Turkey CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Turkey CCTV Camera Market Overview:

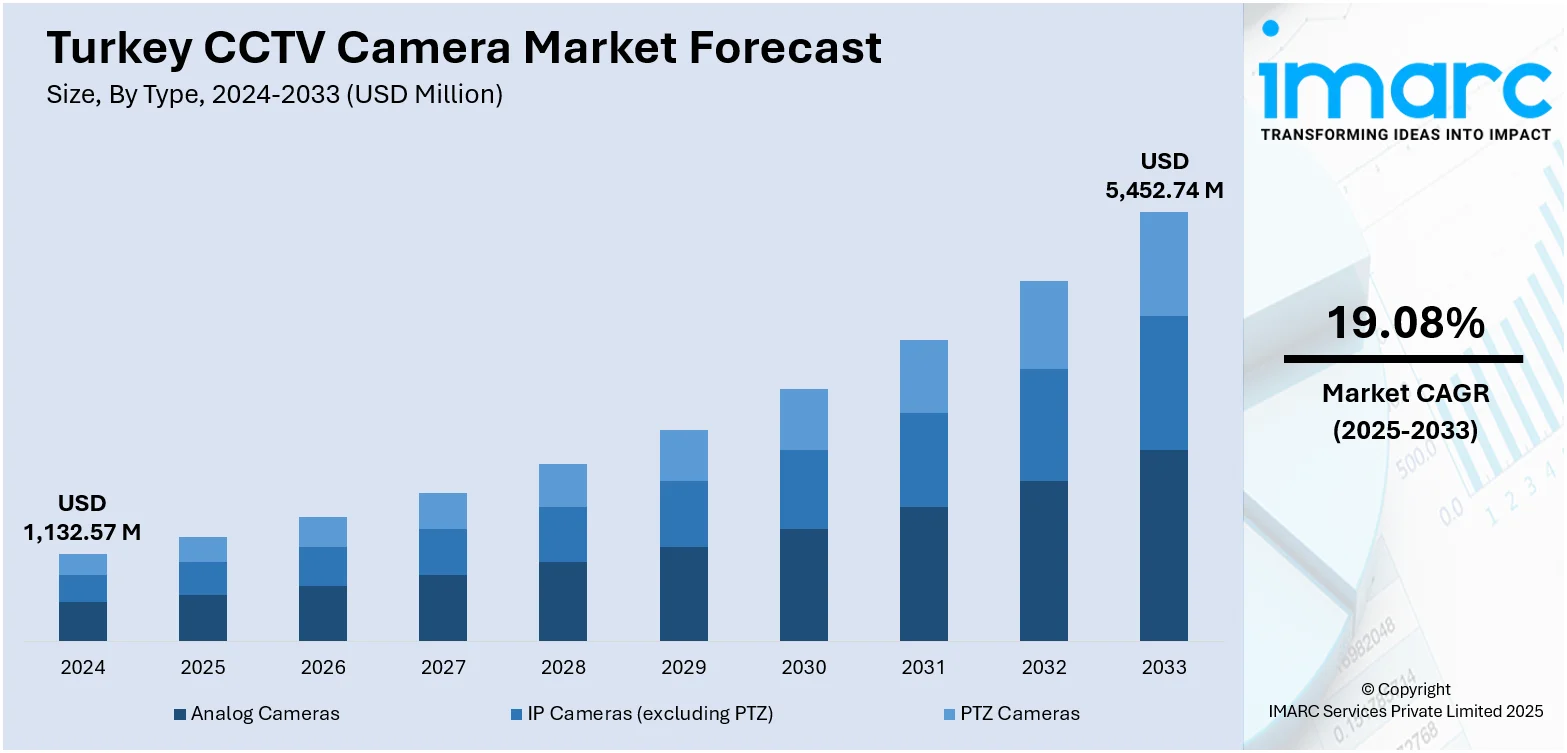

The Turkey CCTV camera market size reached USD 1,132.57 Million in 2024. Looking forward, market is projected to reach USD 5,452.74 Million by 2033, exhibiting a growth rate (CAGR) of 19.08% during 2025-2033. The market is growing steadily, driven by rising concerns over public safety, increased urban surveillance, and expanding infrastructure projects. Adoption of advanced technologies, such as IP-based systems and AI-powered analytics, is further accelerating demand. Both government and private sectors are investing in smart security solutions to enhance monitoring capabilities. With expanding applications across industries, the Turkey CCTV camera market share is witnessing consistent and robust growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,132.57 Million |

| Market Forecast in 2033 | USD 5,452.74 Million |

| Market Growth Rate 2025-2033 | 19.08% |

Turkey CCTV Camera Market Trends:

Integration of AI and Video Analytics

The Turkey CCTV camera market is experiencing a surge of innovation driven by the incorporation of AI-enhanced video analytics. Modern surveillance systems are now equipped with capabilities such as real-time object detection, facial recognition, crowd behavior analysis, and anomaly detection, which support proactive security management. Public safety authorities utilize these features to keep an eye on suspicious activities, accelerating incident response and optimizing the allocation of resources. In commercial environments like retail and banking, AI analytics improve loss prevention strategies, foot traffic monitoring, and employee safety measures. For instance, in November 2024, Acıbadem Healthcare Group in Turkey enhanced security at its Ataşehir Hospital by deploying 900 Hanwha Vision cameras with AI-powered analytics. This system improves perimeter security, reduces false alarms, and provides insights on patient flow and occupancy, ultimately enhancing patient experience and operational efficiency. Additionally, companies are implementing behavior analytics to automate alerts for irregular activities, which boosts overall situational awareness and minimizes the need for manual supervision. The shift toward AI-powered CCTV solutions is also advancing the creation of scalable, intelligent network infrastructures and encouraging collaborations between hardware manufacturers and analytics software developers. These innovations are greatly enhancing efficiency and reliability, driving continuous Turkey CCTV camera market growth.

To get more information on this market, Request Sample

Expansion in Retail and Commercial Segments

The retail and commercial industries in Turkey are playing a crucial role in the increasing adoption of CCTV camera systems. Businesses are progressively allocating funds toward advanced surveillance technologies to enhance their loss prevention tactics, monitor inventory in real time, and boost everyday operations. The use of high-definition cameras paired with video analytics helps in identifying shoplifting, unauthorized access, and employee misconduct. Furthermore, retailers are utilizing surveillance insights to assess customer behavior and refine store layouts. In commercial environments and office buildings, CCTV systems contribute to securing entry points, parking lots, and sensitive areas. This expanding incorporation of intelligent security technologies in retail and commercial settings is improving operational supervision, increasing customer safety, and significantly contributing to the overall growth of the Turkey CCTV camera market.

Cloud Storage and Remote Monitoring

The transition to cloud-based storage and remote monitoring is transforming surveillance practices in Turkey. Organizations and businesses are embracing cloud-enabled CCTV systems that provide scalable, secure, and cost-effective options for video storage. This innovation removes the necessity for large on-site servers, making data management easier. Moreover, remote access through mobile apps and web platforms allows users to oversee live or recorded footage from virtually anywhere, offering unparalleled flexibility and responsiveness. These systems are especially beneficial for operations with multiple sites, including retail chains and logistics hubs, as centralized monitoring enhances coordination and minimizes response times. Additionally, cloud integration supports automated updates, improved data encryption, and effortless integration with AI analytics tools. As organizations focus on agility and scalability in their security setups, cloud-based CCTV solutions are becoming a significant trend aiding in the modernization of the Turkey CCTV camera market.

Turkey CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

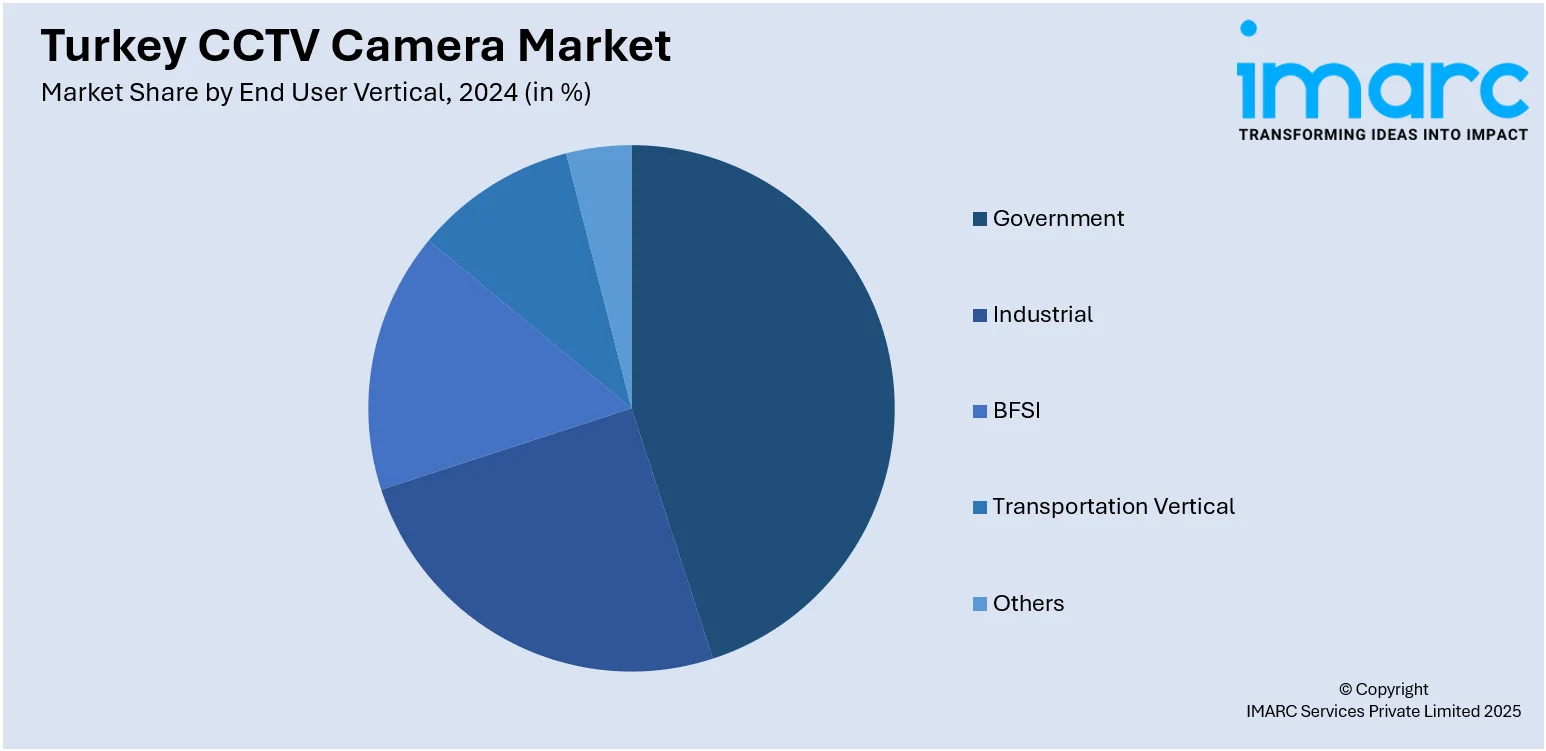

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey CCTV Camera Market News:

- In January 2024, March Networks partnered with Garanti BBVA to transition from analog to digital surveillance, deploying over 22,000 IP cameras and 5,000 NVRs across 883 branches and 4,000 ATMs. The partnership aims to enhance security and efficiency while integrating business intelligence features, marking a significant advancement in banking surveillance technology.

- In January 2024, Yalova's Ro-Ro Terminal in Turkey enhanced security with Hanwha Vision's AI-powered surveillance system. Featuring 48 PNO-A9081R cameras, the technology aids in monitoring, object detection, and alerts for potential incidents. This upgrade aims to improve situational awareness, reduce response times, and safeguard valuable cargo within the busy port.

Turkey CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey CCTV camera market on the basis of type?

- What is the breakup of the Turkey CCTV camera market on the basis of end user vertical?

- What is the breakup of the Turkey CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Turkey CCTV camera market?

- What are the key driving factors and challenges in the Turkey CCTV camera market?

- What is the structure of the Turkey CCTV camera market and who are the key players?

- What is the degree of competition in the Turkey CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)