Turkey E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Turkey E-Invoicing Market Overview:

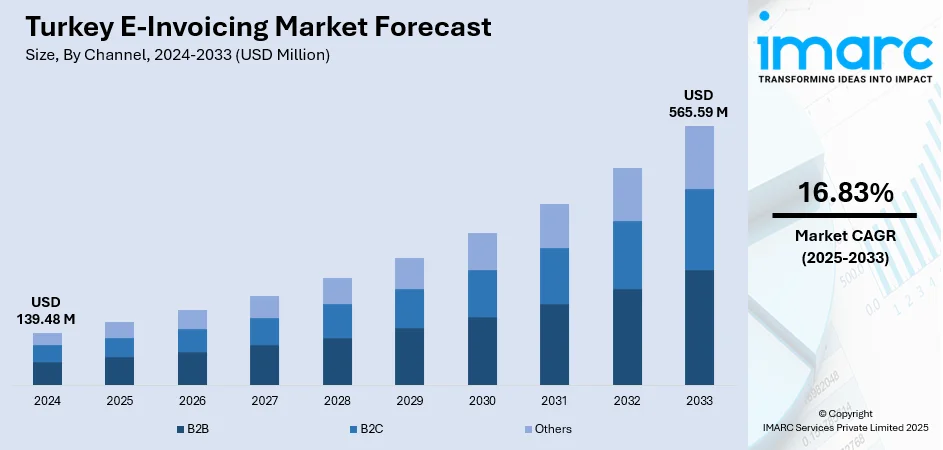

The Turkey e-invoicing market size reached USD 139.48 Million in 2024. The market is projected to reach USD 565.59 Million by 2033, exhibiting a growth rate (CAGR) of 16.83% during 2025-2033. The market is growing steadily as businesses continue to adopt digital tools to streamline financial operations. Regulatory support and digital transformation initiatives have encouraged more companies to transition from paper-based invoices to electronic systems. This shift is improving efficiency, reducing errors, and enhancing transparency in transactions across sectors. With increasing awareness and integration of modern billing technologies, both large and small enterprises are contributing to the sector’s positive momentum, supporting long-term growth in the Turkey e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 139.48 Million |

| Market Forecast in 2033 | USD 565.59 Million |

| Market Growth Rate 2025-2033 | 16.83% |

Turkey E-Invoicing Market Trends:

Expanded E‑Document Mandates Broaden Scope

Turkey has modernized its e-invoicing landscape by significantly expanding the scope of mandatory digital documents in 2024. The Revenue Administration (GIB) introduced regulatory changes that resulted in a 30% increase in taxpayer participation in the e-invoice and e-Archive system. This shift has encouraged broader adoption of digital invoicing across sectors such as retail, manufacturing, and services. Starting January 2025, invoices meeting specific thresholds will be required to be processed digitally, streamlining tax monitoring and compliance audits. This update allows for seamless integration with ERP systems, reducing manual errors and paperwork. Additionally, these mandates support other digital documentation platforms like e-ledger and e-delivery, promoting a unified electronic tax environment. Businesses are adapting by investing in automation and compliant software solutions, aligning internal processes with regulatory expectations. The widespread rollout of these digital tools marks a critical step in elevating auditability and data transparency. These reforms strongly reinforce Turkey e-invoicing market growth, driving efficiency, regulatory compliance, and digital innovation across the country’s business ecosystem.

To get more information on this market, Request Sample

Real-Time Platform Deployment Improves Efficiency

In late 2024, Turkey's Revenue Administration introduced a new centralized real-time application for managing e-Invoices and e-Waybills, aiming to improve transaction traceability and digital tax compliance. This unified platform enables businesses to submit invoices and delivery notes with digital signatures and QR codes, while ensuring instant validation by government systems. The system allows for seamless integration with internal ERP tools and simplifies inter-company exchanges by reducing manual reconciliation. According to the Turkish Ministry of Treasury and Finance, the initiative supports more accurate and real-time regulatory reporting and ensures consistency in audit trails. Businesses benefit from improved transparency, faster processing times, and greater operational efficiency. The centralized architecture also enhances document consistency across procurement, sales, and logistics. Companies in logistics and distribution sectors are among the early adopters, finding efficiency gains in invoice tracking and reduced compliance delays. These enhancements underscore the direction of Turkey e-invoicing market trends, reinforcing the country's efforts to standardize electronic documentation and strengthen its national digital economy.

International Alignment with EU Standards

Turkey has taken significant steps to align its e-Invoicing regulations with European Union digital tax compliance frameworks. In 2025, the country continued expanding its electronic invoicing ecosystem to match EU cross-border trade requirements, particularly those tied to the ViDA (VAT in the Digital Age) initiative. According to the Turkish Revenue Administration, enhancements in cross-border e-Invoice interoperability now allow businesses operating between Turkey and EU countries to process digital VAT records more seamlessly. With over 85% of cross-border trade invoices now digitized, the system supports real-time data exchange, standardizes invoice formats, and simplifies customs clearance procedures. Turkish exporters are especially benefiting from this integration, which reduces administrative delays and supports smoother coordination with European partners. Additionally, the adoption of structured XML formats and certified timestamping ensures compliance with both Turkish and EU legal requirements. This progress supports ongoing market growth, demonstrating the country’s commitment to enhancing trade efficiency, reducing tax leakage, and strengthening digital trust in international transactions

Turkey E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

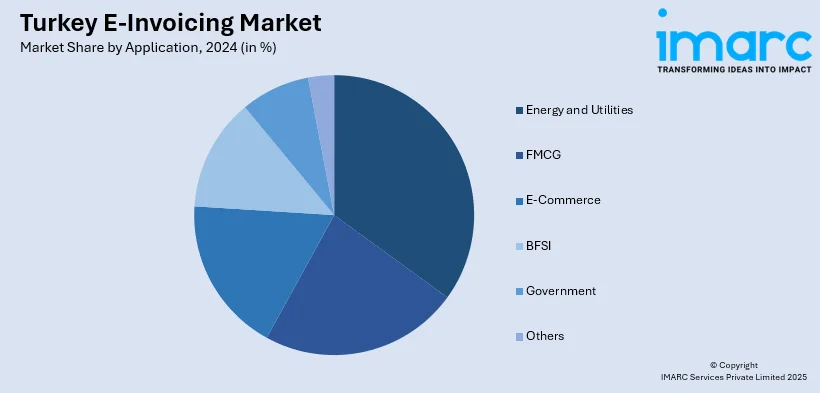

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey E-Invoicing Market News:

-

December 2024: Turkey’s Revenue Administration launched a centralized platform to streamline the country’s e-Invoice and e-Waybill processes. The system, known as the “New Central Application,” allows direct communication between sender platforms and the central mailbox, improving document delivery efficiency and reducing administrative burdens. This integration is designed to support a more transparent and traceable digital invoicing environment. The initiative marks a significant step in advancing the government’s broader strategy for digital transformation in financial reporting.

Turkey E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey e-invoicing market on the basis of channel?

- What is the breakup of the Turkey e-invoicing market on the basis of deployment type?

- What is the breakup of the Turkey e-invoicing market on the basis of application?

- What is the breakup of the Turkey e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Turkey e-invoicing market?

- What are the key driving factors and challenges in the Turkey e-invoicing?

- What is the structure of the Turkey e-invoicing market and who are the key players?

- What is the degree of competition in the Turkey e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)