Turkey Agribusiness Market Size, Share, Trends and Forecast by Product, and Region, 2025-2033

Turkey Agribusiness Market Overview:

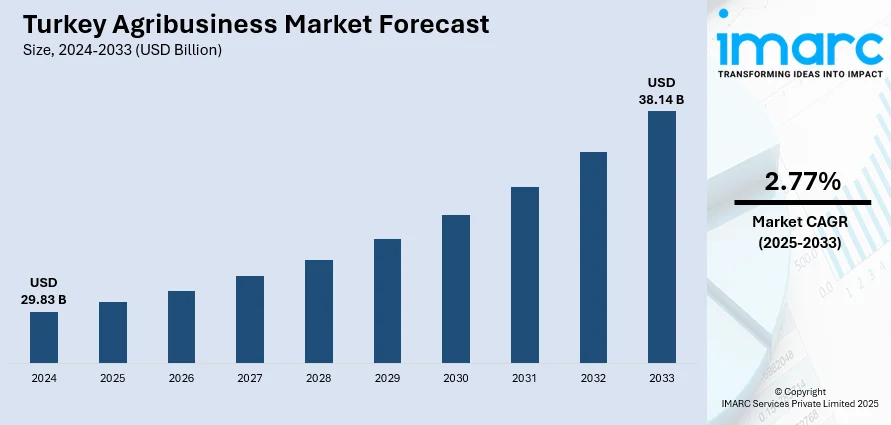

The Turkey agribusiness market size reached USD 29.83 Billion in 2024. The market is projected to reach USD 38.14 Billion by 2033, exhibiting a growth rate (CAGR) of 2.77% during 2025-2033. Beneficial weather conditions, featuring plenty of sunlight and balanced rainfall in various farming regions, lengthen growing periods and enable several harvests annually, enhancing yield and profitability. Besides this, increasing international demand for Turkish goods is boosting revenue for farmers, processors, and traders, thus contributing to the expansion of the Turkey agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.83 Billion |

| Market Forecast in 2033 | USD 38.14 Billion |

| Market Growth Rate 2025-2033 | 2.77% |

Turkey Agribusiness Market Trends:

Presence of fertile soil and favorable climatic conditions

The presence of fertile soil and favorable climatic conditions is a major driver of the market, enabling the country to cultivate a wide variety of crops, including grains, fruits, vegetables, and industrial plants, throughout the year. Turkey's agricultural production hit a historic peak, surpassing USD 70 Billion for the first time in 2024, as stated by Agriculture and Forestry Minister Ibrahim Yumakli. Rich soil composition in regions, such as the Aegean, Marmara, and Mediterranean, provides high yields and supports the cultivation of high-value crops like olives, citrus fruits, nuts, and cotton. Favorable weather patterns, with ample sunshine and moderate rainfall in many agricultural zones, extend growing seasons and allow multiple harvests annually, boosting productivity and profitability. This natural advantage reduces dependence on imported raw agricultural materials and encourages domestic food production. The ability to cultivate diverse crops also supports the expansion of the food processing industry, adding value to agricultural output. Furthermore, the consistency in crop quality due to optimal growing conditions enhances Turkey’s competitiveness in international markets, attracting investments in farming, processing, and distribution. These conditions also make the country suitable for emerging sectors like organic farming and greenhouse cultivation.

To get more information on this market, Request Sample

Increasing export activities

Rising export activities are fueling the Turkey agribusiness market growth. According to the Turkish Exporters Association (TIM), the agricultural sector of Turkey achieved a historical annual export volume of USD 36.2 Billion in 2024. Turkey is a major exporter of products like fruits, vegetables, nuts, grains, and processed food items to markets in Europe, the Middle East, and Asia, benefiting from its strategic geographic location and well-developed transport networks. Increasing international demand for Turkish goods is boosting revenue for farmers, processors, and traders, while also incentivizing investments in modern farming techniques, storage facilities, and quality control systems to meet global standards. Export-oriented agriculture is promoting the cultivation of high-value crops and enhancing competitiveness in international markets. Additionally, trade agreements and favorable logistics routes, including proximity to major seaports, reduce costs and increase efficiency, making Turkish products more attractive abroad. The influx of foreign currency from exports is strengthening the agricultural sector’s financial stability, enabling reinvestment into technology, mechanization, and research. Overall, rising export activities are not only expanding market reach for Turkish agribusiness but also stimulating innovations, improving quality, and reinforcing Turkey’s position as a key global agricultural supplier.

Turkey Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

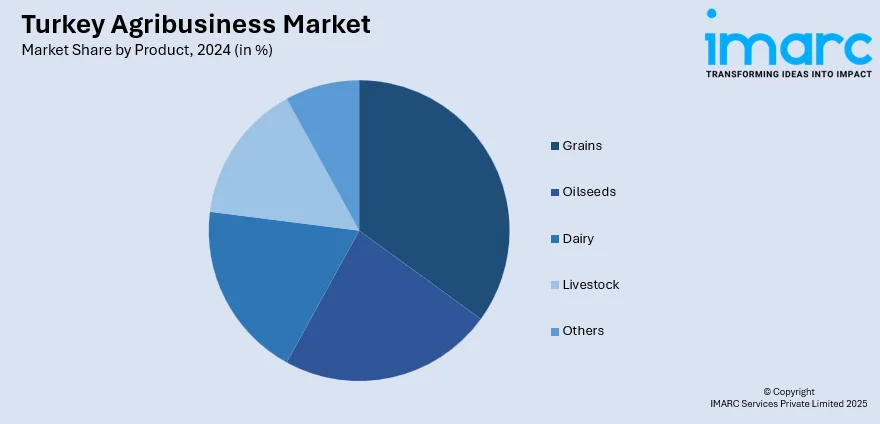

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Agribusiness Market News:

- In December 2024, Turk Telekom and ZTE collaborated to initiate the ‘5G Smart Agriculture Project’ in Çorum, Turkey, aimed at digitizing and modernizing the agricultural industry. The initiative incorporated cutting-edge technologies like drones, intelligent agricultural equipment, and 5G connectivity to improve agricultural methods, such as automated spraying, fertilization, and precise irrigation.

- In August 2024, the Agriculture and Forestry Ministry of Turkey unveiled the initiative to lease agricultural lands that remained uncultivated for two straight years. To locate underused lands for leasing, commissions for land identification were to be formed at both the provincial and district levels. Agricultural lands that were leased would be recorded in the systems set by the ministry, and lessees would qualify for agricultural subsidies associated with these lands.

Turkey Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey agribusiness market on the basis of product?

- What is the breakup of the Turkey agribusiness market on the basis of region?

- What are the various stages in the value chain of the Turkey agribusiness market?

- What are the key driving factors and challenges in the Turkey agribusiness market?

- What is the structure of the Turkey agribusiness market and who are the key players?

- What is the degree of competition in the Turkey agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)