Turkey Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2025-2033

Turkey Cybersecurity Market Overview:

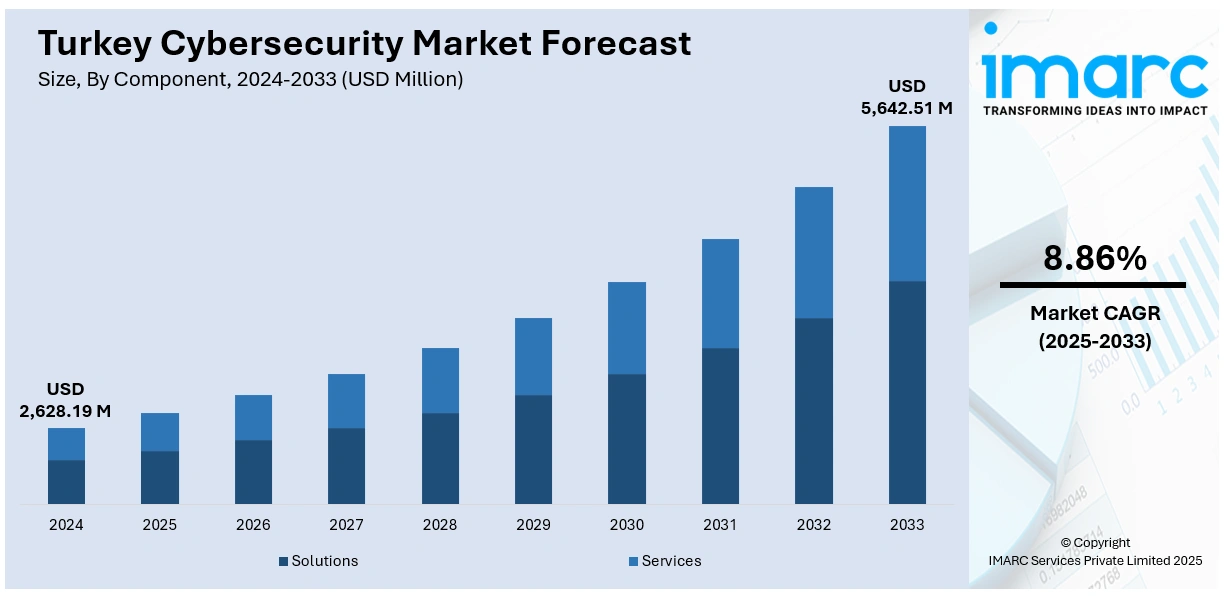

The Turkey cybersecurity market size reached USD 2,628.19 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,642.51 Million by 2033, exhibiting a growth rate (CAGR) of 8.86% during 2025-2033. Regulatory mandates such as the Cybersecurity Law, e-invoice and e-archive requirements, and national SOC deployment are driving demand for cybersecurity solutions. Growing APT threats against critical infrastructure and fintech resilience directives further elevate the Turkey cybersecurity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,628.19 Million |

| Market Forecast in 2033 | USD 5,642.51 Million |

| Market Growth Rate 2025-2033 | 8.86% |

Turkey Cybersecurity Market Trends:

Institutional and Regulatory Imperatives

The adoption of the 2025 Cybersecurity Law, which established a centralized Cybersecurity Authority, has compelled both public agencies and private enterprises in Turkey to prioritize cyber resilience, compliance, and structured risk management. This sweeping regulation imposes both criminal and administrative penalties—ranging from hefty fines to imprisonment—and grants the Cybersecurity Presidency extensive powers including audits, data seizure, and critical infrastructure protection. As digital transformation accelerates in sectors like finance, healthcare, and energy, cyber-risk is increasingly viewed as a board-level concern. Organizations are consequently investing in managed SOCs, threat intelligence platforms, and IAM solutions, driving robust Turkey cybersecurity market growth through reinforced governance frameworks and heightened regulatory accountability.

To get more information on this market, Request Sample

Cloud Security and Hybrid Infrastructure Adoption

Turkey’s rapid migration to cloud platforms and the rise of hybrid IT environments have heightened demand for sophisticated cloud-native security solutions. Organizations are investing in cloud security suites offering encryption, multi-factor authentication, and compliance frameworks tailored to evolving regulatory standards. The growth of fintech and telecom sectors, both subject to stringent oversight, further fuels adoption of advanced cybersecurity infrastructure. For instance, in August 2025, Turkish crypto exchange BTCTurk reported a security breach after $49 Million in cryptocurrency, mainly Ethereum, was siphoned from its hot wallets. Most assets remain secure in cold storage. Blockchain firms flagged the incident before BTCTurk’s public statement. This adds to a growing wave of crypto thefts in 2025, which already exceed $2.1 Billion globally. Integration of AI-driven threat detection and response across hybrid networks has become critical, reinforcing both resilience and compliance. This dynamic support underscores the role of hybrid cloud security in Turkey cybersecurity market growth.

Turkey Cybersecurity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, user type, and industry vertical.

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (identity and access management (IAM), infrastructure security, governance, risk and compliance, unified vulnerability management service offering, data security and privacy service offering, others) and services (professional services, managed services).

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type has also been provided in the report. This includes cloud-based and on-premises.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the user type. This includes large enterprises and small and medium enterprises.

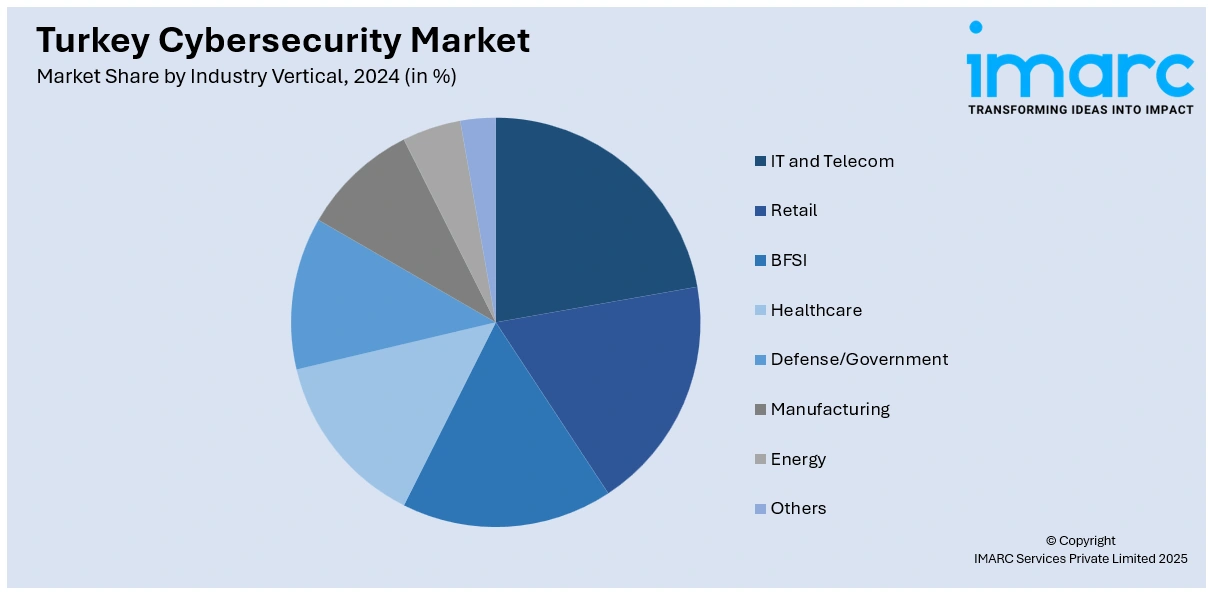

Industry Vertical Insights:

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

A detailed breakup and analysis of the market based on the industry vertical has also been provided in the report. This includes IT and telecom, retail, BFSI, healthcare, defense/government, manufacturing, energy, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Cybersecurity Market News:

- In July 2025, Redington Turkey partnered with Mastercard to enhance cybersecurity across Turkey and the CIS region. Through this collaboration, Redington will distribute Mastercard’s cybersecurity tools, Cyber Quant, RiskRecon, and Threat Protection Suite, helping businesses assess risk, simulate crises, and strengthen digital defenses. The partnership combines Mastercard’s global threat intelligence with Redington’s regional reach, aiming to boost cyber resilience amid growing threats. This marks a strategic step toward safeguarding digital transformation in the region while offering a competitive edge through advanced, data-driven security solutions.

- In August 2024, TERA Group signed an agreement to acquire a 60% majority stake in BARİKAT Group, a leading Turkish cybersecurity firm. The acquisition marks a strategic move to boost BARİKAT’s global competitiveness. TERA’s investment will strengthen corporate structure, support growth strategies, and enhance brand value.

Turkey Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-Based, On-Premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey cybersecurity market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey cybersecurity market on the basis of component?

- What is the breakup of the Turkey cybersecurity market on the basis of deployment type?

- What is the breakup of the Turkey cybersecurity market on the basis of user type?

- What is the breakup of the Turkey cybersecurity market on the basis of industry vertical?

- What is the breakup of the Turkey cybersecurity market on the basis of region?

- What are the various stages in the value chain of the Turkey cybersecurity market?

- What are the key driving factors and challenges in the Turkey cybersecurity market?

- What is the structure of the Turkey cybersecurity market and who are the key players?

- What is the degree of competition in the Turkey cybersecurity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey cybersecurity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey cybersecurity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)