Tortilla Chips Market Size, Share, Trends and Forecast by Nature, Type, Distribution Channel, and Region, 2025-2033

Tortilla Chips Market Size and Share:

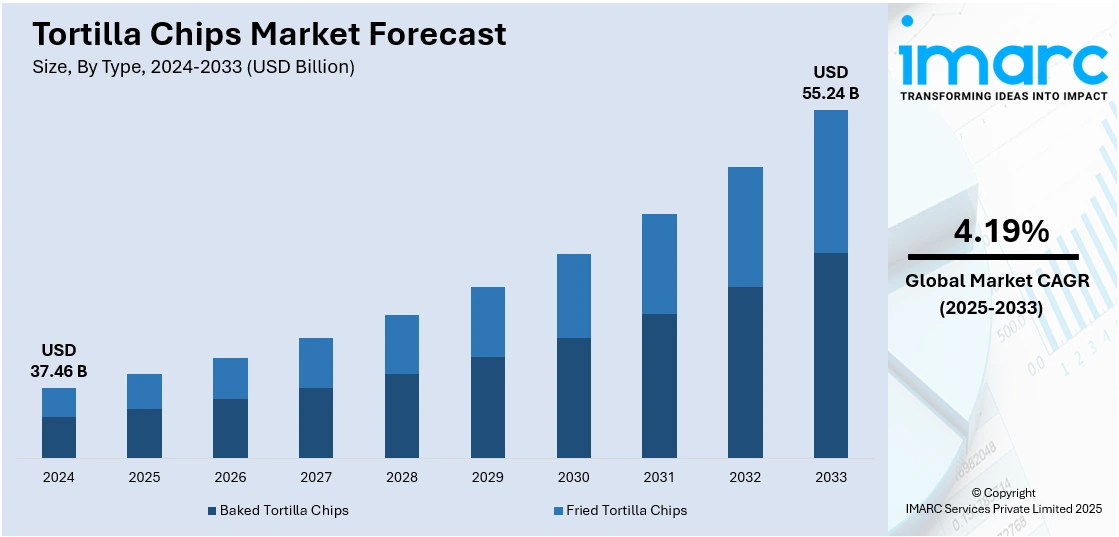

The global tortilla chips market size was valued at USD 37.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.24 Billion by 2033, exhibiting a CAGR of 4.19% from 2025-2033. North America currently dominates the market, holding a market share of 41.6% in 2024. The market is experiencing steady growth, driven by growing demand for convenient snacks, increasing popularity of Mexican cuisine, and rising health awareness leading to preferences for gluten-free and non-GMO options. Flavor innovations and the availability of multigrain and organic varieties, along with expanding distribution through online and retail channels, further supports the global tortilla chips market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.46 Billion |

| Market Forecast in 2033 | USD 55.24 Billion |

| Market Growth Rate 2025-2033 | 4.19% |

Key drivers in the tortilla chips market include the rising consumer demand for convenient and ready-to-eat snacks, growing preference for corn-based and gluten-free products, and the increasing popularity of Tex-Mex cuisine globally. Apart from this, health-conscious consumers are also seeking baked and multigrain variants, prompting product innovation. Expanding retail channels, especially online platforms, are further boosting accessibility and sales. Moreover, flavor diversification and regional adaptations continue to attract wider audiences, supporting positive tortilla chips market outlook.

Key drivers in the United States tortilla chips market include the rising demand for healthier snacking options, such as non-GMO, organic, and gluten-free chips. For instance, in January 2023, Real Food from the Ground Up announced the acquisition of the Food Should Taste Good brand from General Mills, which produces natural tortilla and multigrain bean chips. The popularity of Mexican cuisine and dips like salsa and guacamole continues to fuel consumption. Consumers are also drawn to innovative flavors and artisanal-style products. Growth in convenience foods and expanding retail availability across supermarkets and online platforms further support market expansion. Promotional efforts and clean-label preferences also contribute to sustained interest in tortilla chips across U.S. households.

Tortilla Chips Market Trends:

Growing Health Consciousness

A key factor driving the transformation of the tortilla chips market is the shift in dietary preferences and an increasing health awareness among consumers. As people become more informed about the negative impacts of obesity and heart-related issues, there is a growing search for healthier snack options. For example, the Healthy Snacking Report 2024 indicates that 73% of Indian consumers read ingredient lists and nutritional information before buying snacks, reflecting a trend towards healthier choices. Additionally, nearly 90% of respondents are seeking better alternatives to conventional snacks. Tortilla chips made from whole grains or plant-based ingredients are gaining popularity as healthier options compared to fried snacks or sweets, thanks to their lower fat and sugar levels. These trends are anticipated to drive the growth of the tortilla chips market in the near future.

Rising Influence of Mexican Cuisine

The market is also propelled by the increasing global influence of Mexican cuisine. For instance, according to the Pew Research Center data analysis, around 11% of restaurants in the United States serve Mexican cuisine. Also, according to Statista, more than 230 Million individuals in the U.S. used Mexican food and ingredients in 2020. Consumers are exploring new flavors and food experiences, and the distinct and varied tastes offered by the product cater to this demand. Furthermore, the trend of food fusion, which involves integrating various culinary traditions is becoming popular. Tortilla chips, being versatile, are widely used in such fusion recipes, which is driving their market growth. These factors further positively influence the tortilla chips market forecast.

Product Innovations

The introduction of a wide range of flavors and types, such as organic, gluten-free, and low-fat options, has expanded the market. For instance, in January 2024, Garden Veggie Snacks, a company that specializes in snacks, introduced its newest offering: Flavor Burst Nacho Cheese and Zesty Ranch Tortilla Chips. These tortilla chips are gluten-free and packed with the benefits of five different vegetables. This innovation caters to changing consumer preferences and dietary needs, thereby boosting the tortilla chips market revenue.

Tortilla Chips Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tortilla chips market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on nature, type, and distribution channel.

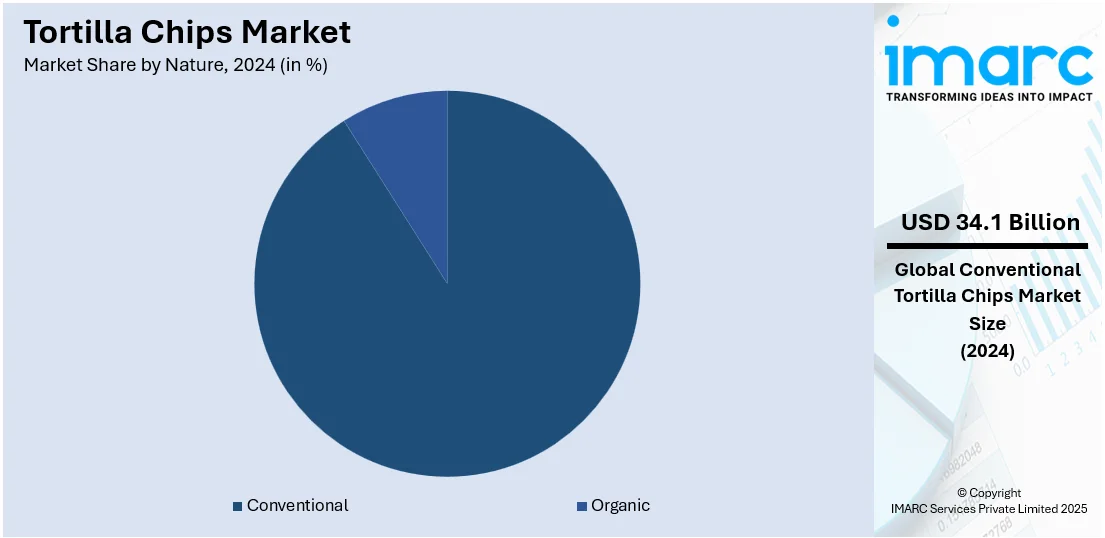

Analysis by Nature:

- Organic

- Conventional

Conventional leads the market with around 91.0% of the market. High production yields and the cost-effectiveness of conventional farming methods also ensure a steady supply of these chips, catering to high consumer demand. The widespread popularity and established presence of conventional products in supermarkets, convenience stores, and other retail outlets further reinforce their market dominance. Moreover, the broad consumer acceptance of conventional tortilla chips, driven by taste preferences and familiar brands, continues to stimulate their sales. Moreover, marketing strategies such as limited-time flavor introductions and promotional deals are proven tactics to boost consumer interest in conventional tortilla chips.

Analysis by Type:

- Baked Tortilla Chips

- Fried Tortilla Chips

Fried tortilla chips lead the market with around 61.5% of market share in 2024. The market drivers for fried tortilla chips play a significant role in shaping the growth and demand within the industry. The increasing popularity of Mexican and Tex-Mex cuisines globally has fueled the demand for fried tortilla chips. Additionally, the growing preference for healthier snack options has driven the demand for baked or fried products made from whole-grain or organic ingredients. In addition, the availability of a wide range of flavors and unique seasonings has also contributed to the tortilla chips market growth, catering to diverse consumer tastes and preferences. Furthermore, the market drivers for the segment encompass changing food preferences, cultural influences, and an emphasis on healthier snacking alternatives.

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 83.5% of market share in 2024. The offline distribution channel continues to be driven by several market factors. Offline retail stores, such as supermarkets, convenience stores, and grocery stores, maintain a strong presence and are convenient shopping destinations for consumers. These physical stores offer immediate access to tortilla chips, allowing customers to quickly satisfy their snack cravings. Along with this, the offline channel allows for a tactile shopping experience, enabling consumers to physically examine the packaging, read product labels, and compare different brands and varieties of tortilla chips. This hands-on experience can influence purchase decisions and build trust in product quality.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.6%. According to the tortilla chips market research report, the tortilla chips industry in North America is driven by the increasing diversity of North American diets and the rising demand for international cuisines. For instance, according to a survey conducted by Statista in 2018, nearly 86% of respondents in the United States said they like the typical dish from the Latin American country. These chips have become a staple in Mexican and Latin American cuisine, and their versatility makes them suitable for a variety of dishes and snacks. In addition, the growing awareness of health-conscious eating habits has led consumers to choose tortilla chips as a healthier alternative to traditional potato chips. They are often produced from corn, which is perceived as a healthier grain option.

Key Regional Takeaways:

United States Tortilla Chips Market Analysis

In 2024, United States accounted for 82.70% of tortilla chips market in North America. The United States is witnessing increased tortilla chips consumption driven by growing health consciousness among consumers. A survey found that 7 in 10 (68%) of American participants believe that maintaining healthy eating habits is a crucial element in enhancing one's likelihood of living a long and healthy life. As individuals shift toward healthier snacking alternatives, tortilla chips made with organic corn, multigrain, or low-fat ingredients are gaining traction. This trend reflects a broader movement towards mindful eating and label scrutiny, fueling demand for snacks with clean ingredients and minimal processing. Fitness-oriented consumers are actively replacing traditional fried snacks with baked or air-popped tortilla chips, aligning with nutritional preferences. Food companies are expanding their portfolios with non-GMO, gluten-free, and additive-free options, resonating with health-conscious buyers. Furthermore, fitness influencers and wellness campaigns are amplifying awareness around balanced snacking, contributing to a favorable perception of tortilla chips. This collective shift is positioning tortilla chips as a preferred snack within wellness-oriented dietary lifestyles.

Asia Pacific Tortilla Chips Market Analysis

Asia-Pacific is experiencing increased tortilla chips adoption due to the growing e-commerce distribution channel. Online platforms are enabling greater accessibility and convenience, allowing consumers to explore diverse snack options previously unavailable in local stores. With the surge in digital penetration and mobile-first purchasing behavior, tortilla chips brands are leveraging online marketplaces to offer extensive flavor choices and bulk packs. Strategic collaborations between snack manufacturers and e-commerce giants are enhancing visibility and boosting trial purchases. Flash sales, targeted ads, and subscription-based delivery models are fostering repeat purchases among young, tech-savvy consumers. Additionally, social media promotions and influencer marketing are generating product curiosity, encouraging first-time buyers to explore tortilla chips. This digital transformation in snack distribution is supporting consistent growth in tortilla chips adoption across diverse population segments in the region.

Europe Tortilla Chips Market Analysis

Europe is observing a rise in tortilla chips consumption due to growing snacks consumption habits among its population. For example, the consumption of savory snacks differs throughout Europe, with an average of about 3.6 kg purchased per person each year. People are progressively choosing ready-to-eat and convenient snack options due to their busy lifestyles and changing meal habits. Tortilla chips, with their versatility and flavor diversity, have emerged as a favored choice during social gatherings, casual dining, and on-the-go snacking. The surge in demand for savory snacks is motivating brands to innovate with locally inspired flavors and healthier options, driving product interest. As plant-based and vegetarian-friendly choices gain ground, tortilla chips offer a meat-free snack alternative appealing to a wide demographic. Moreover, packaging innovations like resealable bags and single-serve packs are enhancing the user experience. This steady shift in consumption behavior is underpinning the increasing penetration of tortilla chips in the European snack market.

Latin America Tortilla Chips Market Analysis

Latin America is witnessing rising tortilla chips adoption driven by the growing influence of Mexican cuisine. For instance, the export prices for tortilla chips originating from Mexico have increased over the last two years due to changes in market supply and demand dynamics. In 2023, these prices varied between USD 1.27 and USD 7.40 per kilogram. Traditional culinary preferences and cultural associations play a central role in expanding demand for tortilla chips as a staple snack. This trend is further supported by increased visibility in street food offerings and local food outlets that popularize regional dips and flavors.

Middle East and Africa Tortilla Chips Market Analysis

The Middle East and Africa are experiencing a steady rise in tortilla chips adoption due to growing demand for international cuisines. For instance, Dubai's ever-evolving culinary industry encompasses approximately 13,000 restaurants and cafés. Urban consumers are becoming more experimental with global flavors, incorporating tortilla chips into fusion meals and modern snacks. This shift in culinary interest is broadening market opportunities for tortilla chips.

Competitive Landscape:

The global market is experiencing significant growth due to the introduction of new flavors, textures, and ingredient combinations to cater to evolving consumer preferences. They strive to offer unique and innovative options, such as spicy flavors, gourmet varieties, organic and gluten-free options, and chips manufactured from alternative grains, including quinoa or multigrain blends. Additionally, key tortilla chips brands invest in marketing campaigns to build brand awareness and promote their products. They leverage social media platforms, digital advertising, and traditional marketing channels to engage with consumers, highlight the quality and taste of their chips, and differentiate themselves from competitors. Tortilla chip manufacturers often collaborate with other food companies or restaurants to create joint marketing campaigns, co-branded products, or cross-promotional activities. Such collaborations help to expand their reach, tap into new customer segments, and leverage the strengths of both parties. As sustainability and ethical considerations gain importance among consumers, tortilla chip companies are adopting environmentally friendly practices.

The report provides a comprehensive analysis of the competitive landscape in the tortilla chips market with detailed profiles of all major companies, including:

- Aranda's Tortilla Company, Incorporated

- Arca Continental S.A.B. de C.V

- Catallia Mexican Foods LLC

- El-Milagro Inc.

- Gruma, S.A.B. de C.V.

- Herr Foods Incorporated

- Intersnack Group GmbH & Co. KG

- La Tortilla Factory Inc.

- Pepsico Inc.

- Target Brands Inc.

- Tyson Foods Inc.

- Xochitl Inc.

Latest News and Developments:

- April 2025: Doritos brought back its Guacamole flavored tortilla chips for the first time in 20 years, thrilling longtime fans. Excitement surged across social media as snack lovers celebrated the long-awaited comeback.

- April 2025: Aldi released a new Mojito-flavoured Fiesta Tortilla Chip as part of its returning Taste of Mexico range. The supermarket reintroduced several themed products, including Chipotle Chilli Wraps, Agave Infused Lemon Iced Tea, and Churro Loaf Cake. Shoppers across the UK reacted to the "strange" new crisp flavor with curiosity and excitement.

- March 2025: Garden Veggie™ Snacks launched two new flavors of its Flavor Burst™ Tortilla Chips—Sweet Tangy Chili and Smoky BBQ. According to the company, these chips provide a satisfying crunch and bold flavor without the use of artificial flavors or preservatives.

- February 2025: ChicP launched a new range of hummus and tortilla chip snack pots. The packs included Beetroot & Horseradish Hummus and Velvet Hummus paired with gluten-free corn tortilla chips. Made with 100% natural ingredients, the snacks offered a convenient, plant-based option for health-conscious consumers.

- February 2025: Takis® introduced two new Tortilla Chips flavors—Nacho Xplosion and Chile Limon. Nacho Xplosion brought intense cheesy heat for spice lovers, while Chile Limon marked the brand’s first global launch with a milder yet flavor-packed twist.

Tortilla Chips Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Types Covered | Baked Tortilla Chips, Fried Tortilla Chips |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aranda's Tortilla Company, Incorporated, Arca Continental S.A.B. de C.V, Catallia Mexican Foods LLC, El-Milagro Inc., Gruma, S.A.B. de C.V., Herr Foods Incorporated, Intersnack Group GmbH & Co. KG, La Tortilla Factory Inc., Pepsico Inc., Target Brands Inc., Tyson Foods Inc., Xochitl Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tortilla chips market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tortilla chips market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tortilla chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tortilla chips market was valued at USD 37.46 Billion in 2024.

The tortilla chips market is projected to reach USD 55.24 Billion by 2033, exhibiting a CAGR of 4.19% from 2025-2033.

Rising demand for convenient snacks, increasing popularity of Tex-Mex cuisine, and growing preference for gluten-free and plant-based products are fueling tortilla chips market growth. Expanding retail channels and product innovations, such as flavored and organic variants, are also encouraging higher consumer adoption globally.

North America currently dominates the tortilla chips market, driven by a strong snacking culture, high demand for ethnic flavors, product innovations, and wide retail distribution.

Some of the major players in the tortilla chips market include Aranda's Tortilla Company, Incorporated, Arca Continental S.A.B. de C.V, Catallia Mexican Foods LLC, El-Milagro Inc., Gruma, S.A.B. de C.V., Herr Foods Incorporated, Intersnack Group GmbH & Co. KG, La Tortilla Factory Inc., Pepsico Inc., Target Brands Inc., Tyson Foods Inc., Xochitl Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)