Turkey Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Turkey Electric Two-Wheeler Market Overview:

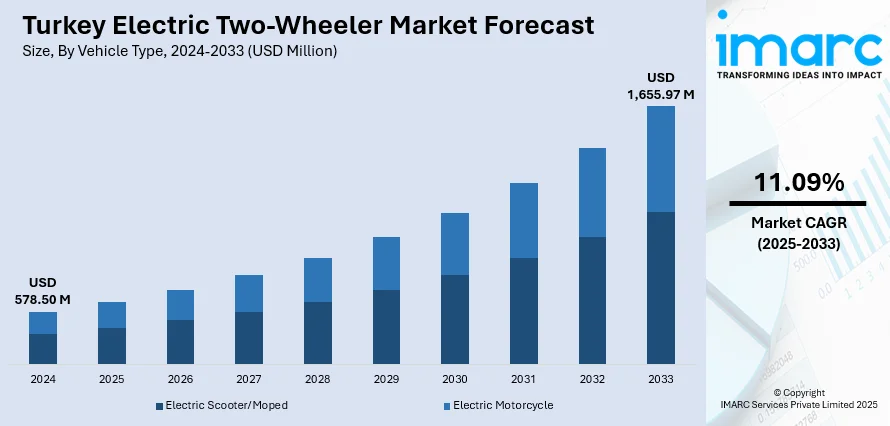

The Turkey electric two-wheeler market size reached USD 578.50 Million in 2024. The market is projected to reach USD 1,655.97 Million by 2033, exhibiting a growth rate (CAGR) of 11.09% during 2025-2033. Rapid urbanization in Turkey’s cities has caused traffic congestion and pollution, making electric two-wheelers an ideal, compact, and eco-friendly solution for easier urban mobility. Government incentives like subsidies, tax breaks, and charging infrastructure reduce costs and encourage adoption. Meanwhile, rising environmental awareness motivates consumers especially younger urbanites to choose zero-emission, cost-effective electric two-wheelers. Together, these factors driving Turkey’s electric two-wheeler market share by addressing practical, economic, and environmental needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 578.50 Million |

| Market Forecast in 2033 | USD 1,655.97 Million |

| Market Growth Rate 2025-2033 | 11.09% |

Turkey Electric Two-Wheeler Market Trends:

Growing Urbanization and Traffic Congestion

Urbanization has accelerated in Turkey, raising population density in large cities such as Istanbul, Ankara, and Izmir to a critical level, creating heavy traffic congestion and pollution. With an increasing number of people using private transport, roads become more congested, resulting in time wastage and increased emissions. Electric two-wheelers have the efficient solution because they provide compact, agile, and environmentally friendly transportation suitable for traffic-congested urban settings. Their compact size makes them easier to park and more convenient to travel along congested traffic. Moreover, electric two-wheelers release no tailpipe emissions, enhancing air quality. This synergy between convenience and environmental advantage spurs both consumer demand and local government support for electric mobility solutions, leading to increased adoption of electric scooters and bicycles, which eases urban traffic congestion and pollution, turning urbanization and congestion into a primary Turkey's electric two-wheeler market trend.

To get more information on this market, Request Sample

Government Incentives and Supportive Policies

The Turkish government actively supports the electric two-wheeler market through financial subsidies, tax reductions, and exemptions that make these vehicles more affordable. This, combined with significant investments in charging infrastructure, improves accessibility and convenience for users. The Turkish Energy Market Regulatory Authority (EMRA) projects that by 2030, electric vehicles will number 2.03 million, supported by 142,000 charging points, growing to 3.3 million vehicles and 273,000 charging points by 2035. These efforts align with Turkey’s commitment to reducing carbon emissions and meeting international climate goals. Regulatory frameworks encourage green mobility, reducing adoption barriers and boosting consumer confidence. As a result, these supportive policies stimulate demand and attract manufacturers and investors, positioning government incentives as a key driver behind the rapid growth of the electric two-wheeler sector in Turkey.

Rising Environmental Awareness Among Consumers

Environmental issues are rapidly impacting Turkey electric two-wheeler market growth. Increasing knowledge of climate change, air pollution, and eco-friendly living fuels the demand for cleaner transport options. Electric two-wheelers attract green consumers due to their zero-emission nature, cutting urban air pollution and supporting climate objectives. The affordability of electric two-wheelers, with reduced running and maintenance costs compared to fuel-based vehicles, is another draw. Youth generations and urban residents are particularly inclined toward the adoption of electric scooters and bicycles for short distances and last-mile connectivity. This change in attitude is an indicator of a larger societal inclination toward green products, and thus environment concern is a major driver of the growth in Turkey's electric two-wheeler market.

Turkey Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

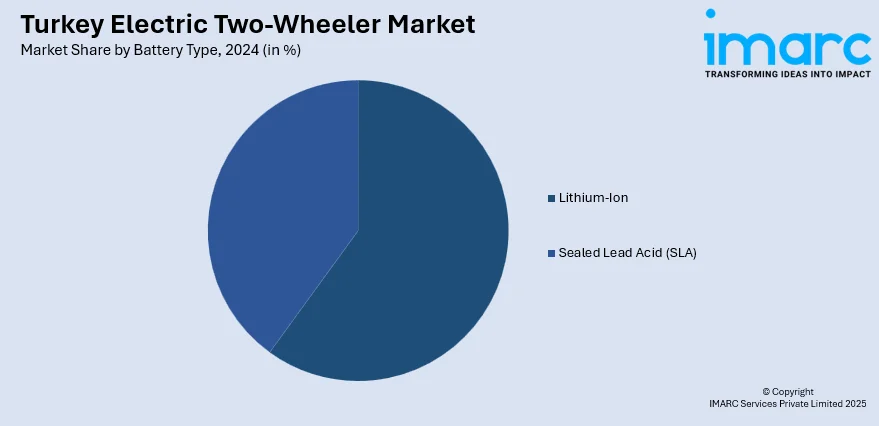

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Electric Two-Wheeler Market News:

- In June 2025, NAVEE, Europe’s leading e-scooter brand known for its advanced suspension and climbing performance, has launched its flagship models including the ST3 Pro, GT3 Max, and affordable N65i & V Series in Turkey. Featuring innovative Polymer Damping Arm™ suspension technology and powerful motors, NAVEE offers smooth rides, long ranges, and superior hill-climbing ability. With TÜV-certified batteries and enhanced safety features, NAVEE aims to redefine urban mobility for Turkish riders.

- In March 2025, Hyundai Motor Türkiye will start producing electric vehicles (EVs) at its Izmit plant in 2026, the company announced on March 3, 2025. While continuing to manufacture internal combustion engine models, Hyundai aims to transition to a zero-tailpipe emissions vehicle lineup in Europe by 2035. This move supports Hyundai’s commitment to sustainability and expanding EV production capabilities in Turkey as part of its broader electrification strategy.

Turkey Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Turkey electric two-wheeler market on the basis of battery type?

- What is the breakup of the Turkey electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Turkey electric two-wheeler market on the basis of peak power?

- What is the breakup of the Turkey electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Turkey electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Turkey electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Turkey electric two-wheeler market?

- What are the key driving factors and challenges in the Turkey electric two-wheeler market?

- What is the structure of the Turkey electric two-wheeler market and who are the key players?

- What is the degree of competition in the Turkey electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)