Turkey Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End-User, and Region, 2026-2034

Turkey Car Rental Market Summary:

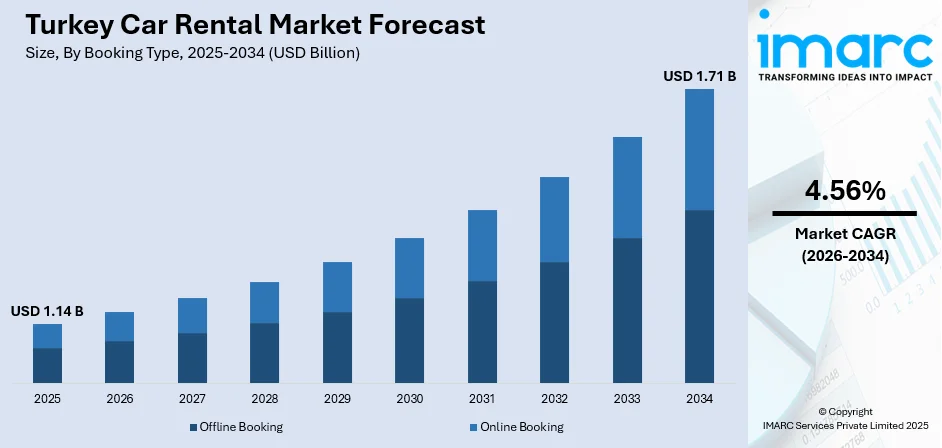

The Turkey car rental market size was valued at USD 1.14 Billion in 2025 and is projected to reach USD 1.71 Billion by 2034, growing at a compound annual growth rate of 4.56% from 2026-2034.

The market is expanding steadily as tourism growth, rising business travel, and increasing demand for flexible mobility solutions drive rental activity. Urbanization and improved road infrastructure are also encouraging short term vehicle use among residents. Digital booking platforms, wider fleet availability, and airport rental services further support market momentum. With growing preference for cost efficient, convenient transportation options, the Turkey car rental market is expected to maintain a positive outlook.

Key Takeaways and Insights:

- By Booking Type: Online booking dominates the market with a share of 74.54% in 2025, driven by increasing smartphone penetration, digital payment adoption, and consumer preference for convenient, contactless reservation experiences.

- By Rental Length: Short term leads the market with a share of 73.92% in 2025, reflecting high demand from tourists, business travelers, and individuals requiring temporary transportation for vacations and short trips.

- By Vehicle Type: Economy represents the largest segment with a market share of 42% in 2025, as cost-conscious travelers and budget-oriented tourists prefer fuel-efficient, affordable vehicles for urban navigation and regional exploration.

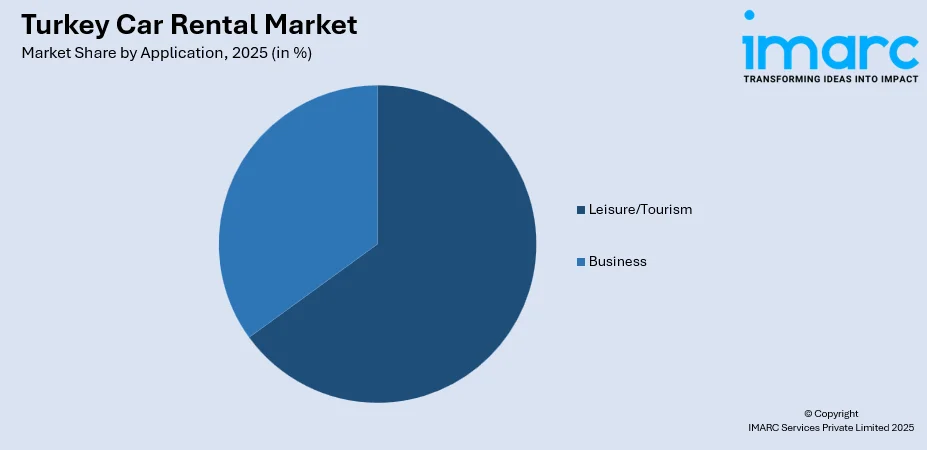

- By Application: Leisure/tourism exhibits a clear dominance with a market share of 65% in 2025, supported by Turkey's position as one of the world's most visited destinations with record-breaking international arrivals.

- Key Players: The Turkey car rental market exhibits moderate competitive intensity, with international rental corporations competing alongside regional operators. Major players focus on fleet expansion, digital platform enhancement, strategic airport partnerships, and service diversification to strengthen market positioning across tourism hubs and urban centers.

To get more information on this market Request Sample

The Turkey car rental market is experiencing steady growth as tourism recovery, expanding domestic travel, and rising urban mobility needs strengthen rental demand across major cities and tourist destinations. Increasing reliance on short term vehicle access, driven by cost efficiency and convenience, is encouraging both leisure and business travelers to choose rental services over ownership. In April 2025, SelfDrive Mobility introduced a Zero Deposit car rental service across daily, weekly, and monthly plans in the UAE, Qatar, Bahrain, Saudi Arabia, the UK, and Turkey. This innovative offering simplifies car rentals, providing a cost-effective, flexible alternative to traditional leasing, with no hidden fees and a fully digital experience. The rapid expansion of online booking platforms, app based rentals, and contactless pickup options is improving accessibility and enhancing customer experience. Additionally, corporate clients are increasingly adopting rental services to reduce fleet management costs and improve operational flexibility. Growing interest in premium, SUV, and electric vehicle rentals is also shaping fleet diversification among service providers. As mobility preferences shift toward on demand transportation, the Turkey car rental market is positioned for continued expansion supported by digitalization, improved road infrastructure, and rising consumer preference for flexible, hassle-free travel solutions.

Turkey Car Rental Market Trends:

Rising Demand from Tourism

Turkey’s flourishing tourism sector continues to drive strong growth in car rentals, supported by increasing international arrivals and expanding domestic travel activity. Turkey's tourism sector achieved a record 26.39 Million international visitors and USD 25.8 Billion in revenue in the first half of 2025, a 1% increase from 2023. The government plans to launch "A Festival of Anatolia" to promote cultural tourism, enhancing its status as a global travel destination. Major cities, coastal regions, and historic destinations generate consistent short term rental demand, especially during peak seasons. Tourists prefer rental cars for convenience, route flexibility, and the ability to explore remote areas without depending on public transport. Airports remain key rental hubs, offering quick access to vehicles and streamlined booking options that enhance the overall travel experience.

Growth of Digital and App Based Rentals

Digitalization is transforming the Turkey car rental market as customers increasingly rely on mobile apps and online platforms for reservations. In April 2025, Regal Car Hire introduced premium car rental services at Dalaman Airport, enhancing travel experiences for both domestic and international visitors. With a diverse fleet available for online booking, the company ensures affordability, safety, and convenience, offering features like 24/7 customer support and no hidden fees for a stress-free journey across Turkey. These solutions offer real time availability, transparent pricing, flexible rental durations, and contactless verification, improving overall convenience. Service providers are investing in user friendly interfaces and automated management systems to enhance customer satisfaction. As digital adoption accelerates, app-based rentals are becoming a preferred choice, allowing travelers to complete the entire rental process efficiently without lengthy in person procedures.

Shift Toward On-Demand Mobility

On demand mobility is gaining traction as consumers prioritize flexibility and affordability over long term vehicle ownership. According to the industry reports, the Turkish short-term car rental sector increased its fleet to 165,300 vehicles in H1 2024, up from 151,000. Renault led the market with a 23% share, while fleet utilization averaged 61%. The average contract duration was 8.3 days. Short term rentals appeal to users who need temporary transportation for errands, weekend trips, or business travel. The shift toward lifestyle-based mobility choices supports higher adoption of pay as you go rental models across urban areas. As maintenance and ownership costs continue to rise, more residents view rentals as a convenient alternative, strengthening the market’s alignment with evolving mobility preferences.

Market Outlook 2026-2034:

The Turkey car rental market outlook remains positive, supported by strong tourism recovery, expanding domestic travel, and rising reliance on short term mobility solutions. Digital platforms will continue to shape customer behavior, with online bookings becoming even more dominant. Growing adoption of electric vehicles and sustained demand from corporate clients will further diversify fleet strategies. While competition and cost pressures persist, operators focusing on technology driven services and flexible rental models are expected to achieve steady growth over the coming years. The market generated a revenue of USD 1.14 Billion in 2025 and is projected to reach a revenue of USD 1.71 Billion by 2034, growing at a compound annual growth rate of 4.56% from 2026-2034.

Turkey Car Rental Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Booking Type | Online Booking | 74.54% |

| Rental Length | Short Term | 73.92% |

| Vehicle Type | Economy | 42% |

| Application | Leisure/Tourism | 65% |

Booking Type Insights:

- Offline Booking

- Online Booking

The online booking dominates with a market share of 74.54% of the total Turkey car rental market in 2025.

Online booking dominates the Turkey car rental market as customers increasingly prefer digital platforms for faster reservations, transparent pricing, and easy comparisons. The segment benefits from widespread smartphone usage, improved app interfaces, and secure digital payment options. Travelers and urban users rely on online channels for last minute bookings and real time availability. As rental platforms enhance user experience and integrate loyalty programs, online booking continues to gain traction, reinforcing its strong market position.

Growth in online booking is supported by expanding internet penetration and rising comfort with digital mobility services. Rental companies focus on seamless digital workflows, reduced paperwork, and instant confirmations, which attract both domestic and international travelers. The shift toward contactless services further strengthens online adoption, especially at airports and major tourist hubs. As pricing transparency and platform reliability improve, online booking remains the preferred channel for most customers, driving sustained expansion of the segment.

Rental Length Insights:

- Short Term

- Long Term

The short term leads with a share of 73.92% of the total Turkey car rental market in 2025.

Short term rentals lead the market due to strong tourism demand, frequent business travel, and increased preference for flexible mobility solutions. Travelers, daily commuters, and occasional users rely on short duration rentals for convenience without long term commitments. This segment gains momentum from airport rentals, weekend travel, and city-based mobility needs. As rental companies expand their short-term fleet availability, the segment maintains steady dominance across urban centers and tourist destinations.

Turkey’s dynamic travel patterns and seasonal tourism peaks further boost the short-term rental segment. Customers benefit from wide vehicle availability, competitive pricing, and simplified digital booking processes designed for immediate use. Rental firms prioritize short term offerings to maximize fleet utilization during peak periods. The increasing popularity of spontaneous travel and same day bookings strengthens the appeal of short term rentals, ensuring continued leadership in the overall Turkey car rental market.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

The economy represents the largest segment with a share of 42% of the total Turkey car rental market in 2025.

The economy segment holds the largest share as customers prioritize affordability, fuel efficiency, and practicality. Budget conscious travelers, daily renters, and short term users prefer economical vehicles for cost effective mobility. These cars offer low maintenance requirements and high availability, making them suitable for both city driving and intercity travel. With rising price sensitivity and fluctuating fuel costs, demand for economy vehicles remains consistently strong across leisure and business travel purposes.

Rental companies focus heavily on expanding their economy fleets to attract wider customer groups, including tourists, students, and corporate clients seeking value driven mobility. Easy handling, compact size, and predictable operating costs make economy cars a reliable choice for most renters. Digital platforms often promote economy models as default options due to their high turnover and strong customer preference. As financial considerations influence renting decisions, the economy segment continues to outperform other vehicle categories.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Leisure/Tourism

- Business

The leisure/tourism exhibits a clear dominance with a 65% share of the total Turkey car rental market in 2025.

Leisure and tourism dominate the market driven by Turkey’s strong travel industry, diverse attractions, and rising domestic tourism activity. In September 2024, İstanbul, Türkiye, announced plans to host the PATA Annual Summit 2025 in March, organized by the Türkiye Tourism Promotion and Development Agency. With a focus on sustainable tourism, the event will bring together global industry leaders for discussions and networking. Turkish Airlines will serve as the official airline partner for the summit. Tourists increasingly rent cars to explore coastal regions, cultural destinations, and rural areas that are less accessible by public transport. This segment benefits from airport rentals and seasonal travel peaks. As international arrivals recover and tourism infrastructure expands, leisure driven car rentals maintain a strong and growing presence across major destinations.

The segment’s dominance is reinforced by travelers seeking flexible, personalized mobility over group tours or fixed transport schedules. Car rentals offer convenience for multi city itineraries, family travel, and extended stays. Rental companies cater to this demand by offering tailored packages, GPS-enabled vehicles, and diverse fleet options suited to leisure needs. Favorable tourism promotions, improved road networks, and rising interest in independent travel further strengthen the leadership of the leisure and tourism segment.

End-User Insights:

- Self-Driven

- Chauffeur-Driven

Self-driven rentals remain widely preferred as customers seek flexible mobility, privacy, and cost effective travel options. Tourists and city travelers choose self-driving for convenience, route freedom, and better control over travel schedules, supporting steady demand across airports, urban centers, and tourist locations.

Chauffeur-driven rentals serve users seeking comfort, premium service, and stress-free travel, particularly business travelers, corporate clients, and tourists unfamiliar with local routes. This segment grows through demand for luxury vehicles, airport transfers, and professional mobility solutions tailored to high convenience expectations.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara remains the one of the most active region for car rentals, supported by dense urban populations, strong tourism inflows, and major transport hubs such as Istanbul airports. High business travel volumes and diverse mobility needs continue to drive consistent rental demand across the region.

Central Anatolia shows steady car rental activity driven by corporate mobility needs, tourism centered around Ankara and Cappadocia, and expanding intercity travel. Growing infrastructure development and rising domestic tourism further support demand across short term and long term rental categories.

The Mediterranean region benefits from strong seasonal tourism, airport arrivals, and coastal travel demand. Popular destinations such as Antalya and Mersin drive high rental volumes, particularly during peak holiday seasons, supporting sustained demand for economy, SUV, and family oriented vehicles.

The Aegean region experiences robust rental demand due to tourist arrivals in Izmir, Bodrum, and Kusadasi. Travelers rely on rentals for coastal exploration, island connections, and intercity trips, contributing to consistent preference for short term and leisure oriented vehicle bookings.

Southeastern Anatolia observes growing rental demand supported by regional business activities, infrastructure development, and increasing domestic travel. Expanding road connectivity and rising interest in cultural tourism contribute to higher adoption of both economy and SUV rental options across key cities.

The Black Sea region sees rising car rental usage driven by nature based tourism, improved highways, and increasing travel to cities like Trabzon and Samsun. Seasonal visitors and domestic travelers prefer rentals for flexible transportation across mountainous routes and coastal attractions.

Eastern Anatolia shows gradual increases in rental activity as tourism, trade, and regional mobility expand. Travelers rely on rentals for long distance routes, cultural site visits, and improved access to remote areas, supporting demand for practical, durable, and cost efficient vehicle options.

Market Dynamics:

Growth Drivers:

Why is the Turkey Car Rental Market Growing?

Rising Interest in Premium and SUV Rentals

Premium and SUV rentals are gaining popularity driven by travelers seeking enhanced comfort, safety, and performance. In March 2025, AUTOWILL rent a car expanded internationally with two new franchise locations at Istanbul airports, offering premium Meet & Greet services and a diverse vehicle range. Travelers can enjoy competitive prices, easy online bookings, and the freedom to explore Istanbul's rich history and culture. Tourists exploring long distance routes, business professionals, and families prefer larger and higher end vehicles for improved ride quality. Service providers are expanding their premium fleets with luxury sedans, high end SUVs, and modern automatic models to meet rising expectations. This trend reflects evolving customer preferences toward upscale travel experiences, encouraging rental companies to diversify offerings and upgrade fleet standards.

Expansion of Corporate Rentals

Corporate demand is expanding as businesses seek cost efficient and flexible mobility solutions for employees. Companies prefer rental fleets to avoid long term vehicle ownership responsibilities, reduce capital expenditure, and support fluctuating operational needs. Daily, weekly, and monthly rental packages provide organizations with greater adaptability for travel schedules, project-based assignments, and intercity transport. The availability of well-maintained vehicles, centralized billing, and tailored corporate agreements continues to strengthen the role of rentals within enterprise mobility strategies.

Growing Adoption of Electric Vehicle Rentals

Electric vehicle rentals are growing steadily as sustainability awareness increases and customers show interest in ecofriendly mobility options. The Turkey electric vehicle market size reached USD 9.82 Billion in 2024 and is projected to reach USD 79.00 Billion by 2033, which supports wider EV availability in rental fleets. Companies are integrating electric models to reduce emissions and align with evolving environmental preferences. Government incentives and expanding charging infrastructure further accelerate adoption. EV rentals appeal to eco-conscious tourists and urban travelers seeking quieter, energy-efficient mobility. As infrastructure continues to improve, electric vehicles are expected to play an increasingly prominent role in Turkey’s rental market.

Market Restraints:

What Challenges the Turkey Car Rental Market is Facing?

High Operational and Maintenance Costs

The Turkey car rental market faces persistent pressure from rising vehicle procurement costs, increasing fuel prices, and higher maintenance expenses. Frequent fluctuations in the Turkish lira further elevate import-dependent costs for spare parts and new fleet acquisitions. These financial burdens reduce profitability for operators, limit fleet expansion, and make it challenging for companies to offer competitive pricing, especially during periods of economic volatility.

Regulatory Complexity and Compliance Challenges

Operators in the Turkey car rental market encounter a multilayered regulatory environment involving licensing requirements, insurance standards, taxation rules, and evolving transportation policies. Frequent regulatory adjustments increase administrative workloads and operational uncertainty. Compliance adds significant costs for documentation, insurance management, and adherence to safety standards. Smaller firms often struggle to meet these requirements, which restricts market entry and limits competitive flexibility across the industry.

Market Competition and Price Sensitivity

The Turkey car rental market experiences intense competition among global brands, regional companies, and low-cost local operators, creating strong pressure on rental pricing. Highly price-sensitive domestic and international customers frequently select the lowest-cost option, reducing margins for established firms. This environment limits differentiation opportunities, complicates value-added service adoption, and forces companies to balance service quality with cost efficiency, ultimately constraining revenue growth and long-term profitability.

Competitive Landscape:

The Turkey car rental market features a competitive landscape shaped by the presence of international brands, regional operators, and budget focused local companies, each competing on fleet diversity, pricing, and service quality. Larger players strengthen their position through advanced digital platforms, wider airport and city coverage, and stronger brand recognition. Local operators focus on affordability and flexible rental terms to attract cost sensitive customers. Companies increasingly compete on value added services, such as contactless bookings, loyalty programs, and tailored corporate packages. Ongoing fleet modernization, including EV adoption, further intensifies competition as firms strive to differentiate offerings and enhance customer experience.

Recent Developments:

- In October 2025, Turkey's car rental firm Getir Arac, formerly majority-owned by Abu Dhabi's Mubadala, was acquired by Tiktak.

Turkey Car Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End-Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey car rental market size was valued at USD 1.14 Billion in 2025.

The Turkey car rental market is expected to grow at a compound annual growth rate of 4.56% from 2026-2034 to reach USD 1.71 Billion by 2034.

Online booking held the largest share, supported by rising digital adoption, app-based convenience, transparent pricing, and faster reservation processes. Travelers increasingly prefer online platforms for comparing options, securing better deals, and accessing flexible, contactless rental experiences.

Key factors driving the Turkey car rental market include expanding tourism, growing business travel, rising demand for short term mobility, and digital transformation. Increased airport traffic and preference for flexible transportation solutions further contribute to strong rental adoption.

Major challenges include high fleet acquisition and maintenance costs, currency fluctuations affecting vehicle imports, regulatory complexities, and intense price competition among operators. These pressures limit profitability and make it difficult for companies to sustain service quality and fleet expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)