Tractor Implements Market Report by Phase Type (Harvesting and Threshing, Sowing and Planting, and Others), Product (Cultivator and Tiller, Plough, Planters, Harrows, Spreaders, Baler, and Others), Power (Powered, Unpowered), Drive (2-Wheel Drive, 4-Wheel Drive), and Region 2025-2033

Market Overview:

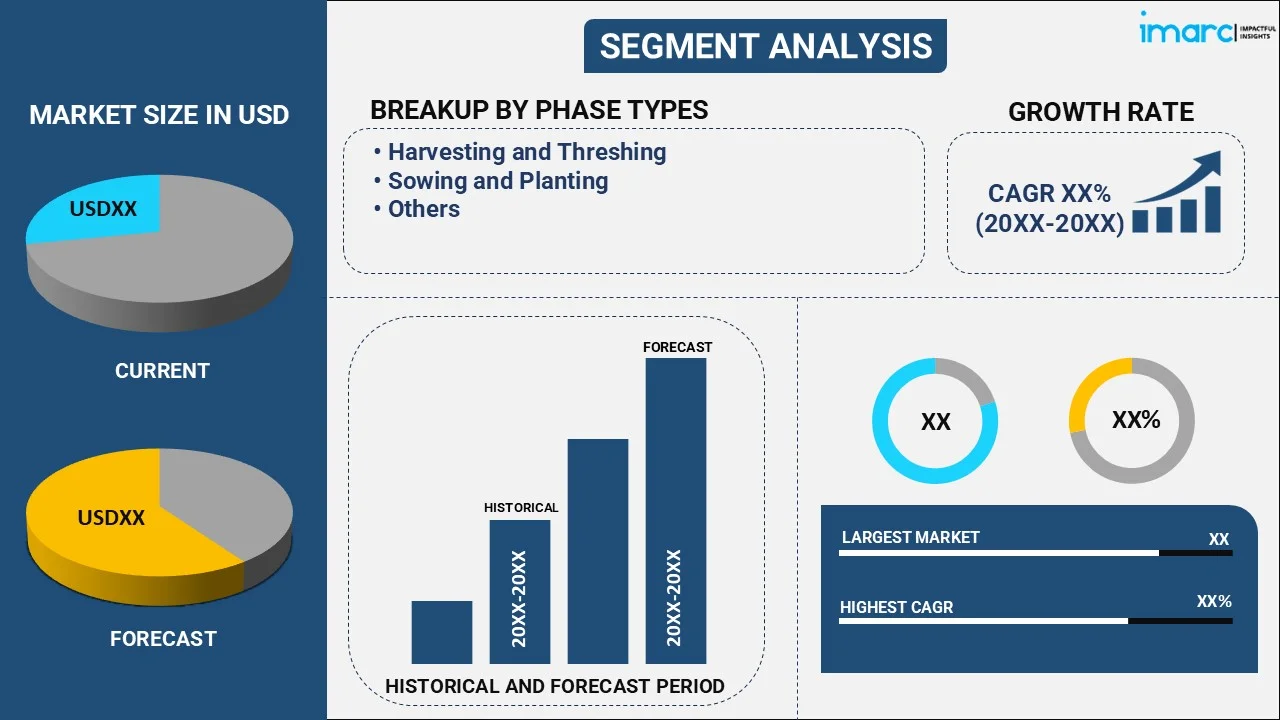

The global tractor implements market size reached USD 38.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 58.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.46% during 2025-2033. The emerging technological advancement in tractor implements, the increased agricultural productivity to meet global food demand, and the growing trend toward mechanization for efficient and precise operations are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.1 Billion |

| Market Forecast in 2033 | USD 58.8 Billion |

| Market Growth Rate (2025-2033) | 4.46% |

Tractor implements are agricultural attachments or tools designed to be towed or mounted onto tractors to perform various tasks related to soil preparation, cultivation, planting, and harvesting. These implements enhance the efficiency and productivity of farming operations by mechanizing traditionally labor-intensive tasks. Some commonly known tractor implements include plows, harrows, cultivators, seeders, planters, mowers, and balers. It serves a specific purpose, contributing to different stages of the crop production cycle. Additionally, modern tractor implements often incorporate advanced technologies, such as precision planting systems and global positioning systems (GPS)-guided steering, to optimize planting accuracy and minimize resource wastage.

The market is primarily driven by the growing population. In addition, the increasing agricultural production to meet the rising population is influencing market growth. Moreover, several technological advancements in tractor implements have significantly increased efficiency and productivity in farming operations representing another major growth-inducing factor. Also, modern implements are designed to optimize tasks such as plowing, seeding, fertilizing, and harvesting, reducing manual labor and saving time, thus augmenting market growth. Besides this, the changing dietary preferences are escalating the demand for agricultural products, compelling farmers to adopt mechanized solutions to meet increased production requirements by allowing farmers to cultivate larger areas and achieve higher yields, addressing food security are accelerating the market growth. Furthermore, the trend toward precision agriculture and tractor implements equipped with GPS and sensor technologies, allows farmers to precisely apply inputs and optimize resource usage, leading to cost savings and reduced environmental impact creating a positive market outlook.

Tractor Implements Market Trends/Drivers:

The emerging technological advancements

The agricultural machinery industry is experiencing a rapid evolution, with innovations that are transforming the way farming operations are conducted, thus influencing market growth. These advancements encompass various aspects of tractor implements, from design and manufacturing to functionality and control. Moreover, the integration of precision farming technologies, such as GPS guidance systems, automated steering, and data analytics represents another major growth-inducing factor. These technologies enable farmers to achieve unprecedented levels of accuracy in planting, fertilizing, and harvesting, resulting in optimal resource utilization, reduced wastage, and increased yields. Along with this, smart implements equipped with sensors can monitor soil conditions, adjust application rates in real time, and optimize operations based on data insights, thus propelling the market growth. Apart from this, the integration of the Internet of Things (IoT) into tractor implements is also enhancing operational efficiency, thus augmenting the market growth. Furthermore, farmers can remotely monitor and control implements, receive real-time data updates, and even perform diagnostics, thereby minimizing downtime and maximizing utilization, thus creating a positive market outlook.

The growing agricultural productivity

The increasing agricultural productivity to meet the escalating agricultural demand due to the growing population is influencing market growth. Additionally, the widespread adoption of advanced tractor implements to meet the demand by allowing farmers to cultivate larger areas more efficiently and effectively is contributing to the market growth. Moreover, modern implements are designed to optimize various tasks, from planting and irrigation to crop protection and harvesting which minimizes human error, ensures consistent operations, and allows for precise application of inputs, resulting in higher yields and improved crop quality representing another major growth-inducing factor. Furthermore, advanced implements help farmers make the most of limited resources, such as water and fertilizers with technologies including drip irrigation systems and variable-rate application of inputs contributing to resource efficiency, minimizing waste, and environmental impact are creating a positive market outlook.

The implementation of favorable government initiatives

Government initiatives supporting the adoption of tractor implements are contributing to market growth. Additionally, governments recognize the significance of modernizing agriculture to enhance food security and rural economies, thus influencing market growth. Moreover, the introduction of subsidies, grants, tax incentives, and training programs to encourage farmers to invest in advanced machinery represents another major growth-inducing factor. Besides this, the growing awareness about the benefits of product use by reducing the upfront costs of purchasing implements, governments allow small and medium-sized farmers to access and benefit from modern agricultural technologies, thus accelerating the market growth. Furthermore, government support also extends to regulations and standards that ensure the safety and performance of tractor implements which instill confidence in farmers, encouraging them to embrace new technologies and improve productivity, thus propelling the market growth.

Tractor implements Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tractor implements market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on phase type, product, power, and drive.

Breakup by Phase Type:

- Harvesting and Threshing

- Sowing and Planting

- Others

Harvesting and threshing represents the most popular phase type

The report has provided a detailed breakup and analysis of the market based on the phase type. This includes harvesting and threshing, sowing and planting, and others. According to the report, harvesting and threshing accounted for the largest market share.

The harvesting and threshing phase involves the collection of mature crops and the separation of grains from the plant which is an essential step that directly impacts yield and crop quality thus influencing the market growth. Additionally, the increasing product use for harvesting and threshing offers advanced solutions to efficiently handle various types of crops, including grains, cereals, and oilseeds, thus contributing to market growth.

Harvesting implements, such as combine harvesters and reapers, are evolving to enhance speed, precision, and ease of operation which reduces the time required for manual harvesting, leading to increased productivity, thus augmenting the market growth. Additionally, threshing attachments and technologies integrated into tractor implements ensure efficient grain separation, minimizing losses and preserving crop quality.

Moreover, tractor implements designed for sowing and planting are essential in ensuring uniform seed placement, proper spacing, and optimal seed-to-soil contact, thus propelling the market growth. Besides this, seed drills, planters, and seeders are key implements used during the sowing and planting phase that allow farmers to achieve consistent seed distribution, reducing wastage and ensuring even germination thus accelerating the market growth.

Breakup by Product:

- Cultivator and Tiller

- Plough

- Planters

- Harrows

- Spreaders

- Baler

- Others

Cultivator and tiller hold the largest share in the market

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes cultivator and tiller, plough, planters, harrows, spreaders, baler, others. According to the report, cultivator and tiller accounted for the largest market share.

Cultivators and tillers are essential implements for soil preparation and weed control. They break up soil, mix in organic matter, and create a favorable seedbed. These implements are versatile, and suitable for pre-planting and post-harvest cultivation which are essential for maintaining soil health and optimizing crop growth. Additionally, ploughs are fundamental implements used for primary tillage that turn over the top layer of soil, burying crop residues and weeds while loosening and aerating the soil. They are essential in breaking compacted soil, improving drainage, and creating an optimal environment for seed germination.

Moreover, the increasing use of planters for accurate and consistent seed placement to ensure uniform seed spacing, depth, and coverage, leading to better crop establishment and higher yields equipped with advanced technologies for variable-rate seeding and monitoring represents another major growth-inducing factor. Besides this, the rising demand for harrows for secondary tillage, leveling, and breaking up clods after primary tillage operations to prepare the soil surface for planting and help incorporate amendments evenly are acclerating the market growth.

Besides this, the widespread adoption of spreaders, including fertilizer spreaders and seed spreaders for evenly distribution of fertilizers, seeds, and other agricultural inputs are accelerating the market growth. Furthermore, the extensive use of balers for collecting and compressing crops such as hay or straw into compact bundles, facilitating storage, transportation, and feeding are creating a positive market outlook.

Breakup by Power:

- Powered

- Unpowered

Powered implements presently account for the largest market share

A detailed breakup and analysis of the market based on the power has also been provided in the report. This includes powered and unpowered. According to the report, powered implements accounted for the largest market share.

Powered implements refer to machinery that relies on an external power source, typically the tractor's engine, to perform various tasks. These implements are equipped with their own engines, motors, or mechanical systems that enable them to carry out specific operations independently. Additionally, some commonly known powered implements include plows, harrows, seed drills, fertilizer spreaders, and combine harvesters that enhance efficiency by automating labor-intensive tasks and improving precision thus influencing the market growth. Powered implements are essential in modernizing agriculture, increasing productivity, and reducing the time and effort required for cultivating, planting, and harvesting.

Moreover, unpowered implements rely entirely on the tractor's power to function including various attachments such as plow blades, cultivator shanks, and harrow discs. They are cost-effective and versatile, allowing farmers to adapt their tractors for different tasks by simply attaching the appropriate implement that are valuable for smaller farms and limited budgets.

Breakup by Drive:

- 2-wheel Drive

- 4-wheel Drive

4-wheel drive dominates the market

A detailed breakup and analysis of the market based on the drive has also been provided in the report. This includes 2-wheel drive, and 4-wheel drive. According to the report, 4-wheel drive accounted for the largest market share.

2-wheel drive tractor implements are designed to work in conjunction with tractors that have power transmitted to only two wheels, thus influencing the market growth. These implements are often used for lighter tasks and operations in more level terrains. They are suitable for activities such as mowing, plowing, planting, and light tilling. Additionally, 2WD tractors and their associated implements are more maneuverable and cost-effective compared to their 4WD counterparts, making them popular choices for small-scale and less complex farming operations, thus augmenting the market growth.

Moreover, 4-wheel drive tractor implements are compatible with tractors equipped with power transmitted to all four wheels. These implements are versatile and robust, capable of handling more demanding tasks and operating effectively in various terrains, including uneven or hilly landscapes. Also, 4WD tractors with implements are preferred for heavy-duty operations such as deep plowing, heavy tilling, large-scale planting, and heavy material handling thus propelling the market growth. The increased traction and pulling power offered by 4WD systems make them suitable for challenging farming conditions.

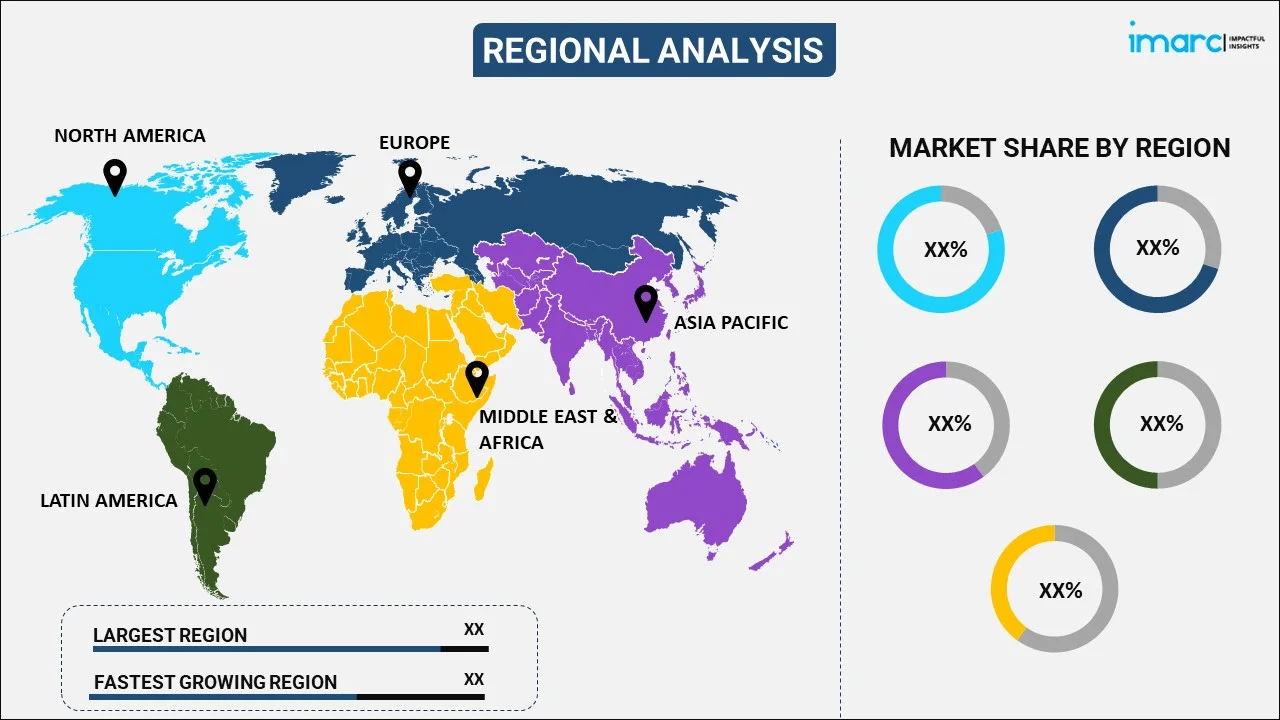

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific market is driven by the rising demand for tractor implements in countries such as India, China, and Japan for various operations. Along with this the Increasing mechanization in these countries, driven by the need for enhanced productivity and labor efficiency, fuels the market growth. Moreover, several initiatives to modernize traditional farming practices and government support for agricultural mechanization contribute to the expansion of the market in this region.

Moreover, Europe market is driven by advanced agricultural practices and a focus on sustainable farming. In addition, the rising demand for modern implements, driven by the need to optimize resource utilization, complying with stringent environmental regulations, and improve operational efficiency represents another major growth-inducing factor. Also, the presence of established agricultural machinery manufacturers and research institutions contributes to continuous innovation and market growth.

Furthermore, North America market is driven by the large-scale agriculture prevalent in countries such as the United States and Canada. Farms with vast acreages seek efficient implements to manage operations effectively. Additionally, the widespread adoption of advanced technology with precision agriculture, the need to address labor shortages, and government incentives for sustainable farming are contributing to the market growth.

Competitive Landscape:

Nowadays, in the competitive landscape of the market, key players are implementing strategic measures to solidify their positions and maintain their competitiveness. Additionally, companies are continuously investing in research and development (R&D) to introduce innovative tractor implements with enhanced features, performance, and efficiency. Along with this, the incorporation of precision farming technologies, smart automation, and advanced material technologies contribute to setting them apart from competitors. Moreover, key players are using cutting-edge technologies such as GPS guidance, telematics, and IoT to offer smart implements that enhance productivity and operational efficiency allowing farmers to make informed decisions for optimized farming practices. Furthermore, companies are expanding their geographic footprint through partnerships, acquisitions, and joint ventures. They prioritize customer engagement and satisfaction by providing comprehensive after-sales support, training, and technical assistance which builds strong relationships with customers, fostering brand loyalty and repeat business.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AGCO Corporation

- Alamo Group Inc.

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- J C Bamford Excavators Ltd.

- Kubota Corporation

- KUHN Group (Bucher Industries AG)

- Mahindra & Mahindra Limited

- SDF Group

- Tractors and Farm Equipment Limited (TAFE)

Tractor Implements Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Phase Types Covered | Harvesting and Threshing, Sowing and Planting, Others |

| Products Covered | Cultivator and Tiller, Plough, Planters, Harrows, Spreaders, Baler, Others |

| Powers Covered | Powered, Unpowered |

| Drives Covered | 2-Wheel Drive, 4-Wheel Drive |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGCO Corporation, Alamo Group Inc., CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, J C Bamford Excavators Ltd., Kubota Corporation, KUHN Group (Bucher Industries AG), Mahindra & Mahindra Limited, SDF Group, Tractors and Farm Equipment Limited (TAFE), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global tractor implements market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global tractor implements market?

- What is the impact of each driver, restraint, and opportunity on the global tractor implements market?

- What are the key regional markets?

- Which countries represent the most attractive tractor implements market?

- What is the breakup of the market based on the phase type?

- Which is the most attractive phase type in the tractor implements market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the tractor implements market?

- What is the breakup of the market based on power?

- Which is the most attractive power in the tractor implements market?

- What is the breakup of the market based on the drive?

- Which is the most attractive drive in the tractor implements market?

- What is the competitive structure of the global tractor implements market?

- Who are the key players/companies in the global tractor implements market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tractor implements market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tractor implements market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tractor implements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)