Turkey Functional Beverages Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Turkey Functional Beverages Market Overview:

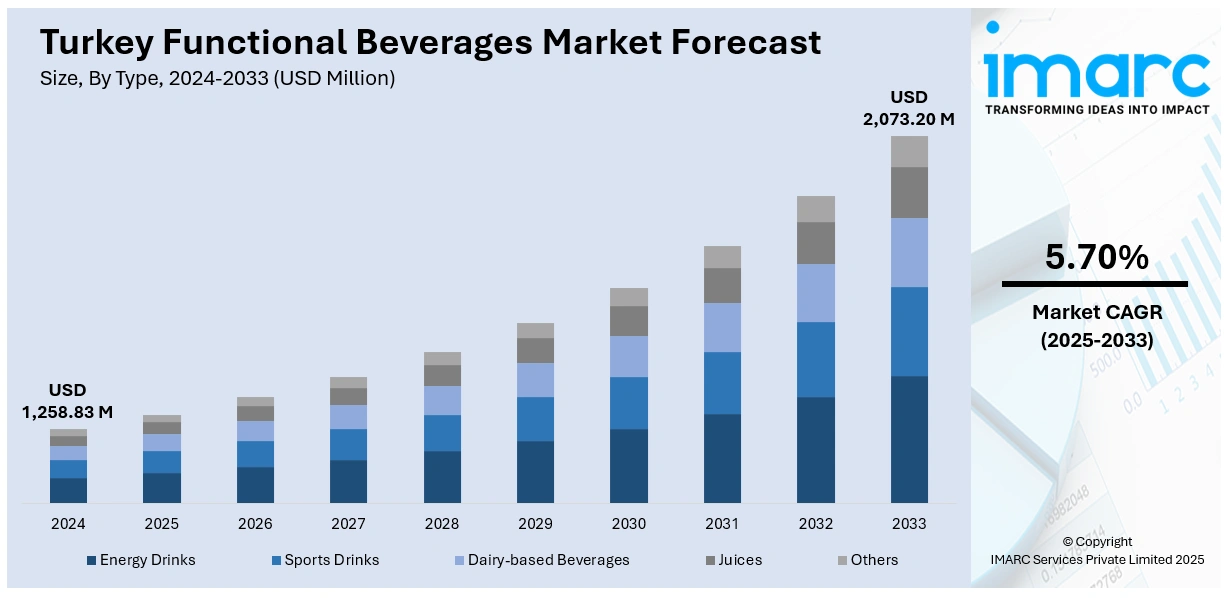

The Turkey functional beverages market size reached USD 1,258.83 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,073.20 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. Rising health awareness, the prevalence of chronic conditions, and increasing interest in wellness are driving the demand for functional beverages in Turkey. The growth of modern retail and online channels enhances accessibility, while younger consumers, with their focus on innovation and convenience, further influencing the Turkey functional beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,258.83 Million |

| Market Forecast in 2033 | USD 2,073.20 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Turkey Functional Beverages Market Trends:

Rising Health and Wellness Awareness

Health awareness is becoming a major influence on the functional beverages market in Turkey, with consumers placing greater emphasis on nutrition and wellness in their everyday decisions. Increasing awareness about concerns like sugar consumption, immune support, digestive health, and long-lasting energy is leading to a high demand for drinks fortified with vitamins, minerals, probiotics, and natural components. The rising prevalence of chronic conditions is prompting more consumers to turn to functional beverages as supportive options for maintaining better health. The Ministry of Health announced that from November 1, 2024, to January 31, 2025, over 10.5 million people were screened for chronic diseases, with over 1.57 million identified with chronic conditions, highlighting the severity of health issues the country is confronting. In this context, functional drinks are seen as practical and convenient resources for promoting healthier living, providing consumers with an easy method to tackle wellness issues without significant lifestyle changes.

To get more information on this market, Request Sample

Expansion of Modern Retail and Online Channels

Effective distribution is emerging as a crucial factor in impelling the Turkey functional beverages market growth, by providing enhanced accessibility and visibility among various consumer groups. Conventional outlets like supermarkets and convenience stores are essential, but the rapid rise of digital platforms is creating a transformative shift in how these products are marketed and consumed. In 2024, the Turkey e-commerce sector attained a value of USD 235.1 Billion, as per the IMARC Group, underscoring the increasing significance of online platforms in influencing consumer behavior. Shopping apps and delivery services simplify the process for buyers to explore and try new types of functional beverages, thus speeding up both initial trials and repeat buying. Moreover, focused advertising, marketing initiatives, and deliberate placements in fitness centers, drugstores, health shops, and coffeehouses increase product visibility. This multichannel distribution approach guarantees that functional beverages are viewed not as niche products but as readily available items that are integrated into daily consumption, thereby driving sales.

Influence of Younger Consumer Demographics

Turkey's young population is a key factor influencing the market, as this group shows a great eagerness to try new flavors and health-oriented advancements. TurkStat's most recent statement indicated that by 2024, Turkey will have 12.7 million youth, accounting for 15% of the overall population. This large group of young consumers responds positively to contemporary branding, innovative packaging, and digital marketing tactics that present functional beverages as desirable lifestyle items. Their choices go beyond flavor to encompass convenience, identity, and harmony with self-care practices, with many prepared to spend more on items that represent these principles. The influence of this demographic goes further than their direct consumption, as their preferences frequently establish wider trends that older generations slowly embrace. By insisting on innovation and genuineness, the youth in Turkey are transforming the beverage sector and accelerating the shift of functional drinks from specialized products to common consumption throughout the nation.

Turkey Functional Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Energy Drinks

- Sports Drinks

- Dairy-based Beverages

- Juices

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes energy drinks, sports drinks, dairy-based beverages, juices, and others.

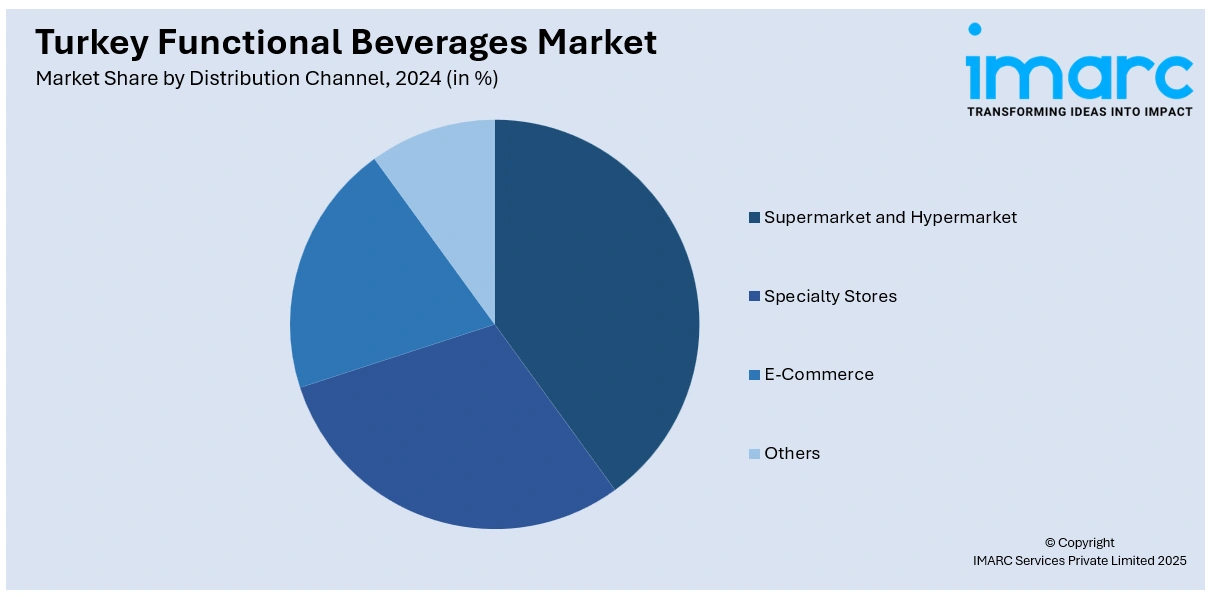

Distribution Channel Insights:

- Supermarket and Hypermarket

- Specialty Stores

- E-Commerce

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket and hypermarket, specialty stores, e-commerce, and others.

End User Insights:

- Athletes

- Fitness Lifestyle Users

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes athletes, fitness lifestyle users, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Functional Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Energy Drinks, Sports Drinks, Dairy-based Beverages, Juices, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Specialty Stores, E-commerce, Others |

| End Users Covered | Athletes, Fitness Lifestyle Users, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey functional beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey functional beverages market on the basis of type?

- What is the breakup of the Turkey functional beverages market on the basis of distribution channel?

- What is the breakup of the Turkey functional beverages market on the basis of end user?

- What is the breakup of the Turkey functional beverages market on the basis of region?

- What are the various stages in the value chain of the Turkey functional beverages market?

- What are the key driving factors and challenges in the Turkey functional beverages market?

- What is the structure of the Turkey functional beverages market and who are the key players?

- What is the degree of competition in the Turkey functional beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey functional beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey functional beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey functional beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)