Treasury Management Services Business Plan and Project Report 2026: Industry Trends, Business Setup, Revenue Model, Investment Opportunities, Income, Expenses, and Profitability

Treasury Management Services Business Plan Report Summary

- Purpose: A comprehensive blueprint for setting up a treasury management service, providing a strategic roadmap for offering cash, liquidity, and risk management solutions, ensuring effective financial management and maximizing value for businesses in a dynamic and competitive market.

- Market Opportunity: Increasing demand from corporations to optimize cash flow, manage financial risks, and enhance operational efficiency across various sectors.

- Investment Required: Significant investment will be required in specialized software, skilled professionals, regulatory compliance systems, and a strong digital infrastructure to provide effective solutions tailored to client needs.

- Technical Requirements: A detailed feasibility study is essential, covering robust financial software for real-time reporting, risk management tools, and secure systems for data management, enabling seamless integration with client accounting and financial platforms.

- Regulatory Approval: Securing the necessary licenses, permits, and accreditations to ensure adherence to financial industry standards and regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), and data protection laws, thereby enabling secure and compliant treasury management practices.

- Financial Analysis: A comprehensive financial assessment evaluating revenue streams from service fees, subscription models, and transaction-based pricing, along with operational costs, to determine the profitability and sustainability of treasury management services.

- ROI & Viability: Strong financial returns supported by client acquisition, the scalability of solutions, and market penetration, thereby offering long-term profitability through recurring revenue models and value-added services.

What are Treasury Management Services?

- Treasury management services (TMS) are a set of solutions that enable businesses to manage their financial activities more effectively. They are intended to automate cash flow and financial workflows, streamline routine processes, and enhance transparency into cash flow to ensure that companies maintain their best liquidity levels and reduce financial risks.

- These services usually consist of cash and liquidity management, fraud mitigation, risk management, and optimizing the working capital. Furthermore, treasury management services offer real-time information on financial data, allowing businesses to base their decisions on facts.

Treasury Management Services Business Setup:

Setup of a treasury management services business will involve creating the infrastructure required to provide these solutions, including instilling financial software, employing qualified financial experts, and complying with financial regulations. Aside from this, the company will also have to create strategic alliances with banks, payment providers, and other financial institutions in order to provide a wide array of services. Overall, continuous client support, constant updates, and scalable service offerings will be essential to address the changing business needs and maintain long-term success within this competitive industry. IMARC Group’s report, titled “Treasury Management Services Business Plan and Project Report 2025: Industry Trends, Business Setup, Revenue Model, Investment Opportunities, Income, Expenses, and Profitability” provides a complete roadmap for setting up a treasury management services facility.

Key Requirements for Setting up a Treasury Management Services Facility

- Detailed Business Model & Operations Plan:

- Service Overview

- Service Workflow

- Revenue Generation Model

- SOPs and Service Quality Standards

The report outlines the core aspects of the service, including a clear overview of the offering and the step-by-step workflow that drives daily operations. It explains the revenue generation mechanisms, highlighting how the business creates and captures value. It also covers standard operating procedures (SOPs) and service quality standards to ensure consistent delivery and customer satisfaction, providing a practical blueprint for effective management and scalability.

- Technical Feasibility:

- Site Selection Criteria

- Space Requirement and Costs

- Equipment Requirement and Cost

- List of Equipment Suppliers

- Furniture, Fixtures, and Interior Setup

- Utility Requirement and Cost

- Human Resource Requirements and Wages

The feasibility study evaluates the practical aspects of setting up and operating the treasury management service. It covers criteria for selecting an ideal site, detailing space requirements and associated costs. The report also outlines the necessary equipment, along with estimated costs and a list of reliable suppliers. It also addresses the furniture, fixtures, interior setup, utility needs with cost estimates, and human resource requirements including wage considerations, ensuring a comprehensive understanding of the infrastructure and operational essentials.

- Project Economics:

- Capital Investments

- Operating Costs

- Expenditure Projections

- Revenue Projections

- Taxation and Depreciation

- Profit Projections

- Financial Analysis

The report also covers a detailed analysis of the project economics for setting up a treasury management service. This includes the analysis and detailed understanding of capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report also provides a detailed analysis of the licenses and approvals required, information related to financial assistance, along with a comprehensive list of certifications required for setting up a treasury management service.

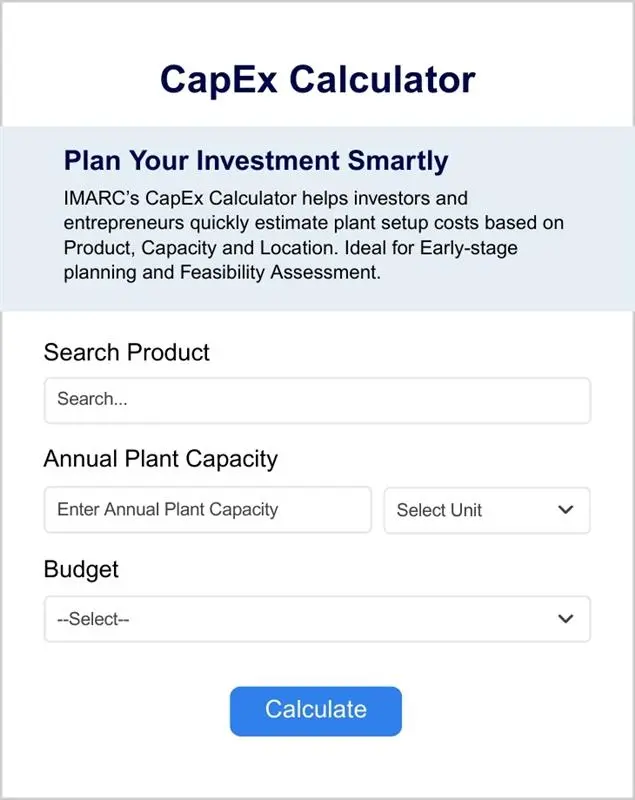

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Capital Investment (CapEx): Equipment & Machinery costs account for the largest portion of the total capital expenditure. The cost of facility development forms another substantial part of the overall capital investment. This allocation ensures a solid foundation for safe and efficient operations.

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the treasury management services is projected to be significant, covering salaries & wages, utilities, overheads, depreciation, taxes, among others. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential increase in the labor cost.

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Facility Development Costs | XX |

| Civil Works Costs | XX |

| Equipment & Machinery Costs | XX |

| Other Capital Costs | XX |

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Salaries & Wages | XX |

| Finance costs | XX |

| Depreciation and Amortization Expense | XX |

| Other Expenses | XX |

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX |

| Net Profit | US$ | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX |

Market Analysis:

- Market Trends

- Market Breakup by Segment

- Market Breakup by Region

- Cost Structure

- Market Forecast

- Competitive Landscape

The report also provides a concise evaluation of the market landscape, covering key trends, market segmentation, regional demand variations, cost structures, future growth projections, and the competitive landscape with major players and entry barriers. This section offers critical insights to assess the viability and strategic opportunities for establishing a treasury management service.

Treasury Management Services Market Trends and Growth Drivers:

- Digital Transformation of Financial Services

The rising digitalization of banking and financial services is largely reshaping the treasury management environment. Companies are looking for integrated, cloud-based treasury management solutions that provide access to real-time data, automation, and improved risk management features, creating demand for digital treasury services.

- Growing Need for Risk Management Solutions

As the world's markets become more turbulent, businesses are looking more and more towards managing risk. Treasury management services that offer solutions to manage currency, interest rate, and credit risks are now becoming increasingly important to businesses in order to mitigate financial uncertainties and protect their operations.

- Shift Toward Automation and Artificial Intelligence

Artificial intelligence (AI) and automation are transforming treasury management by automating processes like reconciliations, payments processing, and cash forecasting. This movement lowers operational expenses, enhances precision, and facilitates real-time decision-making for companies and promotes its widescale adoption.

- Increased Regulatory Pressures

As regulatory oversight increases in the banking and financial services industry, there is a heightened demand for treasury management services that promote adherence to intricate laws and regulations like AML, KYC, and FATCA. This is pushing significant growth in the compliant and secure financial solution market.

Latest Industry Developments:

- September 2025: FIS launched the FIS Neural Treasury, an AI-driven solution developed to optimize and streamline treasury management services. This solution integrates artificial intelligence (AI), machine learning (ML), and robotics in order to enable corporate treasurers in companies of all sizes increase productivity, lower operational risk, and unleash cash flow to better fund strategic growth possibilities.

- July 2025: Trovata acquired ATOM, an enterprise Treasury Management System (TMS) created by Financial Sciences Corporation. This acquisition is a significant milestone in Trovata’s goal to democratize and streamline treasury technology, enabling the complete range of capabilities needed to support major international corporations.

- April 2025: FIS launched Treasury and Risk Manager, the company’s next-gen enterprise treasury management solution. This cloud-native service supports higher workloads, increased transaction volumes, and enhanced enterprise connectivity to give corporate treasurers and CFOs better risk visibility, better data-driven decision-making, and quicker, more effective money movement.

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Treasury Management Services |

| Report Coverage |

Business Model & Operations Plan: Business Overview, Business Workflow, Revenue Generation Model, SOPs, and Service Quality Standards Technical Feasibility: Site Selection Criteria, Space Requirement and Costs, Equipment Requirement, Cost & List of Equipment Suppliers, Furniture, Fixtures, and Interior Setup, Utility Requirement and Cost, and Human Resource Requirements and Wages Financial Feasibility: Capital Cost of the Project, Techno-Economic Parameters, Income Projections, Expenditure Projections, Pricing and Margins, Taxation, Depreciation, Financial Analysis, Profitability Analysis, Sensitivity Analysis, and Economic Analysis. Market Analysis: Global Market Trends, Segmentation, Regional Breakup, cost structure, competitive landscape Marketing and Sales Strategy: Branding and positioning, offline and online marketing channels, pricing strategy, customer retention and loyalty programs, and strategic partnerships. Risk Assessment and Mitigation: Operational risks, market risks, financial risks, legal and regulatory risks, and risk mitigation strategies. Other Analysis Covered in The Report: Licenses and Approvals Required, Certifications Required, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- What are the key operational steps involved in establishing a treasury management service?

- What is the total space required for setting up a treasury management service?

- What equipment are necessary for setting up a treasury management service?

- What are the human resource requirements and associated wage structures in setting up a treasury management service?

- What is the key marketing & branding strategies involved in a treasury management services business?

- What are the associated risks and mitigation strategies in a treasury management services business?

- What are the capital expenditure requirements in setting up a treasury management services facility?

- What are the operational costs involved in a treasury management services facility?

- What is the cost structure of a treasury management service?

- What are the projected income and expenditure involved in a treasury management services facility?

- What is the estimated break-even period in a treasury management services business?

- What profit margins can be expected in a treasury management services business?

- What are the key licenses and approvals required in setting up a treasury management services facility?

- Which certifications are necessary to operate a treasury management service legally and effectively?

- How has the global treasury management services market performed and what are the future growth prospects?

- What are the key segments within the global treasury management services market?

- How is the treasury management services market distributed across different regions worldwide?

- How is the treasury management services industry structured, and who are the major players?

Report Customization

While we have aimed to create an all-encompassing treasury management services feasibility study, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your facility.

- Equipment and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our feasibility study team can assist you in understanding the most complex service models. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of facility costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing business setups worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Our feasibility studies assess several key factors to provide a detailed evaluation of your project's potential. The study includes a pricing analysis of feedstocks, helping to understand industry profit margins and cost variations. Detailed insights into mass balance, unit operations, raw material requirements, and the manufacturing process flow are also provided to ensure a clear understanding of the production setup.

The study also covers critical elements such as location analysis, environmental impact, plant layout, and costs associated with land, machinery, raw materials, packaging, transportation, utilities, and human resources. The project economics section provides an in-depth analysis of capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity, profitability, payback period, net present value (NPV), uncertainty, and sensitivity analysis.

Additionally, IMARC Group's feasibility studies address regulatory procedures, financial assistance, and necessary certifications, ensuring all legal and compliance requirements are met. By covering these aspects, IMARC Group's feasibility studies support informed decision-making, risk reduction, and the overall viability of your business.

Yes, our site identification services include a thorough assessment of potential sites based on proximity to raw materials, ensuring cost-effective and timely supply chain operations. We also consider access to infrastructure, such as transportation networks, utilities, and technology, which are essential for smooth plant operations. Labor availability is another key factor we analyze to ensure that the site has access to a skilled workforce. Additionally, we evaluate the environmental impact to ensure compliance with regulations and sustainable practices. By integrating these factors, we provide a comprehensive site evaluation to identify the optimal location for your new plant, supporting your strategic goals and operational efficiency.

Yes, our regulatory approvals and licensing services are made specifically to support companies in effectively and efficiently navigating the ever-changing regulatory environment. We start by carefully evaluating your company's requirements as well as the unique regulatory framework that applies to your sector. After that, you are assisted by our team of professionals throughout the whole process of securing the necessary industrial permits, business licenses, and environmental clearances.

Additionally, we help with industry-specific regulatory licensing so that your company complies with all sector-specific regulations. To further safeguard your brand and innovations from the outset, we also offer support for intellectual property rights (IPR) registrations and licensing. We manage the required documentation and communicate with pertinent authorities on your behalf by utilizing our deep industry experience and painstaking attention to detail. This allows you to focus on building and growing your business while we take care of the regulatory complexities. Partnering with us ensures that your business is fully compliant and ready to thrive from the start.

Our skilled engineering staff specializes in designing efficient and effective plant layouts that meet your unique needs. We begin with a comprehensive process design to ensure the best possible workflow and use of resources.

Our services include careful equipment selection, ensuring that your plant design incorporates the most suitable and advanced machinery. We also focus on meticulous layout planning, strategically arranging workstations and equipment to optimize output and reduce operational bottlenecks. Furthermore, our facility design takes into account every important factor, such as regulatory compliance, scalability, and safety.

By leveraging our expertise, we ensure that your plant layout not only meets your current operational needs but is also adaptable to future growth and technological advancements. Our goal is to create a well-organized, efficient, and compliant facility that enhances your overall operational efficiency and supports your business objectives.

Yes, our raw material and machinery sourcing services are designed to identify and connect you with reliable and affordable providers. We leverage our extensive network and industry expertise to source high-quality raw materials and advanced machinery that meet your specific requirements.

We also conduct supplier audits and evaluations so that you get the best value for your investment. We evaluate potential suppliers on the basis of cost, quality, reliability, and delivery timelines. We also make sure that all the legal requirements are met, including customs, tax regulations, labor laws, and import/export laws, to ensure you are fully compliant.

When you choose to work with us, you gain access to a list of suppliers pre-screened for affordability and reliability, helping you optimize your procurement process and reduce overall operational costs. It is our goal to assist you in establishing a new plant effectively and economically, ensuring long-term success and sustainability.

IMARC Group can effectively manage the construction of your new facility through our comprehensive construction management services. Our dedicated construction management team oversees the entire construction phase, ensuring that all activities are executed according to plan and within the specified timeline. We manage contractors, coordinating their efforts to ensure smooth and efficient workflow on-site.

Furthermore, our team pays great attention to the progress of the construction work, and we conduct site reviews and quality control to ensure that the construction work is done to the highest standards. We resolve any problems as they arise, thus avoiding any form of delay and keeping the project on schedule. When you work with us, you can be assured that your new facility will be constructed to the highest standards that will enable you to concentrate on your core business activities.

Yes, our distributor identification services are designed to connect companies with trusted distributors who meet high standards of reliability, performance, and ethical practices. We leverage our vast network of vetted distributors across various industries and regions to find the best match for your business needs.

Our process begins with a careful analysis of your particular needs and business goals. We then carry out rigorous research and due diligence to identify the distributors that have market reach and the capability to manage your product lines effectively. Our thorough vetting process involves the distributors' background checks and performance history reviews to ensure that they meet industry standards and have a proven track record.

Also, we ensure compliance with the relevant legislation and regulations to avoid legal issues that may affect the functioning of the company. Once potential distributors are identified, we organize business meetings, as well as handle all logistics to facilitate productive discussions. We provide continuous support throughout the partnership, including performance monitoring and logistics coordination, to ensure the success and optimization of your distribution networks in the long run.

Yes, our factory audit services provide a systematic and thorough evaluation of your plant's performance across various critical parameters. Our experienced auditors utilize industry best practices to conduct detailed inspections, focusing on safety, quality, efficiency, compliance, and sustainability.

Our audits assess safety protocols to ensure a secure working environment, evaluate quality standards to enhance product satisfaction and optimize processes to increase productivity and reduce costs. Compliance checks ensure adherence to relevant regulations, mitigating legal risks, and our sustainability assessments recommend eco-friendly practices to minimize environmental impact.

Our holistic approach delivers actionable insights through detailed audit reports, offering clear recommendations for continuous improvement. By partnering with us, you gain valuable insights into your plant's operations, enabling you to drive enhancements, achieve operational excellence, and maintain a competitive edge.

Yes, our contract manufacturer identification services are designed to assist businesses in navigating the complex landscape of contract manufacturing. We start by defining the ideal contract manufacturer through in-depth discussions with our clients, followed by extensive research to identify potential candidates.

Once potential manufacturers are identified, we conduct a rigorous evaluation and vetting process to ensure they meet high standards of quality, reliability, and compliance with relevant regulations. Our team handles the pre-screening process, arranging meetings between our clients and interested candidates, and managing all logistics to facilitate productive discussions.

We have strict performance monitoring and quality control checks to ensure the manufacturers remain at par with your expectations and contribute positively to your business throughout the partnership lifecycle. Through our expertise and extensive network, we ensure that you partner with capable and credible contract manufacturers, who help you drive efficiency, quality, and growth in your production processes.

IMARC Group offers a comprehensive suite of marketing and sales services dedicated to helping businesses increase revenues and effectively sell products. Our performance marketing services focus on data-driven campaigns that maximize return on investment, utilizing programmatic advertising and retargeting techniques to reach the right audience at the right time. We enhance your online presence through SEO and SMO, driving organic traffic and improving your digital footprint.

The lead generation strategies we use target high-quality quality leads that convert into loyal clients, while our brand promotion strategies including influencer marketing and creative designing enhance the visibility and credibility of your brand. Our social media management services assist you in engaging with your audience, establishing relationships with them, and driving conversions through targeted campaigns.

By partnering with IMARC Group, you benefit from our approach that is tailored to your business needs and unique objectives. Our strategies cover all aspects of digital marketing so that you can reach your target audience consistently, along with our ongoing support and optimization to keep your campaigns effective and relevant. Our cutting edge and performance driven marketing services help you gain the competitive advantage and ensure long-term success.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization