Turkey Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Turkey Home Decor Market Summary:

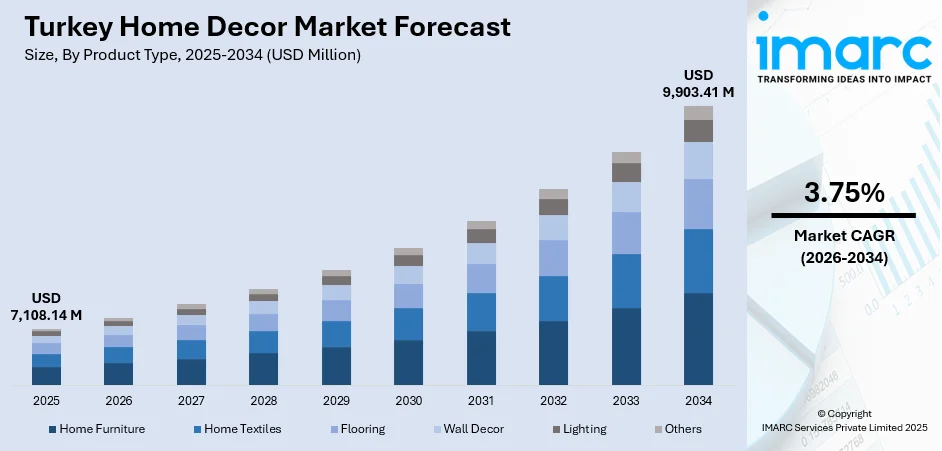

The Turkey home decor market size was valued at USD 7,108.14 Million in 2025 and is projected to reach USD 9,903.41 Million by 2034, growing at a compound annual growth rate of 3.75% from 2026-2034.

The Turkey home decor market is experiencing sustained momentum driven by accelerating urbanization, rising consumer spending on interior aesthetics, and a growing preference for modern living spaces. Digital retail transformation is reshaping purchasing behaviors, with omni-channel strategies gaining prominence across major metropolitan areas. Increasing demand for multifunctional furniture solutions and sustainability-focused products continues to enhance Turkey home decor market share.

Key Takeaways and Insights:

- By Product Type: Home furniture dominates the market with a share of 40% in 2025, driven by rising household formation rates and consumer preference for functional, aesthetically appealing living spaces.

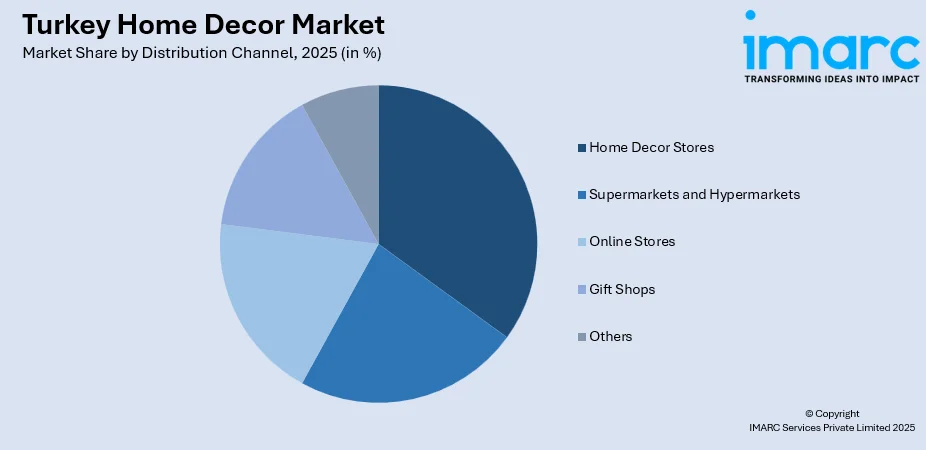

- By Distribution Channel: Home decor stores lead the market with a share of 35% in 2025, benefiting from experiential shopping preferences and personalized customer service in physical retail environments.

- Key Players: The Turkey home decor market exhibits moderate competitive intensity characterized by a dynamic mix of established domestic manufacturers and international retailers. Market participants compete through product innovation, brand positioning, sustainability initiatives, and omni-channel distribution strategies to capture consumer preference across diverse price segments.

To get more information on this market, Request Sample

The Turkey home decor market represents one of the most dynamic segments within the broader Middle Eastern consumer goods landscape, driven by the nation's strategic position bridging European and Asian markets. Turkey's rapid urbanization trajectory, now residing in urban centers creates substantial structural demand for residential furnishing and decoration products. The market benefits from a well-established manufacturing base, enabling competitive domestic production alongside significant export capabilities. In 2024, Turkish furniture industry exports reached USD 4.5 Billion, demonstrating the sector's global competitiveness and design capabilities. Consumer preferences increasingly favor products combining contemporary aesthetics with practical functionality, reflecting global design influences while incorporating traditional Turkish craftsmanship elements.

Turkey Home Decor Market Trends:

Digital Transformation and Omni-Channel Retail Expansion

The Turkey home decor market growth is being propelled by rapid digital commerce adoption and evolving consumer shopping behaviors. Retailers are integrating augmented reality visualization tools, enabling customers to virtually preview furniture within their living spaces before purchase. In 2024, Turkey's e-commerce sector experienced remarkable expansion, with the Ministry of Trade reporting that total online transaction volume reached 3.16 trillion TRY, representing 61.7% year-on-year growth. Major furniture brands now operate full-featured online platforms with virtual showrooms, live chat assistance, and nationwide delivery services.

Rising Demand for Multifunctional and Space-Saving Solutions

Urban densification across Turkish metropolitan areas is fueling demand for furniture that maximizes limited living spaces while maintaining aesthetic appeal. Manufacturers are responding with convertible sofas, extendable dining tables, modular shelving units, and wall-mounted storage systems featuring minimalist designs with neutral color palettes. Turkish Statistical Institute data from December 2024 revealed that the national population grew to 85.66 million, with urban residency rates climbing to 93.4%. This demographic shift toward smaller urban apartments drives innovation in compact, efficient furniture solutions that balance functionality with contemporary style preferences.

Growing Focus on Sustainability and Eco-Friendly Materials

Environmental consciousness is increasingly influencing consumer preferences and manufacturing strategies within Turkey's home decor market, spurring innovation in sustainable product design and materials. The Turkish government has implemented regulations promoting sustainable practices in the furniture industry, mandating manufacturers to adopt eco-friendly materials and production processes that reduce environmental impact. Rattan furniture, being a renewable and biodegradable material, is experiencing growing popularity for outdoor and indoor applications. Turkish manufacturers are investing in machinery, skilled artisanship, and design capabilities to meet global sustainability standards, positioning the country as an attractive source for environmentally conscious importers worldwide.

Market Outlook 2026-2034:

The Turkey home decor market demonstrates promising growth potential throughout the forecast period, supported by irreversible urbanization trends, evolving consumer aesthetics, and expanding digital retail infrastructure. The market generated a revenue of USD 7,108.14 Million in 2025 and is projected to reach a revenue of USD 9,903.41 Million by 2034, growing at a compound annual growth rate of 3.75% from 2026-2034. Government-supported infrastructure modernization, rising household incomes, and increasing international brand presence will continue shaping competitive dynamics and product innovation across all market segments.

Turkey Home Decor Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Home Furniture |

40% |

|

Distribution Channel |

Home Decor Stores |

35% |

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The home furniture segment dominates with a market share of 40% of the total Turkey home decor market in 2025.

Home furniture represents the cornerstone of Turkey's home decor market, encompassing living room, bedroom, dining, and office furniture categories that address fundamental household furnishing requirements. This segment benefits from rising household formation rates driven by urbanization, with new residential units constructed annually across Turkish cities. Consumer preferences increasingly favor pieces combining modern aesthetics with traditional craftsmanship elements, reflecting Turkey's unique cultural positioning between European contemporary design and Middle Eastern decorative traditions.

The segment's leadership is reinforced by Turkey's substantial manufacturing capabilities, with major production clusters in Istanbul, Ankara, Kayseri, and Izmir supplying both domestic demand and export markets. Living room furniture and home accessories maintain particular popularity due to their essential role in home aesthetics and functionality. Market trends highlight increased demand for modular and multifunctional furniture solutions, with smart furniture integration gaining traction among technology-conscious urban consumers seeking connectivity features and space optimization.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Stores

- Gift Shops

- Others

The Home decor stores segment leads with a share of 35% of the total Turkey home decor market in 2025.

Home decor specialty stores maintain distribution leadership through their ability to deliver curated shopping experiences, expert consultation services, and comprehensive product assortments that address diverse consumer preferences. These retail formats benefit from trust associations developed through direct product interaction, enabling customers to evaluate quality, comfort, and aesthetic compatibility before purchase. Major urban centers including Istanbul, Ankara, and Izmir host extensive specialty retail networks ranging from large-format showrooms to boutique design studios.

The channel's dominance reflects consumer preferences for experiential shopping environments where personalized guidance enhances purchase confidence for high-value items. Specialty retailers increasingly integrate digital elements including virtual room planning tools and online catalog browsing to complement in-store experiences. However, online stores represent the fastest-growing distribution channel, driven by Turkey's e-commerce expansion with transaction volumes reaching 3 trillion TRY in 2024 according to Ministry of Trade data.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara region dominates Turkey's home decor market, anchored by Istanbul as the nation's commercial hub and primary center for furniture manufacturing, retail, and international trade. The region hosts major furniture complexes including MASKO and MODOKO, which bring together hundreds of brands under single locations, offering consumers comprehensive shopping experiences across all price segments and design styles. Bursa province, particularly the İnegöl district, dominates wooden furniture production with vertically integrated facilities handling everything from raw timber processing to finished goods. The region benefits from superior per capita income levels, advanced e-commerce penetration, and concentrated population density driving sustained demand for modern, premium home furnishings.

Central Anatolia represents a significant manufacturing hub for Turkey's home decor industry, with Kayseri serving as headquarters for major furniture brands including Istikbal, Bellona, and Mondi. Ankara, the capital city, hosts a growing middle class that actively invests in home decor, supported by expanding residential construction and modernization of existing housing stock. The region's furniture manufacturers produce panel furniture, upholstered items, and bedroom sets distributed nationally and internationally through extensive retail networks. Traditional carpet and kilim production in cities like Konya, historically praised by Marco Polo as producing the world's most beautiful carpets, continues to contribute distinctive handcrafted products to the home decor market.

The Mediterranean region, centered around Antalya as Turkey's tourism capital, drives demand for home decor products serving both residential and hospitality sectors. The region's coastal lifestyle creates strong demand for outdoor furniture, garden furnishings, and Mediterranean-style interior design elements suited to the warm climate. Modern shopping complexes including TerraCity, MarkAntalya, and Mall of Antalya provide comprehensive home decor retail experiences featuring local and international brands. The thriving tourism industry, attracting millions of visitors annually, supports demand for vacation rental furnishings and holiday home decor, while established expat communities contribute to sustained residential market activity throughout the year.

The Aegean region, with Izmir as its commercial center, represents a distinctive market segment characterized by coastal lifestyle preferences and contemporary design sensibilities. Izmir's strategic coastal location benefits furniture manufacturers focused on outdoor furniture and stylish home furnishings appealing to both residents and tourists. The region hosts specialized furniture production clusters focusing on contemporary designs and benefiting from coastal logistics facilitating exports. Historic bazaars including Kemeraltı in Izmir offer traditional home decor items, ceramics, textiles, and handcrafted accessories, while modern shopping centers cater to consumers seeking contemporary furniture and international brand offerings.

Southeastern Anatolia holds significant importance for Turkey's home decor market through its rich heritage of traditional craftsmanship, particularly in copper work, textile production, and kilim weaving. Gaziantep, as a UNESCO Creative Cities Network member, is renowned for exquisite coppersmithing at the historic Bakırcılar Çarşısı, producing decorative trays, wall art, candle holders, and functional kitchenware prized for their artisanal authenticity. The region's strategic proximity to Middle Eastern markets supports cross-border trade while preserving distinctive design traditions influenced by centuries of cultural exchange. Traditional kilim production continues using slitweave methods, with designs adapted to accommodate contemporary interior decoration preferences of urban and international buyers.

The Black Sea region contributes to Turkey's home decor market through distinctive architectural heritage and traditional craftsmanship reflecting the area's unique cultural identity. Trabzon and Samsun serve as regional commercial centers, with traditional house architecture inspiring furniture designs characterized by wooden craftsmanship suited to the mountainous terrain and cooler climate. Safranbolu, a UNESCO World Heritage site, showcases centuries-old Ottoman-era mansions that influence regional interior design preferences and support artisanal production of traditional home decor items. The region's forest resources support local woodworking traditions, while period furniture production preserves historical design elements appreciated by collectors and heritage-conscious consumers.

Eastern Anatolia represents the most multicultural region for Turkey's home decor market, with carpet and kilim traditions reflecting influences from Kurdish, Armenian, and Turkmen heritage communities. Erzurum and Van serve as market centers for handwoven rugs, kilims, and decorative textiles featuring distinctive regional motifs and color palettes influenced by the harsh mountain climate. The region's carpet production, characterized by long-pile construction providing heat insulation in extremely cold winters, uses high-quality wool from locally bred sheep known for glossy, silky fibers. Traditional handicrafts including copperware and felt products produced in historic caravanserais-turned-marketplaces contribute unique artisanal items valued for their cultural authenticity and handcrafted quality.

Market Dynamics:

Growth Drivers:

Why is the Turkey Home Decor Market Growing?

Accelerating Urbanization and Population Growth Driving Residential Demand

Turkey is experiencing sustained urbanization that fundamentally reshapes housing demand patterns and creates structural long-term growth drivers for the home decor market. The Turkish Statistical Institute reported in February 2025 that the national population reached 85.66 Million by December 2024, with urban residency rates climbing to 93.4% from 93% in the previous year. The population growth rate accelerated to 3.4 per thousand in 2024, up significantly from 1.1 per thousand in 2023. This urban concentration, particularly in major metropolitan areas including Istanbul with 15.7 Million residents, Ankara with 5.86 Million, and Izmir with 4.48 Million, generates continuous demand for residential furnishing as households establish and upgrade living spaces. The urban housing market sees approximately 1.5 million new homes built annually, each requiring comprehensive interior decoration and furnishing.

Digital Commerce Transformation Enhancing Market Accessibility

The Turkish e-commerce landscape is experiencing transformative expansion that directly benefits the home decor market by improving product accessibility, reducing purchasing barriers, and enabling broader geographic reach beyond traditional urban retail centers. The Ministry of Trade's 2025 report revealed that Turkey's e-commerce sector grew by 61.7% in 2024, reaching total transaction volumes of 3 Trillion TRY with 5.91 Billion total transactions. Retail e-commerce specifically recorded 1.85 Billion transactions, marking a 10.1% year-on-year increase. Quick commerce experienced particularly rapid growth at 98.1% year-on-year, reaching TRY 249.8 Billion in transaction volume. This digital infrastructure expansion enables home decor retailers to reach consumers across all regions, including previously underserved areas, while providing enhanced visualization tools and flexible delivery options.

Rising Consumer Spending and Middle-Class Expansion

Increasing household incomes and evolving consumer aspirations are driving demand for quality home decor products that reflect personal style and social status. Despite inflationary pressures, Turkish consumers demonstrate sustained interest in home improvement investments, with home sales jumping 37.3% in September 2024 according to Turkish Statistical Institute data. This indicates strong underlying demand for residential properties requiring furnishing and decoration. The growth of Turkey's middle class, particularly in urban centers, supports premiumization trends as consumers increasingly seek higher-quality furniture, designer pieces, and internationally-inspired aesthetics. Rising living standards and exposure to global design trends through digital platforms further stimulate demand for contemporary home decor solutions.

Market Restraints:

What Challenges the Turkey Home Decor Market is Facing?

Economic Instability and Inflationary Pressures

Turkey's economy has faced significant challenges with inflation rates reaching 75% peak in May 2024 before moderating to approximately 38% by early 2025. This persistent inflation erodes purchasing power and directly causes cautious consumer spending behavior, particularly affecting discretionary categories including home decor. Essential expenses such as food, housing, and utilities have experienced substantial price increases, forcing households to prioritize basic needs over home improvement investments.

Intense Competition from Domestic and International Players

The Turkish home decor market remains highly crowded, with local manufacturers competing alongside global brands that continue to expand their presence. Buyers have a wide selection across every price tier, pushing companies to work harder to stand out through design, quality, and retail placement. Larger brands enjoy advantages tied to scale: stronger supply chains, well-funded marketing, and wider access to retail partners. These strengths help them secure visibility that smaller firms struggle to match. Mid-sized and emerging players often face pressure to defend their existing market share, manage rising costs, and keep up with shifting consumer preferences driven by aggressive competitors.

Technology Adoption Requirements and Investment Demands

Companies in the sector face mounting expectations to upgrade their technology, both in production and in customer-facing channels. Modern equipment, automation, and smart-home-compatible product features require steady investment that can be difficult for smaller firms to absorb. Digital retail has become equally important, pushing businesses to build stronger e-commerce systems, improve online merchandising, and introduce features like AR-based room previews or virtual showrooms. These tools help buyers make more confident decisions but demand ongoing spending on software, training, and updates. For traditional manufacturers and independent retailers, the financial strain can limit their ability to innovate at the pace the market now expects.

Competitive Landscape:

The Turkey home decor market exhibits moderate competitive intensity characterized by a dynamic mix of established domestic manufacturers, regional players, and international retailers. Major domestic participants including Doğtaş, Bellona, Yataş, Çilek, Kelebek, İstikbal, Lazzoni, Vivense, and Mudo Concept compete through product innovation, brand differentiation, and multi-channel distribution strategies. International players such as IKEA maintain significant market presence through competitive pricing and broad product assortments. The competitive landscape is increasingly shaped by sustainability initiatives, e-commerce capabilities, digital marketing effectiveness, and the ability to deliver customized solutions addressing evolving consumer preferences for modern, multifunctional designs.

Recent Developments:

- In October 2024, Danish variety store chain Flying Tiger Copenhagen opened its first store in Turkey at Kanyon Shopping Mall, Istanbul, through a strategic partnership with Karaca Group. The brand, operating in 37 countries, plans to open 110 stores across Turkey over five years, with 10 stores operational by end of 2024 in Istanbul, Ankara, Izmir, Antalya, and Bursa. The expansion targets Turkish consumers with affordable home decor, kitchenware, and accessories.

- In September 2024, Turkish furniture brand Konfor entered the Indian market through a partnership with Creaticity, launching a 12,000 sq. ft. showroom in Pune. The collection features Turkish-inspired home décor including sofas, beds, wardrobes, and storage solutions tailored for urban spaces. Expansion plans include 20 stores across 15 Indian cities, e-commerce channels, and B2B partnerships, demonstrating Turkish manufacturers' international expansion capabilities.

Turkey Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey home decor market size was valued at USD 7,108.14 Million in 2025.

The Turkey home decor market is expected to grow at a compound annual growth rate of 3.75% from 2026-2034 to reach USD 9,903.41 Million by 2034.

Home Furniture dominates the Turkey home decor market with a 40% share in 2025, driven by rising household formation rates, urbanization trends, and consumer preference for functional, aesthetically appealing furniture that addresses residential furnishing requirements across diverse price segments.

Key factors driving the Turkey home decor market include accelerating urbanization with 93.4% of the population in urban areas, digital commerce transformation with e-commerce reaching 3 trillion TRY in 2024, rising consumer spending on home aesthetics, increasing demand for multifunctional furniture, and growing sustainability focus.

Major challenges include persistent inflationary pressures impacting consumer purchasing power, supply chain disruptions extending raw material lead times, currency volatility affecting import costs, intense competitive pressure from market fragmentation, and economic uncertainty influencing discretionary spending behavior.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)