Global Toluene Market Size Anticipated to Reach USD 44.7 Billion by 2033 - IMARC Group

Global Toluene Market Statistics, Outlook and Regional Analysis 2025-2033

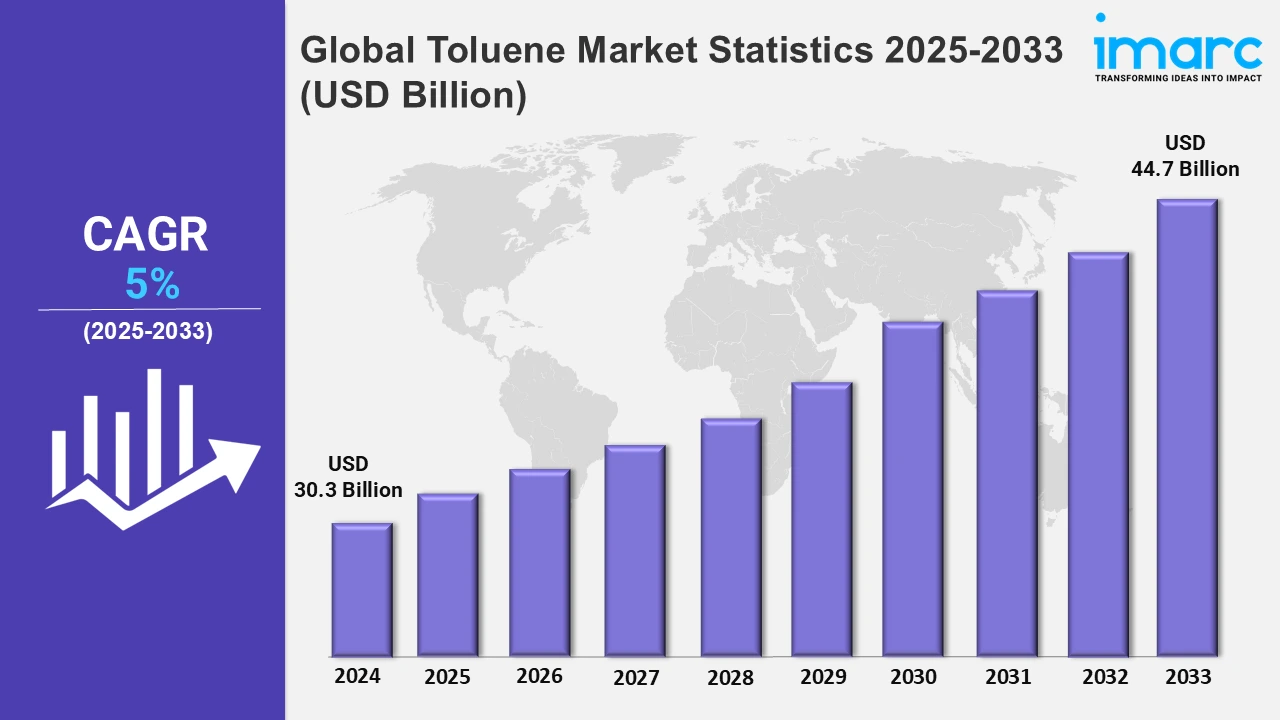

The global toluene market size was valued at USD 30.3 Billion in 2024, and it is expected to reach USD 44.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing demand for toluene as a feedstock in the production of benzene, xylene, and other aromatics is a primary driver of market growth. Toluene is used extensively in petrochemical processes to synthesize these derivatives, which are critical in the manufacture of plastics, resins, and synthetic fibers. For example, in 2024, BioBTX secured €80M to establish a renewable aromatics plant in the Netherlands. The facility will convert plastic waste and biomass into sustainable aromatics, reducing carbon emissions, decreasing reliance on fossil fuels, and advancing circular chemistry. That, in addition to lowering dependence on fossil fuel, supports the shift toward a circular economy. As the demand for advanced materials continues to grow in emerging markets, renewable aromatics can then be supplied to meet the industrial demand with significantly reduced environmental impacts. With the increase in end-user industries, especially in emerging economies, the toluene market is said to move forward at a steady rate.

Advances in toluene processing technologies, such as catalytic reforming and toluene disproportionation, are significantly driving efficiency and cost-effectiveness in production. For example, Covestro is investing a substantial mid-to-high double-digit million euro sum to modernize its Dormagen TDI plant by 2025, enhancing sustainability and competitiveness in flexible foam production across Europe. Such innovations will maximize the yield in production and the quality of the product, fulfilling global demand at high purity standards for toluene. Additionally, research for bio-solvents based on toluene as well as environmentally friendly alternatives now provides new avenues in market development. Similar trends are picking up speed as industries feel the pressure to comply with regulatory requirements and reduce their environmental footprint. The development and integration of advanced refining technologies into existing production facilities are also pushing toluene to new versatility and sustainability peaks across applications.

Global Toluene Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, increasing demand for toluene in petrochemical applications, and expanding automotive and construction industries.

Asia-Pacific Toluene Market Trends:

Asia-Pacific toluene market is growing at an immense rate as there is huge industrialization and urbanization. Additionally, its chemical sector is also expanding day by day. China, India, and South Korea take the highest share in the market because of its growing demand from end-use industries of paints, coatings, adhesives, and petrochemicals. For example, in 2024, Honeywell announced ENEOS will develop the world's first commercial Liquid Organic Hydrogen Carrier project using Honeywell's Toluene Hydrogenation process to convert hydrogen into methylcyclohexane (MCH), compatible with existing infrastructure. Toluene is used as feedstock in the production of benzene and xylene, the production of which has been on the rise. The automotive and construction industries in the region are also growing and thus increasing the demand.

North America Toluene Market Trends:

The North American toluene market is driven by demand from the automotive, construction, and chemical sectors. Toluene's use as a feedstock for benzene and xylene supports plastics, resins, and coatings production. The region emphasizes sustainability, integrating renewable feedstocks and advanced refining techniques. The U.S. dominates, supported by robust industrial activity and advancements in petrochemical processes.

Europe Toluene Market Trends:

The European toluene market is influenced by stringent environmental regulations and demand for sustainable materials. Key applications include adhesives, coatings, and petrochemicals. The focus on renewable feedstocks and circular chemistry is growing. Germany, the U.K., and France lead in toluene consumption, driven by the automotive and construction industries, while overcapacity challenges and energy costs shape market dynamics.

Latin America Toluene Market Trends:

Latin America's toluene market benefits from increasing industrialization and infrastructure development. The petrochemical industry drives demand, particularly in Brazil and Mexico, where construction and automotive sectors are expanding. The region is adopting sustainable production practices and emphasizing efficiency to compete globally. Rising interest in renewable feedstocks signals future opportunities in a growing, yet competitive market.

Middle East and Africa Toluene Market Trends:

The Middle East and Africa toluene market leverages abundant petrochemical resources, with applications in paints, coatings, and adhesives. Demand is spurred by construction and automotive growth, especially in the UAE and Saudi Arabia. The region is investing in advanced production technologies and exploring renewable options to align with global sustainability goals while maintaining cost advantages.

Top Companies Leading in the Toluene Industry

Some of the leading toluene market companies include Exxon Mobil Corporation, SK Global, British Petroleum, Versalis, Compañia Española De Petroleos Sau, among many others. For instance, in 2024, Versalis, Eni's chemical subsidiary, completed the acquisition of 100% of Tecnofilm S.p.A., a compounding specialist, after receiving approval from relevant authorities, marking a strategic expansion in advanced materials.

Global Toluene Market Segmentation Coverage

- On the basis of the technology, the market has been categorized into reformation process, pygas process, coke/coal process, and styrene process, wherein reformation process represents the leading segment due to its efficiency in producing high-purity toluene and widespread adoption in the petrochemical industry. Its versatility and cost-effectiveness make it a preferred choice for producing benzene, xylene, and other derivatives.

- Based on the application, the market is classified into gasoline, STDP/TPX, solvents, trans alkylation (TA), hydrodealkylation, toluene diisocyanate (TDI), toluene disproportionation (TDP), and others., amongst which gasoline dominates the market due to its extensive use as a blending component to enhance octane ratings, supporting the growing transportation sector and fueling global demand.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 30.3 Billion |

| Market Forecast in 2033 | USD 44.7 Billion |

| Market Growth Rate 2025-2033 | 5% |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Reformation Process, Pygas Process, Coke/Coal Process, Styrene Process |

| Applications Covered | Gasoline, STDP/TPX, Solvents, Trans Alkylation (TA), Hydrodealkylation, Toluene Diisocyanate (TDI), Toluene Disproportionation (TDP), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Exxon Mobil Corporation, SK Global, British Petroleum, Versalis, Compañia Española De Petroleos Sau, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Toluene Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)