Turkey Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2026-2034

Turkey Fintech Market Summary:

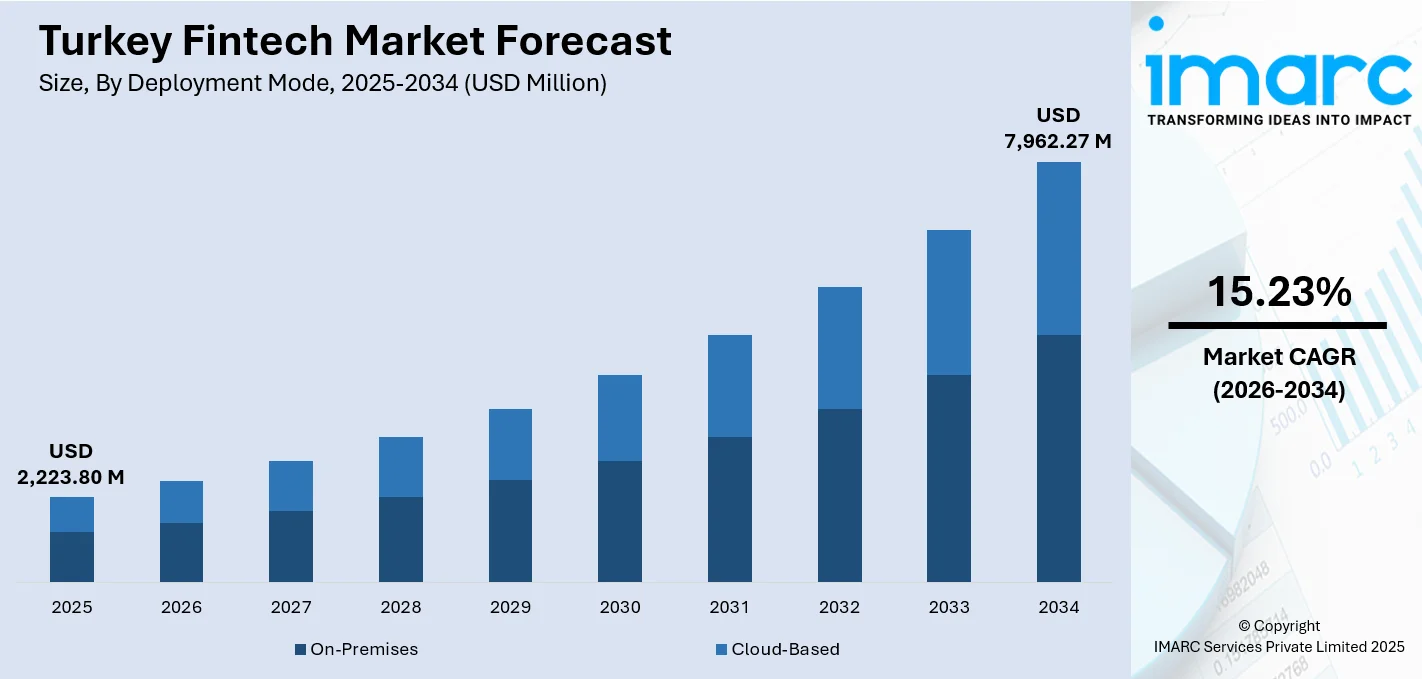

The Turkey fintech market size was valued at USD 2,223.80 Million in 2025 and is projected to reach USD 7,962.27 Million by 2034, growing at a compound annual growth rate of 15.23% from 2026-2034.

The market is driven by accelerating digital transformation, progressive regulatory frameworks supporting innovation, and widespread smartphone penetration enabling seamless financial access. Growing preference for cashless transactions alongside expanding instant payment infrastructure strengthens financial inclusion across underserved segments. Government support through policy coordination encourages entrepreneurial ventures while convergence of artificial intelligence (AI), blockchain, and open banking standards reshapes service delivery, positioning Turkey as a strategic hub capturing significant Turkey fintech market share.

Key Takeaways and Insights:

-

By Deployment Mode: On-premises dominates the market with a share of 35.06% in 2025, driven by financial institutions prioritizing data sovereignty, enhanced security control, compliance requirements mandating localized infrastructure, and legacy system integration needs.

-

By Technology: Application programming interface leads the market with a share of 25.04% in 2025, owing to critical role enabling seamless platform integration, facilitating open banking implementations, supporting developer ecosystems, and accelerating innovation through standardized connectivity.

-

By Application: Payment and fund transfer represents the largest segment with a market share of 45.08% in 2025, driven by surging consumer demand for instant transactions, expanding e-commerce activities, cashless economy initiatives, and widespread mobile wallet adoption.

-

By End User: Banking dominates the market with a share of 50.1% in 2025, owing to traditional institutions accelerating digital transformation, implementing customer-centric technologies, expanding lending platforms, and leveraging fintech partnerships for competitive advantage.

-

By Region: Marmara leads the market with a share of 22% in 2025, driven by concentration of financial headquarters in Istanbul, superior digital infrastructure availability, higher disposable incomes supporting adoption, and dense population clusters enabling innovation.

-

Key Players: The market exhibits dynamic competitive positioning with established providers competing alongside emerging digital-native ventures. Strategic collaborations between traditional banks and agile startups characterize the landscape, enabling complementary capabilities and innovation.

To get more information on this market Request Sample

Turkey fintech market experiences robust expansion propelled by converging forces reshaping financial services delivery. Progressive regulatory frameworks established by governmental authorities create supportive environments balancing innovation encouragement with consumer protection priorities. Widespread smartphone adoption across demographic segments enables seamless access to digital financial platforms while evolving consumer preferences favor convenient, transparent, and instantaneous transaction capabilities. Strategic government initiatives promoting digital transformation alongside substantial infrastructure investments in instant payment systems accelerate market maturation. Collaborative partnerships between traditional banking institutions and technology-driven startups foster innovation ecosystems leveraging complementary strengths. According to sources, in April 2025, Turkish payments platform Sipay secured $78 Million Series B funding led by Elephant VC, valuing the company over $875 Million, serving 6.3 Million users and 25,000 merchants. Moreover, growing financial inclusion objectives targeting underserved populations drive digital lending platform expansion while blockchain technology adoption enhances transparency and security standards. Turkey's strategic geographical positioning connecting diverse regional markets creates unique opportunities for cross-border payment innovations, collectively establishing foundations for sustained sectoral growth and technological advancement.

Turkey Fintech Market Trends:

Open Banking Framework Expansion Reshaping Financial Ecosystems

Open banking implementation fundamentally alters how financial institutions share customer data and interact with third-party providers. Regulatory alignment with international standards enables secure data exchange through application programming interfaces between banks and authorized fintech platforms. This empowers consumers with greater control over financial information while enabling innovative solutions leveraging aggregated banking data. Traditional institutions recognize open banking as strategic opportunity, fostering collaborative ecosystems where specialized firms complement banking capabilities. According to sources, TPAY MOBILE acquired 100% of Payguru, Turkey’s first licensed mobile payment provider, which supported 1,300 merchants and processed over 13 Million transactions annually, expanding alternative payment and carrier billing capabilities. Moreover, enhanced transparency and robust security protocols build consumer confidence, democratizing financial services access while intensifying competitive dynamics.

Artificial Intelligence Integration Revolutionizing Financial Decision-Making

AI technologies permeate fintech applications, enhancing operational efficiency and customer experience across multiple touchpoints. As per sources, in August 2025, industry analysis highlighted that 72% of financial services firms use AI in at least one function, underscoring AI’s growing role in fraud detection, automation, and personalized fintech services. Furthermore, machine learning (ML) algorithms power sophisticated credit scoring models analyzing alternative data sources, enabling underserved segments to access financing opportunities. Intelligent chatbots provide instant customer support through natural language processing capabilities. Predictive analytics optimize fraud detection systems, identifying suspicious patterns while minimizing false positives. Personalization engines deliver tailored product recommendations aligned with individual objectives. Automated compliance monitoring helps institutions navigate complex regulatory landscapes efficiently.

Blockchain-Based Infrastructure Supporting Digital Asset Innovation

Blockchain technology adoption accelerates as institutions explore distributed ledger applications beyond cryptocurrency trading. Strengthened regulatory frameworks provide clarity encouraging institutional participation while implementing consumer protection safeguards. Smart contract functionality enables programmable financial instruments automating execution, reducing intermediary dependencies and settlement timeframes. Tokenization extends to traditional assets, creating fractional ownership opportunities and enhanced liquidity mechanisms. As per sources, in March 2025, Turkey’s BankPozitif partnered with Swiss platform Taurus to launch crypto custody services for institutional clients, securing a temporary license from the Capital Markets Board and supporting top five cryptocurrencies. Further, cross-border payment corridors leverage blockchain infrastructure reducing transaction costs compared to conventional banking networks. Identity verification systems utilize decentralized approaches enhancing security while streamlining customer onboarding.

Market Outlook 2026-2034:

The Turkey fintech market demonstrates exceptional growth trajectory throughout the forecast period as digital transformation imperatives intensify across financial services landscape. Revenue expansion reflects accelerating technology adoption rates, expanding service offerings addressing diverse consumer needs, and increasing institutional investments in digital infrastructure capabilities. Regulatory evolution supporting innovation while maintaining stability standards creates favorable conditions for sustained sectoral development. Emerging technologies including AI, blockchain distributed ledgers, and quantum-resistant cryptography reshape operational paradigms. Geographic expansion initiatives position Turkish fintech providers as regional technology hubs serving neighbouring markets. The market generated a revenue of USD 2,223.80 Million in 2025 and is projected to reach a revenue of USD 7,962.27 Million by 2034, growing at a compound annual growth rate of 15.23% from 2026-2034.

Turkey Fintech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Deployment Mode | On-Premises | 35.06% |

| Technology | Application Programming Interface | 25.04% |

| Application | Payment and Fund Transfer | 45.08% |

| End User | Banking | 50.1% |

| Region | Marmara | 22% |

Deployment Mode Insights:

- On-Premises

- Cloud-Based

On-premises dominates with a market share of 35.06% of the total turkey fintech market in 2025.

On-premises dominated the market capturing substantial revenue share as financial institutions prioritize data sovereignty requirements and regulatory compliance obligations mandating localized infrastructure control. Traditional banking entities with established legacy systems favor on-premises architectures enabling seamless integration with existing technology stacks while maintaining familiar operational frameworks. Security considerations drive preference for internally managed infrastructure among institutions handling sensitive customer information and high-value transactions. Compliance requirements particularly regarding data residency regulations necessitate domestic hosting arrangements within national boundaries. In September 2025, SAP launched its “On-Site” sovereign cloud, enabling customers to host managed cloud infrastructure within their own facilities, enhancing data residency, control, and compliance for regulated sectors.

This deployment approach provides institutions with complete control over hardware configurations, software customizations, and data management protocols aligned with organizational security policies. Financial enterprises managing large transaction volumes and sensitive customer portfolios leverage on-premises infrastructure ensuring immediate data access without external dependencies. Legacy system compatibility remains critical advantage where decades-old banking applications require specific hosting environments incompatible with cloud architectures. However, maintenance overhead including hardware upgrades, security patching, and capacity planning increasingly challenges cost efficiency.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application programming interface leads with a share of 25.04% of the total Turkey fintech market in 2025.

Application programming interface commanded the leading market position enabling critical connectivity between disparate financial systems and facilitating open banking implementations mandated by regulatory frameworks. APIs standardize data exchange protocols allowing third-party developers to build innovative services leveraging banking infrastructure without requiring direct system access or complex integration projects. As of March 2025, Turkey amended payment regulations, limiting BKM Gateway integration to licensed account service providers and top FAST participants, easing obligations for other digital wallet and payment institutions. Moreover, financial institutions deploy APIs exposing selected functionalities including account information retrieval, payment initiation, and transaction history access to authorized external applications. This architectural approach accelerates service innovation by empowering specialized fintech firms to develop customer-centric solutions while banks maintain core infrastructure control and regulatory compliance responsibilities.

Application programming interface fundamentally transforms financial services ecosystems by enabling modular, interconnected platforms replacing monolithic legacy architectures with flexible service-oriented designs. Developer ecosystems flourish around standardized API specifications, creating vibrant marketplaces of financial applications serving diverse customer needs from budgeting tools to investment platforms. Enhanced customer experiences emerge through seamless integrations where users access multiple financial services through unified interfaces without repetitive authentication or manual data entry. Security protocols including OAuth authentication, encryption standards, and rate limiting protect sensitive information while enabling controlled access.

Application Insights:

.webp)

Access the comprehensive market breakdown Request Sample

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payment and fund transfer exhibits a clear dominance with a 45.08% share of the total Turkey fintech market in 2025.

Payment and fund transfer represented the dominating segment with substantial market presence, attributed to surging consumer demand for instant digital transactions and expanding e-commerce activities reshaping retail landscapes. As per sources, in 2025, Turkey’s card payments reached 2.21 Trillion TL, with 463.2 Million cards in circulation and contactless transactions representing 80 % of in-store payments. Further, widespread smartphone adoption enables seamless mobile payment experiences through applications supporting peer-to-peer transfers, merchant payments, and bill settlements without physical cash or card requirements. Government initiatives promoting cashless economies accelerate digital payment infrastructure development including instant payment systems facilitating real-time fund transfers between bank accounts.

Digital payment platforms leverage technologies including QR codes, near-field communication, and biometric authentication delivering convenient, secure transaction experiences meeting evolving consumer expectations. E-commerce growth drives merchant acceptance network expansion as retailers integrates digital payment options reducing cash handling costs and improving operational efficiency. Cross-border remittance corridors benefit from digital platforms reducing transaction fees and settlement timeframes compared to traditional money transfer services. Instant payment infrastructure enables innovative use cases including request-to-pay functionality, split payment arrangements, and automated recurring transfers.

End User Insights:

- Banking

- Insurance

- Securities

- Others

Banking leads with a market share of 50.1% of the total Turkey fintech market in 2025.

Banking emerged as the largest end-user category controlling substantial market share, driven by traditional financial institutions accelerating digital transformation strategies to maintain competitive positioning amid evolving customer expectations and emerging fintech challengers. Established banks implement comprehensive technology solutions spanning mobile banking applications, automated lending platforms, AI-powered customer service systems, and advanced analytics frameworks enhancing operational efficiency while delivering superior customer experiences. In November 2024, Garanti BBVA launched TAMİ, a digital payment and e-money platform offering multi-bank POS systems and prepaid cards, enhancing e-commerce payments and financial inclusion across Türkiye. Moreover, digital channels increasingly serve as primary interaction touchpoints replacing branch-based services for routine transactions, account management, and product applications.

Banking adoption of fintech solutions addresses multiple strategic imperatives including cost reduction through process automation, revenue enhancement via expanded digital service offerings, and risk mitigation through improved fraud detection and compliance monitoring systems. Traditional banks possess inherent advantages including established customer relationships, regulatory expertise, extensive infrastructure assets, and trusted brand recognition, positioning them favorably when combined with technological capabilities. Digital-native challenger banks demonstrate pure-play fintech approaches, intensifying competitive pressures motivating incumbent transformation initiatives.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara dominates with a market share of 22% of the total Turkey fintech market in 2025.

Marmara held the leading geographical position capturing substantial market share, propelled by concentration of financial headquarters in Istanbul, Turkey's economic and commercial capital hosting major banking institutions, fintech startups, and technology companies. Superior digital infrastructure availability including broadband connectivity, mobile networks, and data center facilities enables advanced fintech service delivery supporting high transaction volumes and real-time processing requirements. Higher disposable incomes prevalent in metropolitan areas drive technology adoption as affluent consumers embrace digital financial services including mobile payments, robot-advisory platforms, and digital lending solutions.

The region’s position as cultural, educational, and business hub attracts skilled technology talent essential for fintech development including software engineers, data scientists, and user experience designers. Entrepreneurial ecosystems flourish through accelerator programs, venture capital availability, and networking opportunities connecting founders with investors and industry experts. Proximity to regulatory authorities facilitates engagement with policymakers shaping fintech frameworks and enables rapid response to compliance requirements. International connectivity through airports, seaports, and telecommunications infrastructure supports cross-border fintech operations serving regional markets beyond Turkey.

Market Dynamics:

Growth Drivers:

Why is the Turkey Fintech Market Growing?

Progressive Regulatory Frameworks Fostering Innovation While Ensuring Stability

Turkey's regulatory environment strikes deliberate balance between encouraging financial technology innovation and maintaining systemic stability protecting consumer interests. Government authorities recognize fintech's potential contributing to economic growth and financial inclusion goals, implementing frameworks supporting entrepreneurial ventures while establishing appropriate oversight mechanisms. The Central Bank's regulatory authority over payment and electronic money institutions provides clear operational guidelines reducing market uncertainty. Open banking regulations aligned with international standards facilitate data sharing enabling third-party service development. Digital banking licensing frameworks lower barriers for new entrants while fintech sandbox initiatives allow controlled experimentation under regulatory supervision. Cryptocurrency regulations evolve providing clarity around permissible activities and consumer protection requirements, building investor confidence. As per sources, in Turkey, the Capital Markets Board implemented Twin FinTech Communiqués III-35/B.1 and III-35/B.2 on 13 March 2025, mandating licensing, operational standards, and capital requirements for crypto asset service providers.

Accelerating Digital Transformation Initiatives Across Financial Services Sector

Comprehensive digital transformation efforts reshape how financial institutions deliver services and interact with customers throughout Turkey's banking ecosystem. Traditional banks increasingly recognize digital channels as primary customer touchpoints rather than supplementary conveniences, driving substantial technology infrastructure investments. Mobile banking applications evolve beyond basic transaction capabilities toward comprehensive financial management platforms integrating budgeting tools, savings automation, and investment options. Instant payment system enhancements streamline transaction initiation and settlement processes while contactless payment adoption surges driven by consumer convenience preferences. Digital identity verification systems utilizing biometric authentication reduce onboarding friction while enhancing security standards. Cloud computing enables scalable infrastructure supporting fluctuating demand patterns without proportional cost increases as competitive pressures intensify.

Expanding Financial Inclusion Objectives Driving Digital Lending Platform Growth

Financial inclusion goals targeting underserved population segments fuel digital lending platform proliferation across Turkey fintech market. Traditional banking credit assessment methodologies often exclude individuals lacking conventional employment documentation or established credit histories, creating substantial unmet financing demand. Alternative credit scoring models leverage diverse data sources including mobile phone usage patterns, utility payment histories, and social media activity, enabling more holistic risk assessments. Automated underwriting systems utilizing machine learning algorithms process applications rapidly, delivering instant credit decisions and fund disbursements. According to reports, Turkey’s AI-powered digital loan aggregator market reached USD 50 Million, driven by smartphone penetration, fast loan approvals averaging 24 hours, and growing adoption of AI-driven personal loan platforms. Moreover, reduced operational overhead compared to branch-based lending enables competitive interest rates and lower minimum loan amounts expanding accessibility. Small business entrepreneurs and young professionals particularly benefit from streamlined processes requiring minimal documentation.

Market Restraints:

What Challenges the Turkey Fintech Market is Facing?

Regulatory Compliance Complexity Creating Operational Burdens

Evolving regulatory landscapes present ongoing compliance challenges particularly for emerging fintech startups lacking dedicated legal expertise. New regulations governing payment services, data protection, anti-money laundering, and digital assets require substantial implementation efforts. International expansion faces regulatory fragmentation with inconsistent standards across jurisdictions. Compliance infrastructure investments strain limited resources while documentation requirements consume significant operational capacity.

Cybersecurity Threats Undermining Consumer Trust and System Stability

Digital financial services face elevated cybersecurity risks given sensitive financial data attracting malicious actors. Increasing cyberattacks sophistication challenges defensive capabilities as threats evolve faster than security measures. Data breach incidents damage consumer confidence triggering customer attrition and reputational harm. Financial losses from successful attacks strain resources while regulatory penalties compound impacts. Identity theft exploits authentication vulnerabilities compromising accounts. Distributed denial-of-service attacks disrupt service availability.

Economic Volatility Affecting Investment Flows and Consumer Behaviour

Macroeconomic uncertainties including currency fluctuations and inflation pressures create challenging operating environments for fintech ventures. Currency depreciation impacts international funding arrangements while inflation erodes purchasing power affecting consumer spending patterns. Economic instability triggers risk-averse investor behaviour reducing available venture capital. Consumer confidence fluctuations influence technology adoption willingness particularly during uncertain periods. Credit quality deterioration increases default risks for lending platforms.

Competitive Landscape:

Turkey fintech competitive environment reflects dynamic interplay between diverse organizational archetypes pursuing complementary and overlapping market opportunities. Traditional banking institutions leverage established customer relationships, regulatory expertise, and infrastructure assets while accelerating digital capabilities through internal development and strategic partnerships. Digital-native challengers differentiate through superior user experiences, specialized service offerings, and technological agility unencumbered by legacy constraints. Payment service providers focus on transaction processing efficiency and merchant acceptance network expansion. Lending platforms target underserved segments through alternative credit assessment methodologies. Wealth management solutions democratize investment access through automated advisory services. Insurance technology ventures streamline policy distribution and claims processing.

Recent Developments:

-

In April 2025, FaturamPara, Turkey's first company combining RegTech and FinTech, joined the SME Finance Forum. As the exclusive authorized risk center for the Electronic Document Registration Center, FaturamPara aims to enhance SME financial access globally, promoting sustainable supply chains and innovative digital payment solutions.

-

In May 2024, Turkish fintech Iyzico announced the $87 Million acquisition of Istanbul-based Paynet, integrating its B2B payments and collections solutions to expand Iyzico’s digital payment offerings and strengthen services for businesses and e-commerce platforms across Turkey.

Turkey Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey fintech market size was valued at USD 2,223.80 Million in 2025.

The Turkey fintech market is expected to grow at a compound annual growth rate of 15.23% from 2026-2034 to reach USD 7,962.27 Million by 2034.

On-premises held the largest market share as financial institutions prioritize data sovereignty, enhanced security control over sensitive information, and regulatory compliance requirements mandating localized infrastructure. Traditional banks favor on-premises architectures enabling seamless legacy system integration while maintaining operational control.

Key factors driving the Turkey fintech market include progressive regulatory frameworks supporting innovation, accelerating digital transformation across financial institutions, expanding smartphone penetration enabling service access, government policy coordination, growing financial inclusion objectives, and collaborative partnerships between traditional banks and technology providers.

Major challenges include regulatory compliance complexity requiring substantial implementation resources, cybersecurity threats undermining consumer trust, economic volatility affecting investment flows and consumer behaviour, talent acquisition difficulties, legacy system integration constraints, and international expansion barriers from fragmented cross-border regulatory frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)