phenol-free and certified for home compostability, highlighting Ricoh’s commitment to sustainability. This innovation aims to reduce environmental impact through eco-friendly materials and processes.

- May 2025: NYSCC announced its participation in the 2025 Paper Expo China, held from June 5–7 in Guangzhou. Specializing in thermal chemical materials, NYSCC will showcase its advanced thermal paper and BOPP coatings. The company aims to attract international brands and buyers from China and Southeast Asia.

- April 2025: Beontag launched Phenol-Free Direct Thermal Papers in the US, eliminating harmful Bisphenol-A and Bisphenol-S from their labeling materials. These safer, high-performance facestocks support industries like food packaging and logistics while ensuring compliance with evolving US regulations. The move reinforces Beontag’s commitment to sustainable and health-conscious labeling solutions.

Thermal Paper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Direct Thermal, Thermal Transfer |

| Applications Covered | Point of Sale (PoS), Lottery and Gaming, Tags and Labels, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Appvion Operations Inc, Gold Huasheng Paper Co. Ltd., Hansol Paper Ltd., Henan JiangHE Paper CO. LTD, Jujo Thermal Ltd. (Nippon Paper Industries Co. Ltd), Koehler Group, Lecta Group, Mitsubishi Paper Mills Limited, Nakagawa Manufacturing Inc., Oji Holdings Corporation, Ricoh Company Ltd., Thermal Solutions International Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thermal paper market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global thermal paper market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thermal paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The thermal paper market was valued at USD 4.7 Billion in 2025.

The thermal paper market is projected to exhibit a CAGR of 4.22% during 2026-2034, reaching a value of USD 6.9 Billion by 2034.

Key factors driving the thermal paper market include increasing demand for point-of-sale (POS) applications, rapid growth in retail and logistics sectors, rising adoption of linerless labels, and expansion of e-commerce. Additionally, technological advancements in phenol-free and eco-friendly thermal papers are supporting long-term market growth.

Asia Pacific currently dominates the thermal paper market, accounting for a share of 42.2% in 2025. This dominance is driven by expanding retail infrastructure, rapid industrialization, growing e-commerce, and rising demand for efficient POS and logistics systems.

Some of the major players in the thermal paper market include Appvion Operations Inc, Gold Huasheng Paper Co. Ltd., Hansol Paper Ltd., Henan JiangHE Paper CO. LTD, Jujo Thermal Ltd. (Nippon Paper Industries Co. Ltd), Koehler Group, Lecta Group, Mitsubishi Paper Mills Limited, Nakagawa Manufacturing Inc., Oji Holdings Corporation, Ricoh Company Ltd., Thermal Solutions International Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)