Turkey E-commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Region, 2026-2034

Turkey E-commerce Market Summary:

The Turkey e-commerce market size was valued at USD 294.30 Billion in 2025 and is projected to reach USD 2,065.49 Billion by 2034, growing at a compound annual growth rate of 24.17% from 2026-2034.

The Turkey e-commerce market is experiencing robust expansion driven by increasing internet penetration and widespread smartphone adoption among the country's young population. Digital transformation initiatives, evolving consumer preferences toward online shopping, and significant infrastructure investments in logistics and payment systems are reshaping the retail landscape. The market benefits from growing social commerce integration, quick commerce adoption, and expanding cross-border trade opportunities across European and Middle Eastern markets.

Key Takeaways and Insights:

-

By Type: Groceries dominate the market with a share of 23.04% in 2025, owing to the rapid expansion of quick commerce services offering ultra-fast delivery of everyday essentials. Growing consumer demand for convenient online grocery shopping and increased mobile app usage for food purchases are driving this segment's leading position.

-

By Transaction: Business-to-Business leads the market with a share of 78.02% in 2025. This dominance is driven by widespread digital procurement adoption among enterprises, government e-export incentives supporting cross-border trade, and the growing integration of supply chain management platforms connecting manufacturers with retailers.

-

By Region: Marmara is the largest region with 28.02% share in 2025, driven by the concentration of major urban centers including Istanbul, superior digital infrastructure with dense fiber networks, established logistics hubs, and the presence of major e-commerce platform headquarters.

-

Key Players: Key players drive the Turkey e-commerce market by expanding marketplace capabilities, enhancing last-mile delivery networks, and developing integrated payment solutions. Their investments in quick commerce infrastructure, cross-border trade platforms, and mobile-first shopping experiences accelerate digital adoption and strengthen competitive positioning across diverse consumer and business segments.

The Turkey e-commerce market demonstrates remarkable dynamism, fueled by the country's strategic position bridging European and Asian markets. Widespread mobile device penetration enables seamless online shopping experiences, while evolving payment ecosystems featuring domestic card networks and digital wallets enhance transaction convenience. Government initiatives promoting digital transformation and e-export opportunities create favorable conditions for market expansion. The young, tech-savvy population increasingly embraces online retail for convenience, variety, and competitive pricing. Quick commerce platforms revolutionize grocery and essentials delivery with ultra-fast fulfillment capabilities. Social commerce integration through popular platforms enables direct consumer engagement and influences purchasing decisions. In 2024, Turkish e-commerce processed approximately 5.91 Billion transactions, reflecting the sector's scale and consumer adoption. Cross-border e-commerce growth positions Turkey as an emerging hub connecting diverse regional markets, while continued logistics infrastructure investments narrow urban-rural service gaps.

Turkey E-commerce Market Trends:

Rising Mobile-First Commerce Adoption

Mobile commerce continues to reshape the Turkish e-commerce landscape as consumers increasingly prefer shopping through smartphones and dedicated retail applications. The proliferation of mobile-optimized websites and feature-rich shopping apps enhances user experiences with personalized recommendations, streamlined checkout processes, and intuitive navigation interfaces. Retailers are investing heavily in mobile payment integration and app-based loyalty programs to capture the growing segment of on-the-go shoppers seeking convenience and accessibility in their purchasing journeys. Push notifications enable targeted promotional campaigns that drive engagement and repeat transactions.

Quick Commerce and Ultra-Fast Delivery Expansion

Quick commerce platforms are transforming consumer expectations for delivery speed, with dark store networks enabling rapid fulfillment of grocery and everyday essentials across densely populated urban areas. The demand for sub-hour delivery services continues accelerating across major metropolitan centers, driving substantial investments in micro-fulfillment infrastructure and last-mile logistics optimization. This trend reflects evolving lifestyle preferences where time-pressed consumers prioritize immediate gratification and seamless ordering experiences through dedicated mobile applications, fundamentally changing traditional retail purchasing patterns and convenience expectations.

Social Commerce Integration and Influencer Marketing Growth

Social media platforms increasingly serve as discovery and purchasing channels, blurring boundaries between content consumption and online shopping experiences. Brands leverage influencer partnerships and user-generated content to build authentic connections with younger demographics seeking culturally resonant products and trusted recommendations. Live streaming commerce gains significant traction as interactive formats enable real-time product demonstrations and direct audience engagement, while seamless social platform integrations facilitate smooth transitions from inspiration to purchase completion, creating unified shopping journeys.

Market Outlook 2026-2034:

The Turkey e-commerce market outlook remains highly promising as digital transformation accelerates across retail sectors and consumer adoption deepens. Infrastructure investments in logistics networks, payment systems, and broadband connectivity will continue narrowing service gaps between urban centers and developing regions. The market generated a revenue of USD 294.30 Billion in 2025 and is projected to reach a revenue of USD 2,065.49 Billion by 2034, growing at a compound annual growth rate of 24.17% from 2026-2034. Cross-border e-commerce opportunities will expand as domestic platforms strengthen international logistics capabilities and leverage Turkey's strategic geographic position. The continued evolution of digital payment solutions, including domestic card networks and mobile wallets, will enhance transaction convenience and security.

Turkey E-commerce Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Groceries | 23.04% |

| Transaction | Business-to-Business | 78.02% |

| Region | Marmara | 28.02% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

Groceries dominate with a market share of 23.04% of the total Turkey e-commerce market in 2025.

The groceries segment has emerged as the leading product category in Turkey's e-commerce landscape, driven by the explosive growth of quick commerce platforms offering ultra-fast delivery of everyday essentials. Consumer preferences have shifted decisively toward online grocery shopping, attracted by unparalleled convenience, competitive pricing structures, and extensive product assortments spanning fresh produce, pantry staples, and specialty items. Dark store networks strategically positioned across major urban centers enable remarkably rapid delivery fulfillment, fundamentally transforming traditional purchasing patterns and consumer expectations. The proliferation of dedicated grocery delivery applications has created seamless ordering experiences that rival the immediacy of traditional retail while offering superior product variety and home delivery convenience.

The segment benefits substantially from strategic partnerships between e-commerce platforms and local farmers, which compress sourcing lead times and ensure exceptional product freshness that builds consumer confidence. Mobile applications have become the primary ordering channel, featuring intuitive interfaces, personalized product recommendations, and streamlined checkout processes that enhance user experiences. Subscription models for recurring grocery purchases gain significant traction among busy urban households seeking automated replenishment solutions. The integration of flexible digital payment solutions and installment options addresses affordability concerns effectively, while comprehensive loyalty programs encourage repeat purchases and deepen customer relationships across diverse demographic segments throughout the country.

Transaction Insights:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

Business-to-Business leads with a share of 78.02% of the total Turkey e-commerce market in 2025.

The business-to-business segment commands the largest share of Turkey's e-commerce market, reflecting the widespread digital transformation of procurement processes across enterprises of varying scales and industries. Digital trade portals have become essential gateways connecting manufacturers, wholesalers, and retailers through streamlined ordering systems and sophisticated supply chain management platforms that enhance operational efficiency. Enterprise resource planning integrations with national electronic invoice channels substantially reduce administrative overhead while enhancing operational transparency and compliance capabilities for businesses of all sizes. The adoption of digital procurement tools accelerates as organizations recognize the competitive advantages offered by automated purchasing workflows and centralized supplier management systems.

The segment's commanding dominance stems from Turkey's strategic geographic position bridging European and Asian markets, enabling cost-effective cross-border commerce opportunities that attract international trading partners. Digital procurement platforms significantly reduce sales-cycle lengths while providing valuable data visibility regarding demand patterns, inventory optimization, and seasonal purchasing trends. Small and medium enterprises increasingly view online B2B marketplaces as essential channels for reaching international buyers and expanding their market presence beyond traditional geographic limitations. Subsidized technology upgrade programs offered through government development agencies help bridge regional digital adoption gaps, enabling businesses in developing areas to participate actively in the growing digital trade ecosystem.

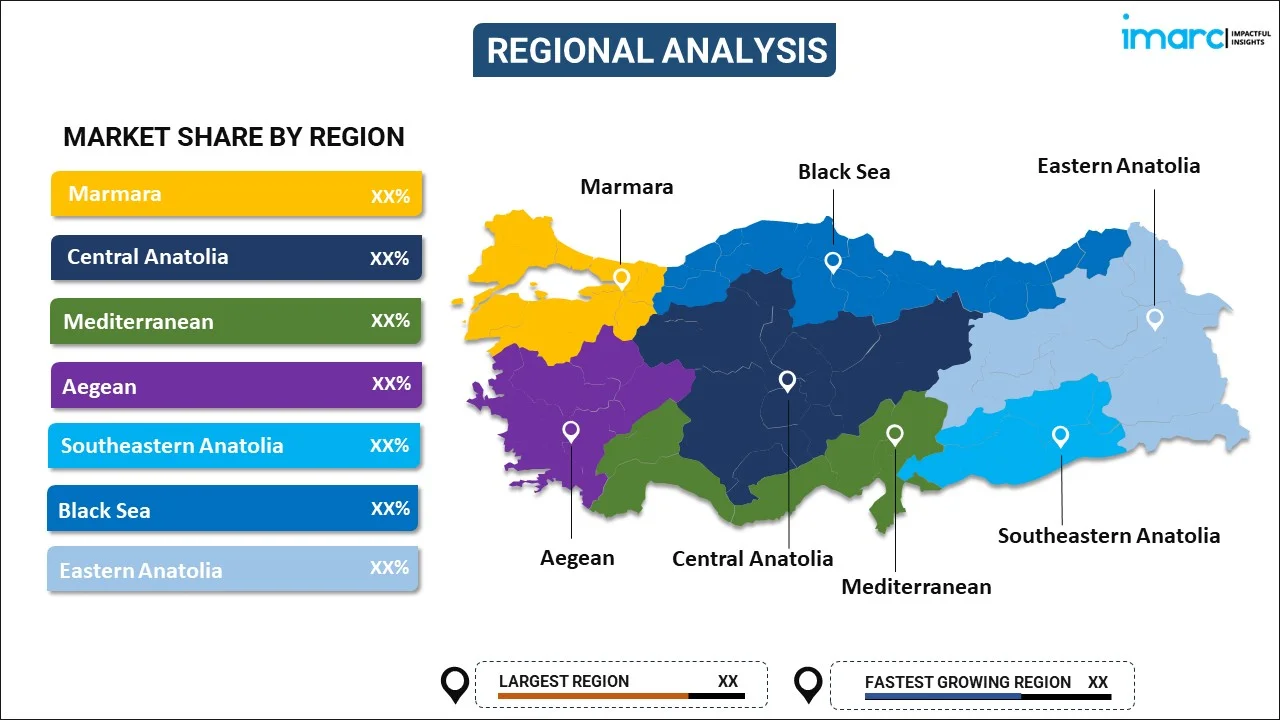

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

Marmara exhibits a clear dominance with a 28.02% share of the total Turkey e-commerce market in 2025.

The Marmara region leads Turkey's e-commerce market, anchored by Istanbul's commanding position as the country's preeminent commercial and digital hub attracting technology investments and entrepreneurial talent. The region benefits from superior infrastructure including dense fiber optic networks, established port access facilities supporting international trade, and comprehensive same-day courier networks enabling rapid order fulfillment across densely populated urban corridors. Major e-commerce platform headquarters concentrate in this region, creating a vibrant ecosystem of technology talent, innovation clusters, and supporting service providers that drive continuous market advancement. The concentration of venture capital resources and technology incubators fosters startup development and accelerates digital commerce innovation.

The region's dominance extends comprehensively across both consumer and business segments, with the highest concentration of active online shoppers and registered e-commerce merchants in the country. Advanced logistics infrastructure enables quick commerce platforms to offer ultra-fast delivery services that establish benchmarks for the broader national market and influence consumer expectations. Cross-border commerce nodes effectively leverage Turkey's unique tri-continental geographic location, with expanding data center capacity enhancing connectivity to European consumers and facilitating international transaction processing. The concentration of financial services institutions, technology companies, universities producing skilled graduates, and experienced workforce creates exceptionally favorable conditions for continued e-commerce innovation and sustained market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Turkey E-commerce Market Growing?

Widespread Smartphone Penetration and Mobile-First Consumer Behavior

Turkey's e-commerce market expansion is fundamentally driven by the pervasive adoption of smartphones among its predominantly young population. Mobile devices have become the primary gateway to online shopping, with consumers increasingly comfortable making purchases through dedicated retail applications and mobile-optimized websites. The convenience of anytime-anywhere shopping resonates strongly with urban professionals and younger demographics seeking seamless purchasing experiences. Retailers respond by investing heavily in mobile application development, incorporating intuitive interfaces, personalized product recommendations, and streamlined checkout processes. Push notification capabilities enable targeted marketing that drives engagement and repeat purchases. The integration of mobile payment solutions including digital wallets and contactless transactions further reduces friction in the purchasing journey. Social commerce features within popular mobile applications blur boundaries between content consumption and shopping, creating new pathways to purchase. This mobile-centric ecosystem continues maturing as network infrastructure improvements enhance connectivity speeds and reliability across urban and increasingly rural areas.

Government Digital Transformation Initiatives and E-Export Incentives

Proactive government policies supporting digital economy development create favorable conditions for e-commerce market expansion in Turkey. Strategic initiatives focused on improving digital infrastructure, promoting technological adoption among businesses, and facilitating cross-border trade provide essential catalysts for growth. E-export support programs offer financial incentives that enable small and medium enterprises to compete effectively in international digital marketplaces. Regulatory frameworks establishing standards for consumer protection, data security, and electronic transactions build confidence among both buyers and sellers. The national payment network strengthens domestic financial infrastructure while reducing dependence on international payment systems. Investment in broadband connectivity and fiber network expansion progressively narrows the digital divide between developed urban centers and emerging regional markets. Subsidy programs administered through development agencies offset technology upgrade costs for businesses in underserved areas, democratizing access to digital commerce opportunities. These coordinated policy interventions establish Turkey as an emerging hub for regional digital trade connecting European, Middle Eastern, and Central Asian markets.

Evolving Payment Ecosystem and Financial Technology Innovation

The rapid evolution of Turkey's digital payment landscape directly enables e-commerce market growth by addressing consumer demands for convenience, security, and flexibility. Domestic card networks expand acceptance while digital wallet platforms attract millions of users seeking simplified transaction experiences. Buy-now-pay-later solutions address affordability concerns, particularly important during periods of economic pressure, enabling consumers to manage cash flow while maintaining purchasing activity. Fintech startups introduce innovative payment products that compete with traditional banking services, driving improvements across the ecosystem. Installment payment options remain deeply ingrained in Turkish consumer culture, with e-commerce platforms seamlessly integrating credit facilities into checkout processes. Mobile payment adoption accelerates as consumers embrace contactless transactions for both online and in-store purchases. The emergence of instant payment systems enables real-time fund transfers that benefit both consumers and merchants. These payment innovations collectively reduce barriers to online commerce participation while building trust in digital transaction security among previously hesitant consumer segments.

Market Restraints:

Inflationary Pressures on Consumer Purchasing Power

Persistent inflation erodes consumer purchasing power and creates uncertainty that impacts discretionary spending patterns. Price volatility complicates inventory management for e-commerce operators while creating challenges in maintaining competitive pricing strategies. Consumers become increasingly price-sensitive, prioritizing essential purchases and seeking discounts, which compresses profit margins across the retail sector and affects long-term business sustainability.

Regulatory Complexity and Evolving Compliance Requirements

The evolving regulatory landscape creates compliance challenges for e-commerce operators, particularly smaller businesses lacking specialized legal and technical resources. New licensing requirements, consumer protection mandates, and data privacy regulations demand continuous operational adjustments. Cross-border commerce faces additional complexity from customs regulations and varying international requirements, potentially limiting expansion opportunities for domestic platforms.

Cybersecurity Concerns and Digital Fraud Risks

Growing digital transaction volumes attract sophisticated fraud attempts that challenge platform security capabilities. Smaller e-commerce operators often lack resources for advanced fraud detection systems, creating vulnerabilities that affect consumer trust. Data protection concerns persist among segments of the population hesitant to share personal and financial information online, limiting market penetration among risk-averse consumers.

Competitive Landscape:

The Turkey e-commerce market features an intensely competitive landscape characterized by the presence of dominant domestic marketplace platforms alongside expanding international players. Market leaders invest substantially in logistics infrastructure, payment integration, and technology capabilities to strengthen competitive positioning and capture growing consumer demand. Platform operators focus on expanding product assortments, enhancing seller tools, and improving customer experience through faster delivery options and seamless payment processes. Strategic partnerships between e-commerce platforms and financial services providers create integrated shopping and payment ecosystems. Investment flows into quick commerce capabilities as operators recognize growing consumer demand for ultra-fast delivery services. Cross-border commerce expansion receives increasing attention as platforms develop international logistics networks and localized services for foreign markets. The competitive environment drives continuous innovation in mobile applications, personalization algorithms, and fulfillment technologies that benefit consumers through improved service quality and broader selection.

Recent Developments:

-

In December 2025, Kaspi.kz injected an additional TRY 4.17 Billion (approximately USD 97.6 Million) into Hepsiburada following its earlier acquisition. The capital increase, approved by shareholders at an extraordinary general meeting, will be used to accelerate the development of digital tools and services offered to SMEs and retailers selling on the platform, signaling long-term commitment to Turkey's e-commerce sector.

Turkey E-commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey e-commerce market size was valued at USD 294.30 Billion in 2025.

The Turkey e-commerce market is expected to grow at a compound annual growth rate of 24.17% from 2026-2034 to reach USD 2,065.49 Billion by 2034.

Groceries dominated the market with a share of 23.04%, driven by the rapid expansion of quick commerce platforms offering ultra-fast delivery of everyday essentials and growing consumer preference for convenient online grocery shopping experiences.

Key factors driving the Turkey e-commerce market include widespread smartphone penetration and mobile-first consumer behavior, government digital transformation initiatives and e-export incentives, and the evolving payment ecosystem featuring digital wallets and buy-now-pay-later solutions.

Major challenges include inflationary pressures affecting consumer purchasing power, evolving regulatory compliance requirements for e-commerce operators, cybersecurity concerns and digital fraud risks, logistical infrastructure gaps in rural areas, and competition for skilled technology talent.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)