Turkey Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Turkey Duty-Free and Travel Retail Market Overview:

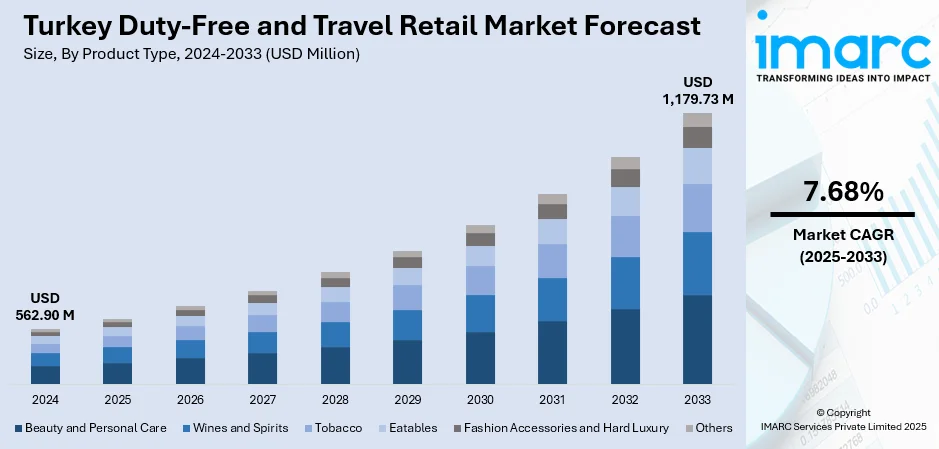

The Turkey duty-free and travel retail market size reached USD 562.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,179.73 Million by 2033, exhibiting a growth rate (CAGR) of 7.68% during 2025-2033. Rising tourist arrivals, new airport infrastructure, expanded airline connectivity, and increasing disposable income are some of the factors contributing to the Turkey duty-free and travel retail market share. Strategic locations like Istanbul Airport and strong partnerships with global brands further support category expansion in beauty, fashion, alcohol, and confectionery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 562.90 Million |

| Market Forecast in 2033 | USD 1,179.73 Million |

| Market Growth Rate 2025-2033 | 7.68% |

Turkey Duty-Free and Travel Retail Market Trends:

Expansion of Locally-Driven Retail in Emerging Hubs

Increased focus on regional airports with growing passenger volumes is creating new opportunities for retail operators to establish a foothold in previously untapped locations. As new international gateways open, there’s a visible move toward offering product ranges that reflect local culture and preferences. This approach not only enhances the traveler experience but also supports tourism and commerce. Mid-sized airports with high growth potential are becoming viable entry points for global operators aiming to diversify geographically. A focus on terminals with both domestic and international reach ensures a broad customer base, while culturally tailored assortments help drive engagement. These developments indicate that retail formats tied closely to regional identity are gaining importance in markets with rising connectivity and visitor flows. These factors are intensifying the Turkey duty-free and travel retail market growth. For example, in October 2024, Avolta AG secured its first duty-free contract in Turkey at the newly opened Çukurova International Airport in Mersin. The company would operate 1,000 m² of retail space in the Departures and Arrivals areas, offering a locally inspired product mix. The airport, with a capacity of 9 Million passengers, aims to boost regional tourism and connectivity across domestic and international routes.

To get more information on this market, Request Sample

Shift toward Large-Scale, Locally-Rooted Retail Operations

Operators with a strong regional footprint are expanding their presence by securing contracts at high-traffic airports. There’s a noticeable move toward large-format retail spaces that combine global brand offerings with concepts rooted in local culture and design. Experience in multi-location management is becoming a key factor in winning new contracts, especially in competitive locations. Retail zones now go beyond traditional duty-free, incorporating curated luxury zones and locally themed areas to attract a wider customer mix. This approach blends commercial scale with regional character, catering to diverse traveler expectations. The growing preference for operators that can deliver both operational expertise and cultural relevance highlights a changing landscape in airport retail across well-established travel hubs. For instance, in September 2024, ATÜ Duty Free took over the duty-free operations at Antalya Airport, replacing Avolta-owned Dufry. This marks ATÜ’s fifth airport in Turkey. The retailer will manage 12,000 m² of space, featuring core duty-free, Luxury Square, and the Old Bazaar concept. ATÜ plans to apply its experience from 21 airports and one cruise port across seven countries to the new location.

Turkey Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

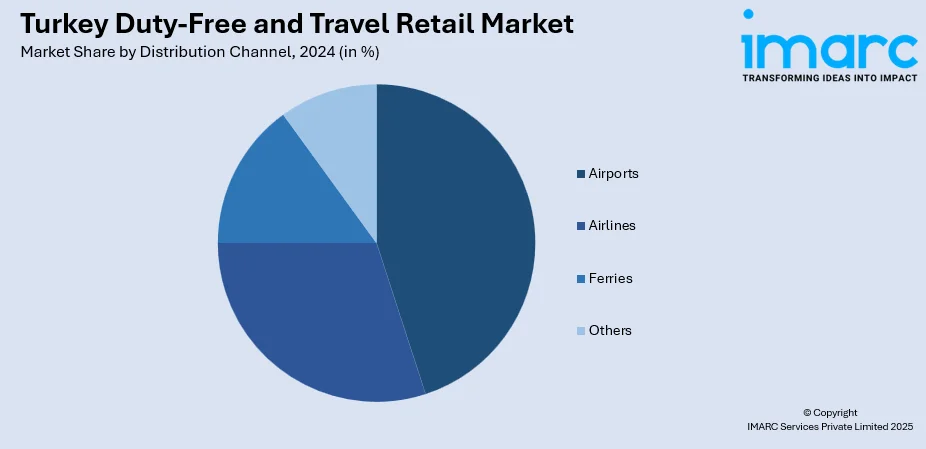

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Duty-Free and Travel Retail Market News:

- In January 2025, Mazaya strengthened its presence in Turkey by expanding listings beyond Istanbul Airport to Sabiha Gökçen and Antalya Airports. This move follows a strong 2024 performance driven by wider geographic reach and new product launches. The company aims to grow further in 2025, with Turkey and North Africa as strategic focus areas, despite ongoing tobacco-related regulatory hurdles affecting profitability and growth.

Turkey Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey duty-free and travel retail market on the basis of product type?

- What is the breakup of the Turkey duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Turkey duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Turkey duty-free and travel retail market?

- What are the key driving factors and challenges in the Turkey duty-free and travel retail market?

- What is the structure of the Turkey duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Turkey duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)