Turkey Green Hydrogen Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region, 2026-2034

Turkey Green Hydrogen Market Summary:

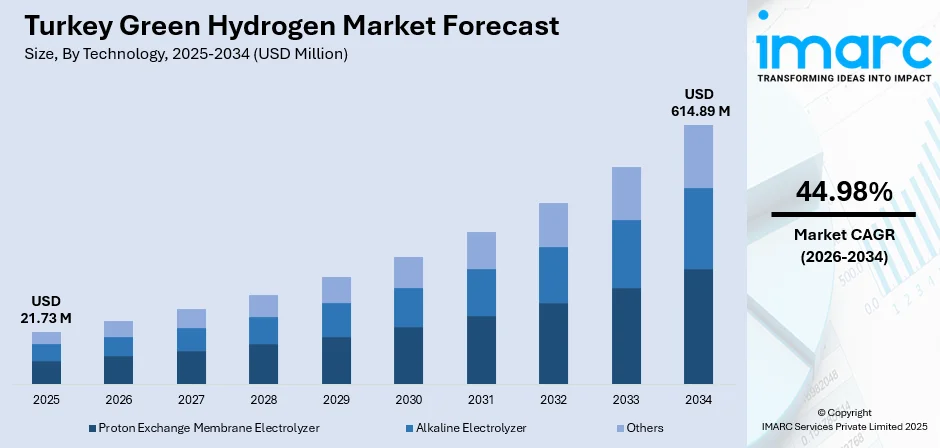

The Turkey green hydrogen market size was valued at USD 21.73 Million in 2025 and is projected to reach USD 614.89 Million by 2034, growing at a compound annual growth rate of 44.98% from 2026-2034.

The market is experiencing rapid expansion driven by national decarbonization commitments and strategic infrastructure development aimed at positioning Turkey as a regional hydrogen hub. Government support through the National Hydrogen Technologies Strategy and Roadmap, combined with favorable renewable energy resources and geographic positioning between Europe, Asia, and the Middle East, is creating momentum for electrolyzer capacity expansion and pilot project deployment. The integration of green hydrogen into industrial applications and power generation systems, supported by international partnerships and EU alignment initiatives, is expanding the Turkey green hydrogen market share.

Key Takeaways and Insights:

-

By Technology: Proton exchange membrane electrolyzer dominates the market with a share of 46.12% in 2025, driven by superior operational flexibility and compatibility with variable renewable energy sources.

-

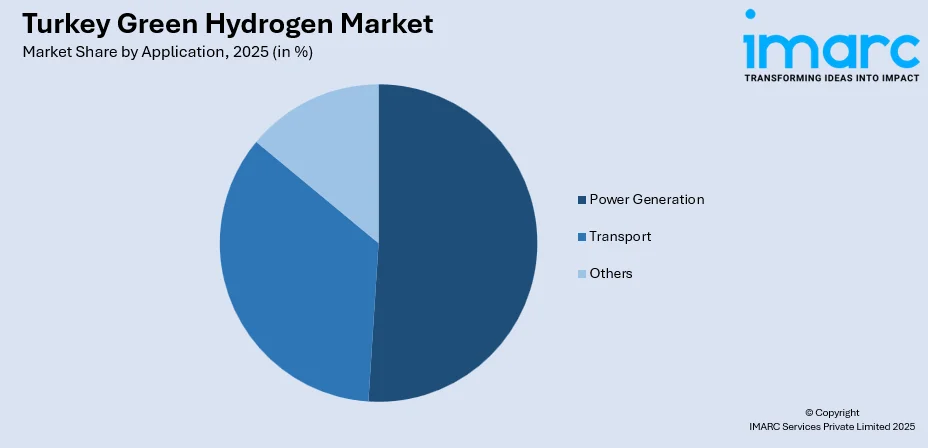

By Application: Power generation leads the market with a share of 51.05% in 2025, reflecting strong demand for grid stabilization and energy storage solutions.

-

By Distribution Channel: Cargo represents the largest segment with a market share of 63.09% in 2025, highlighting current infrastructure limitations and reliance on compressed storage transportation.

-

By Region: Marmara leads the market with a share of 19% in 2025, due to industrial demand, renewable capacity, ports, and existing energy infrastructure.

-

Key Players: The Turkey green hydrogen market features emerging domestic capabilities alongside international technology providers, with key focus areas including electrolyzer manufacturing, renewable energy integration, and infrastructure development through public-private partnerships.

To get more information on this market Request Sample

Turkey's strategic positioning as an energy corridor connecting continents, combined with abundant solar and wind resources in Central Anatolia and Aegean regions, provides natural advantages for green hydrogen production and export. The government has outlined ambitious targets including 2 GW electrolyzer capacity by 2030 and potential hydrogen production reaching 3.4 million tons annually by 2050, with significant export potential. Recent developments demonstrate practical progress, with international collaboration exemplified by June 2025's EU-funded green hydrogen project announcement focusing on electrolysis technology and domestic energy infrastructure integration. Major cities including Istanbul, Ankara, and Izmir serve as innovation centers, attracting investments in hydrogen technologies. The Güney Marmara Hydrogen Coast project, which secured a €7.5 million European Commission grant in 2025, represents Turkey's major planned hydrogen valley and demonstrates concrete infrastructure development advancing the sector beyond policy frameworks into operational deployment.

Turkey Green Hydrogen Market Trends:

Government-Led Strategic Infrastructure Development

Turkey is advancing from hydrogen strategy formulation to concrete implementation through coordinated policy frameworks and targeted investments. The government has established electrolyzer capacity targets progressing from 2 GW by 2030 to 5 GW by 2035, demonstrating long-term commitment to sector development. This structured capacity building approach addresses both domestic energy security objectives and export market opportunities. In 2025, The EU has initiated a €3 million technical support project aimed at advancing Türkiye's green and low-carbon hydrogen ecosystem, with BOTAS being the primary beneficiary. The project will evaluate hydrogen compatibility within current infrastructure, create a national Hydrogen Master Network Plan, and provide extensive capacity-building assistance.

Renewable Energy Integration Driving Production Economics

The declining costs of renewable energy generation, particularly solar and wind power, are fundamentally improving green hydrogen production economics in Turkey. Coastal regions including the Aegean and Black Sea demonstrate lower production costs due to superior renewable resource availability, while strategic integration of electrolysis systems with existing renewable infrastructure enables efficient utilization of electricity supply fluctuations. Turkey aims to increase renewable energy capacity substantially, with projections indicating potential cost reductions for hydrogen production from under $2.4/kg by 2035 and to $1.2/kg by 2050. This is primarily planned through improved electrolyzer efficiency. This cost trajectory, combined with favorable solar irradiance and wind conditions across diverse geographic regions, positions renewable-powered electrolysis as economically viable for industrial-scale deployment.

Strategic Geographic Positioning for Export Markets

Turkey's location bridging Europe, Asia, and the Middle East creates unique advantages for hydrogen trade route development and pipeline connectivity. The country possesses an extensive natural gas pipeline network totaling 10,000 kilometers with capacity enabling potential hydrogen transportation either in pure form or blended configurations. This existing infrastructure foundation, combined with proximity to major European demand centers pursuing decarbonization goals, positions Turkey strategically for hydrogen export markets. Policy discussions increasingly focus on aligning green hydrogen production with EU environmental regulations and export strategies. In 2025, Four major firms from various parts of Europe officially executed a Memorandum of Understanding (MoU) at the Global Hydrogen Summit in Rotterdam, initiating the formation of the See Hydrogen Mobility Consortium. The project seeks to create an extensive hydrogen transportation route that extends across Eastern and Central Europe, Turkey, and links to Western Europe. The initial pilot was launched in 2028 in Bulgaria.

Market Outlook 2026-2034:

The Turkey green hydrogen market is positioned for accelerated growth as pilot projects transition to commercial operations and infrastructure investments mature. The market generated a revenue of USD 21.73 Million in 2025 and is projected to reach a revenue of USD 614.89 Million by 2034, growing at a compound annual growth rate of 44.98% from 2026-2034. Electrolyzer technology localization efforts, modeled after Turkey's successful domestic solar panel manufacturing evolution, aim to reduce technology import dependency. Integration of hydrogen into industrial decarbonization pathways, particularly for steel production and chemical manufacturing, will expand beyond current power generation applications.

Turkey Green Hydrogen Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Proton Exchange Membrane Electrolyzer |

46.12% |

|

Application |

Power Generation |

51.05% |

|

Distribution Channel |

Cargo |

63.09% |

|

Region |

Marmara |

19% |

Technology Insights:

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Others

Proton exchange membrane electrolyzer dominates with a market share of 46.12% of the total Turkey green hydrogen market in 2025.

Proton exchange membrane (PEM) electrolyzer technology leads Turkey's green hydrogen market through superior operational characteristics that align with renewable energy integration requirements. PEM systems demonstrate rapid response capabilities to power fluctuations, making them ideally suited for coupling with variable solar and wind energy sources prevalent across Turkish regions. The technology operates at lower temperatures compared to alternative electrolysis methods while delivering high current density and producing ultra-pure hydrogen exceeding 99.999 percent purity, meeting stringent industrial application requirements. PEM electrolyzers' compact design and smaller footprint enable deployment across diverse facility configurations, from industrial sites to distributed generation installations. In May 2024, Biga Hydrogen signed collaboration agreements with Stargate Hydrogen for electrolyzer stack supply, with the first phase involving a 100 cubic meter per hour capacity turnkey electrolysis plant in Manisa's industrial zone, scheduled for third-quarter 2025 operation, demonstrating practical PEM technology deployment advancing Turkey's industrial decarbonization objectives.

Turkey is pursuing domestic electrolyzer manufacturing capabilities to reduce technology import dependency, mirroring its successful solar panel localization strategy that achieved domestic production from complete import reliance within a decade. Research institutions have developed PEM electrolyzer module prototypes, establishing national competence in both hydrogen consumption through fuel cells and production technologies. These efforts aim to create indigenous capacity in energy storage and green hydrogen production, crucial for enhancing energy supply security and achieving decarbonization targets. The technology's advantages including fast switching on-off capabilities and high efficiency position PEM electrolyzers as strategic components for renewable energy storage, converting excess electricity from solar or wind installations into hydrogen for long-term lossless storage, addressing intermittency challenges inherent in renewable power generation.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Transport

- Others

Power generation leads with a share of 51.05% of the total Turkey green hydrogen market in 2025.

Power generation applications lead the Turkey green hydrogen market as the sector addresses electricity grid stabilization challenges associated with increasing renewable energy penetration. Green hydrogen enables long-duration energy storage, converting surplus electricity from solar and wind installations during peak generation periods into storable fuel that can be converted back to electricity through fuel cells or combustion during demand peaks or renewable generation gaps. This capability addresses Turkey's growing renewable capacity integration needs while enhancing grid reliability and energy security. Industrial facilities are exploring combined heat and power systems incorporating hydrogen to improve energy efficiency and reduce carbon emissions from on-site generation.

Turkey's electricity demand growth projections annually create sustained requirements for flexible generation capacity that hydrogen-based systems can fulfill. The technology enables sector coupling, connecting electricity, heating, and transportation systems through hydrogen as an energy vector. Pilot projects are demonstrating technical feasibility for hydrogen integration into existing power infrastructure, including natural gas power plants where hydrogen can supplement or replace fossil fuels in generator cooling systems and combustion processes. The Bandırma Energy Hub project exemplifies such applications, with green hydrogen production targeted for generator cooling applications in natural gas power facilities, serving as a model for broader industry adoption patterns.

Distribution Channel Insights:

- Pipeline

- Cargo

Cargo exhibits a clear dominance with a 63.09% share of the total Turkey green hydrogen market in 2025.

Cargo-based distribution currently dominates Turkey's green hydrogen market due to limited dedicated pipeline infrastructure for hydrogen transport. Compressed gas trailers and specialized containers enable hydrogen delivery to industrial facilities, pilot projects, and emerging refueling stations across dispersed locations. This transportation method provides flexibility during the market's nascent development phase, allowing hydrogen producers to reach customers without requiring extensive fixed infrastructure investments. Mobile refueling solutions are gaining attention, exemplified by July 2025's announcement of Akfen Renewable Energy securing a €3.4 million Eurogia2030 grant for mobile hydrogen filling station development, addressing distribution challenges through transportable refueling infrastructure that can serve multiple locations and support early-stage hydrogen vehicle fleet operations before permanent station networks emerge.

However, pipeline distribution is positioned for substantial growth as Turkey leverages its existing 10,000-kilometer natural gas transmission and distribution network. These pipelines can transport hydrogen either in pure form or blended with natural gas at varying concentrations, with current strategies contemplating hydrogen blending until 2025. The 32 billion cubic meter natural gas pipeline capacity theoretically enables transporting an estimated 575 million tons of hydrogen yearly to neighboring countries using 20 percent hydrogen-natural gas blending ratios. This infrastructure foundation positions Turkey as a potential hydrogen corridor linking Europe with Middle Eastern and Asian regions, supporting export-oriented market development alongside domestic distribution requirements.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara leads with a share of 19% of the total Turkey green hydrogen market in 2025.

The Marmara region stands out as the largest and most advanced region in Turkey’s green hydrogen market, driven by its strong industrial base, dense energy infrastructure, and access to renewable power. Home to major manufacturing clusters, ports, and logistics networks, Marmara offers ideal conditions for early adoption of green hydrogen across multiple sectors. Industries located here, including steel, chemicals, cement, glass, and refining, already rely heavily on hydrogen and are under growing pressure to cut emissions, making the shift to green hydrogen both practical and urgent. Marmara also benefits from significant wind and solar capacity, particularly in southern parts of the region, which supports cost-effective green hydrogen production through electrolysis.

Proximity to demand centers reduces transport challenges and supports pilot projects that integrate production, storage, and end use within a limited geographic area. The region’s ports further strengthen its position by enabling future hydrogen and derivative exports, as well as imports of technology and equipment. Strong collaboration between industry players, research institutions, and public bodies has helped Marmara move ahead of other regions in project development and planning. With expanding renewable capacity, existing gas infrastructure that can be adapted, and clear industrial demand, Marmara is expected to remain the focal point of Turkey’s green hydrogen growth in the coming years.

Market Dynamics:

Growth Drivers:

Why is the Turkey Green Hydrogen Market Growing?

National Hydrogen Technologies Strategy and Roadmap Implementation

Turkey's comprehensive National Hydrogen Technologies Strategy and Roadmap establishes clear capacity expansion targets and policy frameworks driving systematic market development. The government has committed to increasing electrolyzer capacity, providing long-term visibility for industry investment planning. These targets align with projected green hydrogen production reaching 3.4 million tons annually by 2050. The strategy includes price reduction objectives, targeting hydrogen production costs of 2.40 dollars per kilogram by 2035 and further reduction to approximately 1.20 dollars per kilogram by 2050, creating economic conditions for competitive market positioning.

Strategic Geographic Positioning for Regional Hydrogen Hub Development

Turkey's unique geographic location bridging Europe, Asia, and the Middle East creates natural advantages for establishing a regional hydrogen production and distribution hub serving multiple continental markets. The country's strategic positioning on energy transit routes between supplier and consumer regions enables potential participation in emerging international hydrogen trade networks. Turkey possesses an extensive natural gas transmission and distribution pipeline network totaling 10,000 kilometers with large-diameter infrastructure capable of transporting hydrogen either in pure form or blended with natural gas. In 2024, Limak Cement has reached a pioneering achievement in Turkey by successfully performing hydrogen-powered cement production trials at their Limak Anka Cement facility. This project, executed in strategic partnership with Air Liquide, represents an important advancement toward carbon-neutral cement manufacturing in the Turkish sector.

Decarbonization Commitments and EU Green Deal Alignment

Turkey's climate commitments and alignment efforts with EU environmental standards are creating policy-driven demand for green hydrogen as a decarbonization pathway across hard-to-electrify sectors. The country's participation in international climate frameworks necessitates emission reduction strategies in industrial processes including steel manufacturing, cement production, and chemical synthesis where hydrogen can replace fossil fuel inputs. Industrial sectors recognizing hydrogen's strategic importance include major producers which co-financed Turkey's first domestic green hydrogen pilot plant to reduce carbon emissions from their processes and prepare for new trade systems under the European Green Deal. In 2024, Turkey unveiled the Türkiye Industrial Decarbonisation Investment Platform (TIDIP), initiated by the Ministry of Industry and Technology in partnership with the EBRD and the World Bank Group. The Commission aims to back this platform, recognized as an innovative effort propelling the comprehensive decarbonization of Türkiye's industrial sector in accordance with its NDC objectives and 2053 net-zero pledge.

Market Restraints:

What Challenges the Turkey Green Hydrogen Market is Facing?

High Initial Capital Investment Requirements

Establishing green hydrogen production infrastructure requires substantial upfront capital investments for initial commercial-scale projects in Turkey, creating significant barriers to entry for potential investors. Individual components including electrolyzers, renewable energy installations, storage systems, and distribution infrastructure each demand considerable financial commitments before revenue generation commences. The long return-on-investment timelines for hydrogen projects, often spanning multiple years, deter immediate funding and development particularly in nascent markets without established demand certainty.

Limited Hydrogen Distribution and Refueling Infrastructure

Turkey currently possesses nascent hydrogen distribution networks with only handful of refueling stations operational, hampering widespread adoption of hydrogen technologies across transportation and industrial applications. The lack of comprehensive distribution infrastructure creates chicken-and-egg challenges where hydrogen vehicle manufacturers hesitate to enter markets without refueling networks, while infrastructure investors require demonstrated demand to justify capital deployment. Hydrogen's low volumetric density creates storage and transportation challenges, requiring high-pressure compression or cryogenic liquefaction adding costs and complexity. Existing natural gas pipeline networks require modifications and safety certifications for hydrogen transport, necessitating technical assessments and regulatory approvals before repurposing for hydrogen distribution.

Technology Import Dependency and Local Manufacturing Gaps

Turkey currently lacks domestic manufacturing capabilities for critical green hydrogen technologies including advanced electrolyzers, requiring technology imports that increase costs and limit local value capture. As of current assessments, Turkey must import 100 percent of electrolyzer equipment if pursuing green hydrogen production at scale, creating supply chain dependencies and currency exposure risks. While the country achieved substantial localization success in solar panel manufacturing, transitioning from complete import reliance to 90 percent domestic production over a decade, similar progress in electrolyzer manufacturing requires sustained research investment and industrial policy support. The absence of indigenous production capabilities limits job creation potential and technology transfer benefits while exposing projects to international supply chain disruptions and price volatility.

Competitive Landscape:

The Turkey green hydrogen market features evolving competitive dynamics characterized by collaboration between domestic energy companies and international technology providers. Major Turkish energy firms and renewable energy developers are establishing pilot projects and commercial initiatives, while international electrolyzer manufacturers provide technology and expertise for early-stage installations. Project developers are partnering with equipment suppliers like Stargate Hydrogen to deploy turnkey electrolysis systems in industrial zones. Research institutions are developing indigenous electrolyzer prototypes to establish national manufacturing capabilities. The competitive landscape emphasizes public-private partnerships, with government entities providing strategic direction and funding support while private sector actors implement projects and develop commercial applications. Istanbul, Ankara, and Izmir serve as primary centers of competitive activity, attracting investments through strategic locations, robust industrial bases, and government green energy initiative support. The market exhibits moderate competitive intensity as stakeholders focus on establishing proof-of-concept operations and securing favorable policy frameworks rather than direct market competition.

Recent Developments:

-

In September 2025, Armara University's technology faculty has garnered interest in sustainable technology, as its Mechatronics Engineering Club reveals its innovative hydrogen-powered prototype vehicle on international and national stages. The automobile, built for the Shell Eco-Marathon, has proudly showcased Türkiye in Poland and is now a feature at Teknofest Istanbul.

Turkey Green Hydrogen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others |

| Applications Covered | Power Generation, Transport, Others |

| Distribution Channels Covered | Pipeline, Cargo |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey green hydrogen market size was valued at USD 21.73 Million in 2025.

The Turkey green hydrogen market is expected to grow at a compound annual growth rate of 44.98% from 2026-2034 to reach USD 614.89 Million by 2034.

Proton exchange membrane electrolyzer dominated the technology segment with 46.12% market share, driven by superior operational flexibility, rapid response to power fluctuations, and compatibility with variable renewable energy sources including solar and wind installations prevalent across Turkish regions.

Key factors driving the Turkey Green Hydrogen market include implementation of the National Hydrogen Technologies Strategy establishing electrolyzer capacity targets, strategic geographic positioning between Europe, Asia, and Middle East enabling hydrogen hub development, decarbonization commitments aligned with EU Green Deal creating policy-driven demand, and abundant renewable energy resources particularly solar and wind capacity supporting cost-competitive production.

Major challenges include high upfront capital investment requirements for initial commercial projects creating significant barriers to entry, limited hydrogen distribution and refueling infrastructure with only handful of operational stations hampering widespread adoption, technology import dependency requiring complete electrolyzer equipment imports due to absence of domestic manufacturing capabilities, and production cost competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)