Titanium Alloy Market Size, Share, Trends and Forecast by Microstructure, End-Use Industry, and Region, 2025-2033

Titanium Alloy Market Overview:

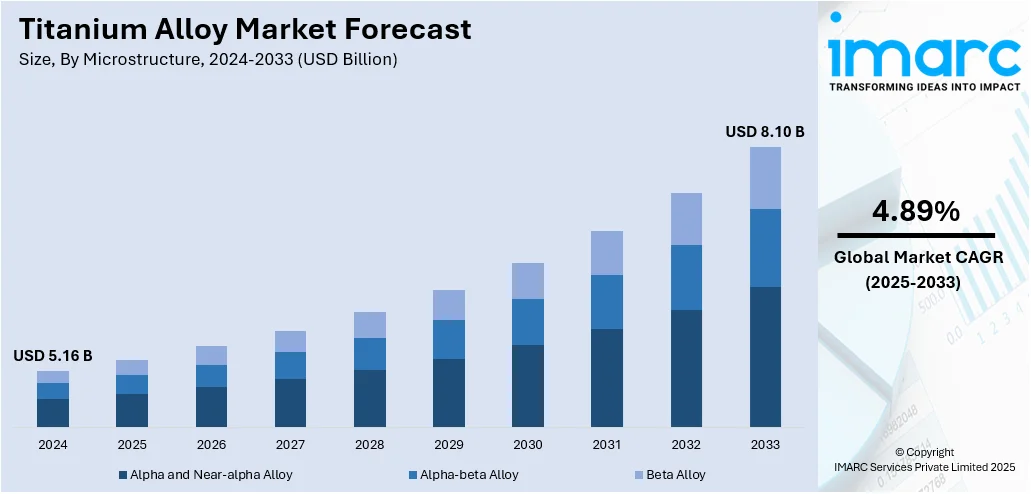

The global titanium alloy market size was valued at USD 5.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.10 Billion by 2033, exhibiting a CAGR of 4.89% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 43.0% in 2024. The market is expanding due to increasing use of lightweight, high-strength materials in aerospace and automotive industries. Growing demand for corrosion-resistant alloys in medical and industrial applications continues to support titanium alloy market share across both commercial and defense manufacturing segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.16 Billion |

| Market Forecast in 2033 | USD 8.10 Billion |

| Market Growth Rate 2025-2033 | 4.89% |

Titanium alloys are commonly used in joint replacements, dental implants, spinal fixation devices, and cardiovascular implants because they are non-toxic and perform well within the human body. Their resistance to bodily fluids and minimal risk of rejection make them ideal for long-term use. As populations age and demand for advanced healthcare solutions rises, the volume of surgeries involving titanium-based implants is steadily increasing. The medical sector is becoming an important contributor to titanium alloy market growth, mainly due to the rising need for durable, biocompatible materials in surgical and orthopedic procedures. Moreover, technological advancements in imaging, 3D modeling, and surgical precision have enabled more personalized implants, many of which rely on titanium alloys. The growing adoption of additive manufacturing in medical applications also supports custom, patient-specific devices, which improve surgical outcomes and recovery times.

To get more information on this market, Request Sample

In the United States, titanium alloys are being increasingly adopted in industrial machinery and equipment due to their strength, corrosion resistance, and ability to withstand high temperatures. Key industries such as chemical processing, oil refining, and power generation are prioritizing materials that reduce maintenance costs and enhance operational safety. Titanium alloys are now more commonly used in components like condensers, heat exchangers, and piping systems that demand consistent performance under stress. In the later part of this trend, US based manufacturers are expanding domestic production capabilities to reduce reliance on imports and strengthen supply chain resilience. This shift is supported by rising federal and state-level investments in infrastructure modernization and energy development, which are fueling demand for durable, high-performance materials.

Titanium Alloy Market Trends:

Growth of Recycling Practices

Recycling is becoming a strong focus within the titanium alloy market, as industries move toward more resource-efficient and environmentally responsible operations. Recovering titanium scrap from both production waste and used components helps manufacturers reduce dependence on primary raw materials. For instance, in July 2024, IperionX Limited, through its subsidiary ELG Utica Alloys, partnered with Aperam to convert titanium scrap from electronic products into usable titanium alloys. The goal of processing up to 12 metric tons of scrap demonstrates a broader industry effort to lower carbon output and improve local sourcing for sectors such as aerospace and electric mobility. These efforts reduce mining-related emissions and preserve limited natural reserves. Advanced recycling methods are also improving scrap quality and allowing for its use in high-specification applications. Strengthening recycling partnerships enhances supply continuity and cost control, aligning with global sustainability targets. Companies benefit not just environmentally but economically, with lower input costs and improved compliance with emissions and waste management policies. As regulations tighten and sustainability pressures grow, the focus on recycled titanium is expected to intensify, reshaping how the market meets material demand through circular practices.

Advancements in Alloy Design

Titanium alloy market trends is advancing rapidly to meet evolving needs in sectors requiring high-performance materials. Companies are prioritizing research to engineer alloys with improved toughness, workability, and thermal stability. A notable example came in 2025, when ATI Inc. launched a new facility in South Carolina for producing aerospace-grade titanium alloy sheets. For example, in August 2024, a joint initiative between MIT and ATI Specialty Materials led to the creation of an alloy designed to overcome the common trade-off between strength and ductility. This was achieved by modifying alloy chemistry and refining processing steps. One such method, cross-rolling, allowed for consistent deformation, improving structural reliability. These developments are expanding the scope of titanium alloys in aerospace and biomedical sectors, where precision and performance are critical. Enhanced temperature resistance is another key focus, ensuring materials remain stable in extreme environments such as jet engines and industrial turbines. Improved machinability is helping manufacturers lower production time and cost. Tailored alloys are also being created for specialized applications like surgical implants and high-temperature engine parts. These innovations reflect a growing emphasis on performance customization, enabling titanium alloys to better serve emerging technical requirements and remain competitive in demanding industries.

Expansion in Aerospace and Defense

Titanium alloys are seeing strong adoption in the aerospace and defense sectors due to their light weight, high strength, and corrosion resistance. These attributes are essential for aircraft and spacecraft, where performance and weight efficiency directly influence fuel use, speed, and durability. Countries are increasing their defense budgets, with China projecting USD 293 Billion in military spending for 2025, up 7.2% from the previous year. Such investment signals rising demand for high-performance materials in fighter jets, space vehicles, and defense equipment. Titanium’s resistance to heat and fatigue allows it to perform reliably in critical components such as airframes, engine parts, and missile structures. This has led to a sharp rise in alloy use across global defense programs and commercial aviation projects. Manufacturers are focused on alloy variants that can tolerate stress while remaining lightweight. This demand is supporting production growth and new material development. The titanium alloy market share is benefiting from this trend, as aerospace and defense contractors increasingly rely on materials that offer performance without compromising safety or compliance standards. As global security needs evolve and aviation technology advances, the role of titanium alloys in these sectors is expected to grow steadily.

Titanium Alloy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global titanium alloy market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on microstructure and end-use industry.

Analysis by Microstructure:

- Alpha and Near-alpha Alloy

- Alpha-beta Alloy

- Beta Alloy

As per the titanium alloy market outlook, in 2024, alpha and near-alpha alloy segment led the market accounted for the market share of 38.0%, driven by the segment’s excellent high-temperature performance, oxidation resistance, and superior weldability. These characteristics make alpha and near-alpha alloys well-suited for critical applications in aerospace engines, gas turbines, and chemical processing systems, where thermal stability and long service life are essential. Their low density and favorable strength-to-weight ratio further strengthen demand, especially in applications where minimizing structural weight is critical. These alloys also offer enhanced corrosion resistance, particularly in marine and offshore environments. Growing investments in next-generation aircraft and energy systems have reinforced the need for materials that can reliably operate under extreme conditions. Additionally, manufacturers prefer alpha and near-alpha alloys for their ease of fabrication and formability during complex component production, contributing to faster manufacturing cycles and cost-efficiency.

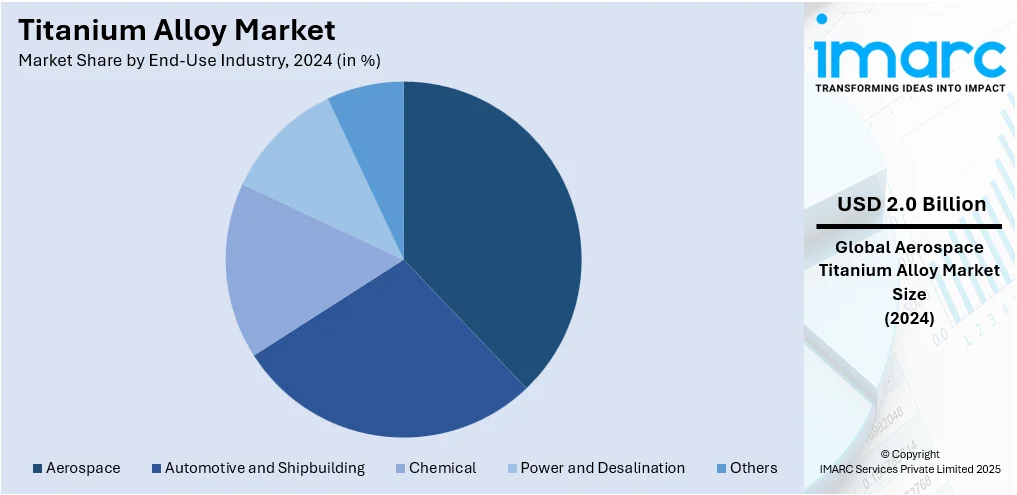

Analysis by End-Use Industry:

- Aerospace

- Automotive and Shipbuilding

- Chemical

- Power and Desalination

- Others

Based on the titanium alloy market forecast, in 2024, the aerospace segment led the market accounted for the market share of 37.8%. The dominance of this segment stems from the increasing use of titanium alloys in both commercial and defense aviation. These alloys are prized for their lightweight, high strength, and fatigue resistance, essential for reducing fuel consumption and enhancing aircraft performance. Titanium alloys are widely used in airframes, landing gear, engine components, and structural fasteners. The ongoing fleet modernization programs across North America, Europe, and Asia, coupled with growing passenger air traffic, have driven aircraft production, further boosting titanium alloy consumption. Defense budgets have also grown, particularly in Asia-Pacific and the Middle East, leading to expanded procurement of advanced military aircraft, which extensively utilize titanium parts. With sustainability becoming a focus in aerospace, titanium’s recyclability and lower lifecycle emissions compared to some alternatives make it a preferred material, strengthening its market position.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia-Pacific led the titanium alloy market accounted for the market share of 43.0%, driven by expanding aerospace and defense activities, growing industrial production, and rising investments in infrastructure and medical technologies. China and India, in particular, are increasing aircraft manufacturing capabilities and building strong domestic supply chains for titanium components. Regional demand is also supported by a surge in automotive lightweighting trends and the construction of chemical processing plants that require corrosion-resistant materials. Titanium alloys are increasingly used in orthopedic implants and surgical instruments, aligning with the region's growing healthcare infrastructure. Government-backed programs to localize production of strategic materials, coupled with rising foreign direct investment in advanced manufacturing, have stimulated titanium alloy demand. The availability of raw materials like ilmenite and rutile, along with the presence of key producers, further strengthens Asia-Pacific’s position in the global supply chain. These factors collectively fuel sustained growth in the region’s titanium alloy market.

Key Regional Takeaways:

United States Titanium Alloy Market Analysis

In 2024, the United States accounted for 87.50% of the titanium alloy market in North America, driven by multiple factors. United States is experiencing a significant surge in titanium alloy adoption, driven by growing investment in aerospace and defense. For instance, as per reports, the United States remains the largest military spender, allocating USD 997 Billion, which accounts for 37% of the global military budget. Enhanced budget allocations toward advanced military technologies and next-generation aircraft programs are accelerating demand for high-performance materials. Titanium alloy’s superior strength-to-weight ratio and corrosion resistance make it highly suitable for jet engines, fuselage components, and structural parts in defense equipment. Expanding contracts from government defense bodies and private aerospace manufacturers are fuelling usage. Additionally, the trend toward lightweight military hardware is encouraging titanium alloy applications across multiple platforms. Continued focus on technological superiority and material innovation in the aerospace and defense sectors is expected to intensify titanium alloy utilization.

Asia Pacific Titanium Alloy Market Analysis

Asia-Pacific is witnessing rising titanium alloy usage due to expansion in the chemical sector. According to India Brand Equity Foundation, an investment of Rs. 8 lakh crore (USUSD 107.38 Billion) is estimated in the Indian chemicals and petrochemicals sector by 2025. Growing production capacities and infrastructure investments across industrial chemicals, petrochemicals, and specialty chemicals are propelling demand for high-performance materials like titanium alloy. Its exceptional corrosion resistance, especially in harsh chemical environments, enhances equipment longevity, reducing maintenance costs. Reactors, heat exchangers, and pressure vessels increasingly rely on titanium alloy to support process reliability and safety. As regional chemical manufacturers expand to meet both domestic and global demand, titanium alloy becomes integral to plant design. Rapid industrialization, supported by favourable policies and investment incentives, is further amplifying adoption.

Europe Titanium Alloy Market Analysis

Europe is accelerating its titanium alloy demand with a growing focus on recycling initiatives. For instance, Europe’s push for better access to resources like titanium was already part of the bloc’s strategic vision in legislation like the EU Critical Raw Materials Act from 2022, which set a target for 25% of titanium demand to be met via recycling by 2030. With stricter environmental regulations and circular economy targets, manufacturers are turning to recyclable and sustainable materials. Titanium alloy offers high recyclability without compromising performance, making it attractive for industries prioritizing material recovery and reduced carbon footprints. Aerospace, automotive, and industrial sectors in Europe are incorporating recycled titanium alloy into new components to cut emissions and promote eco-conscious production. Investments in advanced recycling technologies and closed-loop supply chains are further facilitating the alloy’s reuse.

Latin America Titanium Alloy Market Analysis

Latin America is increasing titanium alloy consumption due to growing power generation driven by urbanization. For instance, Brazil is on a mission to significantly expand its solar energy capacity by 2025, aiming to add an impressive 19.2 gigawatts (GW) of new centralized solar power. This strategic initiative is set to elevate solar energy’s contribution within Brazil’s energy mix, increasing from 4.9% in 2025 to a notable 10.7% by 2034. Infrastructure expansion and rising electricity demand in urban areas are prompting investments in modern power systems where titanium alloy plays a vital role. Its strength and resistance to high temperatures and corrosion make it ideal for turbines and heat exchangers used in power generation.

Middle East and Africa Titanium Alloy Market Analysis

Middle East and Africa is witnessing heightened titanium alloy usage due to growing urban population and rising demand in electric and autonomous vehicles. For instance, the UAE’s EV market is booming, surging 62.2% in Q1 of 2025. Expanding city populations are driving the need for advanced transportation technologies. Titanium alloy’s lightweight and durable characteristics make it suitable for electric and autonomous vehicle components. With increasing mobility demands and focus on efficient, long-lasting materials, the region is progressively integrating titanium alloy into automotive production to support innovation and sustainable transport goals.

Competitive Landscape:

Companies in the titanium alloy market are adopting advanced strategies to meet changing technological requirements and manage complex production workflows. They are implementing automation in manufacturing and quality control to reduce manual intervention and ensure uniformity across alloy grades and applications. Integration with digital monitoring, testing, and data analysis tools supports streamlined operations from material design to final component delivery. Real-time feedback mechanisms allow for swift process adjustments based on performance metrics. These efforts improve production efficiency, ensure material consistency, and support data-backed decisions, helping manufacturers avoid performance variability and reduce delays across aerospace, automotive, and industrial sectors.

The report provides a comprehensive analysis of the competitive landscape in the titanium alloy market with detailed profiles of all major companies, including:

- Altemp Alloys

- ATI Inc.

- Carpenter Technology Corporation

- Daido Steel Co., Ltd.

- Haynes International

- Kobe Steel Ltd.

- Mishra Dhatu Nigam Limited

- NeoNickel

- Nippon Steel Corporation

- PJSC VSMPO-AVISMA Corporation

- Precision Castparts Corp.

- thyssenkrupp Materials (UK) Ltd

- United Titanium, Inc.

Latest News and Developments:

- May 2025: India’s largest titanium alloy and superalloy plant, operated by Aerolloy Technologies Ltd, was inaugurated in Lucknow by the defence minister and Uttar Pradesh CM, marking a major step in domestic aerospace-grade titanium alloy production. The facility, with a 6,000-tonne annual capacity, also saw foundation stones laid for seven additional strategic aerospace material units.

- April 2025: Hermith GmbH optimised the production of titanium alloy Ti-6Al-4V wire to enhance its quality for Additive Manufacturing applications. The company, having become one of Europe’s top titanium alloy producers, focused on improving feedstock performance.

- February 2025: MIDHANI showcased its advanced materials at Aero India 2025 in Bengaluru, underscoring its contributions to India's defence and aerospace sectors. It unveiled three new products—High-Temperature Nickel Alloy billets, Alloy S152 forged bars, and Superni 41 plates—designed for next-generation aircraft and space applications. The company also emphasized its expertise in high-strength titanium alloys, which had played a vital role in Tejas fighter jets and ISRO's missions.

- January 2025: Aerolloy Technologies, a PTC Industries subsidiary, became India’s first private firm to commission a Vacuum Arc Remelting furnace for aerospace-grade titanium alloy ingots. The titanium alloy facility in Lucknow positioned India among a select group of nations with advanced aerospace metallurgical capabilities.

Titanium Alloy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Microstructures Covered | Alpha and Near-alpha Alloy, Alpha-beta Alloy, Beta Alloy |

| End-Use Industries Covered | Aerospace, Automotive and Shipbuilding, Chemical, Power and Desalination, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altemp Alloys, ATI Inc., Carpenter Technology Corporation, Daido Steel Co., Ltd., Haynes International, Kobe Steel Ltd., Mishra Dhatu Nigam Limited, NeoNickel, Nippon Steel Corporation, PJSC VSMPO-AVISMA Corporation, Precision Castparts Corp., thyssenkrupp Materials (UK) Ltd, United Titanium, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the titanium alloy market from 2019-2033.

- The titanium alloy market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the titanium alloy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The titanium alloy market was valued at USD 5.16 Billion in 2024.

The titanium alloy market is projected to exhibit a CAGR of 4.89% during 2025-2033, reaching a value of USD 8.10 Billion by 2033.

The titanium alloy market is driven by rising aerospace and defense demand, lightweight automotive components, increasing use in medical implants, and industrial applications requiring corrosion resistance and high strength-to-weight ratios. Technological advancements and expanding 3D printing adoption further support market growth.

In 2024, Asia-Pacific dominated the titanium alloy market, accounted for the market share of 43.0%, driven by growing aerospace manufacturing in China and India, rising infrastructure investments, strong automotive production, and expanding healthcare applications. Local mining activities and government support also contributed to regional growth.

Some of the major players in the global titanium alloy market include Altemp Alloys, ATI Inc., Carpenter Technology Corporation, Daido Steel Co., Ltd., Haynes International, Kobe Steel Ltd., Mishra Dhatu Nigam Limited, NeoNickel, Nippon Steel Corporation, PJSC VSMPO-AVISMA Corporation, Precision Castparts Corp., thyssenkrupp Materials (UK) Ltd, United Titanium, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)