Turkey Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Turkey Commercial Insurance Market Overview:

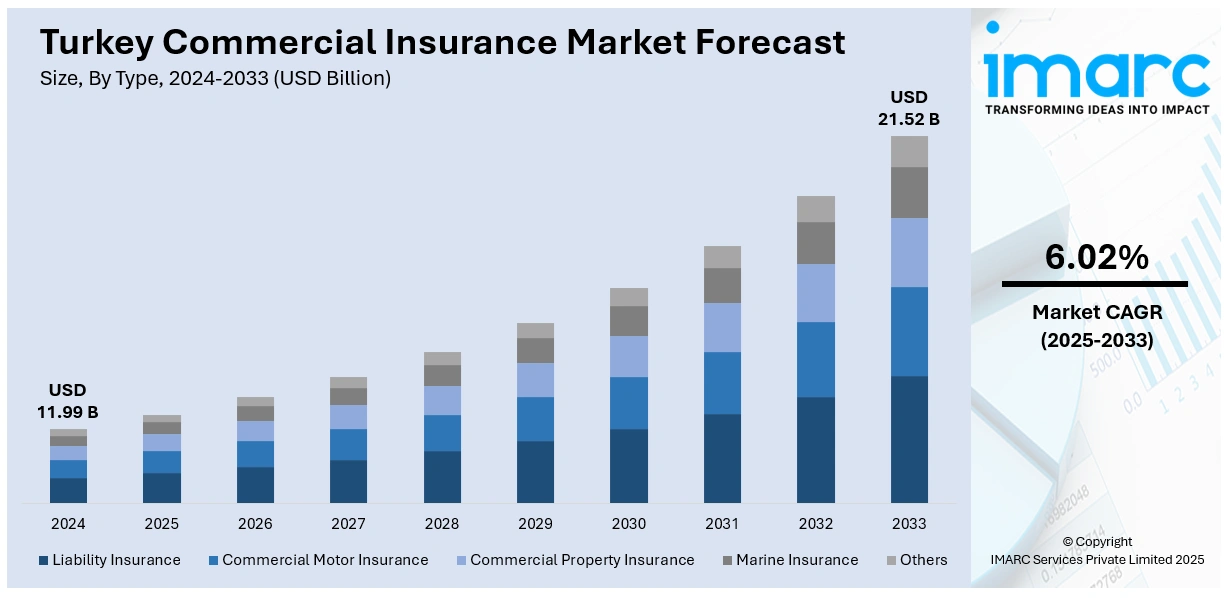

The Turkey commercial insurance market size reached USD 11.99 Billion in 2024. The market is projected to reach USD 21.52 Billion by 2033, exhibiting a growth rate (CAGR) of 6.02% during 2025-2033. Expanding construction activity, growth in SMEs, rising infrastructure investments, and regulatory compliance requirements are some of the factors contributing to the Turkey commercial insurance market share. Increasing awareness of risk management, digital distribution channels, healthcare demand, and rising foreign investments also drive uptake, strengthening premium growth across property, liability, and health segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.99 Billion |

| Market Forecast in 2033 | USD 21.52 Billion |

| Market Growth Rate 2025-2033 | 6.02% |

Turkey Commercial Insurance Market Trends:

Digitalization Driving Insurance Penetration

One of the most noticeable changes in Turkey's commercial insurance sector is the increase in digital distribution and automation. Insurers are aggressively investing in internet platforms, mobile apps, and artificial intelligence-powered solutions to streamline policy issuance, risk assessment, and claims handling. This approach lowers operational expenses and increases product availability to mid-sized firms, many of which were previously underserved owing to manual processes and extensive paperwork. The pandemic hastened this shift, compelling businesses to embrace digital solutions for insurance renewals, customer support, and fraud detection. Turkey's youthful, tech-savvy business community is likewise more comfortable communicating with insurers via digital means. At the same time, partnerships between insurers and fintech firms are becoming more common, enabling data-driven underwriting and customized offerings. As a result, commercial insurance products are reaching industries that were previously hesitant to engage with formal coverage, such as small logistics operators and emerging tech firms. Over the next few years, digital adoption is expected to help narrow Turkey’s insurance penetration gap compared to developed markets. These factors are intensifying the Turkey commercial insurance market growth.

To get more information on this market, Request Sample

Infrastructure Growth and Sector-Specific Demand

Another distinct trend shaping Turkey’s commercial insurance market is the increasing demand generated by large-scale infrastructure and energy projects. Turkey’s strategic location and government-backed investments in highways, airports, and renewable energy projects have created a surge in insurance needs related to construction, liability, and engineering coverage. Multinational contractors and local firms alike are seeking specialized policies to mitigate risks tied to project delays, natural disasters, and political uncertainties. Additionally, the expansion of renewable energy, particularly wind and solar, has pushed insurers to develop tailored products for equipment breakdown, cyber risks, and operational liability. The transportation and logistics sectors, vital for Turkey’s role as a trade hub between Europe and Asia, are also driving growth in marine and cargo insurance. Unlike digitalization, which impacts distribution and efficiency, this trend is rooted in structural changes within the economy and long-term government strategies. The alignment of insurance offerings with sector-specific needs underscores the importance of technical expertise and global reinsurance partnerships in sustaining growth in Turkey’s commercial insurance space.

Turkey Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

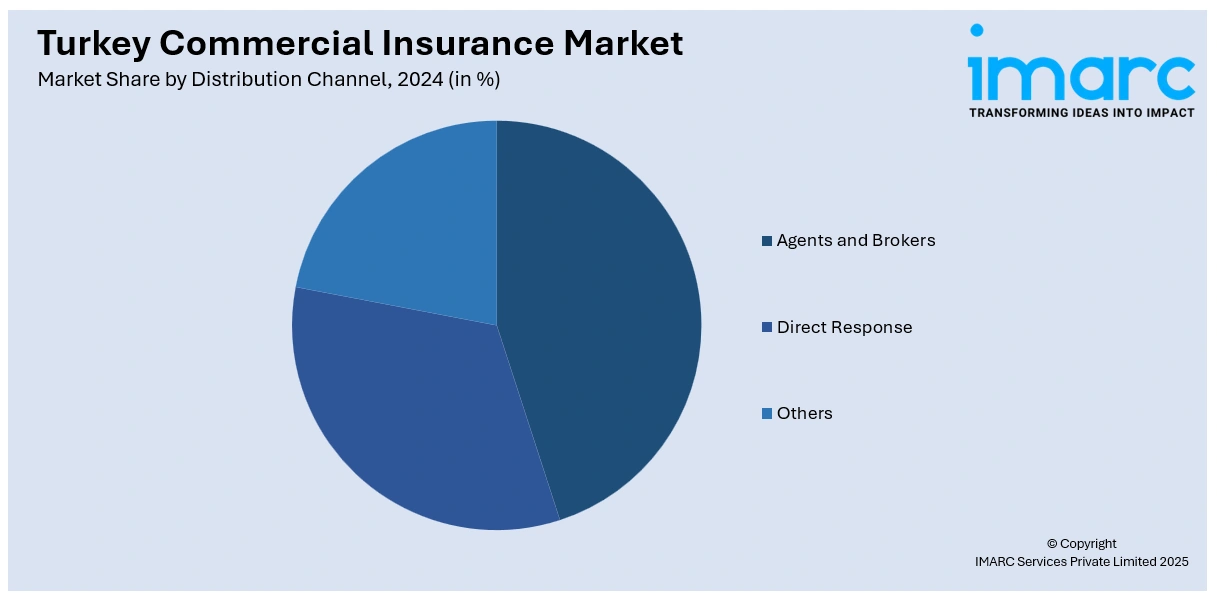

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Commercial Insurance Market News:

- January 2025: Zurich Türkiye completed the acquisition of NN Hayat ve Emeklilik from NN Group, following regulatory approval. With NN exiting the Turkish market, Zurich strengthens its presence in the country’s commercial insurance and pension sector. The move consolidates Zurich’s market position, expanding its customer base and distribution network. NN’s Turkish operations had a limited impact on its global results, but the deal marks a notable shift in Turkey’s insurance landscape.

Turkey Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey commercial insurance market on the basis of type?

- What is the breakup of the Turkey commercial insurance market on the basis of enterprise size?

- What is the breakup of the Turkey commercial insurance market on the basis of distribution channel?

- What is the breakup of the Turkey commercial insurance market on the basis of industry vertical?

- What is the breakup of the Turkey commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Turkey commercial insurance market?

- What are the key driving factors and challenges in the Turkey commercial insurance market?

- What is the structure of the Turkey commercial insurance market and who are the key players?

- What is the degree of competition in the Turkey commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)