Turkey Cloud Kitchen Market Size, Share, Trends and Forecast by Type, Product Type, Nature, and Region, 2026-2034

Turkey Cloud Kitchen Market Summary:

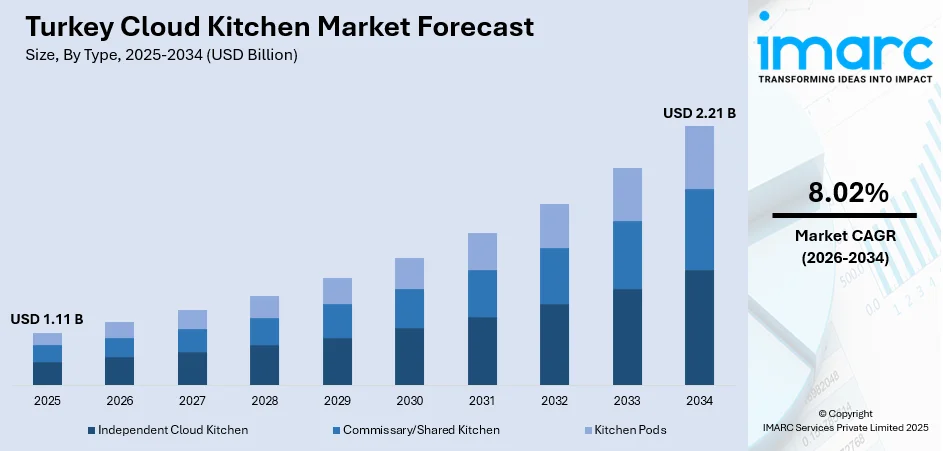

The Turkey cloud kitchen market size was valued at USD 1.11 Billion in 2025 and is projected to reach USD 2.21 Billion by 2034, growing at a compound annual growth rate of 8.02% from 2026-2034.

The Turkey cloud kitchen market is experiencing strong growth as food delivery demand rises and consumers increasingly prefer quick, convenient meal options. Operators are expanding delivery-only kitchens to reduce overhead costs, streamline operations, and serve multiple brands from a single facility. Urbanization, digital ordering platforms, and shifting lifestyles further support adoption. As restaurants optimize online revenue channels, cloud kitchens are becoming a scalable, cost-efficient model driving significant transformation across Turkey’s foodservice landscape.

Key Takeaways and Insights:

- By Type: Independent cloud kitchen dominates the market with a share of 62% in 2025, driven by lower operational costs and flexibility to adapt menus quickly to evolving consumer preferences.

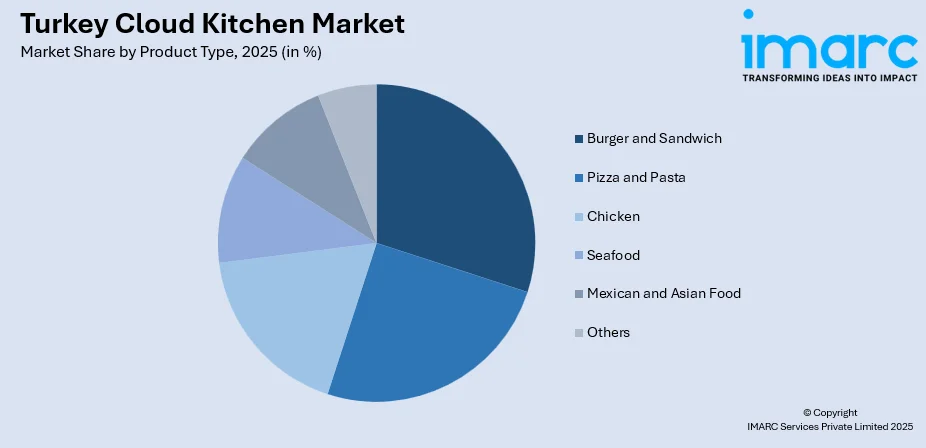

- By Product Type: Burger and sandwich lead the market with a share of 28% in 2025, supported by strong consumer demand for convenient fast-food options and widespread popularity among younger demographics.

- By Nature: Standalone represents the largest segment with a market share of 65% in 2025, reflecting entrepreneurs' preference for independent operations with complete control over brand identity and menu development.

- Key Players: The Turkey cloud kitchen market exhibits moderate competitive intensity, with domestic startups competing alongside established food service operators. Market participants are focusing on technology integration, multi-brand strategies, and strategic partnerships with delivery platforms to strengthen their competitive positioning and expand geographical footprint.

To get more information on this market Request Sample

The Turkey cloud kitchen market is expanding rapidly as consumer reliance on online food delivery accelerates across major urban centers. Rising smartphone penetration, busy lifestyles, and preference for affordable, convenient meal options are driving strong demand for delivery-only kitchen models. In early 2025, Turkey recorded 80.7 million active cellular mobile connections, representing 92.1% of its population. Internet usage reached 77.3 million individuals, with a penetration rate of 88.3%. Cloud kitchens enable operators to minimize rental costs, optimize staff utilization, and manage multiple brands under one facility, making the model financially attractive for both startups and established restaurant chains. The growth of aggregator platforms and improved last-mile logistics further strengthen market development by enabling wider customer reach and faster order fulfillment. Additionally, the increasing popularity of virtual brands and data-driven menu optimization supports operational scalability. As the foodservice industry continues shifting toward digital-first consumption, cloud kitchens are emerging as a key pillar of Turkey’s evolving delivery ecosystem, offering significant opportunities for expansion and innovation.

Turkey Cloud Kitchen Market Trends:

Growth of Third-Party Delivery Platforms

Third-party delivery platforms are playing a pivotal role in expanding the reach of cloud kitchens across Turkey. Partnerships with major apps help operators capture large customer bases without investing in independent delivery networks. These platforms generate valuable data insights on consumer behavior, enabling refined menu design, dynamic pricing, and improved marketing strategies. As app usage rises, cloud kitchens benefit from increased visibility, higher order volumes, and operational efficiency driven by integrated delivery and order management systems.

Rising Popularity of Delivery-Only Brands

Delivery-only brands are becoming a defining trend in the Turkey cloud kitchen market as operators capitalize on lower setup costs and flexible kitchen models. The Turkey online food delivery market size reached USD 1.9 Billion in 2024, and is expected to reach USD 5.8 Billion by 2033, further strengthening demand for virtual brands. Cloud kitchens enable rapid brand launches and low-risk experimentation with new cuisines, supporting targeted customer segmentation and broader menu diversification. As digital ordering accelerates, virtual brands offer a scalable and cost-efficient way to meet evolving consumer preferences across urban markets.

Expansion of Multi-Brand Cloud Kitchen Models

Multi-brand kitchen operations are gaining momentum as operators consolidate several virtual brands within a single facility to maximize resource utilization. This model enables shared staffing, equipment, and ingredients, significantly lowering operational costs while catering to diverse cuisine preferences. It also supports higher order volumes by appealing to broader customer segments. In densely populated cities, running multiple brands from one kitchen enhances agility, improves scalability, and increases profitability by efficiently addressing varied food delivery demands.

Market Outlook 2026-2034:

The Turkey cloud kitchen market outlook remains highly promising, supported by rising online food delivery adoption, expanding urban populations, and strong interest in affordable, convenience-driven dining. Operators are expected to scale multi-brand and delivery-only models to enhance efficiency and profitability. Growing investment from restaurants, startups, and franchise networks will further accelerate expansion. As digital ordering, automation, and data-driven menu optimization advance, cloud kitchens are poised to become a central component of Turkey’s evolving foodservice ecosystem, offering significant growth opportunities. The market generated a revenue of USD 1.11 Billion in 2025 and is projected to reach a revenue of USD 2.21 Billion by 2034, growing at a compound annual growth rate of 8.02% from 2026-2034.

Turkey Cloud Kitchen Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Independent Cloud Kitchen | 62% |

| Product Type | Burger and Sandwich | 28% |

| Nature | Standalone | 65% |

Type Insights:

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

The independent cloud kitchen dominates with a market share of 62% of the total Turkey cloud kitchen market in 2025.

Independent cloud kitchens dominate the Turkey cloud kitchen market as operators prioritize full control over branding, menu design, and operational decisions. These standalone units allow businesses to innovate quickly, refine offerings, and respond to shifting consumer preferences without franchise constraints. Their ability to optimize costs, streamline workflows, and scale across densely populated urban areas strengthens their competitive positioning. With rising online food delivery demand, independent kitchens continue to expand, supported by flexible operating models and faster market adaptability.

The strong performance of independent cloud kitchens is further driven by lower capital requirements and greater autonomy in experimenting with niche cuisines, health-oriented menus, and multi-brand strategies. Operators benefit from direct customer engagement through delivery platforms, enabling data-driven improvements and targeted promotions. Their agility helps them navigate competitive pressures and maintain consistent service quality. As virtual brands gain popularity, independent operators increasingly leverage creativity and operational efficiency to secure higher order volumes and long-term customer loyalty.

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Burger and Sandwich

- Pizza and Pasta

- Chicken

- Seafood

- Mexican and Asian Food

- Others

The burger and sandwich lead with a share of 28% of the total Turkey cloud kitchen market in 2025.

Burger and sandwich offerings lead the Turkey cloud kitchen market due to their broad consumer appeal, quick preparation times, and suitability for delivery. These items maintain quality during transit, making them ideal for fast-paced urban lifestyles. Cloud kitchens capitalize on this demand by developing diverse menus, from classic options to gourmet and fusion variations. High repeat-order potential and affordability further strengthen the segment’s dominance, ensuring steady order volumes across major cities and delivery platforms.

The segment’s leadership also reflects strong demand from younger consumers seeking convenient, customizable, and value-driven meals. Operators use data insights to refine recipes, introduce limited-time flavors, and expand into healthier formats such as grilled or plant-based sandwiches. Consistent consumer preference for quick, familiar comfort food supports menu stability and operational efficiency. As delivery consumption rises nationwide, the burger and sandwich category remains a cornerstone for cloud kitchens looking to maximize reach and profitability.

Nature Insights:

- Franchised

- Standalone

The standalone exhibits a clear dominance with a 65% share of the total Turkey cloud kitchen market in 2025.

Standalone cloud kitchens dominate the Turkey market as they allow operators complete control over operations, brand identity, and menu strategy. Without franchise restrictions, these kitchens can pivot quickly, introduce innovative concepts, and adapt to customer feedback more effectively. Their lower setup costs and flexible expansion models appeal to both emerging entrepreneurs and established restaurateurs seeking to grow through delivery-only formats. This independence enhances creativity and supports stronger positioning in Turkey’s highly dynamic food delivery ecosystem.

The standalone segment also benefits from its ability to cater to niche audiences, test multiple virtual brands, and optimize profitability without sharing revenue with franchise networks. Operators can implement customized marketing strategies, streamline procurement, and scale selectively based on demand patterns. This agility is particularly advantageous in urban centers where competition is high and consumer preferences evolve rapidly. As digital ordering accelerates, standalone cloud kitchens continue to gain traction by offering differentiation, operational flexibility, and cost efficiency.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara region drives strong demand in the Turkey cloud kitchen market due to dense urban populations, high digital adoption, and robust delivery infrastructure. Its diverse consumer base and strong spending patterns make it a leading hub for cloud kitchen expansion.

Central Anatolia shows steady cloud kitchen adoption supported by growing urban centers and increasing online food delivery usage. Rising young populations, improving logistics networks, and expanding quick-service preferences are enhancing demand across key cities within the region.

The Mediterranean region benefits from high tourism activity, strong hospitality demand, and rising interest in convenient food delivery options. Cloud kitchens gain traction due to seasonal population spikes, diversified cuisine preferences, and expanding digital ordering behavior among residents and visitors.

The Aegean region experiences increasing cloud kitchen penetration driven by urban growth, tourism flows, and rising spending on prepared foods. Consumers prefer fast, diverse meal options, encouraging operators to expand delivery-focused brands and leverage strong digital ordering trends in key coastal cities.

Southeastern Anatolia is witnessing gradual expansion in cloud kitchen activity as urbanization increases and digital food delivery platforms gain popularity. Rising disposable incomes and growing young demographics contribute to higher adoption of convenient online meal services across major cities in the region.

The Black Sea region shows moderate cloud kitchen growth supported by improving infrastructure and increasing online ordering habits. Consumers are gradually shifting toward delivery-focused meal options, encouraging operators to introduce diverse menus tailored to regional tastes and emerging digital dining preferences.

Eastern Anatolia’s cloud kitchen presence is developing steadily with expanding internet penetration, increasing urban migration, and rising acceptance of online food delivery. Operators are exploring scalable formats to meet demand for affordable, convenient meals across emerging towns and growing urban clusters.

Market Dynamics:

Growth Drivers:

Why is the Turkey Cloud Kitchen Market Growing?

Increased Adoption of Data and Automation

Cloud kitchens in Turkey are increasingly adopting automation tools and data analytics to streamline operations and improve service quality. Automated inventory management, AI-powered demand forecasting, and smart order routing help reduce errors and enhance speed. Predictive analytics assist in menu optimization by identifying high-demand items and eliminating non-performing dishes. This technology-driven approach minimizes waste, controls costs, and ensures consistent customer satisfaction. As competition intensifies, data-centric decision-making is becoming essential for operational excellence.

Growing Focus on Health-Focused and Niche Menus

Health-oriented and niche menus are emerging as a key trend in Turkey’s cloud kitchen landscape, supported by strong demand from its large and highly urbanized population. As of December 2025, Turkey’s population stands at 87,776,088, with 76.92% living in urban areas, creating significant demand for convenient yet healthier meal options. Cloud kitchens are introducing vegan, low-calorie, keto, and gluten-free offerings, using the delivery-only model to experiment with specialized menus and respond quickly to shifting dietary preferences. These niche concepts help operators differentiate and build strong loyalty among health-conscious consumers.

Rising Investment by Restaurants and Startups

Restaurants and food startups are accelerating their investments in cloud kitchens to expand their presence without significant capital commitments. This model allows businesses to scale quickly, reach new delivery zones, and diversify their brand portfolios. Cloud kitchens reduce dependency on dine-in traffic, offering resilience during demand fluctuations. Startups also leverage the model to test concepts before launching physical outlets. With growing consumer reliance on delivery platforms, this investment trend continues to drive nationwide market expansion.

Market Restraints:

What Challenges the Turkey Cloud Kitchen Market is Facing?

High Competition and Market Saturation

The Turkey cloud kitchen market faces rising saturation as numerous virtual brands, independent operators, and traditional restaurants enter the delivery-only space. Intensifying competition reduces pricing flexibility and heightens customer acquisition costs. Many brands struggle to maintain visibility on crowded delivery platforms, limiting order volumes. This competitive pressure makes it challenging for smaller operators to sustain profitability, differentiate offerings, and secure long-term customer loyalty in an increasingly crowded digital foodservice environment.

Operational Inefficiencies and Quality Control Challenges

Cloud kitchens often struggle with maintaining consistent food quality, managing high-order volumes, and meeting customer expectations across multiple virtual brands. Coordination issues in shared kitchen spaces, limited staff capacity, and delivery delays further impact customer satisfaction. Quality control becomes difficult without direct dine-in oversight, increasing the risk of service inconsistencies. These operational complexities hinder brand reputation, reduce repeat orders, and impose additional costs for monitoring, training, and process optimization.

Rising Delivery and Logistics Costs

Increasing delivery fees, commission charges from third-party platforms, and higher fuel and labor costs significantly impact profitability for cloud kitchen operators. Dependency on external delivery partners reduces control over service quality and margins. As logistics expenses continue to rise, operators face challenges in maintaining competitive pricing while preserving profitability. These cost pressures particularly affect smaller brands, restricting their ability to scale operations and compete effectively within Turkey’s rapidly expanding online food delivery ecosystem.

Competitive Landscape:

The competitive landscape of the Turkey cloud kitchen market is intensifying as local restaurants, national chains, startups, and virtual brand operators increasingly adopt delivery-only models to capture rising online food demand. Shared kitchen providers and multi-brand operators are expanding aggressively, leveraging lower overheads and data-driven menu strategies to scale quickly. Third-party delivery platforms also play a central role by influencing visibility, pricing, and customer reach, creating both opportunities and competitive pressures. With growing investment and rapid brand proliferation, differentiation based on food quality, operational efficiency, and digital visibility has become essential for long-term success in the market.

Recent Developments:

- In January 2025, Rafinera Cloud Kitchen has secured USD 2.7 Million in funding, bringing total investments to USD 5 Million and valuing the startup at nearly USD 20 Million. The Turkish cloud kitchen plans to expand its network to 100 locations and serve 25 Million customers annually, integrating with Cookshop's menu offerings.

- In October 2024, Turkish cloud kitchen startup Paket Mutfak secured USD 2.7 Million in funding, raising its total to USD 8.5 Million. Currently operating 15 branches in Istanbul and delivering over 130,000 meals monthly, the company aims to establish Türkiye's largest cloud kitchen network by expanding its infrastructure and service offerings.

Turkey Cloud Kitchen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods |

| Product Types Covered | Burger and Sandwich, Pizza and Pasta, Chicken, Seafood, Mexican and Asian Food, Others |

| Natures Covered | Franchised, Standalone |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey cloud kitchen market size was valued at USD 1.11 Billion in 2025.

The Turkey cloud kitchen market is expected to grow at a compound annual growth rate of 8.02% from 2026-2034 to reach USD 2.21 Billion by 2034.

The independent cloud kitchen segment held the largest share of the market, driven by its operational flexibility, lower setup costs, and ability to rapidly introduce new menus tailored to evolving urban consumer preferences.

Key factors driving the Turkey cloud kitchen market include rising online food delivery adoption, growing urban populations, increasing demand for convenient meals, and the scalability of delivery-only models that support faster menu innovation and reduced operational expenses for operators.

Major challenges include high competition from numerous delivery-only brands, pressure to maintain food quality during transit, reliance on third-party aggregators, and rising operational costs, which make it difficult for smaller players to sustain consistent profitability and long-term differentiation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)