Turkey Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2026-2034

Turkey Ice Cream Market Overview:

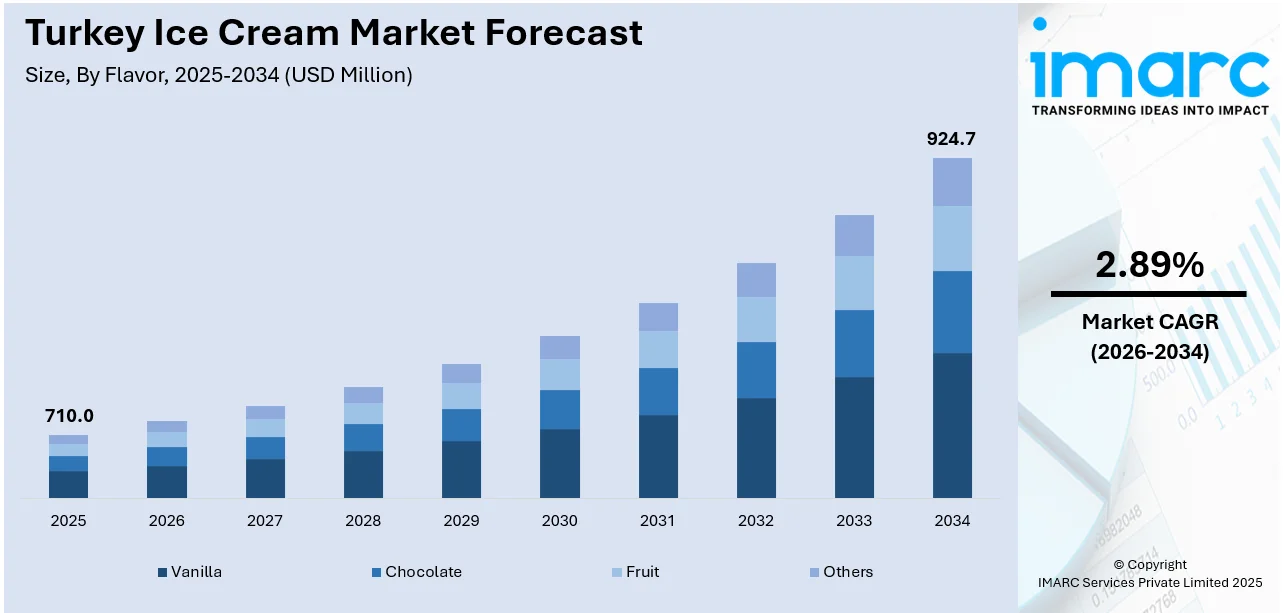

The Turkey ice cream market size reached USD 710.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 924.7 Million by 2034, exhibiting a growth rate (CAGR) of 2.89% during 2026-2034. The market is evolving with growing consumer appetite for innovative flavors, artisanal textures, and plant-based options, while traditional varieties remain deeply rooted. Youth-driven demand and creative product development are expanding offerings in retail and foodservice outlets. Focus on clean-label ingredients and appealing formats is strengthening competition and reshaping distribution strategies, thus enhancing the Turkey ice cream market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 710.0 Million |

| Market Forecast in 2034 | USD 924.7 Million |

| Market Growth Rate 2026-2034 | 2.89% |

Turkey Ice Cream Market Trends:

Traditional and Cultural Appeal

The deep cultural roots of Turkey’s ice cream market strongly influence consumer preferences. Traditional varieties like dondurma, known for its chewy texture and resistance to melting, remain highly popular across the country. Originating from Kahramanmaraş, dondurma is not only a dessert but also a cultural symbol, often served through theatrical performances by street vendors. This blend of food and entertainment has created a unique identity for Turkish ice cream, attracting both domestic consumers and tourists. Local brands have built strong reputations by preserving authenticity while expanding nationally and internationally. The celebration of heritage through product storytelling, branding, and traditional ingredients continues to drive strong local demand. This rich cultural association enhances brand loyalty and ensures the consistent popularity of traditional ice cream within Turkey.

To get more information on this market Request Sample

Flavor Innovation and Premium Offerings

The Turkey ice cream market growth is also driven by evolving consumer preferences and the demand for variety. Brands are innovating with new flavors such as Turkish coffee, baklava, tahini, and exotic fruits to attract attention and excite taste buds. Beyond flavors, premium offerings like gelato, low-sugar options, and artisanal varieties are expanding rapidly, especially in urban areas. Young and health-aware consumers prefer brands that provide indulgence without compromising on quality. Additionally, seasonal product launches and limited-edition formats are used to maintain novelty and encourage repeat purchases. These innovations help brands stand out in a competitive landscape and attract customers seeking personalized or gourmet experiences. As consumers become more experimental, flavor diversity and premium positioning remain key drivers of growth in the Turkish ice cream industry.

Health Awareness and Product Reformulation

Turkish consumers are becoming more health-conscious, prompting ice cream producers to adapt their offerings accordingly. There is increasing interest in plant-based alternatives, reduced-sugar options, and products made from natural ingredients without artificial additives. Brands are responding by introducing vegan ice cream made from almond, soy, or coconut milk, as well as functional variants with added proteins or probiotics. Additionally, lactose-free and gluten-free options are being developed to meet the needs of dietary-restricted individuals. These healthier ice cream types appeal especially to younger and urban consumers who seek guilt-free indulgence. Marketing that emphasizes clean-label ingredients and nutritional benefits is proving effective. As the trend grows, health-focused innovation and reformulation are becoming essential to stay competitive and to meet evolving consumer expectations in Turkey’s ice cream market.

Turkey Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on flavor, category, product, and distribution channel.

Flavor Insights:

- Vanilla

- Chocolate

- Fruit

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes vanilla, chocolate, fruit, and others.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes impulse ice cream, take-home ice cream, and artisanal ice cream.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes cup, stick, cone, brick, tub, and others.

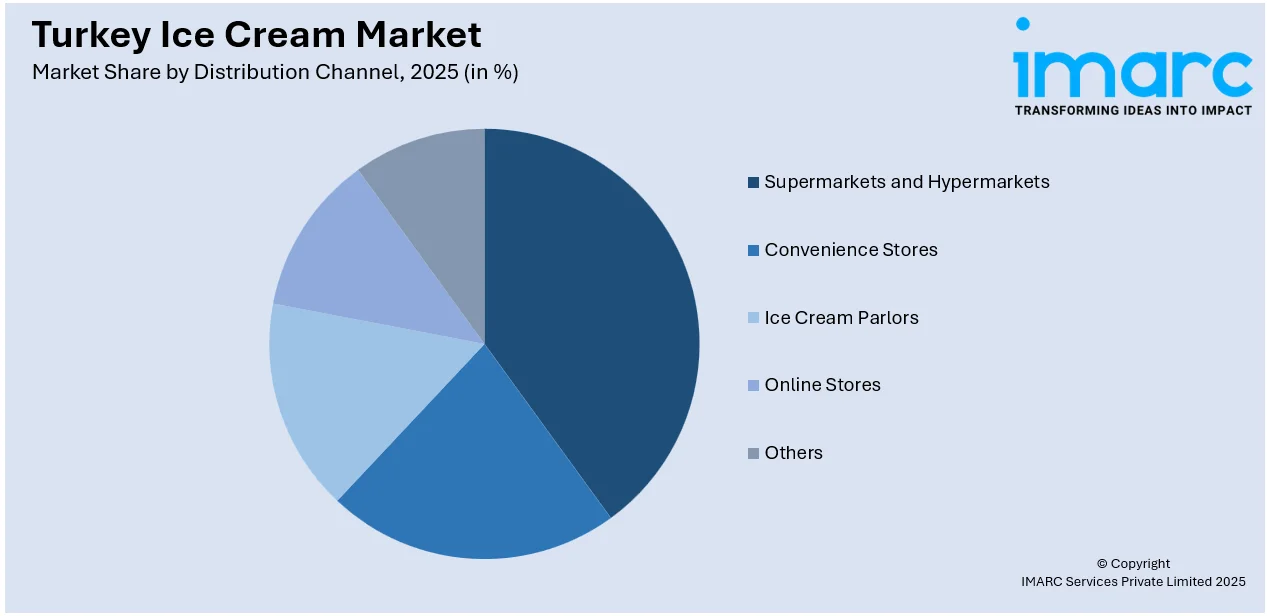

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others.

Region Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey ice cream market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey ice cream market on the basis of flavor?

- What is the breakup of the Turkey ice cream market on the basis of category?

- What is the breakup of the Turkey ice cream market on the basis of product?

- What is the breakup of the Turkey ice cream market on the basis of distribution channel?

- What is the breakup of the Turkey ice cream market on the basis of region?

- What are the various stages in the value chain of the Turkey ice cream market?

- What are the key driving factors and challenges in the Turkey ice cream market?

- What is the structure of the Turkey ice cream market and who are the key players?

- What is the degree of competition in the Turkey ice cream market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey ice cream market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)