Turkey DevOps Market Size, Share, Trends and Forecast by Type, Deployment Model, Organization Size, Tools, Industry Vertical, and Region, 2025-2033

Turkey DevOps Market Overview:

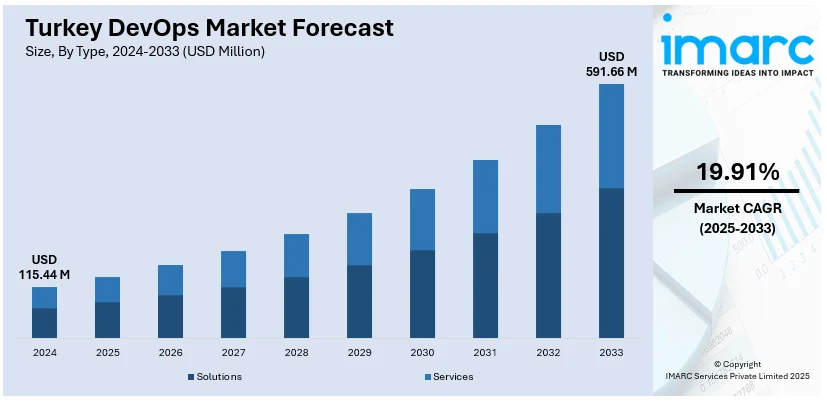

The Turkey DevOps market size reached USD 115.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 591.66 Million by 2033, exhibiting a growth rate (CAGR) of 19.91% during 2025-2033. Rapid digital transformation initiatives, government support such as Vision 2023, growing adoption of cloud and CI/CD practices, rising demand for automation and enhanced security, and enterprise focus on efficient delivery cycles bolster Turkey DevOps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 115.44 Million |

| Market Forecast in 2033 | USD 591.66 Million |

| Market Growth Rate 2025-2033 | 19.91% |

Turkey DevOps Market Trends:

Integration of AI and DevSecOps for Enhanced Automation

A significant trend in the market includes the growing integration of AI, machine learning, and security within DevOps workflows—ushering in DevSecOps. In Turkey, continuous integration tools are incorporating AI capabilities to automate code quality analysis, bug detection, and performance optimization. Meanwhile, DevSecOps practices are embedding security checks into CI/CD pipelines, performing automated vulnerability scanning and compliance enforcement. These advancements enhance delivery speed while elevating reliability and reducing risk. This strategic shift toward proactive automation and security by design is driving Turkey DevOps market growth through more robust and efficient development lifecycles. For instance, in September 2024, GitLab was named a Leader in the Gartner Magic Quadrant for DevOps Platforms, ranking highest for both Ability to Execute and Completeness of Vision. GitLab’s all-in-one DevSecOps platform supports secure, scalable software delivery through features like AI-powered automation, shift-left security, compliance tools, and flexible deployment. The company is advancing with GitLab Duo—its privacy-first AI suite—and GitLab Dedicated for regulated industries. GitLab’s innovation and customer-focused approach continue to shape the future of DevOps and AI-driven software development.

To get more information on this market, Request Sample

Increasing Demand and Specialization in DevOps Talent

Another notable trend is marked by fluctuating yet concentrated hiring dynamics within Turkey’s DevOps job market. Demand for DevOps engineers saw a 58 % increase over the past year, particularly in sectors like e‑commerce, telecommunications, finance, and software development. However, recruitment is highly centralized: Istanbul alone accounts for over 78 % of roles, followed by Ankara and İzmir. The average hiring time spans approximately 34 days. Employers prioritize skills in AWS, Kubernetes, CI/CD tools, and scripting languages, highlighting a premium on both depth and specialization. These patterns reflect a competitive and evolving talent landscape that continues to underpin Turkey DevOps market growth.

Turkey DevOps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, deployment model, organization size, tools, and industry vertical.

Type Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solutions and services.

Deployment Model Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes public cloud, private cloud, and hybrid cloud.

Organization Size Insights:

- Large Enterprises

- Medium-Sized Enterprises

- Small-Sized Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises, medium-sized enterprises, and small-sized enterprises.

Tools Insights:

- Development Tools

- Testing Tools

- Operation Tools

The report has provided a detailed breakup and analysis of the market based on the tools. This includes development tools, testing tools, and operation tools.

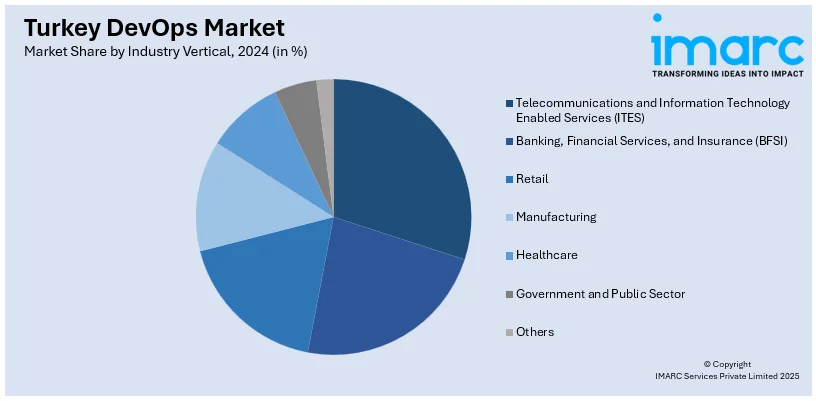

Industry Vertical Insights:

- Telecommunications and Information Technology Enabled Services (ITES)

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare

- Government and Public Sector

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes telecommunications and information technology enabled services (ITES), banking, financial services, and insurance (BFSI), retail, manufacturing, healthcare, government and public sector, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey DevOps Market News:

- In March 2025, Salesforce launched Agentforce 2dx, a next-gen digital labor platform featuring proactive, autonomous AI agents that integrate into any workflow or system. It includes new low-code/pro-code tools, AgentExchange marketplace, and developer tools to rapidly build and deploy AI agents. With real-time analytics, Slack integration, and embedded agents in apps, Agentforce transforms automation by acting without user prompts—accelerating time-to-value and reshaping how businesses deliver customer and employee experiences across industries.

Turkey DevOps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Organization Sizes Covered | Large Enterprises, Medium-Sized Enterprises, Small-Sized Enterprises |

| Tools Covered | Development Tools, Testing Tools, Operation Tools |

| Industry Verticals Covered | Telecommunications and Information Technology Enabled Services (ITES), Banking, Financial Services, and Insurance (BFSI), Retail, Manufacturing, Healthcare, Government and Public Sector, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey DevOps market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey DevOps market on the basis of type?

- What is the breakup of the Turkey DevOps market on the basis of deployment model?

- What is the breakup of the Turkey DevOps market on the basis of organization size?

- What is the breakup of the Turkey DevOps market on the basis of tools?

- What is the breakup of the Turkey DevOps market on the basis of industry vertical?

- What is the breakup of the Turkey DevOps market on the basis of region?

- What are the various stages in the value chain of the Turkey DevOps market?

- What are the key driving factors and challenges in the Turkey DevOps market?

- What is the structure of the Turkey DevOps market and who are the key players?

- What is the degree of competition in the Turkey DevOps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey DevOps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey DevOps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey DevOps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)