Turkey Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industries, and Region, 2026-2034

Turkey Digital Banking Market Summary:

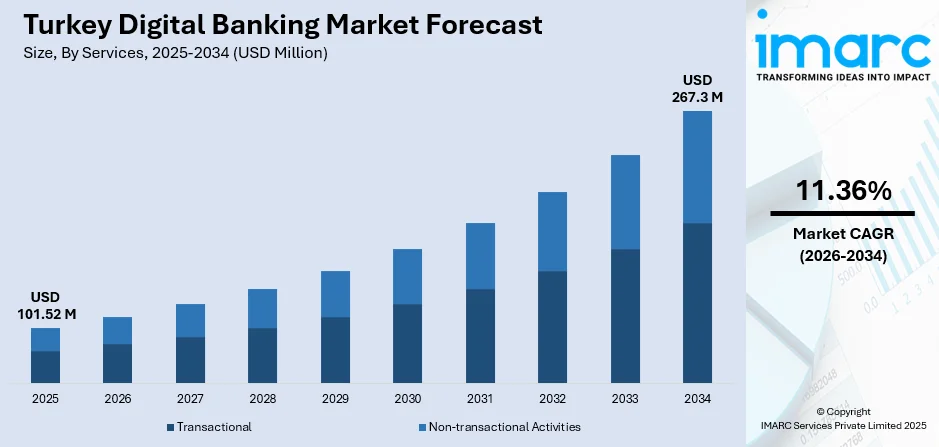

The Turkey digital banking market size was valued at USD 101.52 Million in 2025 and is projected to reach USD 267.3 Million by 2034, growing at a compound annual growth rate of 11.36% from 2026-2034.

The Turkey digital banking sector is enjoying solid momentum as financial institutions speed their digital transformation projects and extend online service offerings. Growing smartphone penetration, rising internet connectivity, and increasing demand for contactless and cashless transactions are reshaping consumer banking preferences. Moreover, the advent of digital-only banks, increasing fintech investments, and supporting regulatory frameworks are strengthening the Turkey digital banking market share.

Key Takeaways and Insights:

- By Services: Transactional services dominate the market with a share of 65% in 2025, reflecting the high volume of fund transfers, deposits, withdrawals, and automated payment processing through digital channels.

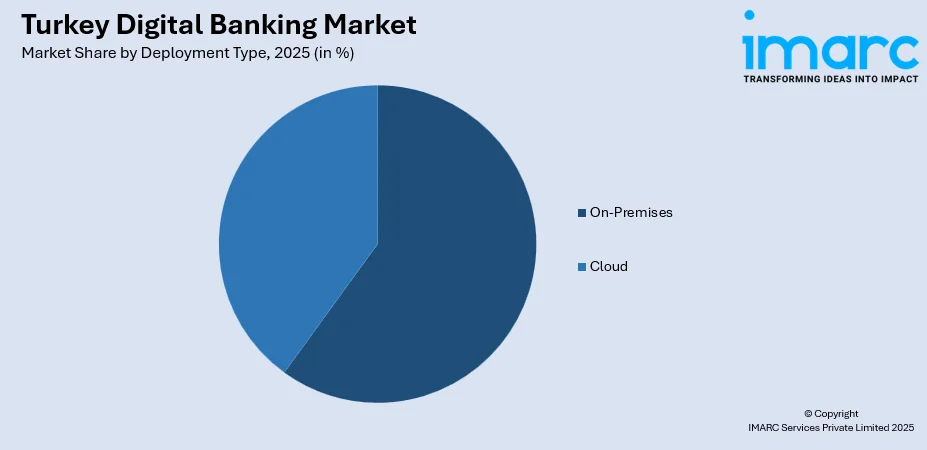

- By Deployment Type: On-premises deployment lead the market with a share of 58% in 2025, as banks prioritize data sovereignty, regulatory compliance, and enhanced security controls.

- By Technology: Internet banking represents the largest segment with a market share of 42% in 2025, driven by established infrastructure and widespread consumer adoption.

- By Industries: The banking industry holds the largest share at 30% in 2025, as traditional financial institutions aggressively expand digital capabilities.

- Key Players: The Turkey digital banking market features intense competition among established traditional banks, emerging neobanks, and innovative fintech companies. Market participants are actively investing in digital transformation, expanding mobile banking capabilities, enhancing payment infrastructure, and forming strategic partnerships to strengthen market positions and capture growing consumer demand for seamless digital financial services.

To get more information on this market Request Sample

The Turkey digital banking market is advancing rapidly as government initiatives, technological innovations, and changing consumer behaviors converge to reshape the financial services landscape. The country has witnessed remarkable growth in active digital banking customers over recent years, demonstrating a significant transformation in how consumers access financial services. The mobile banking segment has demonstrated exceptional growth, with transaction values expanding substantially as consumers increasingly prefer smartphone-based financial management solutions. Turkey's strategic position as a bridge between Europe and Asia, combined with a young, tech-savvy population and robust e-commerce ecosystem, positions the nation as a regional hub for digital banking innovation. Strategic acquisitions and foreign investments in the digital commerce sector are further enhancing payment capabilities and introducing advanced financial features, strengthening the integration between e-commerce platforms and digital banking services across the country.

Turkey Digital Banking Market Trends:

Rising Mobile Banking Adoption Across Demographics

Turkey's mobile banking sector is experiencing unprecedented growth as consumers increasingly prefer smartphone-based financial management solutions. Garanti BBVA Mobil, the bank's mobile banking app, had over 16.5 million active users in 2024, making it one of the most widely used banking apps in Turkey, demonstrating strong adoption across all age groups. This shift is driving the Turkey digital banking market growth as financial institutions invest heavily in mobile application development, user experience optimization, and security enhancements. In 2023, approximately 91 percent of online platform transactions in Turkey were completed on mobile devices, underscoring the mobile-first nature of the Turkish consumer base.

Emergence of Digital-Only Banks

The regulatory framework supporting digital banks has catalyzed the launch of branchless banking institutions in Turkey. The Banking Regulation and Supervision Agency has established comprehensive guidelines and granted digital banking licenses to multiple institutions, creating a structured pathway for neobank operations. These regulatory developments have enabled the emergence of fully digital participation banks and deposit banks that operate exclusively through electronic channels without physical branch networks. The introduction of domestically-owned digital banks marks a significant milestone in Turkey's financial sector evolution, offering comprehensive banking services through mobile applications and internet platforms.

Digital Payment Ecosystem Expansion

Turkey's digital payment infrastructure is undergoing significant transformation as e-commerce platforms, fintech companies, and traditional banks collaborate to create seamless payment experiences. The growing demand for contactless and cashless transactions is driving innovation across the payment value chain. Major platforms have integrated embedded finance solutions, including buy-now-pay-later options, digital wallets, and one-click payment functionalities, driving consumer adoption and enhancing transaction convenience. Strategic acquisitions are consolidating market capabilities and expanding service offerings across merchant networks. In May 2024, iyzico announced the acquisition of Paynet for USD 87 million, strengthening its B2B and B2B2C payment capabilities to serve over 130,000 merchants nationwide.

Market Outlook 2026-2034:

The Turkey digital banking market outlook remains highly positive as continued digital transformation initiatives, expanding fintech ecosystem, and evolving consumer preferences drive sustained growth. Government programs including the Digital Turkey Roadmap and the Digital Turkish Lira Project are expected to further accelerate innovation and financial inclusion. The market generated a revenue of USD 101.52 Million in 2025 and is projected to reach a revenue of USD 267.3 Million by 2034, growing at a compound annual growth rate of 11.36% from 2026-2034.

Turkey Digital Banking Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Services | Transactional | 65% |

| Deployment Type | On-Premises | 58% |

| Technology | Internet Banking | 42% |

| Industries | Banking | 30% |

Services Insights:

- Transactional

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

- Non-transactional Activities

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

Transactional services dominate the Turkey digital banking market with a 65% share of total revenue in 2025.

Transactional digital banking services form the backbone of Turkey's digital financial ecosystem, encompassing fund transfers, cash management, automated payments, and loan disbursements. The growing preference for instant payment solutions, combined with the expansion of ATM networks, continues to fuel transactional volume growth. Turkish consumers increasingly rely on digital channels for bill payments, peer-to-peer transfers, and salary deposits, driving sustained demand for transactional services. The segment's growth is further supported by open banking initiatives that enable third-party providers to access customer data for personalized payment solutions.

Deployment Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- On-Premises

- Cloud

On-premises deployment leads the Turkey digital banking market with a 58% share in 2025.

On-premises deployment remains the preferred infrastructure model for Turkish banks seeking to maintain direct control over sensitive financial data and ensure compliance with stringent regulatory requirements. The Banking Regulation and Supervision Agency (BRSA) mandates comprehensive data security protocols, prompting many institutions to keep core banking systems within their own data centers. This approach provides enhanced customization capabilities, reduced latency for critical transactions, and greater control over system updates and maintenance schedules.

Technology Insights:

- Internet Banking

- Digital Payments

- Mobile Banking

Internet banking holds the largest share at 42% of the Turkey digital banking market in 2025.

Internet banking continues to serve as a foundational technology platform for digital financial services in Turkey, providing comprehensive access to account management, bill payments, investment services, and loan applications through web-based interfaces. The segment benefits from established infrastructure, widespread consumer familiarity, and the ability to handle complex transactions that may require larger screen interfaces. Turkish banks have invested significantly in enhancing internet banking security through multi-factor authentication, biometric verification, and real-time fraud detection systems. While mobile banking is experiencing faster growth rates, internet banking maintains its dominant position for business banking applications, complex investment transactions, and detailed account analysis.

Industries Insights:

- Media and Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

The banking industry accounts for the highest revenue share at 30% of the Turkey digital banking market in 2025.

The banking sector serves as the primary driver and largest consumer of digital banking solutions in Turkey, as financial institutions invest heavily in digital transformation to remain competitive and meet evolving customer expectations. Traditional banks are rapidly enhancing their digital capabilities, with customers no longer using physical branches for routine transactions. This shift has prompted established financial institutions to develop sophisticated mobile applications, upgrade internet banking platforms, and integrate advanced security features. The sector has also witnessed the emergence of numerous licensed payment and electronic money institutions, creating a dynamic competitive landscape that accelerates innovation.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara region dominates Turkey's digital banking landscape, anchored by Istanbul as the nation's economic and financial hub. The region hosts numerous fintech startups, established banking headquarters, and technology companies, benefiting from superior digital infrastructure, high internet connectivity, and a concentration of tech talent.

Central Anatolia, led by the capital Ankara, benefits significantly from government initiatives promoting digital banking adoption and financial technology development. The region's administrative importance and growing technology sector create favorable conditions for digital banking expansion and regulatory-driven innovation across financial services.

The Mediterranean region demonstrates strong digital banking growth driven by its thriving tourism industry and expanding commercial activities. Coastal cities are witnessing increased adoption of digital payment solutions among businesses catering to international visitors, while retail and hospitality sectors embrace cashless transaction capabilities.

The Aegean region shows robust digital banking adoption supported by its diverse economic base encompassing tourism, agriculture, and manufacturing sectors. The region's commercial centers are increasingly integrating digital financial services, with businesses and consumers embracing mobile banking and electronic payment solutions for everyday transactions.

Southeastern Anatolia presents significant growth opportunities as infrastructure investments and financial inclusion programs address connectivity gaps. Government subsidies and development initiatives are gradually improving digital access, enabling small and medium enterprises to adopt digital banking solutions and participate in the broader digital economy.

The Black Sea region is experiencing gradual digital banking expansion as improved telecommunications infrastructure extends connectivity to previously underserved areas. Agricultural and trading businesses are increasingly adopting digital payment solutions, while financial institutions work to enhance service accessibility across the region's diverse geography.

Eastern Anatolia represents an emerging frontier for digital banking expansion, with ongoing infrastructure investments aimed at bridging the urban-rural digital divide. Financial inclusion initiatives and government programs are working to extend digital banking accessibility, enabling underserved populations.

Market Dynamics:

Growth Drivers:

Why is the Turkey Digital Banking Market Growing?

Surging Smartphone Penetration and Internet Connectivity

Turkey's rapidly expanding digital infrastructure is creating fertile ground for digital banking adoption. The country recorded 80.7 Million active cellular mobile connections in early 2025 according to GSMA Intelligence. This widespread mobile connectivity provides financial institutions with a substantial addressable market for mobile banking applications and digital financial services. The government's continued investment in broadband infrastructure, including planned fiber roll-outs, is enhancing network speeds and extending connectivity to rural areas. These infrastructure improvements are reducing the digital divide and enabling underserved populations to access digital banking services.

Progressive Regulatory Framework and Government Support

Turkey's regulatory environment has evolved to actively support digital banking innovation while maintaining financial system stability. The Central Bank of Turkey (CBRT) has advanced the Digital Turkish Lira Project, issuing a call for participation in September 2025 to explore tokenization, programmable payments, and interoperability solutions. The 2025 Presidential Annual Program includes strategic measures to establish the Istanbul Finance and Technology Base, support domestic fintech solutions, and create regulatory sandbox environments for innovation. These initiatives are reducing barriers to entry and encouraging both domestic and foreign investment in Turkey's digital banking sector.

Robust Fintech Investment and E-Commerce Integration

Turkey's fintech ecosystem has attracted record investment levels, with funding reaching USD 201.3 Million in 2025. The country hosts 901 fintech companies as of end-2024, with 731 actively operating across payment solutions, blockchain, and digital lending segments. Strategic acquisitions are consolidating market capabilities, exemplified by iyzico's USD 87 million acquisition of Paynet in February 2025, which expanded B2B payment solutions. Payment integration partnerships between e-commerce giants and fintech companies are driving digital banking adoption among merchants and consumers alike.

Market Restraints:

What Challenges the Turkey Digital Banking Market is Facing?

Cybersecurity Threats and Data Protection Concerns

The expansion of digital banking services has correspondingly increased exposure to cyber threats and data security risks. Digital banks must implement robust cybersecurity measures, encryption protocols, and comply with data protection regulations including the Turkish Data Protection Law. The reliance on third-party vendors for critical services introduces additional risks related to service reliability and data security.

Regulatory Compliance Complexity

Turkey's digital banking sector faces stringent and evolving regulatory requirements that create operational challenges and increase costs. Financial institutions must navigate multiple regulatory frameworks encompassing anti-money laundering, know-your-customer verification, and consumer protection mandates. Recent updates to identity verification processes have added complexity to customer onboarding procedures and increased operational burdens.

Digital Divide Between Urban and Rural Areas

Significant disparities exist in digital banking accessibility between Turkey's major urban centers and rural regions. Eastern and Southeastern Anatolia lag in internet penetration and digital infrastructure, limiting financial inclusion efforts. Small and medium enterprises in less developed regions cite connectivity and data security concerns as barriers to digital banking adoption.

Competitive Landscape:

The Turkey digital banking market is characterized by intense competition among established traditional banks, emerging neobanks, and innovative fintech companies. Major banking groups are investing heavily in digital transformation to defend market positions. Digital-only entrants are disrupting traditional models with fee-free services and superior mobile experiences. Strategic acquisitions and partnerships are reshaping the competitive landscape, exemplified by foreign. Companies are differentiating through AI-powered personalization, blockchain applications, and embedded finance solutions to capture growing consumer demand for seamless digital banking experiences.

Recent Developments:

- In January 2025, Kaspi.kz finalized a 65.41 percent stake acquisition in Hepsiburada for USD 1.127 billion, bringing integrated payments and buy-now-pay-later capabilities to one of Turkey's largest e-commerce platforms. The transaction represents significant foreign investment in Turkey's digital commerce and fintech ecosystem, enhancing payment innovation across the platform's extensive merchant network.

Turkey Digital Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Deployment types Covered | On-Premises, Cloud |

| Technologies Covered | Internet Banking, Digital Payments, Mobile Banking |

| Industries Covered | Media and Entertainment, Manufacturing, Retail, Banking, Healthcare |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey digital banking market size was valued at USD 101.52 Million in 2025.

The Turkey digital banking market is expected to grow at a compound annual growth rate of 11.36% from 2026-2034 to reach USD 267.3 Million by 2034.

Transactional services, holding the largest revenue share of 65%, remain pivotal for Turkey's digital banking sector, encompassing fund transfers, deposits, withdrawals, automated payments, and loan disbursements through digital channels.

Key factors driving the Turkey digital banking market include surging smartphone penetration and internet connectivity, progressive regulatory frameworks supporting digital innovation, robust fintech investment, expanding e-commerce integration, and growing consumer preference for contactless transactions.

Major challenges include escalating cybersecurity threats and data protection concerns, regulatory compliance complexity across multiple frameworks, the urban-rural digital divide limiting financial inclusion in less developed regions, and evolving KYC/KYB requirements increasing operational costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)