Turkey Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2026-2034

Turkey Bancassurance Market Summary:

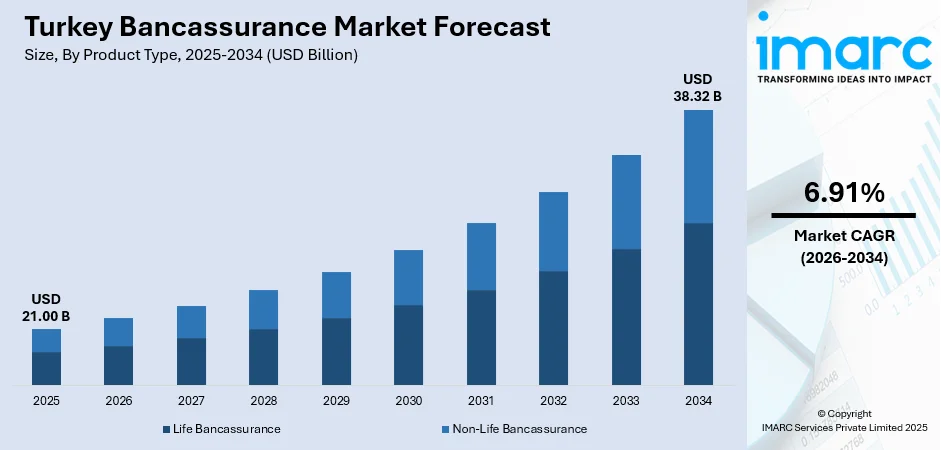

The Turkey bancassurance market size was valued at USD 21.00 Billion in 2025 and is projected to reach USD 38.32 Billion by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

The Turkey bancassurance market is gaining momentum as financial institutions expand insurance offerings through their established distribution networks. Banks are leveraging their extensive customer bases and digital platforms to enhance insurance accessibility across urban and rural populations. Growing consumer awareness of financial protection, supportive regulatory frameworks, and the integration of innovative digital solutions are driving adoption. The diversification of product offerings into life, health, property, and investment-linked insurance, combined with strategic partnerships between banks and insurers, is strengthening the Turkey bancassurance market share.

Key Takeaways and Insights:

- By Product Type: Life bancassurance leads the market with 75.15% share in 2025, reflecting strong consumer demand for financial security and long-term protection solutions distributed through Turkey's extensive banking network.

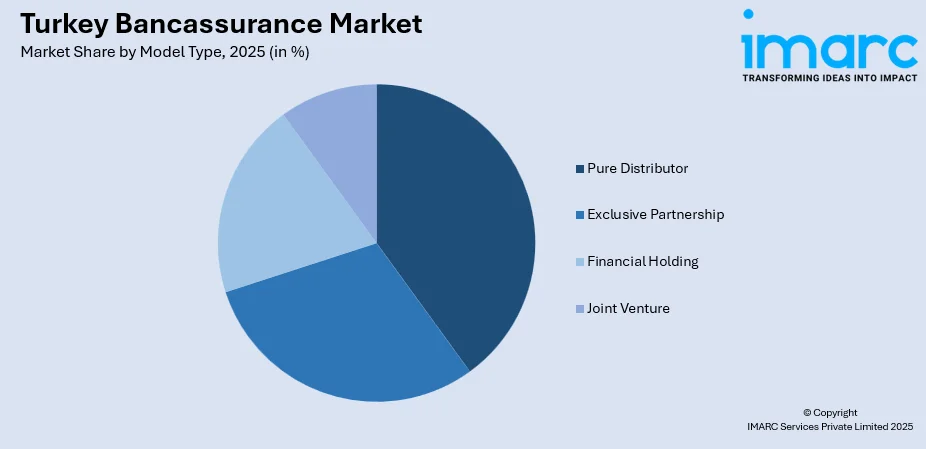

- By Model Type: Pure distributor model dominates the market with 38.94% share in 2025, as banks prefer straightforward distribution agreements that leverage their customer relationships without extensive capital investment in insurance operations.

- Key Players: The Turkey bancassurance market features collaborations between major banks and insurers, with companies focusing on digital transformation, product diversification, and customer-centric solutions to strengthen market position and expand reach.

To get more information on this market Request Sample

The Turkey bancassurance market is advancing as banks and insurers recognize the mutual benefits of integrated financial services distribution. With insurance penetration in Turkey remaining relatively low compared to mature markets, bancassurance provides a critical bridge to expand coverage among underserved populations. Banks are well-positioned to cross-sell insurance products alongside loans, mortgages, and savings accounts, creating convenience for customers and additional revenue streams for financial institutions. The Turkish banking sector posted net profits of approximately USD 18.77 billion in 2024, demonstrating the financial strength that supports bancassurance expansion. Digital banking adoption has surged, with digital banking customers reaching nearly 111 million by the end of 2023.

Turkey Bancassurance Market Trends:

Digital Transformation Accelerating Insurance Distribution

Digital banking channels are revolutionizing bancassurance distribution in Turkey, enabling seamless integration of insurance products with banking services. The Turkey digital banking market size reached USD 90.78 Million in 2024. Looking forward, the market is expected to reach USD 248.32 Million by 2033, exhibiting a growth rate (CAGR) of 11.83% during 2025-2033. Research confirms that both internet and mobile banking transactions have a positive effect on bank profitability in Turkey. Mobile-first approaches and fintech collaborations are making insurance products more personalized and accessible, particularly among younger demographics who prefer digital interactions over traditional branch visits.

Expanding Insurance Penetration through Bank Networks

Turkey's bancassurance sector is gaining momentum as financial institutions expand insurance offerings to wider consumer bases. With insurance penetration still relatively low compared to mature markets, banks play a critical role in bridging the coverage gap by leveraging their established distribution networks. The Turkish insurance sector, currently estimated at approximately USD 25 Billion, is divided into three primary categories, including life insurance, non-life insurance, and private pension plans. Non-life insurance accounts for roughly USD 10 Million, representing about 40 percent of the overall Turkish insurance market.

Growing Demand for Comprehensive Protection Products

Consumer preferences in Turkey are shifting toward more comprehensive coverage options, including health and life insurance, due to increasing awareness of financial security. Rising healthcare costs are pushing individuals toward insurance coverage, while government initiatives promoting health insurance adoption stimulate market growth. Banks are responding by diversifying their product portfolios to include not only credit-linked insurance but also health, property, and investment-linked solutions that appeal to Turkey's growing middle class seeking retirement planning and healthcare coverage.

Market Outlook 2026-2034:

The Turkey bancassurance market is positioned for sustained growth, driven by digital transformation, regulatory support, and increasing consumer awareness of financial protection. Strategic partnerships between banks and insurers, combined with investments in technology and product innovation, will continue to enhance distribution efficiency and customer experience across the forecast period. The market generated a revenue of USD 21.00 Billion in 2025 and is projected to reach a revenue of USD 38.32 Billion by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

Turkey Bancassurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Life Bancassurance | 75.15% |

| Model Type | Pure Distributor | 38.94% |

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

Life bancassurance leads the Turkey bancassurance market, accounting for 75.15% of total market share in 2025.

Life bancassurance products in Turkey are witnessing significant growth as consumers increasingly prioritize financial security and long-term life planning. With rising financial literacy, individuals are more aware of the importance of life insurance for protecting their families in unforeseen circumstances. Banks, leveraging their established customer relationships and credibility, are well-positioned to introduce these essential protection products. This trend reflects a broader shift in consumer behavior toward proactive financial management and risk mitigation through reliable insurance solutions.

The Turkish bancassurance model benefits from strong economic stability and a well-developed banking infrastructure. Customers view banks as trusted partners capable of providing comprehensive financial planning, which encourages the adoption of life insurance and other protection products through banking channels. This alignment between consumer trust, financial expertise, and convenience strengthens the market, while banks continue to expand product offerings and advisory services to meet the evolving needs of individuals seeking holistic life and financial security solutions.

Model Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Pure distributor model dominates the Turkey bancassurance market with 38.94% share in 2025.

The pure distributor model dominates Turkey’s bancassurance market by providing banks with a simple and efficient method for distributing insurance products without heavy investment in underwriting operations. Through this model, banks can utilize their extensive branch networks, customer databases, and digital platforms to offer insurance solutions, while insurers take responsibility for product development, risk management, and claims processing. This structure allows banks to expand their service offerings and strengthen relationships with existing customers.

This model’s flexibility also enables banks to collaborate with multiple insurers, creating diverse product portfolios tailored to varying customer needs. By offering a range of life, health, and property insurance products, banks can address different segments of their client base while generating additional fee income. The arrangement fosters innovation in service delivery and cross-selling, allowing banks to enhance customer satisfaction and loyalty while supporting insurers in reaching broader markets efficiently.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

As Turkey’s most populous and economically developed region, Marmara benefits from high urbanization and financial literacy, driving demand for bancassurance products. Banks leverage extensive branch networks and digital platforms to cross-sell life, health, and investment-linked insurance. Rising consumer awareness of financial security, combined with strong economic activity, supports the adoption of comprehensive insurance solutions. Regulatory support and fintech integration further enhance bancassurance growth in the region.

Central Anatolia, home to the capital Ankara, sees bancassurance growth due to high government and corporate employment, which increases access to structured financial services. Banks utilize strong customer relationships and digital banking channels to promote life, health, and retirement-linked insurance. Regional emphasis on long-term financial planning, combined with growing awareness of protection and investment solutions, drives the expansion of bancassurance products in both urban and semi-urban areas.

Tourism and trade are key economic drivers in the Mediterranean region, generating demand for health, travel, and property insurance. Banks capitalize on high retail banking penetration and customer trust to distribute insurance products effectively. Growing financial literacy and digital banking adoption encourage consumers to integrate insurance into broader financial planning. Bancassurance growth is further supported by regulatory initiatives and the rising preference for convenient, bank-channel-based insurance solutions.

The Aegean region’s dynamic commercial centers and expatriate populations drive bancassurance demand, particularly for health, life, and property coverage. Banks leverage well-established branch networks and digital channels to reach diverse customer segments. Consumers increasingly value financial planning and protection solutions, while regulatory encouragement for bancassurance adoption supports product innovation and cross-selling. Regional economic growth and tourism also expand opportunities for insurance distribution through banking channels.

Southeastern Anatolia is experiencing bancassurance growth due to rising urbanization, government-supported financial literacy programs, and expanding banking infrastructure. Banks use these channels to introduce life, health, and investment-linked insurance products, promoting financial security and long-term planning. Growing awareness of insurance benefits among households and small businesses, combined with improved branch coverage and digital adoption, is gradually increasing the penetration of bancassurance across the region.

The Black Sea region’s growing urban centers and industrial activity foster demand for life, health, and property insurance through bancassurance. Banks capitalize on trusted customer relationships and digital banking platforms to expand insurance offerings. Consumer interest in financial planning, coupled with government support for protection and retirement products, encourages adoption. The region’s economic development, rising disposable income, and regulatory frameworks make bancassurance a convenient and reliable distribution channel.

Eastern Anatolia’s bancassurance growth is driven by gradual financial literacy improvements and expanding banking infrastructure in urban centers. Banks provide convenient access to life, health, and property insurance, emphasizing long-term financial security. Government initiatives supporting insurance awareness and protection products encourage adoption, while digital banking channels help overcome geographic and logistical challenges. Increasing consumer trust in banks as financial partners strengthens the penetration of bancassurance in the region.

Market Dynamics:

Growth Drivers:

Why is the Turkey Bancassurance Market Growing?

Strong Banking Sector Performance and Infrastructure

Turkey's robust banking sector provides a solid foundation for bancassurance expansion. The banking sector posted strong financial performance, with robust profitability and substantial asset growth, demonstrating the sector’s stability. This financial strength provides a solid foundation for supporting insurance distribution activities, enabling banks to expand their product offerings, enhance customer trust, and effectively promote bancassurance solutions alongside traditional banking services. As of October, Turkey’s banking industry consisted of 67 institutions, including state-owned, private, foreign, participation, and development & investment banks. These banks operate a total of 10,765 branches both within the country and internationally, supported by a workforce of 211,184 employees. Strong bank profitability enables investment in digital platforms and customer relationship management systems that enhance bancassurance capabilities and customer experience.

Regulatory Support and Product Diversification

Supportive regulations have strengthened bancassurance as a sustainable growth channel in Turkey. Regulatory authorities promote transparent distribution practices and consumer protection measures that enhance public confidence. Expanded insurance frameworks now cover a broader range of natural disasters beyond traditional risks, creating additional opportunities for distribution through banking channels. Furthermore, initiatives to standardize disclosures and align sales practices with consumer needs have fostered greater trust in bancassurance products across life, health, and property segments, reinforcing the sector’s long-term growth potential. For instance, in October 2025, the Insurance and Private Pension Regulation and Supervision Agency (SEDDK) added a new provision on “transfer procedures,” enabling policyholders to retain their accrued rights and benefits when moving from one insurance provider to another.

Rising Insurance Awareness and Economic Development

Growing consumer awareness about financial protection is driving insurance demand through banking channels. Turkey's developing economy and expanding middle class are creating new customer segments seeking life insurance for family protection, health coverage for rising medical costs, and property insurance for asset protection. The country's young and tech-savvy population increasingly expects integrated financial solutions delivered through convenient digital channels. Rising healthcare costs are pushing individuals toward private health insurance, while government initiatives promoting insurance adoption stimulate market growth. Economic development leads to higher income levels, enabling more consumers to afford comprehensive insurance products distributed through trusted banking relationships.

Market Restraints:

What Challenges the Turkey Bancassurance Market is Facing?

Economic Volatility and Inflation Pressures

High inflation and economic volatility pose challenges to bancassurance growth in Turkey. Rising prices affect consumer purchasing power and may limit discretionary spending on insurance products beyond mandatory coverages. Economic uncertainty can reduce demand for long-term savings and investment-linked insurance products, impacting life bancassurance growth. Currency fluctuations create additional challenges for insurers in pricing products and managing liabilities.

Low Insurance Penetration and Consumer Awareness

Despite recent growth, insurance penetration in Turkey remains relatively low compared to mature markets, limiting bancassurance potential. Many consumers, particularly in rural and semi-urban areas, lack awareness of insurance benefits and available products. Limited financial literacy affects understanding of complex insurance products, reducing uptake. Building consumer trust and education requires sustained investment in awareness campaigns and simplified product offerings.

Limited Distribution Reach in Rural Areas

Despite digital banking expansion, many rural and underserved regions face limited access to bancassurance services. Lower bank branch density in remote areas restricts traditional distribution channels. Internet connectivity challenges and lower digital literacy in certain populations limit online insurance uptake. Reaching these underserved markets requires significant investment in alternative distribution approaches and localized product development.

Competitive Landscape:

The Turkey bancassurance market features a dynamic competitive environment with major Turkish banks partnering with both domestic and international insurers. Competition is intensifying as institutions seek to differentiate through digital innovation, product diversification, and enhanced customer experience. Strategic partnerships between banks and insurers are fostering innovation, accelerating product launches, and improving service delivery. Companies are investing in technology platforms that enable seamless integration of insurance offerings into banking customer journeys. Market players are expanding product portfolios across life, health, and property categories while developing specialized solutions for different customer segments. The competitive landscape is also influenced by regulatory requirements that promote transparency and consumer protection standards.

Recent Developments:

- March 2025: Zurich Sigorta Grubu Türkiye and Alternatif Bank announced a long-term strategic cooperation agreement focused on expanding bancassurance services. The partnership enables Alternatif Bank's retail, commercial, and corporate customers to access Zurich's comprehensive insurance products, including life, individual pension, health, and non-life insurance offerings integrated with banking services.

- November 2024: BBVA engaged Alvarez & Marsal Inc. to advise on reviewing its bancassurance partnership strategy for its Turkish unit, Türkiye Garanti Bankası A.Ş. The Spanish bank is evaluating various options for its insurance sector roadmap as part of routine strategic planning for its insurance distribution activities in the Turkish market.

Turkey Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey bancassurance market size was valued at USD 21.00 Billion in 2025.

The Turkey bancassurance market is expected to grow at a compound annual growth rate of 6.91% from 2026-2034 to reach USD 38.32 Billion by 2034.

Life bancassurance holds the largest share at 75.15% in 2025, driven by growing consumer awareness of financial security, banks' trusted positioning as financial advisors, and the effectiveness of cross-selling life protection products alongside banking services.

Key factors include strong banking sector performance, digital transformation enabling seamless insurance distribution, supportive regulatory frameworks, rising insurance awareness among consumers, and strategic partnerships between banks and insurers.

Major challenges include economic volatility and high inflation affecting consumer purchasing power, relatively low insurance penetration compared to mature markets, limited consumer awareness in rural areas, and distribution reach constraints in underserved regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)