Turkey Biscuits Market Size, Share, Trends and Forecast by Product Type, Ingredient, Packaging Type, Distribution Channel, and Region, 2026-2034

Turkey Biscuits Market Summary:

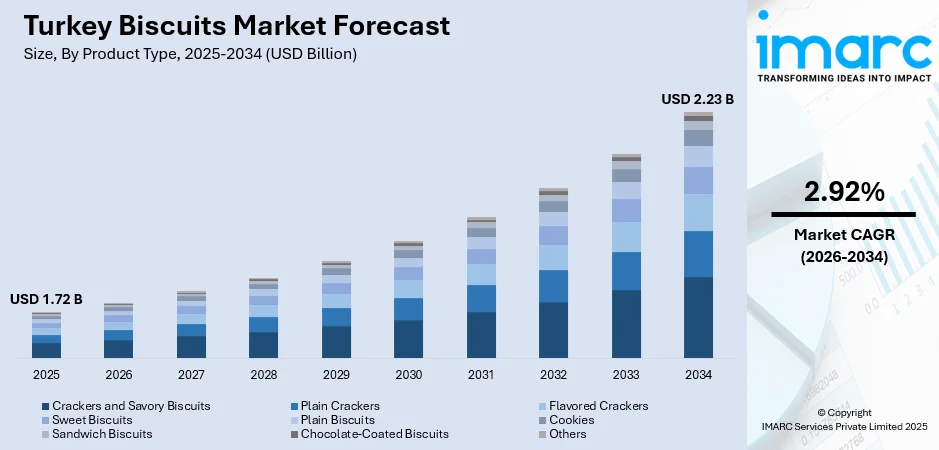

The Turkey biscuits market size was valued at USD 1.72 Billion in 2025 and is projected to reach USD 2.23 Billion by 2034, growing at a compound annual growth rate of 2.92% from 2026-2034.

The market for biscuits in Turkey has been steadily rising due to an increase in consumer preference for fast-moving, ready-to-eat snacks which are not only palatable but full of nutrients. Supermarkets/Hypermarkets can be regarded as a structured channel of retailing which has taken rapid growth in order to facilitate easier access to products while enabling manufacturers to present a number of investigative flavors along with packaging innovations. Major manufacturers in the market for biscuits in Turkey are adopting aggressive marketing strategies in an attempt to capitalize on rising trends of urbanization as well as an increase in consumer preference for healthy snacks among the youth.

Key Takeaways and Insights:

-

By Product Type: Crackers and savory biscuits dominate the market with a share of 58% in 2025, owing to their versatility as standalone snacks and meal accompaniments, appealing to health-conscious consumers seeking lower sugar alternatives. Growing preference for savory flavors drives continued segment expansion.

-

By Ingredient: Wheat leads the market with a share of 55% in 2025, reflecting Turkey's strong agricultural heritage in wheat cultivation and its widespread availability as a cost-effective primary ingredient. Established milling infrastructure supports consistent supply for biscuit manufacturers.

-

By Packaging Type: Pouches/Packets represent the biggest segment with a market share of 49% in 2025, driven by consumer demand for convenient, portable, and resealable packaging solutions that maintain product freshness while enabling on-the-go consumption.

-

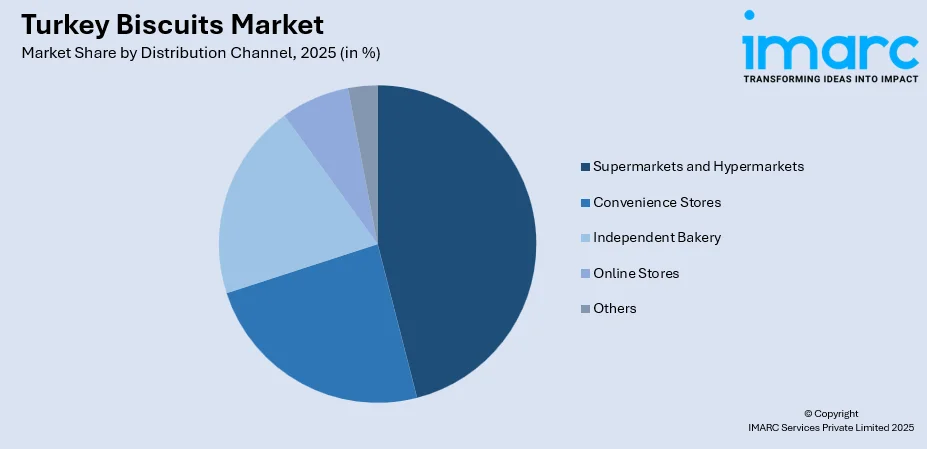

By Distribution Channel: Supermarkets and hypermarkets exhibit clear dominance with 46% share in 2025, leveraging wide product assortments, competitive pricing, and attractive in-store displays that encourage impulse purchases among diverse consumer segments.

-

By Region: Central Anatolia is the largest region with 12% share in 2025, supported by its strategic positioning as Turkey's agricultural heartland with concentrated wheat production and established food processing infrastructure in cities like Konya and Karaman.

-

Key Players: Key players drive the Turkey biscuits market by expanding product portfolios, investing in automation technologies, and strengthening nationwide distribution networks. Their focus on innovation, healthier formulations, and strategic partnerships with retail chains enhances market penetration and consumer loyalty.

To get more information on this market Request Sample

Manufacturers are aligning their focus in an effort to keep pace with new consumer demands through sustainable practices and diversified products in the biscuit industry of Turkey. The increasing well-being trend adopted by customers in Turkey is now complemented by new emphasis on health-oriented formulas that contain less sugar, whole grains, and fiber. Engaging with social media and internet marketing campaigns has also become an integral tool for building brands, where companies leverage such platforms in order to engage with younger generations who emphasize cost-effectiveness and convenience. The large utilization of digital forms of communications in Turkey provides significant opportunities for enhanced brand engagement and defined marketing initiatives. New packaging innovations that leverage hi-tech inventions, such as portioning packaging and re-sealing pouches, address new lifestyle requirements while maintaining food quality and extending shelf life. New focus and investments from manufacturers in research and development capacity continue focusing on inventing new combinations of healthy ingredients and new functionalities that distinguish their products in a rapidly competitive environment.

Turkey Biscuits Market Trends:

Rising Health Consciousness Reshaping Product Development

Consumers in Turkey have become more focused on nutrition while making biscuit purchases, and this has led manufacturers to adapt their products and make them lower in fat, sugar, and salt. The nutritionally driven shift that the market has witnessed has brought out innovative products for functional biscuit categories that contain whole grain ingredients and oats and have enhanced fiber. Consumer demand for healthier snack options that offer balanced indulgence and nutrition continues to impact development.

Modern Retail Expansion Accelerating Market Accessibility

The increasingly rapid growth of various retail formats, such as supermarkets, hypermarkets, and convenience stores, has completely changed the scene of biscuit distribution in Turkey. The leading retail chains in Turkey have set aside space on their shelves for biscuit manufacturers and formulated pricing strategies in which consumers are encouraged to purchase biscuit products. The leading retail chains in Turkey have extensive networks in the country that ensure efficient reach to consumers for biscuit manufacturers.

Premiumization and Flavor Innovation Capturing Consumer Interest

Leading manufacturers are investing in premium product lines featuring artisanal flavors, exotic ingredients, and sophisticated packaging to capture discerning consumers willing to pay higher price points for enhanced quality experiences. This premiumization trend extends across chocolate-coated variants, cream-filled options, and internationally-inspired flavor combinations that differentiate offerings in an increasingly competitive marketplace. Turkish consumers demonstrate growing curiosity toward diverse taste profiles, encouraging continuous product experimentation and limited-edition seasonal releases.

Market Outlook 2026-2034:

The Turkey biscuits market outlook remains positive as manufacturers align product strategies with evolving consumer preferences for convenience, nutrition, and value. Continued investments in production automation and sustainable manufacturing practices position leading players to optimize operational efficiency while meeting rising demand. The market generated a revenue of USD 1.72 Billion in 2025 and is projected to reach a revenue of USD 2.23 Billion by 2034, growing at a compound annual growth rate of 2.92% from 2026-2034. E-commerce platforms and digital ordering systems will complement traditional retail channels, expanding consumer access points. Product innovation focusing on healthier formulations and premium variants will continue driving category growth, while strategic partnerships between manufacturers and retailers strengthen distribution capabilities and market penetration across diverse geographic regions throughout Turkey.

Turkey Biscuits Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Crackers and Savory Biscuits | 58% |

| Ingredient | Wheat | 55% |

| Packaging Type | Pouches/Packets | 49% |

| Distribution Channel | Supermarkets and Hypermarkets | 46% |

| Region | Central Anatolia | 12% |

Product Type Insights:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-Coated Biscuits

- Others

Crackers and savory biscuits dominate with a market share of 58% of the total Turkey biscuits market in 2025.

Crackers and savory biscuits have established dominant positioning within the Turkey biscuits market, driven by their versatility as convenient snacking options and meal accompaniments that appeal across demographic segments. Turkish consumers increasingly gravitate toward savory flavor profiles as healthier alternatives to sugar-laden sweet biscuits, with crackers offering satisfying crunch while typically containing lower calorie content. The segment's widespread acceptance stems from its adaptability across multiple consumption occasions, ranging from standalone snacking to serving as accompaniments during social gatherings and family meals.

The segment benefits from product innovation incorporating diverse flavor profiles including cheese, herbs, and spices that cater to evolving taste preferences among Turkish consumers seeking variety in their snacking experiences. Plain crackers maintain strong demand for pairing with spreads, dips, and cheeses, while flavored variants attract younger demographics seeking bold taste sensations. Growing awareness of nutritional benefits associated with whole grain and fiber-enriched crackers further reinforces segment expansion as health-conscious consumers prioritize functional snacking options that align with wellness objectives without compromising on taste satisfaction.

Ingredient Insights:

- Wheat

- Oats

- Millets

- Others

Wheat leads with a share of 55% of the total Turkey biscuits market in 2025.

Wheat maintains its position as the predominant ingredient in Turkey's biscuit manufacturing industry, supported by the nation's extensive agricultural production and well-established flour milling infrastructure. Turkey ranks among the world's leading flour exporters with production capacity of approximately 30 Million Tons in 598 factors, ensuring consistent raw material supply for biscuit manufacturers. The concentration of wheat cultivation in Central Anatolia, particularly around Konya and Karaman provinces, provides geographic advantages for food processing facilities clustered in these agricultural heartland regions.

The ingredient's cost-effectiveness and familiar taste profile make wheat-based biscuits accessible to price-sensitive consumers across income segments, reinforcing mass-market appeal throughout Turkey. Flour producers have developed specialized biscuit flour formulations optimized for texture, color, and baking performance, supporting quality consistency across diverse product categories. The well-established relationship between wheat farmers, flour millers, and biscuit manufacturers creates an integrated value chain that ensures reliable ingredient sourcing while maintaining competitive pricing structures essential for mass-market product positioning.

Packaging Type Insights:

- Pouches/Packets

- Jars

- Boxes

- Others

Pouches/Packets exhibit a clear dominance with a 49% share of the total Turkey biscuits market in 2025.

Pouches and packets have emerged as the preferred packaging format within Turkey's biscuit market, offering manufacturers cost advantages in production while delivering consumer-valued attributes including portability, convenience, and freshness preservation. Flexible packaging solutions enable portion-controlled single-serve formats that align with on-the-go consumption patterns among urban Turkish consumers navigating busy lifestyles. The Turkey plastic packaging market is expected to grow at a significant rate during the forecast period, with flexible packaging leading consumption across the food sector, highlighting consumer preference for lightweight, easily disposable formats that accommodate modern living requirements.

Modern packaging innovations including resealable closures, metallized barrier films, and eco-friendly materials address evolving sustainability concerns while maintaining product integrity throughout distribution and storage. Turkish flexible packaging manufacturers provide specialized solutions for biscuits and snacks, incorporating advanced barrier technologies that extend shelf life without preservative additions. The proliferation of stand-up pouches featuring attractive graphics and convenient opening mechanisms enhances shelf appeal while facilitating brand differentiation in crowded retail environments where visual impact influences purchase decisions. Manufacturers continue exploring recyclable and biodegradable packaging alternatives responding to growing environmental consciousness among consumers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

Supermarkets and hypermarkets represent the leading segment with a 46% share of the total Turkey biscuits market in 2025.

Supermarkets and hypermarkets have consolidated their position as primary distribution channels for biscuits in Turkey, leveraging extensive store networks, competitive pricing strategies, and diverse product assortments that attract mass-market consumers. Major retail chains operate thousands of outlets nationwide, providing manufacturers with comprehensive market coverage across urban and semi-urban regions. The Turkey retail market reached USD 391.2 Billion in 2024, reflecting the substantial scale of organized retail operations that facilitate biscuit distribution through established logistics infrastructure and supplier relationships.

These retail formats provide dedicated shelf space for biscuit categories, enabling brand visibility through attractive displays, promotional signage, and strategic product placement that encourages impulse purchases. Private label offerings from major retailers create additional competitive dynamics, prompting branded manufacturers to differentiate through quality, innovation, and marketing investments. Discount retailers have gained particular momentum as inflation-conscious Turkish consumers prioritize value, with chains like BIM and ŞOK capturing market share through affordable product offerings that maintain acceptable quality standards.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Central Anatolia dominates with a market share of 12% of the total Turkey biscuits market in 2025.

Central Anatolia has established itself as a strategic hub for Turkey's biscuits market, benefiting from its prominence as the nation's agricultural heartland with concentrated wheat production supporting raw material accessibility for food manufacturers. The region houses significant food processing infrastructure, particularly around Konya and Karaman, where biscuit and confectionery production facilities leverage proximity to grain cultivation areas and established flour milling operations. Central Anatolia's cereal crops and agricultural output provide competitive advantages for manufacturers seeking reliable, cost-effective ingredient supply chains that minimize transportation expenditures and ensure quality consistency.

The region's growing urban centers including Ankara demonstrate increasing biscuit consumption driven by expanding middle-class populations with rising disposable incomes and evolving snacking preferences. Infrastructure investments in organized industrial zones have attracted food manufacturing enterprises seeking modern production facilities equipped with automation technologies that enhance operational efficiency. Regional distribution networks efficiently connect Central Anatolian production facilities with consumption centers across Turkey, facilitating nationwide market penetration while maintaining logistical cost advantages over competitors located in peripheral regions with less developed transportation infrastructure.

Market Dynamics:

Growth Drivers:

Why is the Turkey Biscuits Market Growing?

Rapid Urbanization Transforming Consumption Patterns

Turkey's accelerating urbanization has fundamentally reshaped dietary habits, with metropolitan populations increasingly relying on convenient, ready-to-eat snack options that accommodate fast-paced lifestyles and time constraints. Urban consumers demonstrate heightened preference for packaged biscuits offering consistent quality, hygiene assurance, and extended shelf life compared to traditional unpackaged alternatives requiring fresh preparation. The World Bank reported Turkey's urban population at 66,613,051 in 2024, representing a substantial consumer base concentrated in major cities including Istanbul, Ankara, and Izmir where modern retail infrastructure facilitates biscuit accessibility. Migration flows from rural regions to urban employment centers continue expanding metropolitan populations, generating sustained demand growth for convenient snacking solutions that integrate seamlessly with commuting routines, office environments, and household consumption occasions.

Expansion of Organized Retail Infrastructure

The proliferation of supermarkets, hypermarkets, and discount retail chains across Turkey has dramatically enhanced biscuit distribution efficiency while creating favorable conditions for manufacturer brand building and promotional activities. Organized retail provides standardized shelving, competitive pricing transparency, and impulse purchase opportunities that traditional neighborhood stores cannot replicate at equivalent scale. Major retailers have established nationwide presence, ensuring biscuit availability across urban, suburban, and semi-urban markets. These retail networks enable manufacturers to execute consistent marketing strategies, negotiate promotional placement, and gather consumer insights that inform product development priorities and category management decisions.

Product Innovation and Diversification Strategies

Leading manufacturers are intensifying research and development investments to introduce innovative biscuit variants that capture consumer attention through novel flavors, functional ingredients, and premium positioning strategies. Continuous product diversification addresses evolving taste preferences, dietary requirements, and occasion-based consumption patterns that define contemporary snacking behavior. Ülker launched 51 new products in Turkey during 2024, demonstrating the competitive imperative for innovation-driven growth among market leaders seeking differentiation in crowded retail environments. Product innovation extends beyond flavor experimentation to encompass packaging innovations, portion sizing adaptations, and ingredient reformulations that respond to health consciousness, sustainability concerns, and value perceptions shaping purchase decisions across consumer segments.

Market Restraints:

What Challenges the Turkey Biscuits Market is Facing?

Inflationary Pressures Constraining Consumer Spending

Persistent inflation and currency depreciation have significantly eroded purchasing power among Turkish consumers, which is compelling trade-down behavior toward economy-priced alternatives and private label offerings. Rising production costs associated with imported ingredients, packaging materials, and energy inputs create margin pressures that manufacturers must absorb or pass through to increasingly price-sensitive consumers.

Intensifying Competition from Local and International Players

The Turkey biscuits market faces heightened competitive intensity as established domestic manufacturers defend market positions against expanding international brands and aggressive private label development by major retailers. Price competition compresses profit margins while demanding increased promotional spending that further constrains profitability across industry participants. Smaller regional players struggle to compete effectively against well-resourced competitors.

Raw Material Price Volatility Affecting Production Economics

Fluctuations in wheat, sugar, and vegetable oil prices create uncertainty for biscuit manufacturers attempting to maintain consistent retail pricing while preserving acceptable profit margins. Supply chain disruptions and geopolitical factors influencing agricultural commodity markets introduce planning challenges that complicate inventory management and cost forecasting activities. Currency depreciation further amplifies imported ingredient costs.

Competitive Landscape:

The Turkey biscuits market exhibits a moderately consolidated competitive structure dominated by established domestic manufacturers who leverage extensive distribution networks, brand recognition, and production scale advantages. Leading players continuously invest in manufacturing automation, product innovation, and marketing initiatives to strengthen market positions while responding to evolving consumer preferences and retail dynamics. Competitive strategies emphasize product portfolio expansion, healthier formulation development, and sustainability commitments that resonate with increasingly conscious consumers. Strategic acquisitions and international expansion initiatives demonstrate ambitions extending beyond domestic market boundaries as players seek growth opportunities in regional markets.

Turkey Biscuits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Wheat, Oats, Millets, Others |

| Packaging Types Covered | Pouches/Packets, Jars, Boxes, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Independent Bakery, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey biscuits market size was valued at USD 1.72 Billion in 2025.

The Turkey biscuits market is expected to grow at a compound annual growth rate of 2.92% from 2026-2034 to reach USD 2.23 Billion by 2034.

Crackers and savory biscuits dominated the market with a share of 58%, driven by their versatility as standalone snacks and meal accompaniments, appealing to health-conscious consumers seeking lower sugar alternatives.

Key factors driving the Turkey biscuits market include rapid urbanization and changing lifestyle patterns, expansion of organized retail infrastructure, rising demand for convenient packaged food options, product innovation and diversification strategies, and growing health consciousness among consumers.

Major challenges include persistent inflationary pressures constraining consumer spending, intensifying competition from local and international players, raw material price volatility affecting production economics, currency depreciation impacting import costs, and evolving regulatory requirements for food labeling and safety standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)