Turkey Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Turkey Confectionery Market Overview:

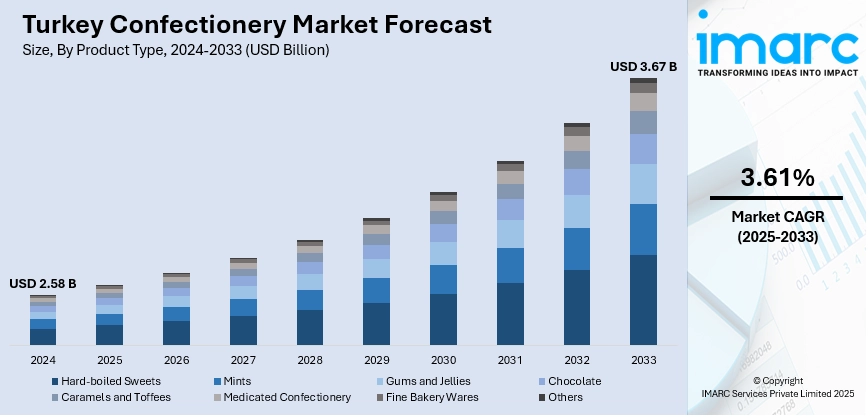

The Turkey confectionery market size reached USD 2.58 Billion in 2024. The market is projected to reach USD 3.67 Billion by 2033, exhibiting a growth rate (CAGR) of 3.61% during 2025-2033. The market is witnessing steady expansion due to rising demand from consumers for better-for-you choices, upscale products, and online retail access. Health-oriented innovations like sugar-free and organic confectionery are popular, with artisanal and luxury chocolates reaching out to elite customers. Moreover, the fast growth of e-commerce portals is expanding market reach and consumer interaction. All these factors combined result in a dynamic and changing confectionery market, boosting the competitive profile of the market players and impacting the Turkey confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.58 Billion |

| Market Forecast in 2033 | USD 3.67 Billion |

| Market Growth Rate 2025-2033 | 3.61% |

Turkey Confectionery Market Trends:

Exponentially Growing Health-Conscious Confectionery Products

The confectionery market in Turkey is experiencing spectacular growth due to improving consumer demand for health-conscious products. As consumer awareness regarding nutrition and wellness increases, consumption of sugar-free, low-calorie, organic, and functional confectionery products has risen exponentially. Producers are innovating by adding natural ingredients, sweetener substitutes, and clean label products in order to cater to changing tastes. The trend follows the worldwide movement toward healthier lifestyles, compelling confectionery companies to create products that balance indulgence with health. The addition of superfoods, vitamins, and probiotics to confectionery is becoming popular, adding nutritional value to old-time favorites. These products find their market among a wide range of consumers, including diabetics, athletes, and parents looking to provide healthier alternatives to kids. The growth of Turkey's confectionery market is increasingly influenced by this consumer interest in health and wellness, driving the industry to change its products and spend on research and development that defends sustainable and health-oriented innovation.

To get more information on this market, Request Sample

Growth of Premium and Artisanal Confectionery Products

Turkey confectionery market trends indicate a strong upsurge in premium and artisanal confectionery product demand. Consumers are increasingly sophisticated and look for distinctive, high-quality items offering outstanding taste and craftsmanship. This has led to the emergence of boutique manufacturers dedicated to small-batch, handcrafted chocolates and confectionaries produced with high-quality ingredients. A focus on authenticity, traditional recipes, and creative taste combinations has won over customers concerned with exclusivity and higher-quality sensory experiences. Heritage-inspired foods and ingredients sourced locally are also on the rise, responding to a wider cultural desire for cultural identity in confectionery. This trend towards premiumization has spurred on luxury packaging and gifting innovation to address festive celebrations and special occasions. The market growth is progressively driven by this move towards quality and exclusivity, which is conducive to higher margins and brand distinction in an aggressive marketplace.

Incorporation of Digital Platforms in Confectionery Retail

Digitalization is becoming the central driver of Turkey confectionery market trends, having a significant impact on how products gain access to consumers. Increased penetration of digital commerce platforms has amplified availability of a diverse range of confectionery items, allowing easy shopping experiences and wider market access. Brands are highly using online channels for selling products, with direct-to-consumer models, subscription services, and product suggestions based on consumer purchase history and preferences. Social media promotion and influencer marketing have emerged as key drivers for reaching youth segments and enhancing brand loyalty. Also, the digital technologies are making supply chains more efficient by streamlining inventory management, demand forecasting, and the gathering of customer feedback. The digital integration not only fuels sales increases but also enables data-driven decision-making to improve product development and marketing strategy. Turkey confectionery market growth is strongly related to the ongoing growth and development in digital retail channels that show the industry's alignment with contemporary consumer behaviors and technology.

Turkey Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

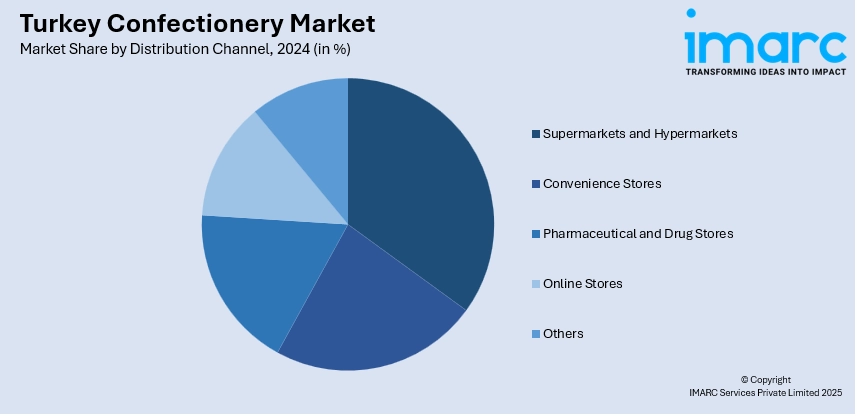

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Confectionery Market News:

- In March 2025, Turkish multinational Ülker brought to the market its "Ülker Go Ahead" range of five high-fiber, no-added-sugar nut and fruit bars. The debut plays into increasing holistic wellness trends, capitalizing on Turkey's cereal and nut bar market growth of 26.7% volume and 108% revenue growth in 2024.

- In January 2025, Dubai chocolate caused a sensation in Türkiye, with consumers falling for its innovative pistachio and shredded phyllo dough pairing. From late 2024, this high-end confection has experienced rocketing demand, leading to mass popularity and long queues at Ankara's shops, evidencing its profound influence on the domestic confectionery market.

Turkey Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey confectionery market on the basis of product type?

- What is the breakup of the Turkey confectionery market on the basis of age group?

- What is the breakup of the Turkey confectionery market on the basis of price point?

- What is the breakup of the Turkey confectionery market on the basis of distribution channel?

- What is the breakup of the Turkey confectionery market on the basis of region?

- What are the various stages in the value chain of the Turkey confectionery market?

- What are the key driving factors and challenges in the Turkey confectionery market?

- What is the structure of the Turkey confectionery market and who are the key players?

- What is the degree of competition in the Turkey confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)