Turkey Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Turkey Aquaculture Market Overview:

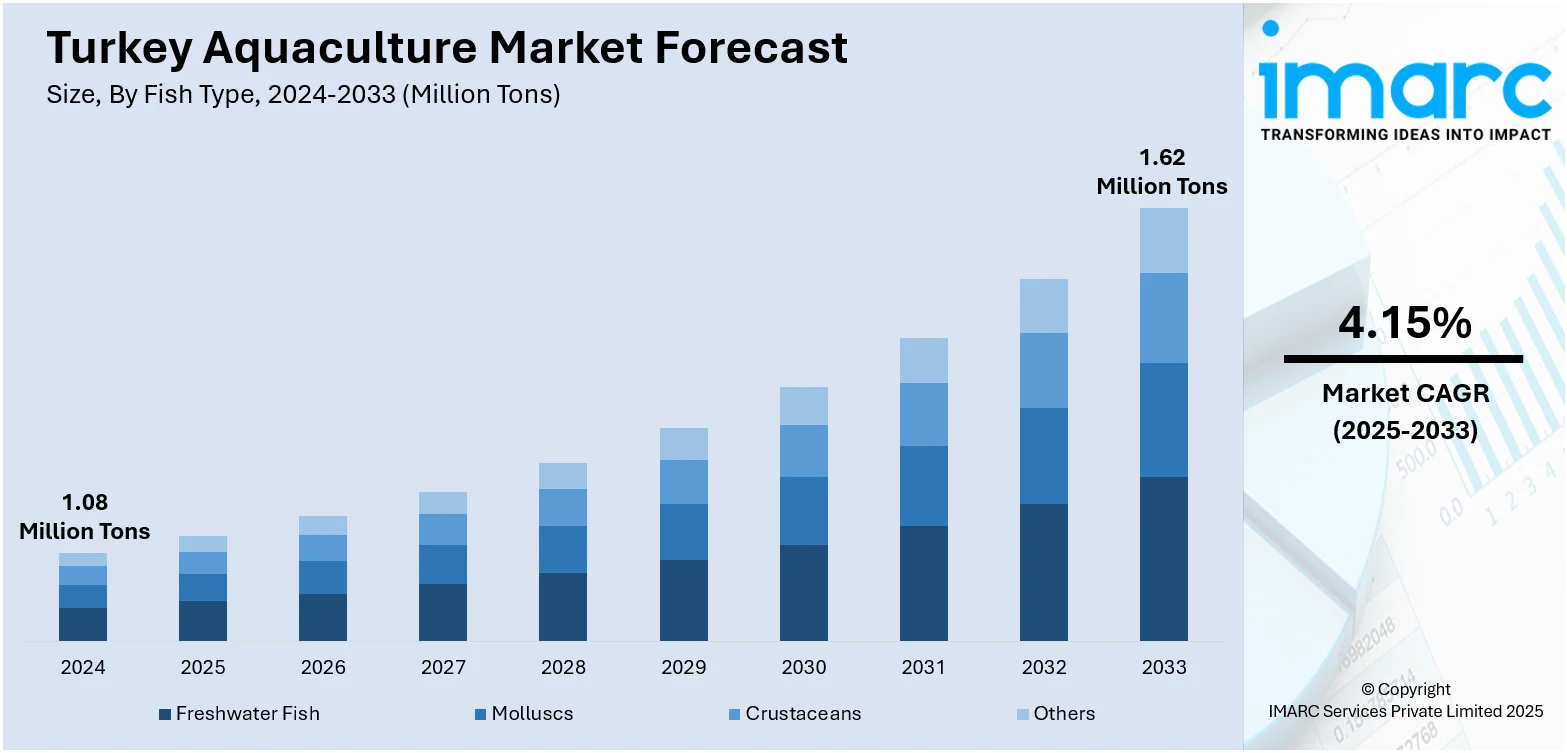

The Turkey aquaculture market size reached 1.08 Million Tons in 2024. Looking forward, the market is projected to reach 1.62 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The market is fueled by strong export demand, favorable marine environments, state support through incentives and subsidies, and rising investments in modern fish farming infrastructure. The focus on sea bass and sea bream farming has proven particularly successful, boosting Turkey aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.08 Million Tons |

| Market Forecast in 2033 | 1.62 Million Tons |

| Market Growth Rate 2025-2033 | 4.15% |

Turkey Aquaculture Market Trends:

Export-Oriented Production Model

Turkey’s seafood exports reached $2.02 Billion in 2024, with a goal of $2.5 Billion by 2027. Turkish salmon exports have skyrocketed 17 times in five years, hitting 100,000 tons and $498 Million in 2024, projected to rise to $650 Million by the end of the year and $1 billion within five years. The industry follows a zero-waste approach, fully utilizing every fish, highlighting a strong commitment to sustainability and science-based growth. Turkey has emerged as a leading exporter of seafood, particularly to EU markets such as Italy, Spain, and Greece. The government’s strategic focus on export-led aquaculture is supported by subsidies, streamlined licensing, and trade partnerships. Strict compliance with EU standards and certifications enables Turkey to maintain competitiveness and expand its reach. With high-quality production and cost-efficient operations, Turkish producers are gaining market share in both Europe and the Middle East. Export revenue from aquaculture has seen consistent growth over the past decade, providing a solid foundation for further investment. This robust export model continues to be a cornerstone of Turkey aquaculture market growth, attracting both domestic and international capital.

To get more information on this market, Request Sample

Domestic Aquafeed Industry Development

To reduce dependency on imported feed and enhance profitability, Turkey is rapidly developing its domestic aquafeed industry. Investments in high-protein, species-specific feed formulations are enabling more efficient growth cycles for popular farmed species like trout, sea bass, and sea bream. Several Turkish feed manufacturers have upgraded their production facilities and R&D capabilities, often in collaboration with European technology providers. Local feed production lowers transportation costs, ensures consistent supply, and allows better quality control. Additionally, government support through tax incentives and infrastructure funding is accelerating this trend. Strengthening the aquafeed supply chain is critical to maintaining production growth, thus contributing significantly to Turkey aquaculture market growth. For instance, AKVA Group Turkey launched its largest project to date, supplying 16 Polarcirkel 220-meter pens (500mm) and three Akvasmart CCS feeding systems to Gümüşdoğa. The new facility in Güllük Bay will be Turkey’s largest bass and bream farm, merging three existing farms in Muğla. Construction is anticipated to run until summer 2026. This project highlights AKVA’s local production capabilities and strengthens its role in Turkey’s growing aquaculture sector.

Turkey Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

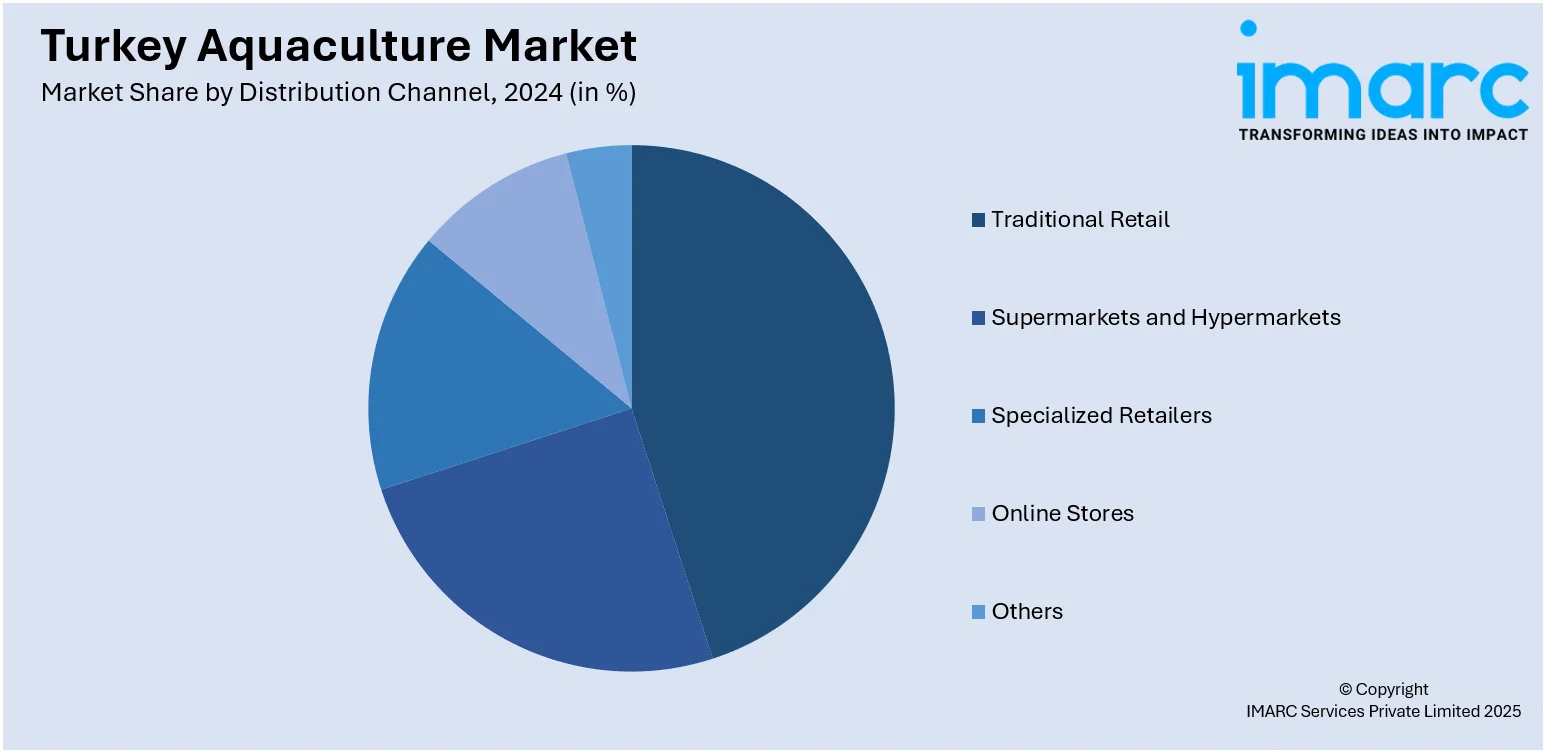

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Aquaculture Market News:

- In July 2024, Metro Türkiye, in partnership with Hatko Aquaculture and Denmark’s Alpha Aqua, built Turkey’s first retail-sector aquaponics RAS facility in Muğla. The pilot project aims to reduce sea bass grow-out time from 15 to 9 months and will also cultivate Salicornia. Using algae-based feed and recirculating water, the system enhances omega-3 content and sustainability.

- In June 2024, Optimar signed an exclusive agreement with Turkey-based OctoAqua to strengthen its presence in the Turkish aquaculture market. OctoAqua will represent Optimar’s advanced fish processing and factory solutions, offering customized systems for both land- and sea-based operations. The collaboration aims to meet the rising demand for high-quality processing technologies in Turkey's growing aquaculture sector.

Turkey Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey aquaculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey aquaculture market on the basis of fish type?

- What is the breakup of the Turkey aquaculture market on the basis of environment?

- What is the breakup of the Turkey aquaculture market on the basis of distribution channel?

- What is the breakup of the Turkey aquaculture market on the basis of region?

- What are the various stages in the value chain of the Turkey aquaculture market?

- What are the key driving factors and challenges in the Turkey aquaculture market?

- What is the structure of the Turkey aquaculture market and who are the key players?

- What is the degree of competition in the Turkey aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)