Turkey Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Region, 2025-2033

Turkey Chocolate Market Overview:

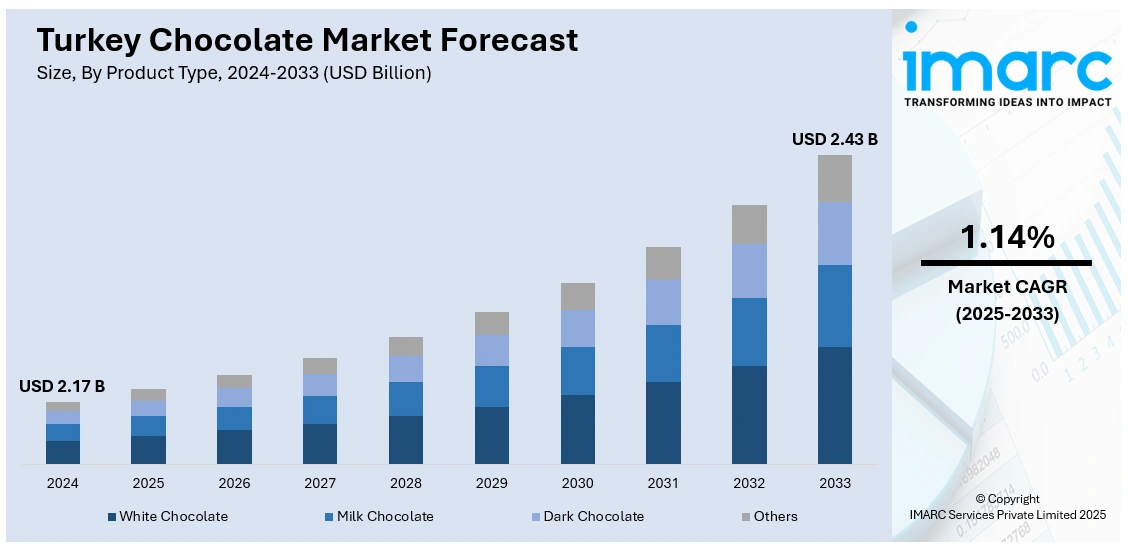

The Turkey chocolate market size reached USD 2.17 Billion in 2024. The market is projected to reach USD 2.43 Billion by 2033, exhibiting a growth rate (CAGR) of 1.14% during 2025-2033. Export growth is not just boosting production levels but also motivating manufacturers to adopt advanced technology, enhance quality criteria, and broaden their product ranges for catering to international preferences, including sugar-free, premium, and organic chocolate varieties. Besides this, the broadening of e-commerce portals is contributing to the expansion of the Turkey chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.17 Billion |

| Market Forecast in 2033 | USD 2.43 Billion |

| Market Growth Rate 2025-2033 | 1.14% |

Turkey Chocolate Market Trends:

Growing export demand

Rising export demand is a powerful driver of the market in Turkey, as the country is leveraging its strong agricultural base, strategic location, and established confectionery tradition to strengthen its global presence. As per industry reports, Turkey's chocolate confectionery industry reached a significant achievement in the first half of 2025, with exports increasing by 61% to USD 743.5 Million, up from USD 461 Million in the equivalent period of 2024. Turkey leads internationally in the production and export of hazelnuts, an essential component in numerous chocolate goods, providing domestic manufacturers with a competitive edge in expenses and supply chain effectiveness. This abundance enables Turkish chocolate producers to craft premium, nut-filled items that attract global markets, especially in Europe, the Middle East, and Asia, where the appetite for various chocolate options is steadily rising. Export expansion is not only increasing production volumes but also encouraging manufacturers to invest in modern technology, improve quality standards, and diversify their product portfolios to meet global tastes, such as sugar-free, premium, and organic chocolate lines. Rising appetite for affordable and high-quality chocolate is creating opportunities for Turkish brands to compete with established multinational players, boosting their international reputation.

To get more information on this market, Request Sample

Broadening of e-commerce portals

The expansion of e-commerce portals is bolstering the Turkey chocolate market growth by transforming the way people discover, purchase, and engage with chocolate brands, making products more accessible and convenient across diverse regions. As per the IMARC Group, the Turkey e-commerce market size reached USD 235.1 Billion in 2024. Online platforms allow both large multinational companies and local artisanal chocolatiers to reach a wider audience without relying solely on traditional retail channels, which is particularly valuable in a country where digital adoption is rapidly increasing. E-commerce provides people with greater product variety, including premium, niche, and imported chocolates that may not always be available in physical stores, while also offering promotional discounts, subscription services, and personalized recommendations that encourage frequent purchases. The ability to buy chocolates online for gifting, seasonal celebrations, and everyday indulgence also aligns well with Turkey’s strong culture of hospitality and sweet consumption. Furthermore, digital marketing and social media integration are enabling brands to showcase new launches, highlight unique flavors like hazelnut-rich chocolates, and engage directly with younger, tech-savvy individuals who prefer online shopping.

Turkey Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, product form, application, pricing, and distribution.

Product Type Insights:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes white chocolate, milk chocolate, dark chocolate, and others.

Product Form Insights:

- Molded

- Countlines

- Others

A detailed breakup and analysis of the market based on the product form have also been provided in the report. This includes molded, countlines, and others.

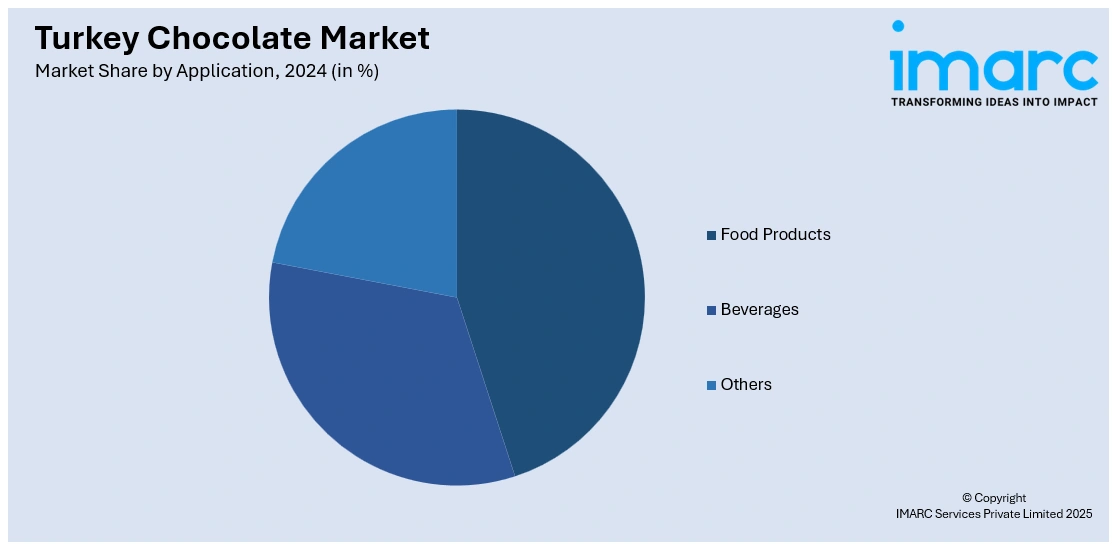

Application Insights:

- Food Products

- Bakery Products

- Sugar Confectionery

- Desserts

- Others

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food products (bakery products, sugar confectionery, desserts, and others), beverages, and others.

Pricing Insights:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes everyday chocolate, premium chocolate, and seasonal chocolate.

Distribution Insights:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes direct sales (B2B), supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Chocolate Market News:

- In March 2025, the Turkish sweets manufacturer, Altinmarka, launched a new product range that included an environment-friendly chocolate, after partnering with the ethically-focused Swiss firm Koa for its ingredients. Leveraging the versatility of cocoa fruit as both a sweetener and a textural element, Altinmarka was ready to expand the Cacaonly product lineup, introducing fresh selections.

Turkey Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey chocolate market on the basis of product type?

- What is the breakup of the Turkey chocolate market on the basis of product form?

- What is the breakup of the Turkey chocolate market on the basis of application?

- What is the breakup of the Turkey chocolate market on the basis of pricing?

- What is the breakup of the Turkey chocolate market on the basis of distribution?

- What is the breakup of the Turkey chocolate market on the basis of region?

- What are the various stages in the value chain of the Turkey chocolate market?

- What are the key driving factors and challenges in the Turkey chocolate market?

- What is the structure of the Turkey chocolate market and who are the key players?

- What is the degree of competition in the Turkey chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)