Turkey Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry and Region, 2025-2033

Turkey Drones Market Overview:

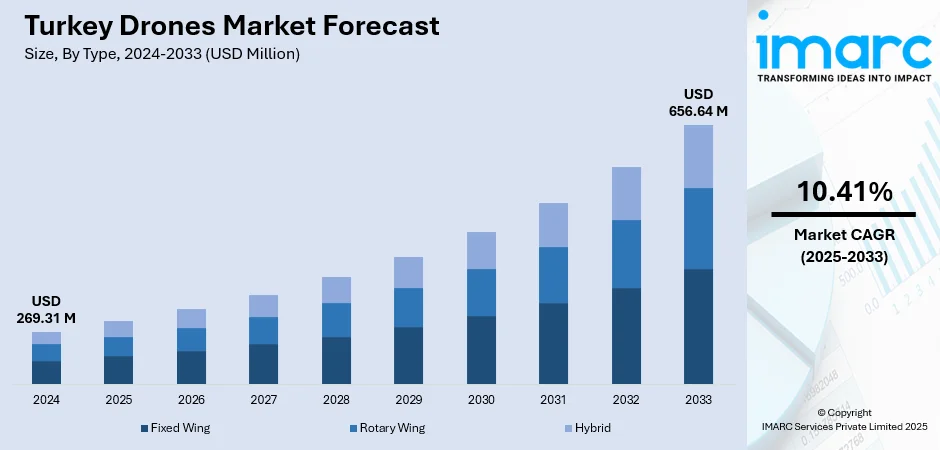

The Turkey drones market size reached USD 269.31 Million in 2024. Looking forward, the market is expected to reach USD 656.64 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market is propelled by government support, expanding defense requirements, and a strategic drive for local technological progress. Escalating geopolitical tensions have spurred local drone manufacturing, while effective warfighting missions have raised global demand. Turkey's emphasis on export-led growth, along with encouraging bilateral defense pacts, also enhances global demand, further impacting the overall Turkey drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 269.31 Million |

| Market Forecast in 2033 | USD 656.64 Million |

| Market Growth Rate 2025-2033 | 10.41% |

Turkey Drones Market Trends:

Domestic Innovation and Self‑Sufficiency Driving Growth

Turkey's drone sector has made a revolutionary transition from being an importer to emerging as an innovator, led by companies such as Baykar and Turkish Aerospace (TAI). Once dependent on foreign systems, Ankara has been focusing on full domestic development, particularly following Western component bans that prompted a switch towards local engines, avionics, and optical payloads. The development of onshore engine manufacturing is also transforming Turkey's supply chain. The approach provides operational sovereignty, accelerated development cycles, and cost containment. Besides, a rich network of over 2,000 SMEs spread across Turkey backs Baykar and TAI, combining research and development with local subcontracting needs that promote the engagement of local companies. Pioneering young engineers under the age of 35 are driving these advancements with a culture of innovation and flexibility. The payoff is a sophisticated ecosystem that can produce various types of drones, from tactical TB2s and naval TB3s to stealth Kızılelma fighter jets, allowing Turkey to circumvent export controls and reaffirm self-sufficiency in defense.

To get more information on this market, Request Sample

Strategic Exports, Diplomacy and Regional Influence

Turkish drones have become instruments of trade as well as diplomacy, recasting geopolitical alignments across Africa, the Middle East, Europe, and Asia. Ankara's drone sales to states like Qatar, Ukraine, Libya, and other African countries have been supported by aggressive financing terms and technology transfer contracts. The trend is to set up production lines in partner nations, including Saudi Arabia for Akıncı drones and Ukraine for TB2 and TB3 models, to allow localized assembly under Turkish oversight. Turkey's exports are acclaimed for being affordable, simple to use, and featuring extensive training programs that frequently involve on-site deployment of staff for longer terms. Such a model allows the recipient countries to operate and sustain systems themselves, enhancing long-term interoperability. Turkish drone diplomacy is a key component of its foreign policy arsenal, allowing Ankara to extend bilateral relations, enhance defense partnership, and bolster its footprint in areas where traditional Western vendors are restricted or more expensive, which further supports the Turkey drones market growth as well.

Naval Integration and Sophisticated System Programs

Turkey is leading the integration of drones into naval operations via platforms like the amphibious assault ship TCG Anadolu, which will be able to accommodate naval UAVs. The Bayraktar TB3 has already made major flight maneuvers from its short flight deck, a world first for fixed-wing drones flying off a small amphibious ship. Such naval employment facilitates Turkey's strategic "Blue Homeland" vision, improving surveillance and strike coverage of its maritime domain. In the meantime, continued next-generation system development such as stealth flying-wing Anka-3 and AI-supported loitering munitions family Kemankeş demonstrates Turkey's desire to expand UAV capabilities throughout air dominance, electronic warfare, and autonomous coordination. Modernization programs for the military focus on network-centric warfare, UAV-artillery synchronization, and integration with unmanned ground vehicles. These stacked developments prove Turkey's aggressive master plan to move beyond basic drone platforms to integrated, multi‑domain systems that extend power across land, sea, and air.

Turkey Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

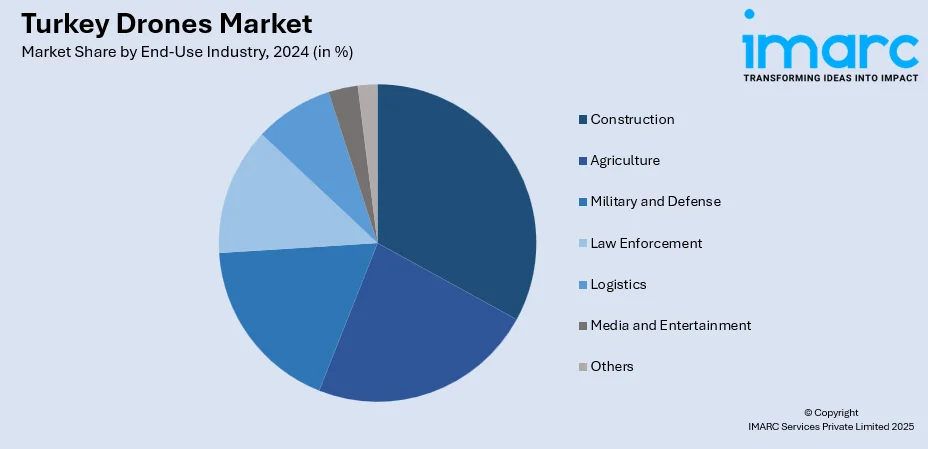

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which includes Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Drones Market News:

- In March 2025, Turkey’s UAV leader Baykar unveiled an agreement with Italy’s Leonardo to secure a share of Europe’s $100 Billion (USD 108 Billion) drone industry and potentially propose a Turkish drone as a contender for the GCAP fighter’s ‘Loyal Wingman.’ The planned 50-50 joint venture aims to assemble drones in Turkey with Baykar platforms and Leonardo electronics and radars, as well as at Leonardo's facilities in Italy, which will facilitate certification for sales in a European market expected to reach $100 Billion over the next decade, the companies stated.

- In July 2025, Turkey and Pakistan are reorganizing a USD 900 Million drone agreement to explore more sophisticated UAV systems aimed at enhancing precision-strike and surveillance abilities after operational shortcomings against India during Operation Sindoor. This updated agreement aims to enhance the drone and munitions capabilities of both nations through advanced technologies. The updated agreement is anticipated to rectify earlier deficiencies and improve military efficiency.

Turkey Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey drones market on the basis of type?

- What is the breakup of the Turkey drones market on the basis of component?

- What is the breakup of the Turkey drones market on the basis of payload?

- What is the breakup of the Turkey drones market on the basis of point of sale?

- What is the breakup of the Turkey drones market on the basis of end-use industry?

- What is the breakup of the Turkey drones market on the basis of region?

- What are the various stages in the value chain of the Turkey drones market?

- What are the key driving factors and challenges in the Turkey drones market?

- What is the structure of the Turkey drones market and who are the key players?

- What is the degree of competition in the Turkey drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)