Turkey eSIM Market Size, Share, Trends and Forecast by Solution Type, Application, and Region, 2026-2034

Turkey eSIM Market Summary:

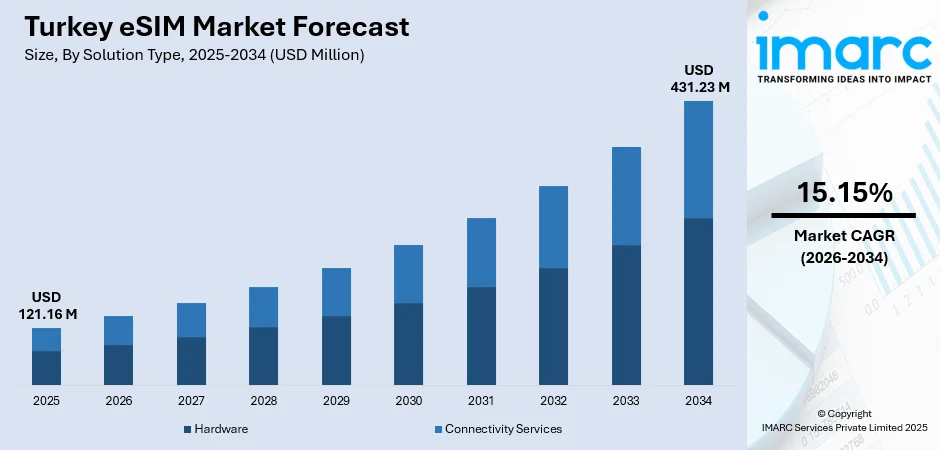

The Turkey eSIM market size was valued at USD 121.16 Million in 2025 and is projected to reach USD 431.23 Million by 2034, growing at a compound annual growth rate of 15.15% from 2026-2034.

The Turkey eSIM market is experiencing robust expansion, driven by accelerating digital transformation initiatives, widespread smartphone adoption featuring embedded SIM capabilities, and growing consumer preferences for seamless connectivity solutions. The country's telecommunications infrastructure modernization, coupled with increasing demand for remote SIM provisioning across consumer electronics and machine-to-machine applications, continues to propel market advancement. Additionally, the rising penetration of wearable devices, smart automotive technologies, and Internet of Things (IoT) ecosystems creates substantial opportunities for eSIM deployment throughout the region.

Key Takeaways and Insights:

-

By Solution Type: Connectivity services dominate the market with a share of 60% in 2025, owing to the growing demand for remote SIM provisioning, seamless network switching capabilities, and the increasing adoption of subscription-based connectivity models across consumer and enterprise segments.

-

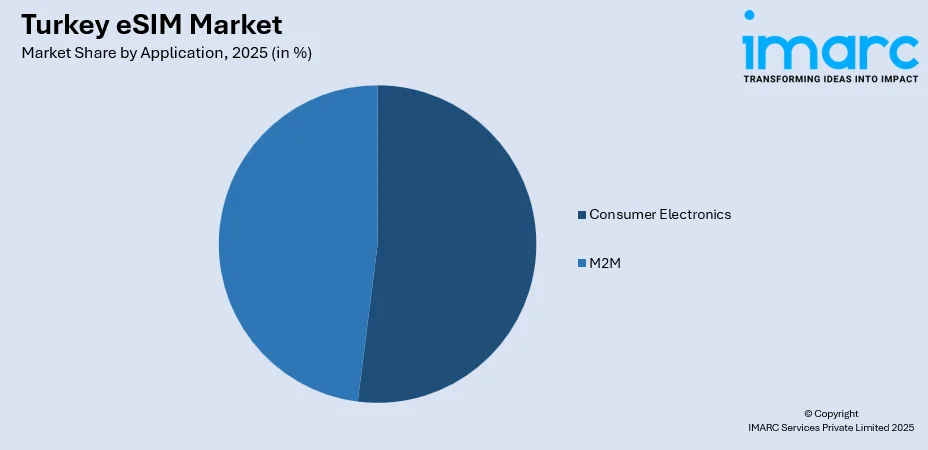

By Application: Consumer electronics lead the market with a share of 52% in 2025, driven by the proliferation of eSIM-enabled smartphones, tablets, smartwatches, and laptops that offer users enhanced flexibility in managing cellular subscriptions without physical SIM card requirements.

-

By Region: Marmara represents the largest region with 20% share in 2025, driven by Istanbul's position as the country's economic hub, high population density, advanced telecommunications infrastructure, and concentration of technology-focused businesses and digitally-savvy consumers.

-

Key Players: Key players drive the Turkey eSIM market by investing in network infrastructure upgrades, expanding eSIM-compatible device portfolios, and developing innovative connectivity solutions. Their strategic focus on partnerships with device manufacturers, telecommunications standards compliance, and customer-centric service offerings ensures consistent market expansion and technology adoption across diverse consumer segments.

To get more information on this market Request Sample

The Turkey eSIM market is witnessing substantial growth momentum, propelled by multiple interconnected factors reshaping the telecommunications landscape. The government's digital transformation agenda provides a supportive framework for advanced connectivity solutions. Increasing smartphone penetration, particularly among younger demographics with high technology affinity, creates fertile ground for eSIM adoption. The telecommunications sector's ongoing modernization efforts, including extensive fiber network expansion reaching over 496,000 Kilometers during Q2 2025, establish robust infrastructure foundations supporting eSIM services. Shifting consumer preferences towards streamlined digital experiences eliminate traditional SIM card handling requirements, while enterprise demand for efficient machine-to-machine communication accelerates market expansion. The convergence of IoT ecosystems, smart city initiatives, and connected automotive technologies further amplifies eSIM deployment opportunities. Rising international travel demand and cross-border mobility are also encouraging eSIM adoption, as users increasingly value seamless network switching, reduced roaming costs, and instant connectivity without physical SIM replacement.

Turkey eSIM Market Trends:

Integration with 5G Network Infrastructure

The imminent rollout of 5G services across Turkey is creating transformative opportunities for eSIM adoption. As of October 2025, around 45% of smartphones in use across Turkey were 5G-ready, indicating strong device ecosystem preparedness for next-generation connectivity solutions, including eSIM technology. The integration enables faster activation processes, improved network selection algorithms, and seamless transitions between coverage areas. Advanced network slicing capabilities supported by eSIM technology allow customized connectivity profiles for different use cases, ranging from high-bandwidth consumer applications to low-latency industrial deployments, establishing foundational infrastructure for comprehensive digital ecosystem advancement.

Expansion in Wearable Device Ecosystem

The wearable technology segment demonstrates significant eSIM integration momentum, with smartwatches, fitness trackers, and health monitoring devices increasingly incorporating embedded SIM functionality. This trend enables standalone connectivity for wearable devices independent of smartphone tethering, enhancing user convenience and safety applications. The growing health and wellness awareness among consumers drives demand for connected wearables capable of real-time data transmission. As per IMARC Group, the Turkey health and wellness market size reached USD 49.48 Billion in 2024. Telecommunications providers are developing specialized eSIM plans for secondary devices, offering multi-device connectivity packages that simplify subscription management across users' connected device portfolios.

Remote SIM Provisioning Advancements

Technological advancements in remote SIM provisioning platforms are streamlining eSIM activation and management processes across Turkey. Enhanced security protocols, improved user interfaces, and automated profile management systems reduce activation complexity while maintaining robust authentication standards. The development of standardized provisioning frameworks facilitates interoperability between device manufacturers and network operators. These improvements enable instant connectivity activation, simplified carrier switching, and efficient multi-profile management, addressing previous barriers to widespread eSIM adoption while supporting both consumer and enterprise deployment scenarios.

Market Outlook 2026-2034:

The Turkey eSIM market outlook demonstrates compelling growth trajectories, supported by convergent technological, regulatory, and consumer behavior factors. Accelerating digital transformation initiatives across government and private sectors establish supportive frameworks for advanced connectivity adoption. The market generated a revenue of USD 121.16 Million in 2025 and is projected to reach a revenue of USD 431.23 Million by 2034, growing at a compound annual growth rate of 15.15% from 2026-2034. The anticipated commercial 5G launch creates synergistic opportunities for eSIM deployment across consumer electronics, automotive, and IoT applications. Expanding device ecosystem compatibility, enhanced provisioning infrastructure, and growing consumer awareness regarding eSIM benefits contribute to sustained market expansion.

Turkey eSIM Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Solution Type | Connectivity Services | 60% |

| Application | Consumer Electronics | 52% |

| Region | Marmara | 20% |

Solution Type Insights:

- Hardware

- Connectivity Services

Connectivity services dominate with a market share of 60% of the total Turkey eSIM market in 2025.

The connectivity services segment maintains commanding market leadership, driven by the fundamental value proposition of eSIM technology in delivering seamless, software-defined network access. Turkish telecommunications providers have developed comprehensive eSIM service portfolios, enabling remote activation, carrier switching, and multi-profile management capabilities that align with consumer expectations for digital-first experiences. The segment benefits from recurring revenue models through subscription-based connectivity offerings that generate sustained income streams for service providers while delivering convenience to users.

The growing emphasis on connectivity services reflects broader telecommunications industry transformation towards service-centric business models. In October 2024, Ericsson and Turkcell partnered to deploy the Secure Entitlement Server (SES) solution enabling seamless eSIM activation for wearable devices, including smartwatches, allowing customers to remotely activate and manage eSIM subscriptions independently of their smartphones. This collaboration exemplifies the strategic investments telecommunications operators are making to expand connectivity service capabilities and enhance customer experience across diverse device categories.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Smartphones

- Tablets

- Smartwatches

- Laptop

- Others

- M2M

- Automotive

- Connected Cars

- Shared Mobility

- Smart Meter

- Logistics

- Others

- Automotive

Consumer electronics lead with a share of 52% of the total Turkey eSIM market in 2025.

The consumer electronics segment dominates the Turkey eSIM market, driven by widespread adoption of embedded SIM technology in smartphones, tablets, smartwatches, and connected laptops and retail broadening. In January 2025, Turkish retail sales rose by 12.5%, fueled by an uptick in consumer interest for electronics and household appliances. The segment benefits from device manufacturers' strategic decisions to integrate eSIM capabilities as standard features in premium and mid-range product lines, expanding accessible device inventory for Turkish consumers.

User demand for simplified connectivity management, dual-SIM functionality without physical card requirements, and seamless international roaming capabilities reinforces consumer electronics leadership in eSIM adoption. The smartphone category represents one of the largest contributor within consumer electronics, supported by major manufacturer adoption of eSIM technology across flagship devices. This device compatibility foundation positions the consumer electronics segment for continued expansion, as users upgrade to eSIM-enabled devices and leverage enhanced connectivity features.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara exhibits a clear dominance with a 20% share of the total Turkey eSIM market in 2025.

The Marmara region, anchored by Istanbul as Turkey's commercial and technological epicenter, commands market leadership through concentrated economic activities, advanced telecommunications infrastructure, and high population density with elevated technology adoption rates. The region benefits from substantial corporate presence driving enterprise eSIM deployment, thriving startup ecosystem fostering digital innovations, and sophisticated consumer base demanding cutting-edge connectivity solutions. Istanbul's strategic position bridging Europe and Asia creates unique international business connectivity requirements that eSIM technology effectively addresses.

The Marmara region's dominance reflects Turkey's broader economic geography concentration, with Istanbul serving as the primary hub for financial services, technology companies, and international commerce. According to startup ecosystem data, Istanbul's total transaction volume for startup investments surged from USD 497 Million in 2023 to USD 2.6 Billion in 2024, representing a 423% increase. The financial technology (fintech) sector in Turkey recorded the largest volume of transactions, totaling 31 deals with startups in 2024, which underscores the region's accelerating digital transformation momentum. This is creating favorable conditions for advanced connectivity technology adoption, including eSIM solutions, across consumer and enterprise segments.

Market Dynamics:

Growth Drivers:

Why is the Turkey eSIM Market Growing?

Accelerating Digital Transformation and Smart City Initiatives

Turkey's comprehensive digital transformation agenda establishes supportive frameworks for eSIM technology adoption across multiple sectors. Smart city initiatives implemented across major metropolitan areas require sophisticated IoT connectivity solutions that eSIM technology effectively enables, from intelligent transportation systems to connected public infrastructure. The need for adaptable, software-defined connection solutions is increased by the convergence of government modernization schemes with private sector digitalization initiatives. eSIM technology enables scalable machine-to-machine communication capabilities, which are necessary for urban development projects involving connected sensors, smart metering systems, and automated public services. More deployment opportunities are created by educational institutions and healthcare facilities adopting digital upgrading programs. eSIM is positioned as enabling infrastructure rather than optional technology augmentation in the holistic approach to national digital growth.

Expanding 5G Network Infrastructure and Service Readiness

The imminent commercialization of 5G services across Turkey creates transformative growth opportunities for the eSIM market. Telecommunications operators are preparing extensive network upgrades to support next-generation connectivity, with fiber infrastructure expanding significantly to enable 5G backhaul requirements. The anticipated commercial 5G launch in April 2026 establishes technological foundations for advanced eSIM applications, including enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type connectivity. Device ecosystem readiness demonstrates substantial 5G and eSIM compatibility, positioning the market for accelerated adoption once network services become commercially available. The synergistic relationship between 5G capabilities and eSIM functionality enables dynamic network selection, optimized connectivity profiles, and seamless service transitions that maximize next-generation network benefits. Telecommunications operators are developing integrated service offerings, combining 5G access with advanced eSIM management platforms. The convergence of network advancement with eSIM technology positions Turkey's connectivity ecosystem for comprehensive digital service evolution.

Rising Consumer Electronics Adoption and Device Ecosystem Maturity

The expanding penetration of eSIM-enabled consumer devices across Turkey's technology-savvy population drives sustained market growth. Major smartphone manufacturers have standardized eSIM integration across flagship and mid-range product portfolios, dramatically expanding the accessible device base for Turkish consumers. Additional avenues for market expansion are created by the rising popularity of fitness trackers, smartwatches, and linked wearables with independent cellular capabilities. In order to provide the always-connected mobile computing experiences required by remote work trends, tablet and laptop manufacturers are progressively integrating eSIM functionality. Young people who have a great affinity for technology show a significant preference for digital-first connectivity experiences, which eSIM makes possible by doing away with the need to handle physical SIM cards. Separating personal and corporate conversations on a single handset is a practical consumer demand that is met by eSIM technology's dual-SIM capabilities.

Market Restraints:

What Challenges the Turkey eSIM Market is Facing?

Regulatory Complexity and Data Localization Requirements

For eSIM service providers, Turkey's telecommunications regulatory framework poses challenges, especially with regard to licensing requirements and data localization regulations. International eSIM providers face operational difficulties as a result of the ICTA's stringent supervision procedures, which mandate that telecommunications data be retained within national borders. Some providers may have to postpone market entry or service growth due to the substantial infrastructure investments and operational changes required to comply with local restrictions.

Limited Consumer Awareness and Education Gaps

Despite growing technology adoption across Turkey, consumer awareness regarding eSIM benefits, activation procedures, and management capabilities remains limited among certain demographic segments. Many potential users continue relying on traditional physical SIM cards due to familiarity and perceived simplicity, creating adoption barriers for eSIM technology. The absence of comprehensive consumer education initiatives explaining eSIM advantages, compatibility requirements, and practical usage scenarios constrains market expansion potential among mainstream users unfamiliar with digital SIM technology.

Infrastructure Investment Requirements and Operator Readiness

Telecommunications operators face substantial infrastructure investment requirements to fully support comprehensive eSIM service offerings, including remote SIM provisioning platforms, subscription management systems, and customer service capabilities. Smaller operators may encounter resource constraints limiting their ability to deploy advanced eSIM infrastructure comparable to larger market participants. The technical complexity of implementing secure, standards-compliant eSIM ecosystems requires specialized expertise and ongoing investment that creates barriers for some service providers.

Competitive Landscape:

The Turkey eSIM market competitive landscape features established telecommunications operators, specialized eSIM solution providers, and technology vendors collaborating to deliver comprehensive connectivity ecosystems. Market participants compete through service portfolio differentiation, pricing strategies, partnership development, and customer experience optimization. Leading telecommunications operators leverage extensive network infrastructure, established customer relationships, and brand recognition to maintain competitive advantages while investing in eSIM platform capabilities. Solution providers differentiate through advanced provisioning technologies, multi-operator compatibility, and enterprise-focused features. Strategic partnerships between device manufacturers, telecommunications operators, and technology vendors accelerate ecosystem development and expand addressable market segments. Competitive dynamics increasingly emphasize service quality, activation simplicity, and value-added features beyond basic connectivity provision.

Turkey eSIM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Hardware, Connectivity Services |

| Applications Covered |

|

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey eSIM market size was valued at USD 121.16 Million in 2025.

The Turkey eSIM market is expected to grow at a compound annual growth rate of 15.15% from 2026-2034 to reach USD 431.23 Million by 2034.

Connectivity services dominated the market with a share of 60%, driven by growing demand for remote SIM provisioning, subscription-based connectivity models, and seamless network management capabilities across consumer and enterprise segments.

Key factors driving the Turkey eSIM market include accelerating digital transformation initiatives, expanding 5G network infrastructure readiness, rising consumer electronics adoption with eSIM compatibility, and growing IoT ecosystem deployment.

Major challenges include regulatory complexity regarding data localization requirements, limited consumer awareness about eSIM benefits and activation procedures, infrastructure investment requirements for comprehensive service deployment, and operator readiness gaps across the telecommunications ecosystem.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)