Turkey Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2026-2034

Turkey Industrial Gases Market Summary:

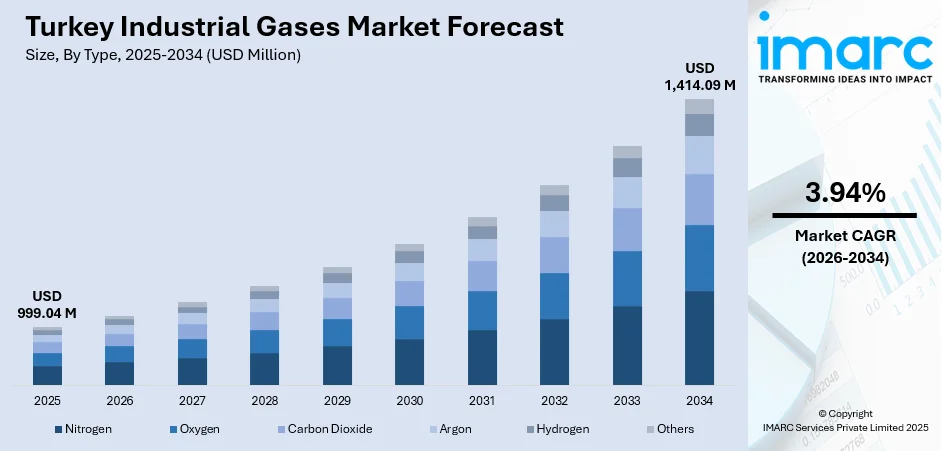

The Turkey industrial gases market size was valued at USD 999.04 Million in 2025 and is projected to reach USD 1,414.09 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

The market is driven by expanding manufacturing capabilities, rising steel production, growing healthcare infrastructure, and increasing food processing activities that require controlled atmospheric environments. Technological advancements in air separation units and growing adoption of on-site gas generation systems further accelerate demand. Infrastructure modernization initiatives and automotive sector expansion create sustained consumption patterns across diverse end-user segments, positioning the Turkey industrial gases market as a vital component of industrial development.

Key Takeaways and Insights:

-

By Type: Nitrogen dominates the market with a share of 28.29% in 2025, driven by its versatile applications in inerting, purging, and blanketing operations across manufacturing facilities, extensive use in food packaging preservation, and critical metal heat treatment processes.

-

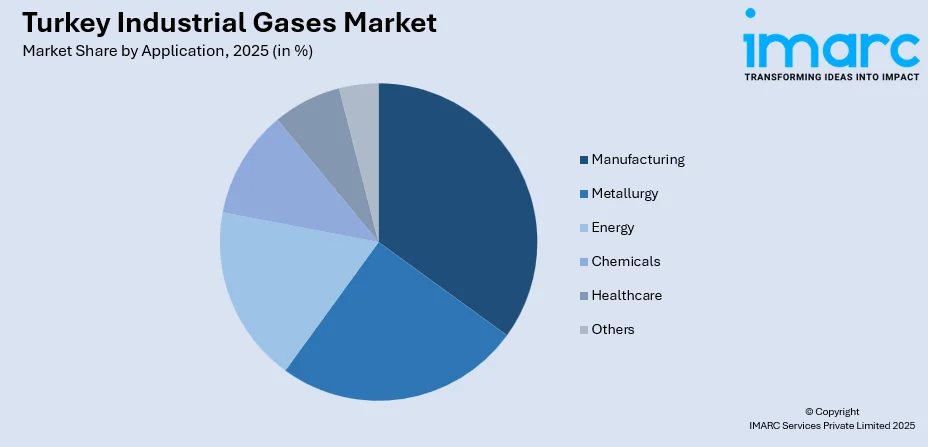

By Application: Manufacturing leads the market with a share of 27.09% in 2025, owing to metal fabrication, welding operations, steel production, chemical manufacturing, and automotive assembly, all of which require precise atmospheric control throughout production cycles.

-

By Supply Mode: Packaged represents the largest segment with a market share of 34.02% in 2025, driven by its flexibility for small to medium enterprises, ease of transportation to remote facilities, cost-effectiveness for intermittent usage, and precise control over specialized gas mixture compositions.

-

By Region: Marmara leads the market with a share of 21% in 2025, owing to Istanbul's industrial concentration, Kocaeli's manufacturing clusters, Bursa's automotive production base, and the strategic hosting of organized industrial zones that drive consistent demand.

-

Key Players: The competitive environment blends multinational corporations with extensive distribution networks and regional suppliers offering specialized services. Market participants compete through supply reliability, technical support capabilities, customized gas solutions, strategic proximity to major industrial clusters, and service differentiation across diverse customer segments.

To get more information on this market Request Sample

The Turkey industrial gases market experiences robust momentum through several interconnected factors. The country's strategic position as a manufacturing hub between Europe and Asia creates sustained demand across diverse sectors. According to the reports, in 2025, Turkey’s industrial production increased 5.0% year-on-year, led by manufacturing growth of 5.5% and a 5.8% rise in electricity and gas output, as reported by TÜİK. Moreover, steel production expansion, particularly in organized industrial zones throughout the Marmara region, generates continuous requirements for oxygen, nitrogen, and argon. The food and beverage (F&B) sector, encompassing nearly thousands of processing facilities, increasingly adopts modified atmosphere packaging and preservation technologies. Healthcare infrastructure modernization drives medical oxygen and specialty gas consumption. Automotive manufacturing growth, with Turkey ranking among global production leaders, necessitates precision welding gases and controlled atmosphere applications. Chemical manufacturing activities, particularly in petrochemical complexes along coastal areas, require hydrogen, nitrogen, and process gases for synthesis operations. Electronics manufacturing emergence and semiconductor initiatives create demand for high-purity specialty gases.

Turkey Industrial Gases Market Trends:

Advanced Gas Separation Technology Adoption

Industrial gas producers increasingly implement membrane separation and pressure swing adsorption technologies alongside traditional cryogenic methods. These modular systems enable on-site gas generation capabilities for large manufacturing facilities, reducing dependency on bulk liquid deliveries and minimizing logistics costs. Membrane nitrogen generators find particular adoption in food processing plants requiring continuous supply for packaging operations, while pressure swing adsorption units serve metal fabrication workshops needing high-purity oxygen for cutting applications. This technological shift aligns with manufacturing sector preferences for operational autonomy and supply chain resilience.

Sustainable Production and Carbon Reduction Initiatives

Environmental consciousness drives industrial gas producers toward renewable energy integration and emission reduction strategies. Solar-powered air separation units emerge in regions with favorable climate conditions, particularly supporting operations in southern manufacturing zones. Energy recovery systems capture waste heat from cryogenic processes for facility heating applications, improving overall efficiency metrics. Green hydrogen production initiatives gain momentum as Turkey positions itself within emerging clean energy supply chains, creating new market segments beyond traditional industrial applications. As per sources, in 2024, Limak Cement and Air Liquide successfully tested hydrogen-blended fuel at Ankara’s Polatli Anka plant, achieving 50 percent thermal substitution in preheating towers, Turkey’s first hydrogen application in cement production. Further, carbon dioxide capture and purification from industrial sources enable circular economy models where waste streams become valuable feedstock for beverage carbonation and greenhouse cultivation.

Integration of Smart Gas Management Systems

Digital transformation penetrates industrial gas supply chains through remote monitoring, predictive maintenance, and automated inventory management platforms. Smart cylinder tracking systems employ sensors and connectivity solutions enabling real-time visibility into gas consumption patterns, cylinder locations, and refill requirements. As per sources, Aygaz labelled 17.7 Million cylinders with QR codes and tracked over 120 Million movements, enhancing transparency, logistics efficiency, and lifecycle monitoring across Turkey’s cylinder gas sector. Moreover, manufacturing facilities deploy integrated control systems linking gas supply parameters with production processes, optimizing consumption efficiency and reducing waste. Cloud-based analytics platforms process usage data to generate insights for demand forecasting and supply optimization. These technological capabilities particularly benefit multi-site manufacturing operations requiring centralized oversight of gas inventories across geographically dispersed facilities.

Market Outlook 2026-2034:

The Turkey industrial gases market demonstrates favourable expansion prospects through the forecast period, supported by industrial capacity additions and manufacturing sector modernization. Revenue growth trajectories reflect sustained investments in organized industrial zones, particularly in earthquake-resilient facilities under development. Steel production capacity utilization improvements, targeting levels above current operational rates, will drive increased consumption of oxygen and argon for metallurgical processes. Automotive sector advancements, including electric vehicle manufacturing initiatives, create demand for specialized welding gases and battery production atmospheres. The market generated a revenue of USD 999.04 Million in 2025 and is projected to reach a revenue of USD 1,414.09 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

Turkey Industrial Gases Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Nitrogen | 28.29% |

| Application | Manufacturing | 27.09% |

| Supply Mode | Packaged | 34.02% |

| Region | Marmara | 21% |

Type Insights:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

Nitrogen dominates with a market share of 28.29% of the total Turkey industrial gases market in 2025.

Nitrogen maintains its leadership position through unmatched versatility across industrial applications. Manufacturing facilities deploy nitrogen extensively for inerting reactors, purging pipelines, and creating protective atmospheres during metal processing operations. According to reports, Forever Gas commissioned a 90 m³/h, 99.999% purity nitrogen generator for stainless steel laser cutting in Turkey’s Aegean region, including compressors, dryers, boosters, and integrated gas lines. Moreover, the F&B industry rely on nitrogen for package flushing, replacing oxygen to extend shelf life of perishable products without chemical preservatives. Electronics manufacturing utilizes high-purity nitrogen for soldering processes and semiconductor production environments requiring contamination-free atmospheres.

Pharmaceutical manufacturing operations depend on nitrogen for maintaining sterile production environments and processing active ingredients under controlled conditions. The gas's inert properties make it indispensable for fire prevention systems in industrial facilities handling combustible materials and explosive atmospheres. Metal heat treatment processes require nitrogen atmospheres for annealing, hardening, and tempering operations controlling material properties. Plastics manufacturing employs nitrogen in injection molding processes, creating hollow sections within products while reducing material costs.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Manufacturing leads with a share of 27.09% of the total Turkey industrial gases market in 2025.

Manufacturing encompasses the broadest spectrum of industrial gas utilization, spanning metal fabrication, automotive production, and general industrial processes. Welding operations consume various gas mixtures including argon-carbon dioxide blends for MIG welding, pure argon for TIG welding, and oxygen-acetylene for cutting applications. Metal heat treatment processes require nitrogen or hydrogen atmospheres for annealing, hardening, and tempering operations that control material properties. In May 2025, ÖZAK Gas Technologies launched containerized nitrogen generator systems in Turkey, enabling on-site, uninterrupted nitrogen production for industries including metal treatment, pharmaceuticals, food processing, and electronics manufacturing. Further, automotive component manufacturing demands precise atmospheric control during painting, assembly, and component production to ensure quality standards.

Manufacturing employs nitrogen in injection molding processes, creating hollow sections within thick-walled products while reducing material costs and improving production efficiency. Steel production facilities consume oxygen in basic oxygen furnaces, significantly reducing melting times compared to traditional methods. Metal fabrication workshops utilize oxygen for cutting operations, enabling precise material processing across construction projects. The manufacturing sector's diversity creates stable demand patterns as different industries experience cyclical variations at different times.

Supply Mode Insights:

- Packaged

- Bulk

- On-site

Packaged exhibits a clear dominance with a 34.02% share of the total Turkey industrial gases market in 2025.

Packaged delivered in high-pressure cylinders serve as the preferred solution for operations requiring flexibility, mobility, or intermittent usage patterns. Small and medium manufacturing enterprises favor cylinders for welding operations where mobility around fabrication facilities outweighs bulk storage considerations. Laboratories and research facilities requiring multiple specialty gases in relatively small volumes find packaged supplies most practical. Remote locations without infrastructure for bulk storage rely on cylinder deliveries despite potentially higher unit costs.

Automotive repair workshops, construction sites, and field maintenance operations depend on portable cylinder supplies enabling equipment mobility across diverse work locations. The packaged gas segment benefits from extensive distribution networks reaching customers across diverse geographical locations, including areas underserved by bulk supply infrastructure. Healthcare facilities in smaller cities utilize cylinder supplies for medical oxygen where cryogenic storage investments remain uneconomical. The flexibility of cylinder-based supply systems accommodates fluctuating demand patterns, seasonal variations, and specialized application requirements across industrial customer segments.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara dominates with a market share of 21% of the total Turkey industrial gases market in 2025.

Marmara leads industrial gas consumption through its concentration of manufacturing capacity, infrastructure development, and population density. Istanbul anchors regional demand through diverse industrial sectors including automotive assembly, food processing, chemical production, and construction activities supporting continuous urban development. Kocaeli province contributes significantly through organized industrial zones hosting automotive suppliers, petrochemical facilities, and metal processing operations. Bursa's automotive manufacturing cluster generates substantial welding gas requirements. Sakarya's growing industrial base adds to regional consumption patterns.

Organized industrial zones throughout the Marmara create concentrated demand nodes where multiple manufacturers share infrastructure and benefit from supply chain proximity. These zones feature dedicated gas distribution networks, enabling efficient service to multiple customers within defined geographical areas. Industrial zone developments in earthquake-resilient locations attract manufacturing relocations, creating new demand centers as capacity shifts to safer facilities. The region's established industrial base generates replacement demand as facilities modernize production equipment.

Market Dynamics:

Growth Drivers:

Why is the Turkey Industrial Gases Market Growing?

Infrastructure Modernization and Industrial Capacity Expansion

Turkey's ongoing infrastructure development programs create sustained demand for industrial gases across construction, manufacturing, and utilities sectors. Organized industrial zone expansions, particularly earthquake-resilient facilities under development, require comprehensive gas supply systems serving new manufacturing tenants. According to reports, in 2025, Türkiye’s Investment Environment Improvement Council released its 2025 Action Plan, promoting industrial transformation, green energy, and digital economy through 39 strategic actions. Furthermore, post-earthquake reconstruction efforts in affected regions drive steel consumption for building reinforcement, consequently increasing oxygen demand in metallurgical operations. Highway network expansions and bridge construction projects utilize welding gases extensively for structural fabrication and on-site assembly. Urban development initiatives in major metropolitan areas generate construction activity requiring cutting gases for steel beam preparation and installation.

Healthcare Sector Expansion and Medical Infrastructure Development

Turkey's healthcare infrastructure investment programs drive medical oxygen demand through hospital capacity additions and facility modernization initiatives. New hospital construction projects integrate centralized medical gas pipeline systems serving patient rooms, operating theaters, and emergency departments. As per sources, in April 2025, Islamic Development Bank's (IsDB) Board approved €500 Million to reconstruct Istanbul hospitals under the ISMEP initiative, increasing bed capacity, enhancing earthquake resilience, and supporting sustainable, continuous healthcare delivery. Moreover, existing facility upgrades retrofit modern medical gas systems replacing aged cylinder-based supply arrangements, improving reliability and safety compliance. Population aging demographics increase chronic respiratory disease prevalence, expanding home healthcare oxygen therapy requirements. Medical tourism initiatives position Turkey as a regional healthcare destination, supporting hospital capacity utilization and consequent medical gas consumption.

Food Processing Industry Growth and Preservation Technology Adoption

Turkey's F&B manufacturing sector expansion, encompassing nearly thousands of processing facilities, creates growing demand for nitrogen and carbon dioxide in preservation and packaging applications. Modified atmosphere packaging adoption increases across meat, poultry, cheese, and prepared food categories, extending shelf life while maintaining product quality without chemical preservatives. According to sources, in December 2025, Ser Pak Packaging in Turkey expanded its Prolong®️ modified atmosphere packaging technology, extending shelf life of fresh produce for exports to North America, Europe, and the Middle East. Moreover, beverage manufacturing growth, including bottled water, soft drinks, and juice production, generates carbon dioxide demand for carbonation processes. Quick freezing applications employ liquid nitrogen for maintaining product quality in frozen food production, particularly in seafood and ready-meal manufacturing.

Market Restraints:

What Challenges the Turkey Industrial Gases Market is Facing?

Energy Cost Volatility and Production Economics Pressures

Industrial gas production operations face significant energy consumption requirements, particularly for cryogenic air separation processes and gas compression activities. Electricity price fluctuations directly impact production costs, creating margin pressures when tariff adjustments cannot immediately pass through to customer pricing. Natural gas costs, relevant for hydrogen production through steam methane reforming, exhibit volatility linked to international energy markets and regional supply dynamics.

Logistics Infrastructure Limitations and Distribution Complexity

Industrial gas distribution networks face geographical constraints delivering to dispersed customer locations across varied terrain and infrastructure quality. Remote manufacturing facilities in developing industrial areas require extended transportation routes, increasing delivery costs and supply chain complexity. Cryogenic liquid transportation necessitates specialized tanker trucks with limited operational ranges between filling stations, constraining service radius from production facilities.

Technical Workforce Availability and Safety Compliance Requirements

Industrial gas operations require specialized technical personnel for production operations, maintenance activities, and customer technical support functions. Gas handling safety regulations mandate comprehensive training programs and certification requirements for personnel involved in cylinder filling, cryogenic operations, and customer installations. Skilled welding technicians understanding proper gas selection and usage parameters for different applications remain scarce in some regions, limiting market development opportunities.

Competitive Landscape:

The Turkey industrial gases market exhibits a sophisticated competitive structure characterized by established supply networks and evolving customer requirements across diverse industrial segments. Market participants range from multinational corporations with extensive production facilities and distribution infrastructure to specialized regional suppliers focusing on particular geographical areas or customer segments. Competition dynamics center on supply reliability, technical support capabilities, product quality consistency, and pricing strategies adapted to customer size and consumption patterns. Successful market positioning requires balanced portfolios serving both large industrial accounts with standardized requirements and smaller customers needing customized solutions and flexible service arrangements.

Recent Developments:

-

In February 2025, Yolbulan Çelik inaugurated a new industrial gas plant in Eskişehir, producing liquid oxygen, argon, and nitrogen. The facility aims to supply high-purity gases for medical, metallurgical, food, and chemical industries, enhance Turkey’s industrial gas capacity, and strengthen the company’s nationwide distribution network.

Turkey Industrial Gases Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-site |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey industrial gases market size was valued at USD 999.04 Million in 2025.

The Turkey industrial gases market is expected to grow at a compound annual growth rate of 3.94% from 2026-2034 to reach USD 1,414.09 Million by 2034.

Nitrogen commands the largest market share, driven by versatile applications across manufacturing inerting operations, food packaging preservation requirements, chemical processing blanketing needs, and metal heat treatment processes. Its cost-effectiveness and abundant availability through air separation sustain market dominance.

Key factors driving the Turkey industrial gases market include expanding manufacturing zones, steel and automotive production, food preservation adoption, healthcare oxygen demand, chemical process needs, and infrastructure projects, all boosting industrial gas consumption across Turkey’s manufacturing, healthcare, and construction sectors.

Major challenges include energy cost volatility, limited logistics, workforce constraints, strict safety regulations, competition from on-site generation, pricing pressures, and regional market concentration, all affecting distribution, operational efficiency, and expansion opportunities in Turkey industrial gases market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)