Turkey Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Turkey Carbon Black Market Overview:

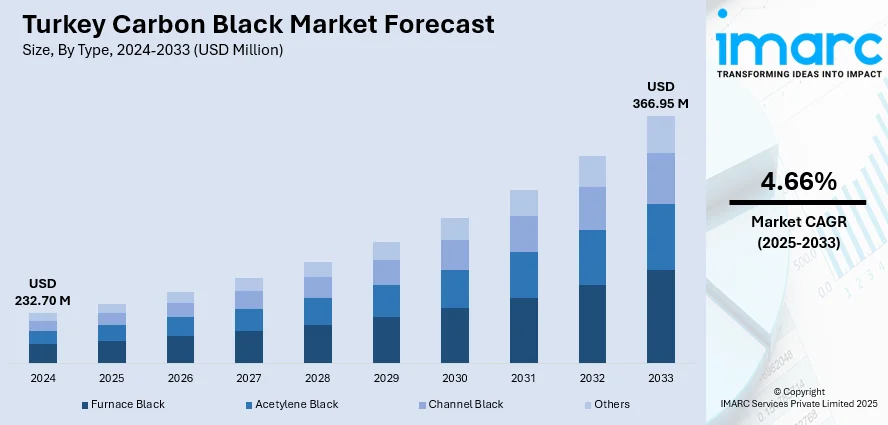

The Turkey carbon black market size reached USD 232.70 Million in 2024. Looking forward, the market is projected to reach USD 366.95 Million by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033. The market is driven by Turkey’s automotive strength, plastic processing capabilities, and expanding industrial coatings sector. Growing demand from construction and packaging further accelerates adoption of specialty grades. With Turkey playing a pivotal role in regional exports and EV manufacturing, demand for high-performance formulations is steadily increasing, further augmenting the Turkey carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 232.70 Million |

| Market Forecast in 2033 | USD 366.95 Million |

| Market Growth Rate 2025-2033 | 4.66% |

Turkey Carbon Black Market Trends:

Strategic Growth in Automotive and Tire Manufacturing

Turkey’s role as a manufacturing hub for automotive OEMs and aftermarket parts continues to intensify carbon black demand, especially in tire and technical rubber applications. With major automakers like Ford Otosan, TOFAŞ, and Hyundai using Turkey as a regional production base, the country sustains robust consumption of carbon black in tires, seals, hoses, and under-hood rubber parts. Turkey imported 174,799 tire shipments in the latest period, sourced by 1,531 Turkish importers from 2,198 suppliers, with Germany (30,090 shipments), Poland (28,422), and Hungary (22,789) as the top suppliers. Additionally, Turkey exported 2,290 tire shipments, reflecting its active domestic tire industry. Local tire manufacturers such as Brisa, Petlas, and Goodyear Turkey produce a broad spectrum of tires ranging from passenger vehicles to agricultural equipment, all of which depend on carbon black for tensile strength, wear resistance, and thermal stability. The Turkish government’s strategic incentives to expand domestic electric vehicle production further contribute to new demand for high-durability rubber compounds and specialized formulations suited for EV tires and lightweight components. The Turkey carbon black market growth is anchored in a resilient automotive base, bolstered by regional exports and production diversification.

To get more information on this market, Request Sample

Expansion in Plastics Processing and Infrastructure-Grade Applications

Turkey’s plastics industry ranks among the top in Europe, with large-scale production of packaging, pipes, films, and automotive plastics that increasingly utilize carbon black as both pigment and UV stabilizer. The average capacity utilization rate improved from 75.7% in 2023 to 76.1% in 2024. Imports of plastic goods decreased 2.6% to USD 4.07 Billion, while exports, direct and indirect, reached USD 15 Billion. Turkish converters apply carbon black to HDPE pipes, cable jackets, drip irrigation tubing, and geomembranes, products essential to infrastructure, agriculture, and utilities. Demand is also growing in masterbatches for black garbage bags, construction films, and agricultural sheeting, where weather resistance and thermal protection are paramount. As Turkey undertakes major infrastructure projects such as canal works, rail expansion, and smart irrigation systems, the requirement for UV-stabilized and long-lasting plastic components continues to rise. Carbon black’s ability to enhance lifespan, protect against photo-degradation, and provide dimensional stability makes it an indispensable additive across these segments. This widespread use across construction and industrial plastic applications ensures consistent demand for both commodity and specialty grades. The emphasis on locally sourced and value-added processing further strengthens Turkey’s position as a key consumer of carbon black in the broader Middle Eastern and European supply chain.

Turkey Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

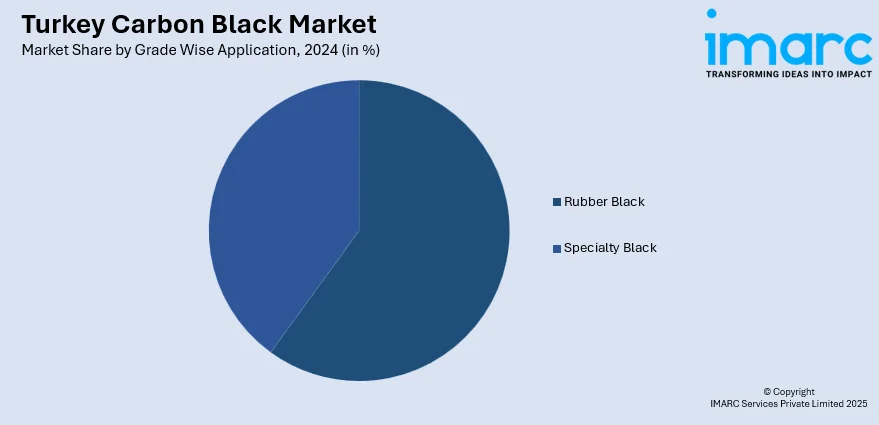

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all major regional markets. This includes Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Carbon Black Market News:

- In December 2024, CSRC Investment Holdings announced that through its subsidiary Continental Carbon, the company is advancing a joint venture with OYAK to support the Iskenderun plant. This partnership is a strategic shift for CSRC amid global restructuring, responding to oversupply in China and a sharp increase in demand outside Asia. The initial output is set at 180ktpa.

Turkey Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey carbon black market on the basis of type?

- What is the breakup of the Turkey carbon black market on the basis of grade wise application?

- What is the breakup of the Turkey carbon black market on the basis of region?

- What are the various stages in the value chain of the Turkey carbon black market?

- What are the key driving factors and challenges in the Turkey carbon black market?

- What is the structure of the Turkey carbon black market and who are the key players?

- What is the degree of competition in the Turkey carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)