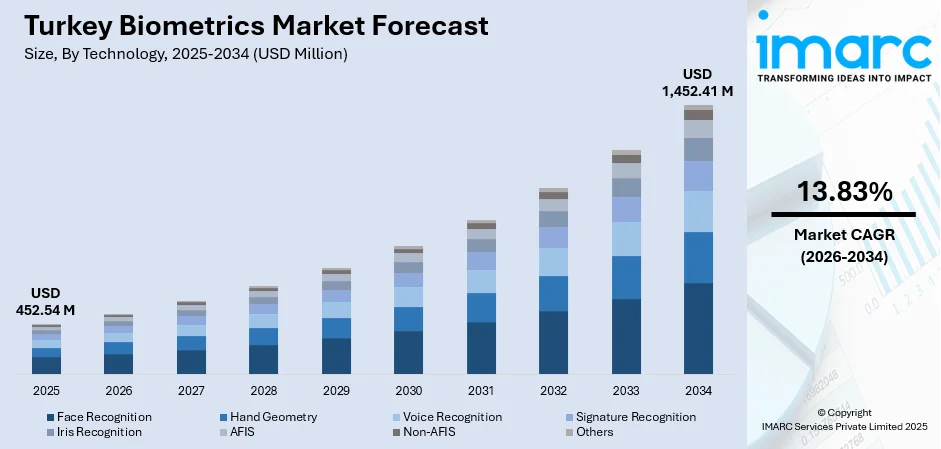

Turkey Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End User, and Region, 2026-2034

Turkey Biometrics Market Summary:

The Turkey biometrics market size was valued at USD 452.54 Million in 2025 and is projected to reach USD 1,452.41 Million by 2034, growing at a compound annual growth rate of 13.83% from 2026-2034.

The market is expanding steadily as public and private sectors increase investments in secure identity verification and access control solutions. Growing adoption of biometric-enabled services in banking, telecom, border management, and corporate security is strengthening market demand. Rising concerns over fraud prevention, stronger compliance needs, and digital transformation initiatives are further accelerating deployment. Advancements in facial recognition, fingerprint technologies, and mobile biometrics continue to shape the market’s future trajectory.

Key Takeaways and Insights:

- By Technology: Non-AFIS dominates the market with a share of 35.64% in 2025, driven by widespread deployment of fingerprint and facial recognition systems across banking, border control, and commercial applications requiring non-criminal identification solutions.

- By Functionality: Contact leads the market with a share of 54.25% in 2025, attributed to established fingerprint scanning infrastructure in government services and time-attendance systems across enterprises.

- By Component: Hardware represents the largest segment with a market share of 84.03% in 2025, reflecting significant investments in fingerprint scanners, facial recognition cameras, and iris scanning devices across government and commercial sectors.

- By Authentication: Single-factor authentication exhibits a clear dominance with a market share of 67.43% in 2025, [owing to its extensive adoption in consumer electronics, access control solutions, and high-throughput environments like airports.

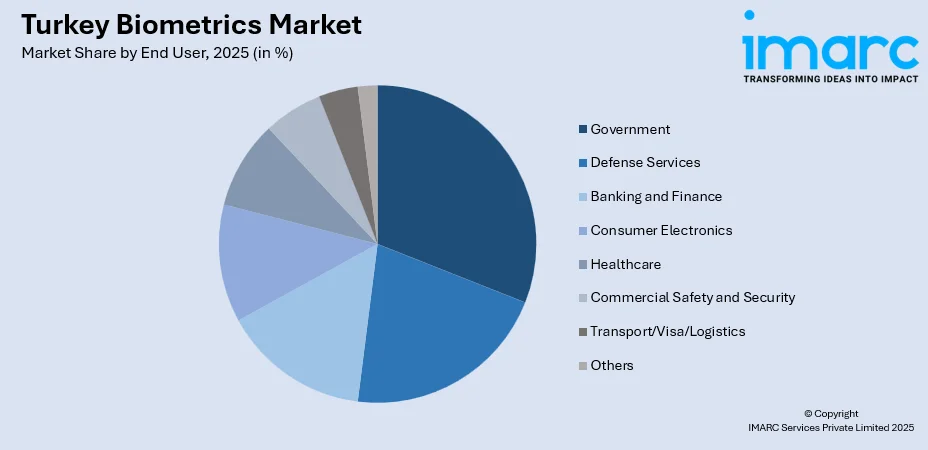

- By End User: Government prevails the market with a share of 21.41% in 2025, supported by national digital identity programs and border security modernization initiatives.

- Key Players: The Turkey biometrics market exhibits a competitive landscape characterized by both international technology providers and domestic solution developers. Market participants are focusing on strategic partnerships with financial institutions, expanding multimodal authentication offerings, and investing in artificial intelligence integration to strengthen market positioning and deliver enhanced security solutions.

To get more information on this market Request Sample

The Turkey biometrics market is experiencing sustained growth as organizations prioritize secure, reliable, and seamless identity verification across critical applications. The government’s increasing focus on national security, public safety, and digital identity modernization is supporting wider deployment of biometric solutions in areas such as border control, law enforcement, and civil registration. In January 2025, the Turkish government announced that it is enhancing its digital identity system by integrating blockchain technology and biometrics. With 83 million citizens registered for smart ID cards, the services now range from e-government to banking. Companies like Colle AI are aligning their technologies with this initiative, while strict regulations on cryptocurrency are being implemented to ensure secure transactions in 2025. In the private sector, enterprises in banking, telecom, retail, and healthcare are integrating biometrics to strengthen customer authentication, reduce fraud, and enhance operational efficiency. The rise of mobile-based biometrics, supported by growing smartphone penetration, is accelerating adoption in everyday transactions and services. Additionally, corporate environments are shifting toward biometric access control to improve workplace security. Emerging advancements in multimodal biometrics, along with the demand for contactless technologies, are shaping the market’s next phase of growth, making biometrics a core component of Turkey’s digital transformation journey.

Turkey Biometrics Market Trends:

Rising Adoption of Contactless Biometrics

Turkey is experiencing strong growth in contactless biometric adoption as organizations focus on faster and more hygienic identity verification. Facial and iris recognition systems are increasingly used across airports, government offices, and high-traffic commercial spaces to support seamless entry and secure identification. In November 2024, Turkish Airlines announced its plans to enhance passenger travel with the rollout of biometric facial recognition technology at Istanbul and Izmir airports. This initiative aims to improve security and streamline the travel process. The airline prioritizes data privacy, ensuring biometric data is securely stored and used solely for travel purposes. The shift toward touch-free authentication is also strengthening workplace security and enhancing user convenience. This trend aligns with broader digital transformation efforts, pushing enterprises to upgrade legacy systems with advanced contactless biometric technologies.

Expansion of Biometric Access Control in Enterprises and Institutions

Enterprises and educational institutions across Turkey are increasingly shifting from traditional access cards to biometric access control systems to strengthen security and streamline identification processes. Fingerprint, facial, and multimodal technologies are being deployed to manage entry points accurately and minimize unauthorized access. This trend is also visible in academic settings. In September 2025, Istanbul University students introduced a facial recognition attendance app, ATTN, to replace manual roll calls, enhancing accuracy and reducing proxy signing. As organizations and colleges modernize operations, biometric access solutions are becoming essential for improving efficiency, ensuring compliance, and supporting secure, automated environments.

Growth of Mobile and Cloud-Based Authentication

Mobile biometrics are becoming integral to secure digital interactions in Turkey, particularly in banking, telecom, and government platforms. The widespread use of smartphones is enabling rapid adoption of fingerprint and facial recognition for app-level verification. In early 2025, Turkey recorded 80.7 million active cellular mobile connections, representing 92.1% of its population. Internet usage reached 77.3 million individuals, with a penetration rate of 88.3%. Cloud-based identity solutions further support this shift by offering scalable, flexible, and cost-efficient authentication infrastructure. Together, these technologies enhance fraud prevention, streamline onboarding processes, and provide a consistent user experience, reinforcing their importance in Turkey’s expanding digital services ecosystem.

Market Outlook 2026-2034:

The outlook for the Turkey biometrics market remains strongly positive as both public and private sectors continue prioritizing secure and seamless identity verification. Growing digital transformation efforts, rising security concerns, and increasing integration of biometrics in banking, public services, telecom, and healthcare are driving broader adoption. Advancements in facial recognition, mobile biometrics, and multimodal systems will further strengthen market growth. With expanding use cases across enterprises and government applications, biometrics is set to become a core component of Turkey’s security infrastructure. The market generated a revenue of USD 452.54 Million in 2025 and is projected to reach a revenue of USD 1,452.41 Million by 2034, growing at a compound annual growth rate of 13.83% from 2026-2034.

Turkey Biometrics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Non-AFIS | 35.64% |

| Functionality | Contact | 54.25% |

| Component | Hardware | 84.03% |

| Authentication | Single-Factor Authentication | 67.43% |

| End User | Government | 21.41% |

Technology Insights:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

The non-AFIS dominates with a market share of 35.64% of the total Turkey biometrics market in 2025.

Non-AFIS systems dominate the Turkey biometrics market due to their faster processing capabilities, lower operational complexity, and suitability for high-volume applications. These systems are widely adopted in sectors requiring quick identity verification, including banking, telecom, and enterprise security. Their ability to deliver rapid authentication without extensive database comparisons makes them highly efficient for daily transactional processes. As digital services expand across Turkey, Non-AFIS solutions continue to gain preference for enabling smooth, reliable, and scalable identity verification.

Non-AFIS technologies further benefit from their ease of integration with mobile platforms and cloud-based authentication systems, supporting wider adoption in fintech, e-government services, and commercial environments. Their flexibility in combining with facial, voice, and fingerprint modalities strengthens their appeal among institutions seeking cost-effective yet secure biometric frameworks. As organizations prioritize speed, user convenience, and operational efficiency, Non-AFIS solutions remain the preferred option, reinforcing their leadership within the Turkey biometrics market.

Functionality Insights:

- Contact

- Non-contact

- Combined

The contact leads with a share of 54.25% of the total Turkey biometrics market in 2025.

Contact-based biometric systems lead the Turkey biometrics market as fingerprint recognition remains the most widely used method across government, banking, and corporate sectors. These systems are known for their high accuracy, mature technological base, and cost-effective deployment. Their long-standing presence in national identity programs, access control systems, and verification checkpoints reinforces their dominance. Organizations continue to rely on contact biometrics due to their proven reliability in high-security environments and well-established infrastructure compatibility.

Despite rising interest in contactless solutions, contact-based biometrics maintain a strong foothold owing to their affordability and widespread user familiarity. Many institutions favor these systems for large-scale workforce management, time-attendance tracking, and secure facility access. Their extensive market penetration, ease of deployment, and consistent performance across routine operations support continued preference for contact-based technologies, sustaining their position as the leading functionality segment in the Turkey biometrics market.

Component Insights:

- Hardware

- Software

The hardware prevails with a share of 84.03% of the total Turkey biometrics market in 2025.

Hardware remains the dominant component in the Turkey biometrics market due to the extensive need for physical devices such as scanners, cameras, sensors, and access terminals across public and private sectors. Organizations continue to invest heavily in robust hardware infrastructure to support secure authentication in workplaces, financial institutions, border control facilities, and government service points. The demand for reliable and durable biometric devices, along with growing system upgrades, reinforces the strong position of the hardware segment.

The widespread adoption of hardware solutions is further supported by their critical role in ensuring accuracy, speed, and real-time verification. As Turkey expands its digital identity systems and enhances security frameworks across institutions, the need for advanced biometric hardware continues to rise. New deployments in education, healthcare, and commercial facilities also contribute to sustained growth. With ongoing modernization efforts, hardware remains essential for enabling efficient end-to-end biometric authentication.

Authentication Insights:

- Single-Factor Authentication

- Multifactor Authentication

The single-factor authentication represents the largest segment with a share of 67.43% of the total Turkey biometrics market in 2025.

Single-factor authentication leads the Turkey biometrics market due to its simplicity, speed, and cost-effectiveness. Organizations prefer this method for routine identity verification tasks, such as access control and attendance tracking, where a single biometric element like fingerprint or facial recognition is sufficient. The ease of deployment and user convenience associated with single-factor systems have played a key role in their widespread acceptance across various sectors, including government, banking, and commercial environments.

The dominance of single-factor authentication is further strengthened by its compatibility with existing infrastructures, allowing institutions to upgrade security systems without major operational changes. Many organizations prioritize quick, frictionless authentication, making single-factor solutions ideal for high-traffic locations and daily identity checks. Although multi-factor methods are gaining interest for sensitive applications, single-factor authentication continues to be the preferred option for large-scale, everyday use, sustaining its leadership in the market.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

The government exhibits a clear dominance with a 21.41% share of the total Turkey biometrics market in 2025.

The government sector holds the largest share of the Turkey biometrics market as national security, public safety, and identity management remain top priorities. Biometric systems are extensively used in civil registration, border control, law enforcement, and e-government platforms. Initiatives aimed at improving secure identification, preventing fraud, and enhancing service delivery drive continuous investment in advanced biometric technologies. Government-led digital transformation programs further reinforce the segment’s leading position in the market.

The expansion of biometric-enabled public services also strengthens government dominance. Applications such as national ID verification, passport issuance, voter registration, and social service authentication rely heavily on biometric frameworks. As Turkey continues modernizing its administrative systems, the need for reliable, scalable, and secure identity infrastructure grows. These sustained initiatives ensure that the government sector remains the primary adopter of biometrics, shaping overall market growth and development.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara region shows strong adoption of biometric technologies driven by dense urban populations, advanced public services, and expanding corporate security needs. Growing demand from banking, transportation, and government institutions further supports wider integration of biometric authentication across daily operations.

Central Anatolia demonstrates increasing use of biometrics as government institutions, educational facilities, and commercial establishments modernize security frameworks. Expanding digital services and rising demand for efficient identity verification are encouraging broader deployment of facial, fingerprint, and contact-based biometric systems across the region.

The Mediterranean region is witnessing steady growth in biometric adoption supported by rising tourism activity, transportation upgrades, and expanding commercial infrastructure. Hotels, airports, and enterprises are increasingly integrating biometric authentication to enhance security, streamline access control, and improve service delivery for residents and visitors.

The Aegean region is experiencing growing demand for biometric solutions as businesses, public institutions, and transport facilities prioritize secure authentication. Rising digital transformation efforts and expanding commercial activity are driving adoption of facial and fingerprint technologies for access control and identity verification applications.

Southeastern Anatolia is gradually adopting biometrics with rising focus on public safety, administrative modernization, and secure service delivery. Government agencies, transport facilities, and healthcare institutions are integrating biometrics to improve identity accuracy, enhance operational efficiency, and strengthen security frameworks across the region.

The Black Sea region is expanding biometric usage as public institutions, enterprises, and transport hubs enhance security infrastructure. Increasing reliance on digital platforms and growing awareness of fraud prevention are supporting wider adoption of fingerprint, facial, and other identity verification technologies.

Eastern Anatolia shows a steady rise in biometric deployment driven by ongoing modernization initiatives in public administration, education, and healthcare. Institutions are adopting biometrics to improve secure access, ensure accurate identification, and support digital transformation initiatives across both urban and developing areas.

Market Dynamics:

Growth Drivers:

Why is the Turkey Biometrics Market Growing?

Increasing Use of Biometrics in Banking and Fintech

Biometric authentication is becoming a core security layer in Turkey’s banking and fintech sector as institutions work to reduce fraud and strengthen customer trust. The Turkey fintech market size reached USD 1,919.39 Million in 2024 and is projected to reach USD 7,220.45 Million by 2033, supporting wider adoption of secure digital verification tools. Banks are integrating facial recognition, fingerprints, and voice verification into login, payments, and onboarding processes. As digital transactions accelerate, financial institutions increasingly rely on biometrics to enhance identity assurance and deliver faster, more secure user experiences across mobile banking and financial platforms.

Expansion of Biometric Solutions in Public Services

Government agencies in Turkey are expanding biometric deployment to improve national security and deliver more efficient public services. Biometrics play a growing role in e-government initiatives, civil registrations, border control systems, and law enforcement applications. Turkey's 2025 biometric passport overhaul enhances border security with advanced features like facial recognition and fingerprint scanning. Designed to combat fraud and streamline travel, the new passports will comply with international standards, improving efficiency for Turkish citizens and global travelers while bolstering national security. These solutions help verify identities accurately, prevent document fraud, and support secure citizen interactions. As public services continue to digitalize, government institutions are adopting advanced recognition technologies to strengthen operational reliability and enhance the overall accessibility and integrity of administrative processes.

Growing Adoption in Healthcare and Patient Identification

Healthcare providers in Turkey are increasingly adopting biometrics to strengthen patient identification and protect sensitive medical data. The Turkey healthcare IT market size reached USD 3,186.1 Million in 2024, and is expected to reach USD 9,959.2 Million by 2033, supporting greater investment in secure digital systems. Hospitals and clinics use fingerprint and facial recognition to reduce administrative errors, ensure accurate treatment delivery, and control access to electronic health records. As the sector advances toward deeper digital integration, biometric technologies are becoming essential for enhancing security, improving patient outcomes, and streamlining clinical and administrative workflows.

Market Restraints:

What Challenges the Turkey Biometrics Market is Facing?

High Implementation and Integration Costs

Many organizations in Turkey face financial constraints when adopting advanced biometric systems due to the high costs associated with hardware procurement, software licensing, system integration, and ongoing maintenance. These expenses can be particularly challenging for small and medium enterprises that operate with limited budgets. Additionally, upgrading existing infrastructure to support modern biometric technologies requires significant investment, which slows adoption. As a result, cost sensitivity remains one of the most prominent restraints affecting wider market penetration.

Data Privacy and Security Concerns

Growing concerns around the storage, handling, and potential misuse of biometric data act as a major restraint in the market. Organizations must comply with strict data protection regulations, increasing operational complexity and legal risks. Users are also more cautious about sharing biometric identifiers, fearing breaches or unauthorized access. These concerns can undermine trust, delay project approvals, and reduce public acceptance. Ensuring secure encryption, transparent data governance, and compliance readiness remains a persistent challenge for market participants.

Technical Limitations and Accuracy Challenges

Despite advancements, biometric systems can still face accuracy issues due to environmental factors such as lighting conditions, temperature variations, or device quality. Performance inconsistencies can lead to false rejections or incorrect matches, affecting user experience and operational reliability. Additionally, legacy infrastructure in many institutions creates integration challenges, making it difficult to implement seamless biometric workflows. These technical limitations may discourage adoption, particularly in high-security environments where precision, speed, and reliability are crucial for daily operations.

Competitive Landscape:

The competitive landscape of the Turkey biometrics market is characterized by increasing participation from technology providers offering advanced identity verification and security solutions. Companies are focusing on product innovation, particularly in facial recognition, mobile biometrics, and multimodal authentication, to meet rising demand across government, banking, telecom, and enterprise sectors. The market is becoming more dynamic as firms compete on accuracy, speed, cost efficiency, and integration capabilities. Growing emphasis on data protection and compliance further drives vendors to enhance encryption, software reliability, and cloud-based identity platforms. Overall, competition is intensifying as organizations pursue scalable, secure, and user-centric biometric solutions.

Turkey Biometrics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End User Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey biometrics market size was valued at USD 452.54 Million in 2025.

The Turkey biometrics market is expected to grow at a compound annual growth rate of 13.83% from 2026-2034 to reach USD 1,452.41 Million by 2034.

Non-AFIS technology held the largest share, supported by its faster processing, ease of integration, and suitability for high-volume applications. Its reliability and efficiency make it widely preferred across government, banking, and enterprise sectors.

Key factors driving the Turkey biometrics market include rising digital transformation, expanding public service modernization, and increasing security needs across banking, government, and corporate environments. Growing adoption of mobile biometrics and advancements in facial and fingerprint technologies further strengthen overall market expansion.

Major challenges include high implementation costs, data privacy concerns, and technical limitations affecting accuracy. Integration with legacy systems, user hesitation toward biometric data sharing, and the need for strong cybersecurity measures also restrict faster adoption across institutions and industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)