Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End-User, and Region, 2026-2034

Trade Finance Market Size and Share:

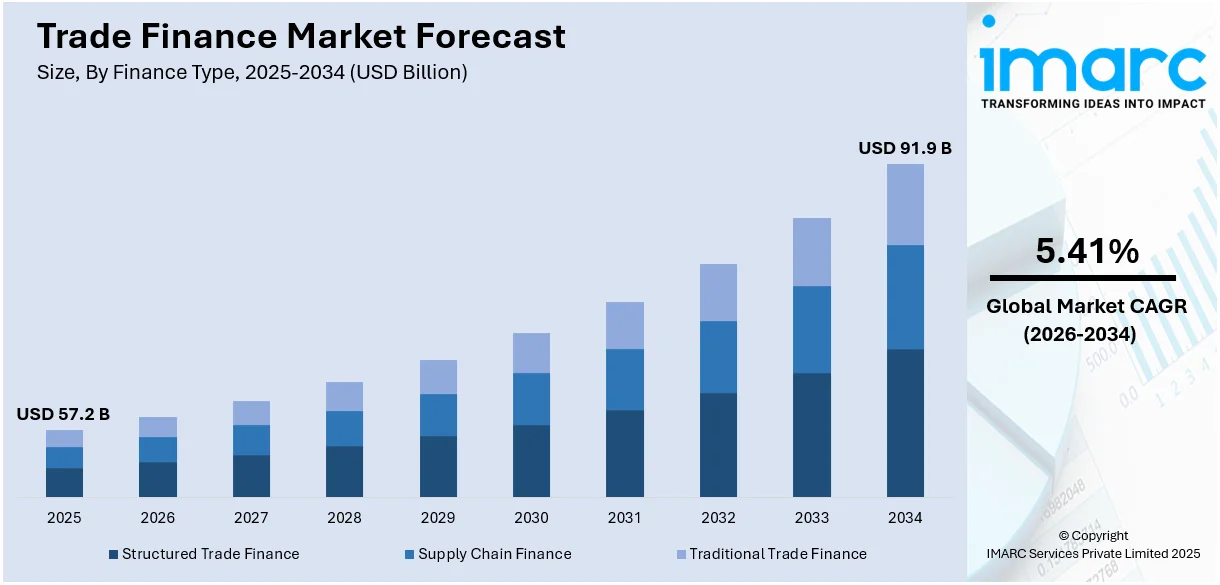

The global trade finance market size was valued at USD 57.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 91.9 Billion by 2034, exhibiting a CAGR of 5.41% during 2026-2034. North America currently dominates the market. The market is undergoing steady growth due to the growing volume of international trade, integration of artificial intelligence (AI) and data analytics to enhance risk assessment and increasing complexity in the supply chain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 57.2 Billion |

|

Market Forecast in 2034

|

USD 91.9 Billion |

| Market Growth Rate 2026-2034 | 5.41% |

The global trade finance market is driven by the growing globalization of businesses and the increasing need for cross-border trade. In line with this, the increasing number of international trade agreements and collaborations are positively influencing the demand for efficient financial instruments that facilitate large-scale transactions. Advancements in digital technologies, such as blockchain and AI, are streamlining processes, enhancing transparency, and reducing operational risks. On 21st November 2024, the Central Bank of Brazil (BCB) partnered with Banco Inter, Microsoft Brazil, 7COMm, and Chainlink for the second phase of its DREX digital currency pilot. The initiative explores blockchain’s potential in automating trade finance, focusing on tokenized documentation, automated payment triggers, and cross-border settlement using Chainlink’s CCIP for interoperability. The project aims to enhance supply chain management and facilitate secure, efficient international transactions. Additionally, the rising focus on mitigating payment defaults and ensuring liquidity for exporters and importers propels the adoption of trade finance solutions. Emerging markets, with their rapid financial development, present significant opportunities, further fueling market expansion. Regulatory developments promoting secure and structured trade practices also play a critical role in sustaining the overall trade finance market growth.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by the country’s position as a global trade leader and its extensive network of trade partnerships. The strong presence of well-established financial institutions offering tailored trade finance solutions contributes to market growth. Along with this, increasing import and export activities, driven by rising consumer demand and industrial production, further stimulate the need for robust financial support in the United States. The adoption of innovative financing solutions, such as supply chain finance and electronic documentation, is enhancing efficiency in trade processes. Besides this, government initiatives, including export promotion programs and favorable trade policies, provide additional impetus to US trade finance market share. Furthermore, the U.S. market benefits from a focus on mitigating credit risks and ensuring liquidity for businesses involved in international and domestic trade operations.

Trade Finance Market Trends:

Globalization and increased international trade

Rapid globalization and the growing international trade volume are bolstering the market growth. Businesses are entering the global market, which is prompting them to invest in safe finance trade solutions to support cross-border transactions. This is further supported by the increasing dependence on e-commerce platforms due to the associated convenience, which is allowing business of all sizes to engage in international trade. On the basis of the data provided by the IMARC group, the global e-commerce industry value was USD 21.1 Trillion in 2023. The market is projected to reach USD 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. Trade credit insurance and letters of credit are becoming indispensable tools for reducing the risks involved in international trade. Trade finance services are becoming necessary in the global economy due to the interconnectedness of economies and the search for new markets. The global trade finance market revenue is poised for moderate growth, reflecting the expanding demand for financial services that facilitate international trade transactions.

Technological advancements and digitalization

The rising reliance on digital solutions in trade finance is improving the process of conducting business. These include blockchain, which helps to reduce fraud and errors by offering unprecedented transparency and security in supply chain finance and trade settlements. Furthermore, data analytics and artificial intelligence (AI) are enhancing risk assessment, enabling more accurate lending choices, and reducing the funding gap for businesses, particularly small and medium-sized firms (SMEs). Furthermore, the rising emergence of fintech entrepreneurs, who are developing innovative digital platforms to simplify trade finance, is propelling market growth. For instance, India stands as one of the most rapidly expanding Fintech markets globally. In 2021, the market size of the Indian Fintech industry reached USD50 Billion, with projections indicating a substantial increase to approximately USD 150 Billion by the year 2025.

Changing regulatory environment

Governing bodies and international organizations in various countries are imposing stringent rules on cross-border commerce due to the rise in financial crisis cases and shifting geopolitical environments. These regulations include anti-money laundering (AML) and know your customer (KYC) requirements, which are becoming more stringent and complicated. This requirement to adhere to these strict norms is catalyzing the demand for trade finance. As per the data provided by the IMARC group, the global e-KYC market size reached USD 673.2 Million in 2023 and is estimated to reach USD 3,398.5 Million by 2032, exhibiting a growth rate (CAGR) of 19.71% during 2024-2032.

Supply chain complexity and resilience

Suppliers, logistics companies, and middlemen from different parts of the world are involved in modern supply chains that span across many nations. This is increasing numerous risks, such as natural calamities and geopolitical conflicts. Businesses are seeking trade finance tools including supply chain financing to reduce these risks and ensuring the continuous flow of commodities. This lets them improve their working capital, get short-term finance, and fortify their ties with suppliers. Trade credit insurance also offers peace of mind during difficult times by guarding against non-payment risks. The trade finance market price rises as businesses seek to mitigate global supply chain risks and uncertainties. Moreover, International Credit Insurance & Surety Association (ICISA), states that the global trade credit insurance market in 2022 attained a value of USD 13.89 Billion. Insured shipments amounted to USD 7 Trillion, indicating a substantial coverage within the trade sector. The penetration rate of trade credit insurance stands at 13.16% of the total worldwide trade in goods, underlining its significant role in mitigating risks associated with international commerce.

Trade Finance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global trade finance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on finance type, offering, service provider, and end-user.

Analysis by Finance Type:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Supply chain finance stands as the largest component in 2025. Supply chain finance (SCF) includes financial solutions that are designed to maximize working capital throughout supply chain. The SCF (Supply Chain Finance) allows companies to extend longer payment durations to their suppliers while also securing early payment options for those in need of liquidity. This approach is gaining popularity as it helps save funds, enhance productivity, and mitigate risks within complex global supply chains. It proves particularly beneficial for SMEs by making it simpler for them to access affordable financing, which in turn supports their growth and strengthens their relationships with suppliers.

Analysis by Offering:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Letters of credit leads the market in 2025. According to the report, letters of credit provide a secure method for international trade transactions by ensuring that payment will be made to the seller upon the presentation of compliant shipping documents. They offer a high level of risk mitigation, particularly for parties new to trade relationships or dealing with uncertain trading environments. They come in various types, including revocable and irrevocable, with irrevocable letters of credit being commonly used due to their binding nature.

Analysis by Service Provider:

- Banks

- Trade Finance Houses

Banks lead the market in 2025. Banks offer a wide range of trade finance services, including letters of credit, trade credit insurance, and export financing. As per the data provide by the World Bank, in 2021, the percentage of people over 14 years of age with bank accounts averaged 65.76% across 121 countries. Denmark recorded the highest value at 100%, while Afghanistan reported the lowest value at 9.65%. They have a well-established global presence and extensive networks, making them the first choice for many businesses engaged in international trade. Their role is multifaceted, as they provide financing and offer expertise in navigating complex trade regulations and compliance issues. Banks are trusted partners for both buyers and sellers in trade transactions, leveraging their financial strength and reputation to facilitate secure and efficient global trade.

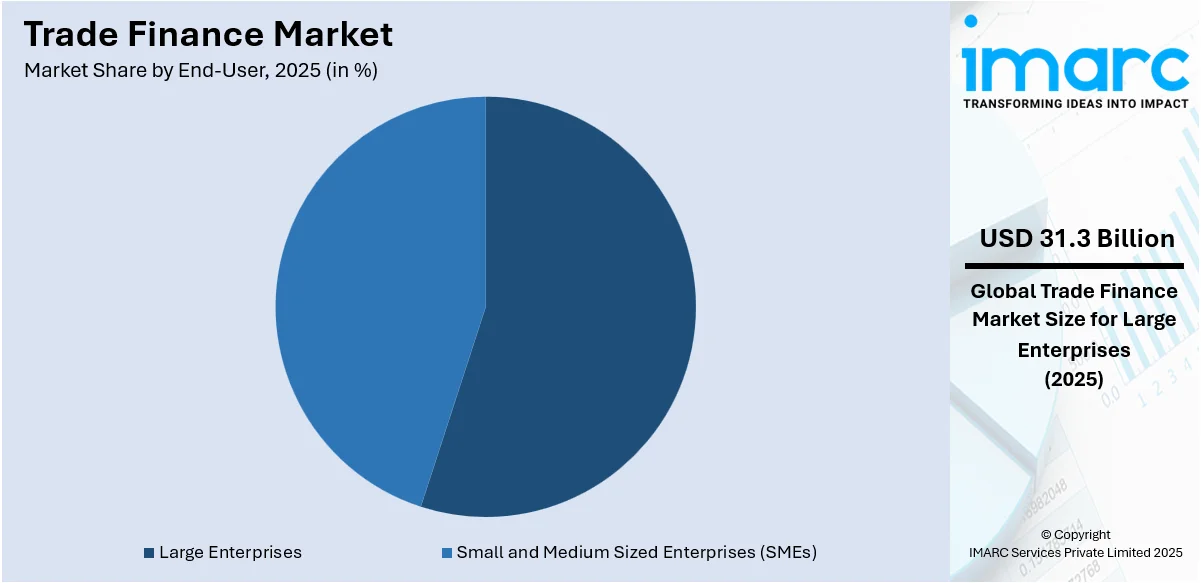

Analysis by End-User:

Access the comprehensive market breakdown Request Sample

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Large enterprises lead the market in 2025. Large enterprises engage in extensive international trade activities, often managing complex supply chains and a high volume of transactions. For large enterprises, trade finance serves as a critical tool for optimizing working capital, mitigating risks, and ensuring the smooth flow of goods and services across borders. They typically have established relationships with major banks and financial institutions, which provide them with access to a wide range of trade finance solutions, including letters of credit, export financing, and trade credit insurance. On the basis of the data provided by Eurostat, In 2021, the EU recorded 30.1 Million enterprises, supporting 155 Million workers. Despite representing just 0.2% of total enterprises, large enterprises stood out for employing over a third of the business labor force, totaling 56 million employees. This underscores their substantial contribution to economic vitality and stability in the region.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share. North America has a robust economy with a substantial volume of international trade. Moreover, its strong financial infrastructure and well-established banking institutions make it a hub for trade finance activities. North American businesses benefit from a wide range of trade finance services, including letters of credit, export financing, and risk mitigation solutions. The emphasis on technological innovation and digitalization in the region is propelling the trade finance market growth. The IMARC Group states that the United States trade finance market is expected to exhibit a growth rate (CAGR) of 7.1% during 2024-2032.

Key Regional Takeaways:

United States Trade Finance Market Analysis

The rise in international trade has propelled the need for financial instruments to mitigate risks and facilitate transactions. For instance, in the third quarter of 2024, U.S. residents' foreign financial assets rose by USD 201.9 Billion, reflecting a significant enhance in international trade. This rise in cross-border transactions enhances global financial flows, driving growth in trade finance. The increased foreign asset holdings underscore the expanding opportunities for financing international trade activities. Trade finance solutions have become vital for exporters and importers to manage working capital, ensure liquidity, and handle cross-border trade complexities. Increasing global supply chain integration and the rise in advanced manufacturing have further necessitated the use of trade finance. Enhanced digitization in financial services has streamlined processes, improving transaction efficiency and transparency. Key industries leveraging these solutions include technology and agriculture, capitalizing on secure payment mechanisms. With a robust focus on export-oriented production, businesses actively utilize trade finance to bridge cash flow gaps, ensuring competitiveness in a dynamic global market.

Asia Pacific Trade Finance Market Analysis

The expanding base of Small and Medium-sized Enterprises (SMEs) has driven demand for accessible financial services to support trade activities. SMEs require tailored solutions to overcome liquidity challenges and enable participation in regional and international markets. According to India Brand Equity Foundation, Indian government allocated approximately USD 808 Million for the RAMP scheme to enhance MSMEs performance by enhancing market and credit access and fostering institutional growth. This initiative aims to green SMEs and improve state-centre partnerships, benefiting trade finance by empowering businesses with greater credit opportunities and sustainable practices. The rise of e-commerce and cross-border digital trade has amplified the need for credit facilities, guarantees, and export-import financing. Financial institutions in the region have introduced innovative offerings, including digital trade platforms, to cater to the growing client base. Key sectors such as textiles, consumer goods, and electronics are driving the uptake of trade finance solutions, ensuring seamless transaction flows and risk mitigation for businesses.

Europe Trade Finance Market Analysis

The banking sector has played a pivotal role in fostering trade finance adoption by offering innovative and scalable solutions. As financial institutions strengthen their global trade networks, businesses benefit from enhanced credit lines, letters of credit, and export insurance. According to International Trade Administration, Germany's robust universal banking system encompasses over 1,679 banks and 25,800 branches, enabling seamless deposit-taking, loan issuance, and securities trading. With no credit shortages reported, market-determined rates ensure access for domestic and foreign investors. This diverse credit environment supports trade finance by fostering liquidity and flexibility in financing options. High bank borrowing and cross-shareholding traditions further strengthen industrial influence and financial integration. The growing emphasis on sustainable trade practices has also encouraged adoption, with banks promoting green financing options for trade activities. Industries such as automotive and pharmaceuticals leverage these financial tools to navigate international trade complexities, ensuring supply chain stability. The focus on reducing payment delays and enhancing operational efficiency has further bolstered the use of trade finance solutions across diverse sectors.

Latin America Trade Finance Market Analysis

Rising income levels and external investments have increased demand for trade finance services. According to UNCTAD's World Investment Report 2023, Brazil's FDI inflows increased by 69.9% in 2022, reaching USD 86 Billion, up from USD 50.6 Billion in 2021—the second-highest level ever and ranking fifth globally. This growth is attributed to a doubling of reinvested earnings, driven by rising disposable incomes. The increase in FDI inflows strengthens trade finance by enhancing liquidity and supporting cross-border transactions. Expanding consumer markets have spurred industries such as food processing, consumer electronics, and textiles, which rely heavily on imports and exports. Trade finance solutions ensure seamless cross-border operations by offering liquidity and risk management tools. Additionally, the inflow of capital has accelerated industrial development, creating opportunities for businesses to explore international markets. Financial institutions are offering tailored services to meet the growing needs of enterprises, contributing to economic diversification and growth.

Middle East and Africa Trade Finance Market Analysis

The growth of trade finance is being fueled by expanding energy-related industries including oil and gas and the development of key transport networks. Increased demand for energy resources has led to a rise in financial activities supporting exports and imports, particularly in the energy sector. According to International Energy Agency, energy investment in the Middle East is projected to hit USD 175 Billion in 2024, with 15% allocated to clean energy initiatives. This rise reflects a shift towards sustainable infrastructure, enhancing regional energy security. Increased investment supports trade finance by fostering reliable energy markets and economic stability. Enhanced transportation infrastructure and changing trade routes are facilitating smoother and faster cross-border exchanges, encouraging higher volumes of trade. These advancements support structured financing solutions, ensuring efficient cash flow management for businesses engaged in trade. Additionally, digital innovations in financial services are streamlining processes, reducing transaction times, and enabling better risk management. The synergy between industrial development and improved logistics systems is creating robust opportunities for trade finance to thrive in rapidly changing markets.

Competitive Landscape:

Leading market players are engaging in advanced technologies to enhance their services. Banks are employing AI and blockchain technologies to enhance the functionality of trade finance and improve transparency. Key players are also emphasizing sustainable trade solutions in accordance with ESG principles. Trade finance companies and other specialist providers are leading the way in innovation by providing customized solutions that address the demands of certain industries, such as structured trade finance and supply chain financing. Additionally, these companies are reaching out to SMEs, assisting them with their financial needs, and encouraging financial inclusion in international commerce. Amidst these transformations, the trade finance market's recent developments reflect a shift towards digitalization, sustainability, and inclusion, reshaping the landscape to meet the modern demands of global trade.

The report provides a comprehensive analysis of the competitive landscape in the trade finance market with detailed profiles of all major companies, including:

- Asian Development Bank

- Banco Santander SA

- Bank of America Corp.

- BNP Paribas SA

- Citigroup Inc.

- Crédit Agricole Group

- Euler Hermes

- Goldman Sachs Group Inc.

- HSBC Holdings Plc

- JPMorgan Chase & Co.

- Mitsubishi Ufj Financial Group Inc.

- Morgan Stanley

- Royal Bank of Scotland

- Standard Chartered Bank

- Wells Fargo & Co.

Latest News and Developments:

- December 2024: Modifi plans to allocate a significant part of its recently secured USD15 Million Series C funding to expand its trade finance operations. The investment will focus on strengthening local markets and accelerating growth. This strategic move aims to enhance accessibility for SMEs in global trade. Modifi's commitment underscores its mission to simplify cross-border business financing.

- December 2024: HSBC and the World Bank's IFC have introduced a USD1 Billion trade finance program to support emerging markets. The initiative aims to strengthen cross-border trade and enhance exports in vital sectors. This collaboration seeks to address global supply chain challenges and promote economic growth. Key industries will benefit from improved access to trade finance solutions.

- December 2024: The International Islamic Trade Finance Corporation (ITFC) and ESCAP have partnered to enhance exports in Central Asia through the Trade Connect Central Asia+ (TCCA+) Program. The initiative aims to drive foreign direct investment (FDI), enhance regional trade, and promote sustainable development among OIC member countries.

- November 2024: The African Development Bank has approved a USD4 Million trade finance guarantee for Access Bank Sierra Leone Limited (ABSL). This initiative aims to enhance access to financing for small and medium-sized enterprises (SMEs) and local businesses. The guarantee will facilitate trade, bolster economic growth, and strengthen Sierra Leone’s private sector. This marks a significant step in empowering the country’s entrepreneurial landscape.

- November 2024: Mashreq has partnered with British International Investment (BII) to establish a USD50 Million trade finance facility aimed at enhancing cross-border trade in South Asia and Africa. The collaboration addresses a trade finance gap by providing liquidity for critical imports amid rising inflation. Leveraging a Master Risk Participation Agreement, it will enhance trade finance services in markets such as Angola, Bangladesh, Benin, and Ivory Coast. This partnership strengthens Mashreq's network and expands support for emerging economies.

Trade Finance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finance Types Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters Of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium Sized Enterprises (SMEs), Large Enterprises |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asian Development Bank, Banco Santander SA, Bank of America Corp., BNP Paribas SA, Citigroup Inc., Crédit Agricole Group, Euler Hermes, Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co., Mitsubishi Ufj Financial Group Inc., Morgan Stanley, Royal Bank of Scotland, Standard Chartered Bank, Wells Fargo & Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the trade finance market from 2020-2034.

- The trade finance market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the trade finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Trade finance refers to the financial instruments and services that facilitate international and domestic trade. These include loans, guarantees, letters of credit, and other tools that mitigate risks and ensure liquidity for exporters and importers.

The global trade finance market was valued at USD 57.2 Billion in 2025.

IMARC estimates the global trade finance market to exhibit a CAGR of 5.41% during 2026-2034.

The market is driven by rapid globalization, the increasing volume of international trade, advancements in digital technologies such as blockchain and AI, the integration of complex supply chains, and a focus on mitigating payment defaults and credit risks.

Supply chain finance represented the largest segment by finance type, driven by its ability to optimize working capital and provide liquidity.

Letters of credit lead the market by offering due to their secure transaction processes and ability to mitigate payment risks.

Banks are the leading segment by service provider, driven by their extensive networks and ability to offer comprehensive trade finance solutions.

Large enterprises represented the largest segment by end-user, driven by their extensive international trade operations and complex supply chains.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global trade finance market include Asian Development Bank, Banco Santander SA, Bank of America Corp., BNP Paribas SA, Citigroup Inc., Crédit Agricole Group, Euler Hermes, Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co., Mitsubishi Ufj Financial Group Inc., Morgan Stanley, Royal Bank of Scotland, Standard Chartered Bank, and Wells Fargo & Co., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)