Turkey Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2025-2033

Turkey Cheese Market Overview:

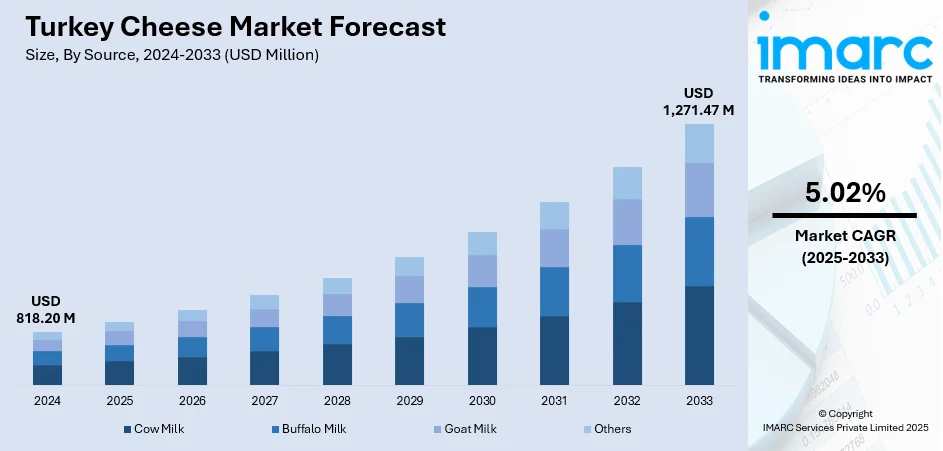

The Turkey cheese market size reached USD 818.20 Million in 2024. The market is projected to reach USD 1,271.47 Million by 2033, exhibiting a growth rate (CAGR) of 5.02% during 2025-2033. The market is experiencing steady growth, triggered by increasing domestic consumption, changing dietary trends, and rising demand for traditional and convenience-based cheese products. Trends including urbanization, foodservice innovation, and health-focused product reformulations are driving sustained momentum through retail and HORECA channels. Growth is additionally supplemented by cold chain infrastructure and value-added dairy processing improvement. Artisanal and functional cheese segments are also gaining momentum. These trends are jointly driving the upward growth of Turkey cheese market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 818.20 Million |

| Market Forecast in 2033 | USD 1,271.47 Million |

| Market Growth Rate 2025-2033 | 5.02% |

Turkey Cheese Market Trends:

Increasing Need for Artisanal and Traditional Cheese Types

The most prominent trend in Turkey's cheese market is boosting demand for artisanal and local cheese types. Turkish customers are intensely looking for domestically produced cheeses like Ezine, Tulum, and Mihaliç, which are sought after due to their unique taste profiles and cultural heritage. According to the reports, in January 2024, Turkey's "Ezine Peyniri" was granted EU Protected Designation of Origin status to Turkey's first cheese, boosting authenticity, local pride, and potential export expansion in the Turkey cheese market. Moreover, this is coupled with amplified consumer demand for authenticity and traceability overall. In addition, tourism in Turkey's regional regions has increased access to these native cheeses, driving mounted domestic and global demand. Production of artisanal cheese is also gaining from small dairy cooperatives and better cold chain logistics that protect quality and freshness. As consumers are becoming more advanced, the demand for handcrafted, additive-free cheeses is increasing, fueling market growth. Focus on the conservation of heritage cheese types to satisfy changing taste demands underscores the changing Turkey cheese market trends.

To get more information on this market, Request Sample

Growth of Cheese Application in Packaged and Ready-to-Eat Foods

The incorporation of cheese into increasingly diverse packages and ready-to-eat (RTE) food products has a huge impact on the Turkey cheese market. Urban living and two-career families are fueling demand for easy, high-protein foods in which cheese is a featured ingredient—such as sandwiches, pastries, salads, and microwave dinners. Cheese-filled borek, pide, and pre-wrapped cheese platter foods are becoming more common on supermarket shelves, food delivery apps, and convenience store aisles. This is facilitated by innovations in packaging technologies that extend shelf life and retain flavor without sacrificing nutrition. Cheese producers are innovating in slicing, shredding, and vacuum-sealed packaging formats to meet the needs of this on-the-go consuming group. Such changing consumption patterns highlight a significant rise in demand, supporting Turkey cheese market growth positively. The increasing integration of dairy processing with convenience foods signifies a dynamic change in market trends.

Health-Oriented Reformulations and Functional Cheese Products

Health-awareness is transforming the Turkey cheese market and creating reformulations and functional cheese product introductions. Low-fat, low-sodium, lactose-free, and probiotic-enhanced cheeses are being launched to meet consumers demanding nutritional content without compromising taste. Labeling and front-of-pack marketing campaigns are also promoting healthier cheese consumption. Vitamin-fortified or live culture-enriched functional cheeses are becoming popular across groups interested in digestive health and cardiovascular wellness. As per the sources, in April 2024, Turkey's Muratbey displayed more than 300 new cheese products at the USA's ECRM Fair, marking the Turkey cheese market's export development and international health-oriented product development. Along with this, plant-based cheese substitutes from nuts, soy, and legumes are slowly coming into mainstream consumption, welcomed by vegans and the diet-conscious. This shift synchronizes with broader wellness trends in Turkey's food industry. With manufacturers calibrating their products to suit these nutritional needs, the market is widening in terms of scope and population outreach. These advances not only are creating demand but also are evidence of the advanced character of trends and are helping with increases in market size.

Turkey Cheese Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, product, format, and distribution channel.

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow milk, buffalo milk, goat milk, and others.

Type Insights:

- Natural

- Processed

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes natural, and processed.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mozzarella, cheddar, feta, parmesan, roquefort, and others.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

A detailed breakup and analysis of the market based on the format have also been provided in the report. This includes slices, diced/cubes, shredded, blocks, spreads, liquid, and others.

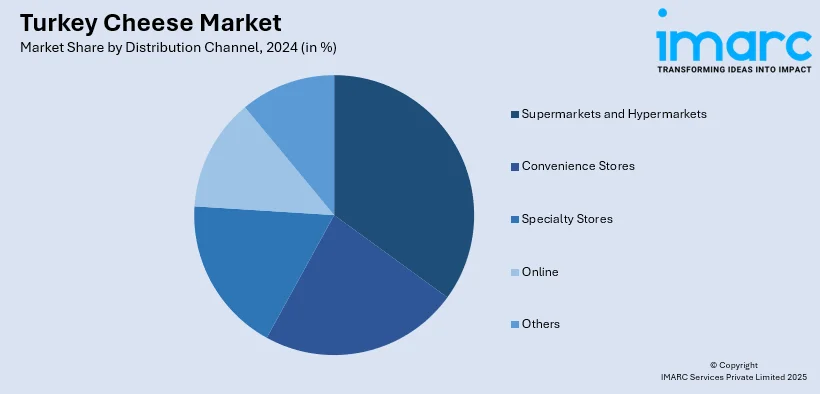

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey cheese market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey cheese market on the basis of source?

- What is the breakup of the Turkey cheese market on the basis of type?

- What is the breakup of the Turkey cheese market on the basis of product?

- What is the breakup of the Turkey cheese market on the basis of format?

- What is the breakup of the Turkey cheese market on the basis of distribution channel?

- What is the breakup of the Turkey cheese market on the basis of region?

- What are the various stages in the value chain of the Turkey cheese market?

- What are the key driving factors and challenges in the Turkey cheese market?

- What is the structure of the Turkey cheese market and who are the key players?

- What is the degree of competition in the Turkey cheese market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey cheese market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey cheese market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)