Turkey Bus Market Size, Share, Trends and Forecast by Type, Fuel Type, Seat Capacity, Application, and Region, 2026-2034

Turkey Bus Market Summary:

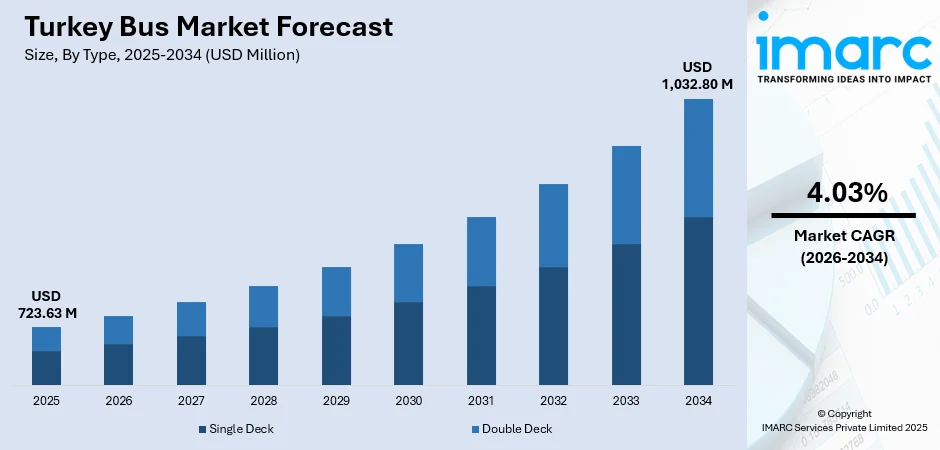

The Turkey bus market size was valued at USD 723.63 Million in 2025 and is projected to reach USD 1,032.80 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

The Turkey bus market is expanding steadily as urban mobility demands increase across major metropolitan regions and intercity travel networks strengthen. Rising investments in public transportation infrastructure, coupled with growing tourism activity driving coach and shuttle demand, are reinforcing market expansion. Manufacturers are modernizing fleets with advanced safety features and improved passenger comfort, while sustainable transport initiatives encourage fleet operators to evaluate cleaner propulsion alternatives. These dynamics collectively strengthen Turkey bus market share and position the country as a regional hub for passenger transport solutions.

Key Takeaways and Insights:

- By Type: Single deck buses dominate the market with a share of 92% in 2025, driven by their operational versatility, cost-effectiveness for urban transit routes, and widespread deployment across municipal transportation networks throughout Turkey's major cities.

- By Fuel Type: Diesel lead the market with a share of 82% in 2025, supported by established refueling infrastructure, proven operational reliability for long-distance intercity routes, and lower upfront acquisition costs compared to alternative propulsion systems.

- By Seat Capacity: The 31-50 seats segment represents the largest segment with a market share of 54% in 2025, reflecting balanced capacity requirements for medium-distance routes, airport shuttles, and tourism applications that optimize passenger throughput with operational flexibility.

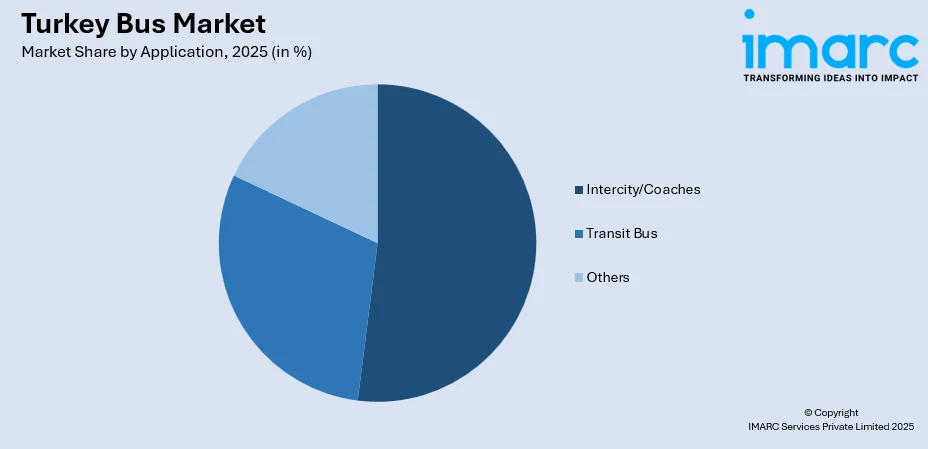

- By Application: Intercity/coaches account for the largest share of 52% in 2025, underpinned by Turkey's extensive intercity bus network serving over one hundred million annual passengers and robust tourism demand connecting major destinations.

- Key Players: The Turkey bus market features a competitive landscape with established domestic manufacturers maintaining strong market positions alongside international players. Companies are expanding product portfolios to include battery electric and fuel cell options while investing in advanced connectivity features and safety technologies to meet evolving operator requirements and regulatory standards.

To get more information on this market Request Sample

The Turkey bus market benefits from the country's strategic geographic position bridging Europe and Asia, creating favorable conditions for both domestic production and export activities. Turkish manufacturers have established strong capabilities in designing buses tailored to diverse operational requirements, from compact urban minibuses navigating historic city centers to full-size coaches serving intercity routes spanning thousands of kilometers. The European Union remains a significant export destination for Turkish buses, with the EU Clean Vehicle Directive creating additional opportunities for manufacturers investing in zero-emission technologies. In November 2025, a domestic manufacturer delivered seventeen electric buses to Mersin Metropolitan Municipality as part of a collaboration with the European Union under the IPA II program, demonstrating the growing momentum toward fleet electrification in public transportation. These developments reflect how evolving regulations, infrastructure investments, and sustainability priorities continue to reshape Turkey's bus market toward cleaner and more technologically advanced solutions.

Turkey Bus Market Trends:

Growing Adoption of Electric and Hybrid Bus Technologies

Urban transit authorities across Turkey are increasingly evaluating electric and hybrid buses as part of broader sustainability initiatives aimed at reducing emissions in densely populated areas. Domestic manufacturers have expanded their electric portfolios significantly, with several now offering battery electric models across multiple length configurations. At Busworld Turkey 2024, a domestic manufacturer unveiled its new generation electric bus series available in lengths from ten to twenty-five meters, featuring advanced battery technology offering ranges exceeding three hundred kilometers. This transition toward cleaner propulsion aligns with municipal environmental goals and positions Turkey bus market growth within the sustainable mobility framework.

Integration of Smart and Connected Technologies

Digitalization is reshaping operational efficiency across Turkey's bus fleets through telematics systems, real-time GPS tracking, passenger information displays, and digital ticketing solutions. These connected technologies enable operators to optimize route scheduling, monitor vehicle performance remotely, and enhance passenger experience through improved service transparency. Smart city initiatives in major urban centers are driving demand for buses equipped with advanced monitoring capabilities that integrate seamlessly with centralized traffic management platforms. The convergence of connectivity and mobility represents a defining characteristic of modern fleet procurement across both transit and intercity segments.

Modernization of Intercity Travel Infrastructure

Turkey’s intercity bus network is one of the largest in Europe, connecting cities through an extensive system of operators. Continuous infrastructure enhancements, including highway expansions, terminal upgrades, and improved regional connectivity, are boosting the appeal of bus travel. Operators are modernizing fleets with premium coaches equipped with reclining seats, onboard connectivity, and advanced safety features to meet passenger expectations. This trend is driving ongoing demand for higher-specification vehicles across both intercity and tourism services.

Market Outlook 2026-2034:

The Turkey bus market outlook remains positive through the forecast period as urbanization trends, infrastructure investments, and tourism sector expansion drive sustained demand across all segments. Municipal authorities are prioritizing public transportation enhancements to address congestion and environmental challenges in major cities, creating procurement opportunities for modern bus fleets. International development programs supporting sustainable urban transport are channeling investments toward cleaner mobility solutions, while the country's strong manufacturing base positions domestic producers to capture both domestic and export market opportunities. The market generated a revenue of USD 723.63 Million in 2025 and is projected to reach a revenue of USD 1,032.80 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

Turkey Bus Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Single Deck | 92% |

| Fuel Type | Diesel | 82% |

| Seat Capacity | 31-50 Seats | 54% |

| Application | Intercity/Coaches | 52% |

Type Insights:

- Single Deck

- Double Deck

The single deck segment dominates with a market share of 92% of the total Turkey bus market in 2025.

Single deck buses maintain overwhelming dominance in Turkey's bus market due to their operational versatility across diverse applications ranging from urban transit to intercity travel and tourism services. These vehicles offer an optimal balance between passenger capacity, maneuverability requirements, and infrastructure compatibility across Turkey's varied road networks. Municipal transit operators favor single deck configurations for their lower maintenance complexity and streamlined depot operations, while intercity operators value the consistent passenger experience and efficient boarding processes these buses provide.

Manufacturing capabilities have concentrated around single-deck platforms, with domestic producers developing comprehensive model ranges spanning from compact six-meter minibuses to full-length articulated configurations exceeding eighteen meters. This production focus enables economies of scale and supports competitive pricing while allowing manufacturers to offer variants optimized for specific duty cycles. The established market position of single deck buses reflects practical operating realities across Turkey's transportation landscape, where standardized platforms maximize fleet interoperability and simplify operator training requirements.

Fuel Type Insights:

- Diesel

- Electric and Hybrid

- Others

The diesel segment leads the market with a share of 82% of the total Turkey bus market in 2025.

Diesel-powered buses continue commanding the majority market share in Turkey due to established refueling infrastructure, proven reliability across demanding intercity routes, and favorable total cost of ownership calculations for operators managing large fleets. The extensive diesel distribution network throughout Turkey enables operators to maintain consistent service schedules without range limitations, particularly critical for long-distance intercity services connecting cities separated by hundreds of kilometers. Modern Euro VI compliant diesel engines have significantly reduced emissions compared to earlier generations while maintaining the operational flexibility operators require.

While diesel maintains its dominant position, electric and hybrid alternatives are gaining momentum particularly in urban transit applications where environmental regulations and municipal sustainability commitments create favorable conditions for zero-emission adoption. Turkey's bus market population includes approximately two hundred nine thousand vehicles with sixty percent older than ten years, presenting substantial fleet renewal opportunities that could accelerate the transition toward alternative propulsion systems as charging infrastructure expands and battery costs continue declining.

Seat Capacity Insights:

- 15-30 Seats

- 31-50 Seats

- More than 50 Seats

The 31-50 seats segment holds the largest share at 54% of the total Turkey bus market in 2025.

Medium-capacity buses in the thirty-one to fifty seat range represent the sweet spot for Turkish operators balancing passenger throughput requirements against operational efficiency considerations. These vehicles excel in applications including airport shuttle services connecting terminals with city centers, tourism operations carrying organized groups to historical sites and coastal destinations, and corporate transport services requiring premium amenities. The capacity range accommodates diverse passenger volumes while maintaining maneuverability through Turkey's varied road conditions including narrow historic urban districts.

Turkey has earned recognition as a leader in minibus and midibus design and production, with domestic manufacturers showcasing specialized expertise in this segment at international exhibitions. Production capabilities span multiple configurations optimized for specific applications, from luxury VIP shuttles with individual seating to high-density configurations maximizing passenger capacity for transit operations. This manufacturing strength supports both domestic market requirements and export opportunities across regions where medium-capacity buses align with local transportation needs.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Transit Bus

- Intercity/Coaches

- Others

The intercity/coaches segment accounts for the highest revenue at 52% of the total Turkey bus market in 2025.

Intercity buses and coaches dominate Turkey's bus market reflecting the country's deeply established bus-based intercity travel culture where buses remain the preferred transportation mode connecting cities across the nation's extensive geography. The intercity bus market in Turkey ranks among the largest in Europe with over one hundred million passengers traveling annually via intercity buses. Major routes including Istanbul-Ankara see over one hundred daily departures, demonstrating the scale of operations sustaining this segment. Buses offer cost advantages compared to air travel while providing accessibility to destinations throughout the country including smaller towns lacking airport connectivity.

Tourism sector growth reinforces intercity and coach segment strength as Turkey welcomed over sixty-two million visitors in 2024 generating sixty-one billion dollars in tourism revenue. Organized tours, airport transfers, and excursion services require coach fleets offering premium comfort amenities meeting international visitor expectations. Operators are upgrading vehicles with features including reclining seats, onboard entertainment systems, wireless connectivity, and enhanced safety technologies to maintain competitiveness and justify premium pricing on tourist-oriented routes connecting major attractions.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara Region’s dense population and highly urbanized cities, including Istanbul, create strong intercity and commuter travel demand. Expanding highway networks, modernized terminals, and a thriving tourism industry boost bus ridership. Business travel and daily commuting needs drive fleet upgrades, while operators increasingly offer premium services with enhanced comfort and connectivity. These factors collectively strengthen the market for high-specification intercity and charter buses in the region.

Central Anatolia’s bus market is driven by Ankara’s status as the administrative and commercial hub, supporting frequent intercity and regional travel. Improved road infrastructure, including highways and express routes, enhances connectivity with surrounding provinces. Growing tourism and educational travel, combined with fleet modernization efforts, increase demand for comfortable, safety-equipped buses. Government initiatives to improve public transportation also support regional growth in both passenger and charter bus segments.

The Mediterranean Region benefits from heavy tourism activity and seasonal travel along coastal cities, boosting bus ridership. Upgraded road networks and modern terminals facilitate smooth intercity travel. Operators focus on premium and air-conditioned coaches to meet tourist expectations. Additionally, regional agricultural and industrial activity supports business travel. These factors drive consistent demand for high-quality buses capable of handling both long-distance and tourism-oriented routes.

In the Aegean Region, tourism hotspots and urban centers fuel intercity and charter bus demand. Coastal connectivity and improved highway systems make bus travel convenient for locals and tourists alike. Operators invest in modern, comfortable fleets to attract passengers seeking reliability and amenities. Seasonal tourism surges, combined with daily commuting needs in regional cities, ensure sustained demand for efficient and well-equipped buses across both urban and intercity routes.

Southeastern Anatolia’s bus market is driven by growing urbanization, expanding road infrastructure, and increased regional mobility needs. Intercity travel for business, education, and healthcare purposes supports fleet utilization. Operators are upgrading buses to improve comfort, safety, and reliability on longer routes connecting rural and urban centers. Government-led transport initiatives and investments in terminals further encourage passenger growth, sustaining demand for modern, higher-specification vehicles.

The Black Sea Region’s bus demand is fueled by its dispersed population, regional tourism, and challenging terrain requiring reliable transport. Upgrades in road infrastructure and intercity connectivity facilitate smoother travel. Operators are modernizing fleets with enhanced comfort and safety features to attract both local commuters and tourists. Seasonal travel fluctuations for agriculture and tourism also contribute, maintaining steady demand for buses suited for diverse route conditions and passenger needs.

Eastern Anatolia’s bus market growth is supported by improved highways, increasing urbanization, and government investment in regional transport infrastructure. Intercity travel is essential due to the region’s remote towns and dispersed population. Fleet modernization efforts, including comfortable seating, safety features, and reliable vehicles for long-distance routes, cater to both local commuters and tourism-related travel. These developments collectively drive sustained demand for intercity and charter bus services.

Market Dynamics:

Growth Drivers:

Why is the Turkey Bus Market Growing?

Government Investment in Sustainable Urban Transport Infrastructure

Turkish metropolitan municipalities are channeling substantial investments into public transportation infrastructure as part of broader urban sustainability initiatives. The EBRD Green Cities program has prioritized sustainable urban transportation in selected Turkish cities including Istanbul, Izmir, and Ankara, facilitating investments in cleaner mobility solutions and supporting fleet modernization efforts. Istanbul joined the program as Europe's largest metropolis, with the development bank already financing metro line construction and exploring additional public transport improvements. These international partnerships provide both financing mechanisms and technical expertise supporting the transition toward lower-emission bus fleets. Municipal procurement programs increasingly incorporate environmental criteria favoring buses meeting stringent emission standards or offering zero-emission capabilities, creating demand pull for manufacturers investing in cleaner propulsion technologies.

Robust Tourism Sector Driving Coach and Shuttle Demand

Turkey's tourism industry achieved record performance in 2024 with over sixty-two million visitors generating more than sixty-one billion dollars in revenue, creating sustained demand for tourist coaches, airport shuttles, and excursion vehicles. The country's diverse attractions spanning historical sites, coastal resorts, and cultural destinations, require extensive ground transportation networks connecting airports, hotels, and points of interest. Tourism operators continuously upgrade fleets to meet international visitor expectations regarding comfort, safety, and service quality. Regional diversification initiatives encouraging travel beyond traditional destinations like Istanbul and Antalya toward Cappadocia, Trabzon, and Eastern Anatolia are expanding geographic coverage requirements for coach operators, driving procurement across varied vehicle configurations suited to different route characteristics.

Fleet Renewal Opportunities from Aging Vehicle Population

Turkey's existing bus fleet presents significant renewal opportunities, with approximately sixty percent of the bus population exceeding ten years of age. Aging vehicles operating beyond optimal service life require replacement to maintain reliability standards, comply with evolving emission regulations, and meet passenger expectations regarding comfort and safety features. Fleet renewal cycles create predictable demand patterns supporting manufacturer production planning and dealer inventory strategies. Operators replacing older diesel buses increasingly evaluate modern alternatives, including Euro VI-compliant engines offering improved fuel efficiency or electric powertrains reducing operating costs despite higher acquisition prices. Financial incentives and favorable financing arrangements through development institutions can accelerate fleet modernization by improving total cost of ownership calculations for operators considering technology transitions.

Market Restraints:

What Challenges the Turkey Bus Market is Facing?

High Acquisition Costs for Alternative Propulsion Vehicles

Electric and hydrogen fuel cell buses require substantially higher upfront investments compared to conventional diesel equivalents, creating procurement barriers for operators managing tight capital budgets. While total cost of ownership calculations may favor alternative propulsion over extended service periods through reduced fuel and maintenance expenses, initial acquisition costs remain challenging particularly for smaller operators lacking access to favorable financing terms.

Limited Charging Infrastructure for Electric Bus Deployment

Expanding electric bus deployment requires substantial investments in depot charging infrastructure and potentially opportunity charging installations along routes, adding complexity and cost beyond vehicle procurement. Infrastructure development timelines may not align with fleet acquisition schedules, creating operational challenges for early adopters. Standardization concerns regarding charging protocols and power requirements introduce additional planning uncertainties for operators evaluating long-term electric bus investments.

Supply Chain Dependencies and Component Availability

Bus manufacturing relies on global supply chains for critical components including powertrains, batteries, electronic systems, and specialized assemblies. Disruptions affecting component availability can constrain production volumes, extend delivery timelines, and impact pricing stability. Domestic manufacturers maintaining diversified supplier networks and developing local sourcing capabilities demonstrate greater resilience, though complete supply chain independence remains impractical given specialized component requirements.

Competitive Landscape:

The Turkey bus market features a competitive landscape dominated by established domestic manufacturers who have developed comprehensive product portfolios spanning minibuses through full-size coaches and increasingly incorporating electric and alternative fuel variants. These manufacturers leverage Turkey's strategic position, bridging European and Asian markets, combining competitive production costs with proximity to major export destinations. Companies are investing in research and development capabilities, with leading manufacturers dedicating significant revenue percentages to technology advancement, covering next-generation propulsion systems, advanced safety features, and connected vehicle solutions. Strategic collaborations with international technology partners provide access to specialized expertise in areas including battery systems, autonomous driving capabilities, and hydrogen fuel cell integration. Competition extends beyond domestic borders as Turkish manufacturers target export growth opportunities, particularly in European markets where the EU Clean Vehicle Directive creates demand for zero-emission buses and coaches.

Recent Developments:

- In September 2025, Daimler Buses announced to increase its production capabilities through a strategic collaboration with Otokar Otomotiv ve Savunma Sanayi A.Ş. Beginning in September 2026, Otokar’s Sakarya facility in Türkiye will manufacture the Mercedes‑Benz Conecto city bus with conventional powertrains on behalf of Daimler Buses. Daimler will provide Otokar with all key components and specialized equipment required for assembly, ensuring adherence to brand standards and quality specifications.

- In May 2024, a Turkish manufacturer based in Ankara unveiled its New Generation Bus series at Busworld Turkey 2024, comprising electric buses in ten, twelve, eighteen, and twenty-five meter configurations. The series features third-generation battery technology offering ranges exceeding three hundred kilometers and includes a charging system providing up to three hundred sixty kilowatts of power.

Turkey Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Deck, Double Deck |

| Fuel Types Covered | Diesel, Electric and Hybrid, Others |

| Seat Capacities Covered | 15-30 Seats, 31-50 Seats, More than 50 Seats |

| Applications Covered | Transit Bus, Intercity/Coaches, Other |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey bus market size was valued at USD 723.63 Million in 2025.

The Turkey bus market is expected to grow at a compound annual growth rate of 4.03% from 2026-2034 to reach USD 1,032.80 Million by 2034.

Intercity/coaches, holding the largest revenue share of 52%, remains pivotal for Turkey's bus market driven by the country's extensive intercity travel network serving over one hundred million passengers annually and strong tourism demand requiring coach fleets for airport transfers and organized excursions.

Key factors driving the Turkey bus market include government investment in sustainable urban transport infrastructure, robust tourism sector expansion creating coach and shuttle demand, fleet renewal opportunities from aging vehicle populations, and manufacturing capabilities supporting both domestic requirements and export growth.

Major challenges include high acquisition costs for electric and alternative propulsion vehicles, limited charging infrastructure constraining electric bus deployment, supply chain dependencies affecting component availability, and economic uncertainties impacting operator investment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)