Turkey Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Turkey Advertising Market Overview:

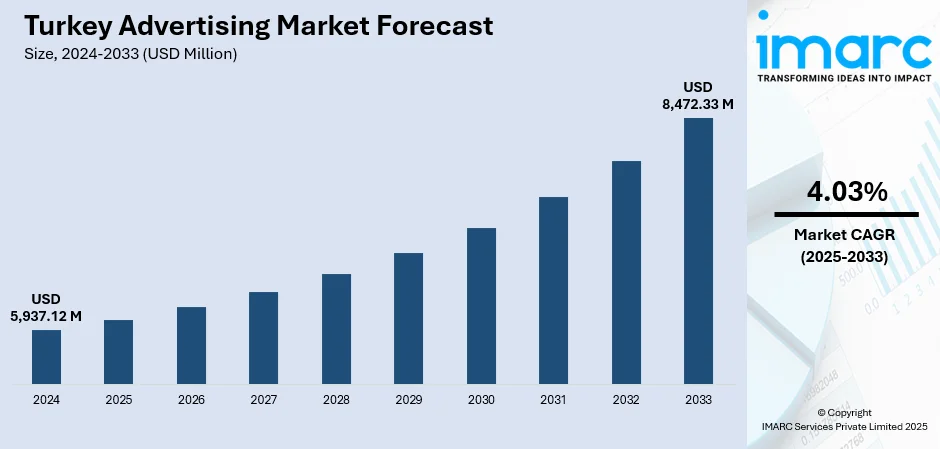

The Turkey advertising market size reached USD 5,937.12 Million in 2024. The market is projected to reach USD 8,472.33 Million by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The market is evolving through rapid digital adoption and urbanization. Digital platforms such as mobile, social media, video, and programmatic advertising have become central to brand strategy, while traditional media like television and billboards continue to play a role in regional outreach. Agencies are increasingly utilizing creative storytelling and data-driven targeting to engage diverse audiences. Regional variations in media access and consumer behavior shape campaign approaches. These shifts redefine competitive dynamics and influence Turkey advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,937.12 Million |

| Market Forecast in 2033 | USD 8,472.33 Million |

| Market Growth Rate 2025-2033 | 4.03% |

Turkey Advertising Market Trends:

Surge in Digital and Mobile Advertising Spend

In May 2024, Turkey recorded a major turning point as digital platforms claimed more than two‑thirds of total ad spend, reflecting a widespread shift in how audiences consume media. Mobile devices drove this growth, with mobile-based ads accounting for a substantial portion of digital impressions, particularly across social and video platforms. Platforms offering short‑form content such as TikTok, Instagram Reels, and YouTube Shorts have gained significant traction among audiences and attracted advertisers aiming to deliver concise, high-impact communications. With campaign planning now rooted in data analytics and flexible format scheduling, marketers are crafting interactive experiences that connect authentically with consumers. Real-time measurement tools enable optimization based on engagement signals and behavioural context. Traditional formats like television and print continue to carry weight with certain consumer segments, but most investment now flows toward responsive, digitized channels. The shift also encourages the development of innovative campaigns that combine influencer narratives, immersive video, and social commerce within integrated strategies. This rapid evolution signals long-term Turkey advertising market growth backed by digital transformation and rising consumer connectivity.

To get more information on this market, Request Sample

Strengthened Enforcement Targets Misleading Ads

In January 2025, Turkey’s Advertisement Board intensified oversight by reviewing nearly two thousand ad campaigns and levying fines for deceptive messaging under updated consumer protection rules. These enforcement actions targeted misleading content such as unsubstantiated claims, unfair comparative adverts, and manipulative digital formats. The regulatory updates followed statute amendments expanding the Advertisement Board’s authority to suspend publications and impose administrative penalties. Advertisements are now expected to comply with accuracy obligations and avoid automated "dark patterns" that misguide consumers. The government has also begun training social media influencers to ensure ethical promotion and transparency in digital sponsorships. As a result, agencies and marketers are adapting campaign creation workflows to build compliance checkpoints, disclosure statements, and better internal review processes. Platforms hosting ads must ensure content passes moderation standards before publication, reinforcing accountability. This shift promotes consumer trust and brand integrity across media, shaping a market environment where legal compliance is central to campaign strategy. Such regulatory momentum is a core feature of emerging Turkey advertising market trends as governance measures deepen across the ecosystem.

Programmatic DOOH Revolutionizes Outdoor Campaigns

In December 2024 Turkey’s urban advertising sector reached a tipping point as digital out‑of‑home (DOOH) media began its programmatic evolution, introducing automated ad buying across screens in transit hubs, ports, and shopping districts. The transition ushered in flexible campaign deployment, where content can be updated in real time based on location conditions, audience flow, or contextual triggers. Media owners have deployed thousands of screens connected to a centralized scheduling platform, enabling advertisers to launch targeted campaigns with real-time measurement and proof-of-play data. As smart-city infrastructure integrates with 5G connectivity and GIS-based permit systems, programmatic DOOH inventory is expanding across Istanbul and other metropolitan areas, providing brands with access to dynamic audiences in high-traffic environments. This shift enables advertisers to blend online targeting precision with offline visibility, merging digital analytics with urban reach. Marketers are adapting creative workflows to include responsive mapping, schedule-based content variation, and cross-channel alignment with mobile and social media tactics.

Turkey Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

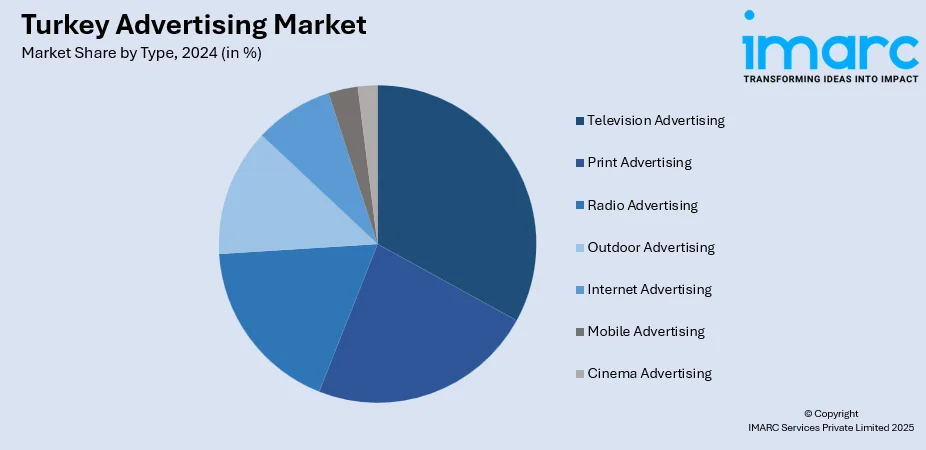

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Advertising Market News:

- July 2025: Turkey’s WPP Media Türkiye has entered a strategic partnership with Mimeda, the country’s first retail media company founded by Migros to enhance retail media advertising solutions. This collaboration blends WPP Media’s global media planning expertise with Mimeda’s local retail infrastructure and audience insights. The alliance enables brands to reach consumers directly at the point of purchase through in-store, online, and programmatic channels. By integrating data-driven strategy and technology, the partnership aims to elevate retail-focused advertising innovation throughout Turkey.

Turkey Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey advertising market on the basis of type?

- What is the breakup of the Turkey advertising market on the basis of region?

- What are the various stages in the value chain of the Turkey advertising market?

- What are the key driving factors and challenges in the Turkey advertising market?

- What is the structure of the Turkey advertising market and who are the key players?

- What is the degree of competition in the Turkey advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)