Turkey Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2026-2034

Turkey Bottled Water Market Summary:

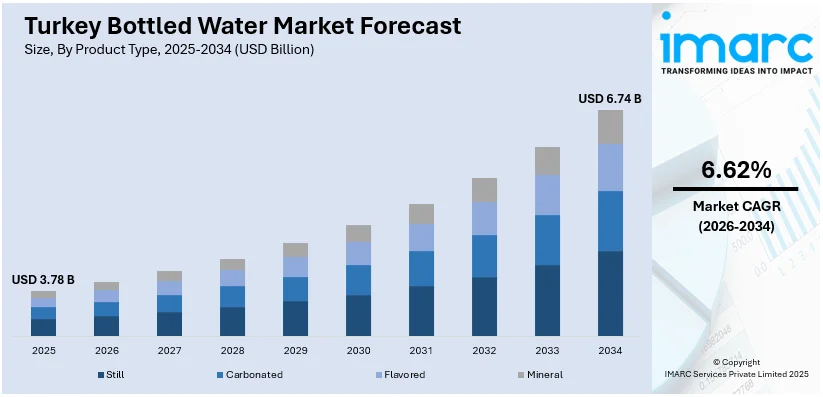

The Turkey bottled water market size was valued at USD 3.78 Billion in 2025 and is projected to reach USD 6.74 Billion by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

The Turkey bottled water market is growing steadily, supported by rising health awareness, urbanization, and concerns over tap water quality. Demand is boosted by tourism, outdoor consumption, and a shift toward mineral-rich and purified options. Competitive pricing, strong distribution networks, and sustainable packaging advancements further enhance market reach. Rising incomes and improved retail infrastructure are strengthening Turkey’s position as an attractive market for regional and global bottled water manufacturers.

Key Takeaways and Insights:

- By Product Type: Still water holds the largest market share at 50% in 2025, establishing itself as the preferred choice among Turkish consumers seeking clean, naturally balanced hydration solutions.

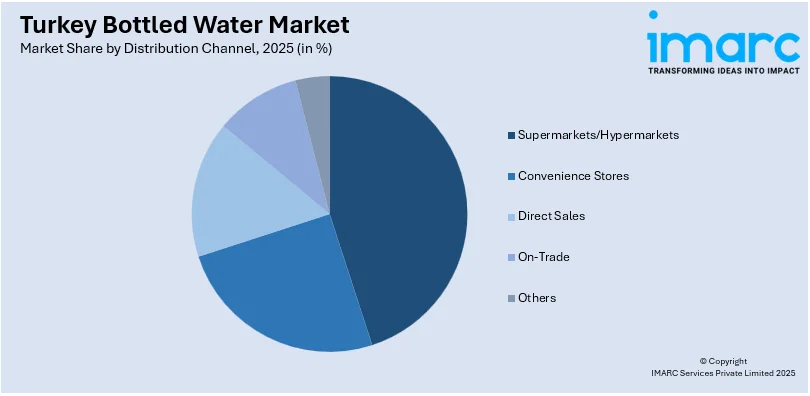

- By Distribution Channel: Supermarkets and hypermarkets dominate the market with 45% share in 2025, enabling widespread accessibility and bulk purchasing options for cost-conscious consumers across urban and suburban areas.

- By Packaging Type: PET bottles command 80% market share in 2025, underscoring their lightweight, cost-effective, and convenient appeal that resonates with both retail consumers and hospitality establishments.

- Key Players: The Turkey bottled water market features strong competition among multinational corporations and local manufacturers, with companies focusing on brand differentiation, sustainable packaging innovations, distribution expansion, and strategic partnerships to strengthen market presence and capitalize on the growing demand for premium and functional water products.

To get more information on this market, Request Sample

Turkey's bottled water industry operates within a dynamic consumer landscape characterized by evolving preferences toward healthier beverage alternatives. The market benefits from concerns regarding municipal water quality in major urban centers, driving household reliance on packaged drinking water as a daily essential. A thriving tourism sector attracting millions of international visitors annually creates substantial seasonal demand spikes. Growing middle-class purchasing power enables consumers to explore premium and functional water variants. Distribution networks spanning traditional retail formats, modern trade outlets, and home-delivery subscription services ensure comprehensive market coverage. Recently, sustainability developments have begun reshaping the packaging side of the business. In late 2024, Dogapet commissioned two advanced bottle-to-bottle recycling lines (operated by Starlinger) at a new facility in Kirklareli, producing food-grade recycled PET pellets and indicating a concrete shift toward eco-friendly packaging in Turkey’s bottled water and beverage industry. Environmental sustainability initiatives are reshaping packaging preferences, with manufacturers exploring eco-friendly alternatives to conventional plastic containers.

Turkey Bottled Water Market Trends:

Rising Demand for Premium and Functional Waters

Turkish consumers increasingly seek premium bottled water variants offering enhanced mineral content and perceived health benefits. Functional waters infused with vitamins, electrolytes, and natural flavors are gaining popularity among health-conscious urban demographics. This premiumization trend encourages manufacturers to expand product portfolios beyond traditional still water offerings. In 2023, Kızılay Mineral Water was chosen as “Beverage Brand of the Year” by public vote at the fourth edition of the Turkey Golden Brand Awards, highlighting consumer appreciation for mineral-rich bottled water and adding prestige to premium water consumption in Turkey.

Sustainable Packaging Initiatives Gaining Momentum

Environmental consciousness is reshaping packaging preferences within Turkey's bottled water sector. Manufacturers are responding to consumer demands for eco-friendly alternatives by introducing recycled plastic containers and glass packaging options. In 2025, the Turkish Ministry of Environment, Urbanization and Climate Change launched a national initiative to reduce single-use plastics in the beverage industry, encouraging companies to adopt sustainable packaging practices and obtain relevant eco-certifications. Sustainability certifications and reduced plastic usage are becoming important differentiators in purchasing decisions across retail channels.

Expansion of Home Delivery and Subscription Services

Large-format container delivery services continue expanding across Turkish metropolitan areas. Subscription-based water delivery models offer convenience for residential and commercial customers seeking reliable hydration solutions. For example, BiSU — a mobile app-based on-demand water delivery service — reportedly doubled its growth every year pre-pandemic, and saw its growth triple during COVID-19 lockdowns, as home-consumption surged. Digital platforms and mobile applications facilitate ordering processes, enhancing customer retention and enabling personalized service offerings across urban demographics.

Market Outlook 2026-2034:

The Turkey bottled water market demonstrates promising growth prospects driven by sustained consumer demand for safe hydration alternatives and expanding distribution networks. Urbanization trends, tourism sector expansion, and rising disposable incomes support continued market development. Manufacturers are positioned to capitalize on premiumization opportunities and functional water innovation. The market generated a revenue of USD 3.78 Billion in 2025 and is projected to reach a revenue of USD 6.74 Billion by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

Turkey Bottled Water Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Still |

50% |

|

Distribution Channel |

Supermarkets/Hypermarkets |

45% |

|

Packaging Type |

PET Bottles |

80% |

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The still dominates with a market share of 50% of the total Turkey bottled water market in 2025.

Still water dominates Turkey's bottled water landscape as the preferred daily hydration choice among consumers. Natural spring water and purified water variants capture substantial market volume through widespread availability across retail and home-delivery channels. Consumer preference for unflavored, non-carbonated options drives sustained demand, particularly among health-conscious demographics seeking clean hydration alternatives to sugary beverages and tap water sources.

The still water segment benefits from diverse packaging formats catering to various consumption occasions. Large-format containers serve residential and workplace needs through delivery services, while single-serve bottles address on-the-go consumption patterns. Manufacturers differentiate through source location marketing, mineral composition claims, and packaging innovations. According to reports, in 2023, Şişecam introduced what was termed “Turkey’s lightest mineral water bottle,” cutting carbon emissions by about 19% during production and 14% during transport — a notable step reflecting growing attention to sustainability in packaging even within the still water segment. Premium still water variants emphasizing natural sourcing and enhanced mineral profiles are gaining traction among affluent urban consumers.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

The supermarkets/hypermarkets lead with a share of 45% of the total Turkey bottled water market in 2025.

Supermarkets and hypermarkets serve as primary distribution points for bottled water across Turkey's urban centers. These retail formats offer extensive product assortments spanning multiple brands, packaging sizes, and price points. Competitive pricing strategies, promotional activities, and strategic shelf placement drive consumer purchasing decisions. Modern trade channels benefit from organized supply chains ensuring consistent product availability. In early 2025, Migros became Turkey’s first food retailer approved by SBTi, earning “A” grades in Climate Change and Water Security, boosting sustainability credentials and private-label bottled water appeal.

Major retail chains leverage private label bottled water offerings to capture price-sensitive consumer segments. Bulk purchasing options and multi-pack promotions encourage higher volume sales. Strategic store locations in densely populated residential and commercial areas maximize consumer accessibility. Integration of loyalty programs and digital payment solutions enhances shopping convenience while building customer retention across metropolitan markets.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The PET bottles dominate with a market share of 80% of the total Turkey bottled water market in 2025.

PET bottles maintain overwhelming dominance in Turkey's bottled water packaging landscape through cost-efficiency and lightweight convenience. Manufacturing scalability enables competitive pricing across retail channels. Consumer familiarity and portability drive preference for plastic containers across single-serve and family-size formats. Distribution logistics benefit from reduced transportation costs compared to heavier glass alternatives.

Environmental sustainability concerns are gradually reshaping packaging preferences within the Turkish market. Manufacturers are introducing recycled PET options and lighter-weight bottle designs to address ecological considerations. Glass packaging is experiencing renewed interest among premium segment consumers perceiving health benefits from non-plastic containers. This trend encourages diversification of packaging portfolios across established brands.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara region plays a major role in Turkey's bottled water consumption, anchored by Istanbul's massive metropolitan population and economic activity. This densely urbanized area generates substantial demand through residential households, commercial establishments, and thriving tourism sectors. Aging municipal water infrastructure heightens consumer reliance on bottled alternatives, with home-delivery subscription services maintaining strong penetration across urban neighborhoods.

Central Anatolia encompasses Turkey's capital Ankara and serves as the agricultural heartland. This vast plateau region experiences continental climate conditions driving seasonal consumption variations. Growing urban populations in major cities sustain steady bottled water demand through modern retail channels and home-delivery networks, while rural agricultural communities increasingly adopt packaged drinking water for household use.

The Mediterranean region represents Turkey's premier tourism destination, with Antalya hosting millions of international visitors annually. Coastal resort areas experience pronounced seasonal demand spikes during summer months. Hotel, restaurant, and catering establishments drive substantial commercial consumption, while residential populations in developing coastal cities contribute to year-round market stability across diverse distribution channels.

The Aegean region combines coastal tourism appeal with industrial and agricultural economic foundations centered around Izmir. Popular destinations attract domestic and international tourists seeking historical sites and beach resorts. Regional manufacturers leverage local spring water sources for bottled water production. Growing urbanization and expanding retail infrastructure support consistent consumption growth across metropolitan and resort areas.

Southeastern Anatolia features diverse ethnic heritage and hosts major cities including Gaziantep renowned for culinary traditions. The region experiences hot summer climates driving hydration needs. Agricultural development projects along Tigris and Euphrates river systems support population centers. Expanding modern trade presence and improving distribution networks enhance bottled water accessibility across urban and semi-urban communities.

The Black Sea region features humid climate conditions and lush forested landscapes distinct from other Turkish territories. Tea plantations and hazelnut orchards characterize agricultural activities. Port cities serve regional commerce and tourism. Local spring water sources supply regional bottled water producers. Moderate population density supports stable consumption patterns through traditional retail channels and emerging modern trade formats.

Eastern Anatolia represents Turkey's most rugged and mountainous territory, featuring harsh continental climates and lower population density. Remote communities present distribution challenges for bottled water suppliers. Major urban centers including Erzurum serve as regional commercial hubs. Improving transportation infrastructure and expanding retail networks gradually enhance market penetration across this geographically challenging region.

Market Dynamics:

Growth Drivers:

Why is the Turkey Bottled Water Market Growing?

Thriving Tourism Sector Driving Seasonal Demand

Turkey's tourism industry serves as a powerful catalyst for bottled water consumption growth across coastal and urban destinations. The country attracts millions of international visitors annually — in 2024, Antalya alone welcomed a record 17.28 million visitors, positioning it among the world's most visited nations. Seasonal tourist influxes create substantial demand surges within hotel, restaurant, and recreational establishment channels. Coastal Mediterranean and Aegean resort areas experience pronounced consumption peaks during summer vacation periods. Tourism revenue contributions to national economic output reinforce infrastructure investments supporting hospitality sector expansion. Airport, transportation hub, and tourist attraction venue sales channels capture impulse purchasing opportunities among travelers seeking convenient hydration solutions.

Urbanization and Population Growth Sustaining Demand

Rapid urbanization concentrates populations within metropolitan centers where municipal water quality concerns drive preference for packaged alternatives. For example, in a study of 980 residents across Istanbul, only about 4% reported they drink tap water “without hesitation. Major cities including Istanbul, Ankara, and Izmir exhibit high household penetration rates for bottled water consumption. Rising middle-class prosperity enables increased spending on convenience beverages and premium hydration products. Residential apartment complexes and commercial office buildings rely heavily on large-format container delivery services. Urban lifestyle patterns emphasizing convenience and on-the-go consumption sustain demand for single-serve bottled water across retail and vending channels.

Health Consciousness Shifting Consumer Preferences

Growing health awareness among Turkish consumers encourages transition from sugary carbonated beverages toward healthier hydration alternatives. Bottled water positioning as a calorie-free, pure refreshment option resonates with fitness-conscious demographics. Nutritional education and wellness trends promote increased daily water intake recommendations. According to a 2023 national “National Water Efficiency Campaign,” the government is emphasising water conservation and safe hydration — a move that reinforces public messaging on water quality and may contribute to consumer preference toward bottled water over sugary drinks. Parents preferentially select bottled water for children's consumption, driving household purchasing patterns. Functional water variants offering vitamin enrichment and mineral supplementation capture health-oriented consumer segments. Food service establishments respond to customer preferences by prominently featuring bottled water options. Workplace wellness initiatives promote hydration through water cooler installations and bottled water provisions.

Market Restraints:

What Challenges the Turkey Bottled Water Market Is Facing?

Rising Product Prices Affecting Affordability

Bottled water prices experienced significant increases in recent years, creating affordability challenges for price-sensitive consumer segments. Inflationary pressures affecting packaging materials, transportation costs, and operational expenses translate into higher retail prices. Some consumers face difficulty maintaining previous consumption levels as purchasing power constraints influence household budgets. Lower-income demographics may reduce bottled water purchases or seek cheaper alternatives.

Environmental Concerns Regarding Plastic Packaging

Increasing environmental awareness creates consumer hesitation regarding single-use plastic bottle consumption. Concerns about plastic waste accumulation and marine pollution influence purchasing decisions among ecologically conscious demographics. Regulatory scrutiny of plastic packaging practices intensifies pressure on manufacturers. Consumer advocacy for sustainable alternatives challenges traditional PET bottle dominance and requires industry adaptation toward recycled materials.

Competition from Filtered Tap Water Solutions

Household water filtration systems present growing competition to bottled water consumption. Consumer investments in point-of-use filtration devices reduce reliance on purchased bottled alternatives. Improving municipal water treatment infrastructure in some areas diminishes safety-driven purchasing motivations. Reusable water bottle adoption among environmentally conscious consumers further challenges single-use bottled water market expansion potential.

Competitive Landscape:

The Turkey bottled water market features moderate competitive intensity with established multinational beverage corporations operating alongside prominent domestic manufacturers. Market participants compete across multiple product categories, distribution channels, and price segments to capture consumer loyalty. Brand differentiation strategies emphasize source quality, mineral composition, packaging innovation, and sustainability credentials. Regional manufacturers leverage local spring water sources and distribution network advantages. Modern trade expansion creates opportunities for private label product development. Premium segment growth attracts new market entrants targeting affluent urban consumers. Competitive dynamics encourage continuous product innovation and marketing investment across the industry landscape.

Recent Developments:

- In July 2025, Gürok Group has expanded into beverages with the launch of its premium mineral-water brand AVOYA. The first bottles were filled in March 2024, and the range now includes plain and flavored variants sourced from Burdur springs. The company partnered with KHS for high-speed bottling and plans major capacity investments as distribution grows.

Turkey Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey bottled water market size was valued at USD 3.78 Billion in 2025.

The Turkey bottled water market is expected to grow at a compound annual growth rate of 6.62% from 2026-2034 to reach USD 6.74 Billion by 2034.

Still water dominated the Turkey bottled water market with a 50% share in 2025, driven by consumer preference for natural, non-carbonated hydration options.

Key factors driving the Turkey bottled water market include thriving tourism sector expansion, rapid urbanization and population growth, rising health consciousness, and consumer concerns about municipal tap water quality.

Major challenges include rising product prices affecting affordability, environmental concerns regarding plastic packaging waste, competition from household water filtration systems, and inflationary pressures impacting operational costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)