Turkey Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2026-2034

Turkey Insurtech Market Summary:

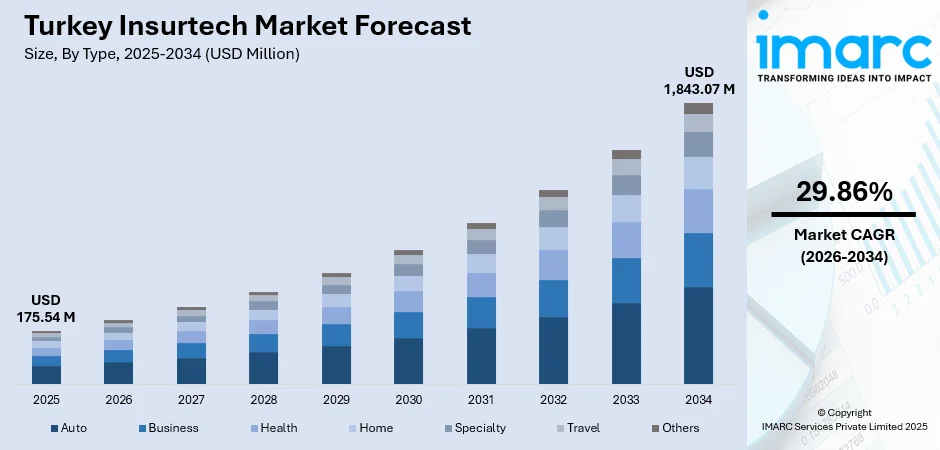

The Turkey insurtech market size was valued at USD 175.54 Million in 2025 and is projected to reach USD 1,843.07 Million by 2034, growing at a compound annual growth rate of 29.86% from 2026-2034.

The Turkey insurtech market is propelled by rapid digital transformation across insurance companies, rising consumer demand for seamless digital experiences, and widespread adoption of mobile-first distribution channels. Regulatory encouragement for technological innovation and increasing demand for data-driven, personalized insurance products further boost growth. These factors collectively drive market share expansion, supported by sustained investments in advanced technological infrastructure across the country’s insurance ecosystem.

Key Takeaways and Insights:

-

By Type: Health dominates the market with a share of 25.76% in 2025, driven by insurance companies' strategic preference for outsourcing complex technological operations to specialized providers, enabling cost optimization while accessing advanced capabilities.

-

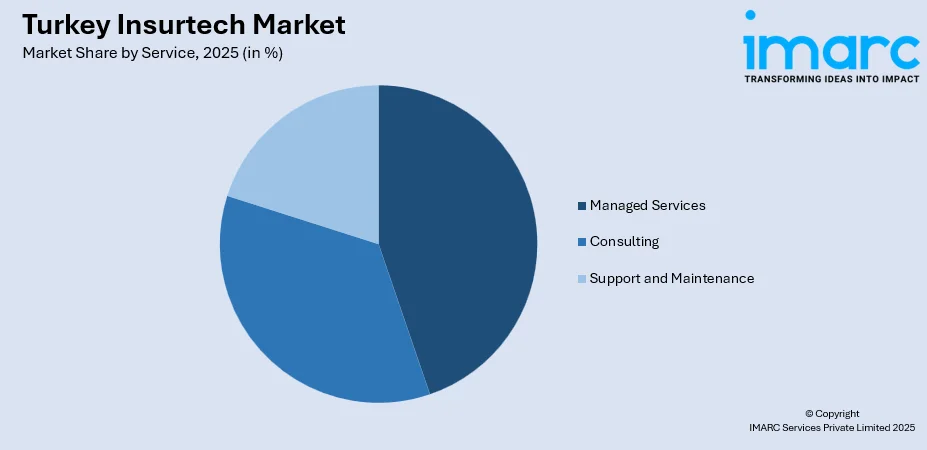

By Service: Managed services lead the market with a share of 44.56% in 2025, owing to escalating healthcare expenditure, expanding private insurance penetration, digital health platform integration requirements, telemedicine adoption, and consumer demand for instant processing.

-

By Technology: Cloud computing dominates the market with a share of 26.88% in 2025, driven by its fundamental role in enabling scalable infrastructure deployment, facilitating rapid application development cycles, supporting real-time data processing capabilities, and ensuring integration.

-

By Region: Marmara leads the market with a share of 23% in 2025, owing to Istanbul's position as Turkey's financial epicenter housing major insurance headquarters, technology talent concentration, superior digital infrastructure availability, and regulatory authority proximity.

-

Key Players: The Turkey insurtech market exhibits dynamic competitive characteristics, with established multinational insurance conglomerates increasingly partnering with agile domestic technology startups across various specializations. Traditional insurers modernize legacy systems while emerging digital-native players introduce innovative business models challenging conventional distribution approaches.

To get more information on this market Request Sample

The Turkey insurtech market growth is fundamentally propelled by the insurance industry's imperative to modernize operational frameworks and meet evolving customer expectations in an increasingly digital economy. The proliferation of smartphone penetration and internet connectivity has created consumer demand for instantaneous, frictionless insurance experiences comparable to other digital services. According to reports in October 2025, in Türkiye, 72% of young people consider insurance valuable for daily life, while 78% prefer purchasing policies through digital platforms, underscoring rising youth-led demand for insurtech solutions. Moreover, insurance companies recognize that traditional paper-based processes and prolonged approval timelines represent competitive disadvantages in attracting younger demographics who expect mobile-accessible policy management. Additionally, regulatory modernization efforts by Turkish authorities have created favorable conditions for technological experimentation, enabling insurtech startups to introduce innovative solutions that complement established insurer capabilities.

Turkey Insurtech Market Trends:

Embedded Insurance Integration Across Digital Ecosystems

Insurance providers increasingly integrate coverage offerings directly within non-insurance digital platforms including e-commerce marketplaces, ride-sharing applications, travel booking services, and financial technology solutions. As per sources, Papara launched its insurance arm in Turkey, introducing mobile and pet insurance within its fintech app, enabling in-app policy purchase, claims access, and up to 5% cashback, advancing embedded insurance adoption. Furthermore, this embedded approach eliminates traditional distribution friction by presenting contextually relevant insurance options at precise moments when consumers recognize coverage needs, such as travel insurance during flight booking or device protection during electronics purchases.

Artificial Intelligence Deployment in Claims Processing Automation

Advanced AI applications are revolutionizing insurance claims management through automated damage assessment, fraud pattern recognition, and accelerated settlement workflows that historically required extensive manual intervention. In 2025, Allianz Turkey processed its 100 millionth health claim through the AI-driven Smart STP system, reducing human intervention by 92% and delivering near-instant decisions for policyholders. Further, computer vision algorithms analyse photographs submitted through mobile applications to evaluate vehicle damage severity, property loss extent, or health-related documentation, generating preliminary settlement recommendations within minutes rather than days.

Personalized Risk Assessment Through Behavioural Data Analytics

Insurers leverage sophisticated data analytics capabilities to develop granular risk profiles based on individual behaviour patterns rather than relying solely on demographic categorizations and historical actuarial tables. Telematics devices and mobile applications capture real-time driving behaviours including acceleration patterns, braking frequency, speed compliance, and journey timing to calculate personalized auto insurance premiums that reward safe operators with reduced rates. In December 2024, Neova Sigorta partnered with SAS and Sade Software to launch AIpowered machine learning pricing, offering tailored auto insurance premiums for up to 95% of customers in Turkey.

Market Outlook 2026-2034:

The Turkey insurtech market demonstrates robust growth trajectory throughout the forecast period, driven by accelerating digital infrastructure investments, expanding technology adoption across traditional insurance enterprises, and favorable demographic trends favoring digital-first insurance experiences. Revenue expansion reflects insurance companies' recognition that technological modernization represents strategic imperative rather than optional enhancement, with competitive pressures compelling laggards to accelerate transformation initiatives. The market benefits from supportive regulatory frameworks that balance innovation encouragement with consumer protection requirements, creating sustainable conditions for both established insurers and emerging technology providers. The market generated a revenue of USD 175.54 Million in 2025 and is projected to reach a revenue of USD 1,843.07 Million by 2034, growing at a compound annual growth rate of 29.86% from 2026-2034.

Turkey Insurtech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Health | 25.76% |

| Service | Managed Services | 44.56% |

| Technology | Cloud Computing | 26.88% |

| Region | Marmara | 23% |

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Health dominates with a market share of 25.76% of the total Turkey insurtech market in 2025.

Health commands substantial market attention as escalating medical costs, expanding private insurance participation, and increasing consumer health consciousness drive demand for sophisticated digital tools streamlining policy administration and enhancing healthcare access. The Turkish healthcare system's dual public-private structure creates opportunities for supplementary insurance products providing faster specialist access, premium facility choices, and comprehensive treatment coverage beyond government-funded basic services.

Technology applications extend beyond basic policy administration to encompass provider network management, prior authorization automation, prescription benefit optimization, and medical necessity verification reducing administrative friction for policyholders and healthcare providers. Mobile applications empower consumers to locate in-network facilities, schedule appointments, access digital insurance cards, and track deductible progression without contacting customer service representatives. AI assists with medical code validation, treatment protocol verification, and duplicate claim detection improving processing accuracy while reducing manual review requirements, delivering superior customer experiences building policyholder loyalty.

Service Insights:

Access the comprehensive market breakdown Request Sample

- Consulting

- Support and Maintenance

- Managed Services

Managed Services leads with a share of 44.56% of the total Turkey insurtech market in 2025.

Managed services dominate the Turkey insurtech market as insurance organizations recognize strategic value in outsourcing complex technological operations to specialized providers rather than maintaining extensive internal departments. This preference stems from rapid technological evolution requiring continuous expertise updates that prove challenging for traditional insurers whose core competencies center on risk assessment and underwriting. Managed service providers deliver comprehensive solutions encompassing cloud infrastructure administration, application monitoring, security management, disaster recovery, regulatory compliance support, and help desk operations ensuring system reliability.

Economic advantages prove particularly compelling for mid-sized insurance companies lacking scale to justify substantial technology infrastructure investments yet requiring modern digital capabilities. According to sources, Türkiye Sigorta Mobil reached over 1 million active users, while weekly downloads grew from 16.3K to 22K, reflecting rising adoption of digital insurance apps in Turkey. Further, service providers deliver enterprise-grade technological sophistication at fractional costs compared to building equivalent internal capabilities, enabling insurers to redirect capital toward customer acquisition and product innovation.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Cloud computing exhibits a clear dominance with a 26.88% share of the total Turkey insurtech market in 2025.

Cloud computing establishes foundational infrastructure enabling Turkey's insurtech transformation by providing scalable, cost-effective alternatives to traditional on-premise data centers requiring substantial capital investments and ongoing maintenance expenses. Modern cloud platforms deliver computing resources, data storage, and application hosting through pay-as-you-use models converting fixed infrastructure costs into variable operating expenses aligned with business volume. This economic model proves particularly advantageous for insurance startups and digital-native insurers requiring enterprise-grade infrastructure without prohibitive upfront investments, lowering barriers to market entry and fostering competitive innovation.

Beyond cost considerations, cloud computing provides technical capabilities essential for modern insurance operations including elastic resource scaling during peak transaction periods, geographic redundancy ensuring business continuity during localized disruptions, and rapid application deployment facilitating faster time-to-market for new product launches. As per sources, in 2024, AgeSA completed Türkiye’s largest hybrid cloud migration, moving over 100 insurance systems with zero service disruption, achieving 25% performance improvement, 20% cost efficiency, and 20.6 % resource savings.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara dominates with a market share of 23% of the total Turkey insurtech market in 2025.

Marmara demonstrates commanding market dominance owing to Istanbul's status as Turkey's undisputed financial services capital where major insurance companies maintain corporate headquarters, technology development centers, and primary distribution operations. Geographic concentration creates network effects as insurtech startups establish operations near potential corporate clients and partners, technology talent gravitates toward regions offering abundant employment opportunities, and innovation ecosystems develop through proximity-enabled collaboration between entrepreneurs, investors, and established industry participants.

Istanbul's cosmopolitan character and international connectivity attract foreign insurtech companies seeking Turkish market entry, creating competitive dynamics accelerating innovation adoption across domestic insurers facing global competitors. The city hosts major technology conferences, insurance industry gatherings, and startup accelerator programs facilitating knowledge exchange and partnership formation essential for insurtech ecosystem development. Higher income levels and greater insurance awareness among Marmara's urban population create receptive markets for innovative insurance products, providing insurtech companies favorable testing grounds for new offerings before broader national expansion.

Market Dynamics:

Growth Drivers:

Why is the Turkey Insurtech Market Growing?

Digital Transformation Imperative Across Insurance Operations

Traditional insurance companies face mounting competitive pressures requiring comprehensive digital transformation initiatives that modernize customer-facing applications, internal operational systems, and analytical capabilities supporting strategic decision-making. Legacy policy administration platforms-built decades ago lack flexibility to support contemporary product structures, omnichannel distribution requirements, and real-time pricing adjustments that digital-native competitors implement effortlessly. According to reports, in 2025, the Türkiye Sigorta mobile app reached 6 million downloads, averaging 200,000 daily users, with 94.4% of health insurance claims processed through the platform, enhancing efficiency. Insurers are replacing legacy systems with cloud-based, microservices, and API-driven platforms to overcome limitations and accelerate innovation.

Consumer Demand for Seamless Digital Insurance Experiences

Contemporary insurance customers, particularly younger demographics, expect frictionless digital experiences enabling policy research, purchase completion, coverage management, and claims submission entirely through mobile devices without agent interaction or paper documentation. In November 2025, Colendi Sigorta expanded its digital insurance solutions to new markets, integrating AI-powered sales, CRM tools, and e-wallet functions to enhance agent operations and customer engagement. Moreover, these expectations reflect broader consumer behaviour shifts toward digital-first engagement models across banking, retail, entertainment, and transportation services that establish baseline convenience standards insurance companies must match to remain relevant. Customers expect instant, personalized quotes with transparent pricing, simplified applications using pre-filled data, and immediate coverage without traditional underwriting delays.

Regulatory Support for Insurance Technology Innovation

Turkish regulatory authorities demonstrate progressive approaches balancing consumer protection requirements with innovation encouragement, creating favorable conditions for insurtech experimentation and adoption. Regulatory sandboxes enable companies to test novel insurance products, distribution models, and technological applications under relaxed compliance frameworks before full-scale market launch, reducing regulatory uncertainty that might otherwise discourage innovation investments. According to reports, in October 2025, a unified InsurTech ecosystem was proposed among Turkic states to harmonize KYC, electronic signatures, cloud technologies, and open insurance standards across the region.

Market Restraints:

What Challenges the Turkey Insurtech Market is Facing?

Legacy System Integration Complexity and Cost Constraints

Insurance companies operating established businesses face substantial challenges integrating modern insurtech solutions with decades-old core systems that utilize outdated programming languages, proprietary data formats, and rigid architectures resistant to modification. These legacy platforms contain critical business logic, historical policy data, and complex rating algorithms that cannot simply be discarded, requiring careful migration strategies that maintain operational continuity while gradually introducing new capabilities.

Data Privacy Concerns and Cybersecurity Vulnerability

Increasing digitalization of insurance operations creates expanded attack surfaces for cybercriminals targeting sensitive personal information, financial data, and medical records that command premium prices in illicit markets. High-profile data breaches affecting financial services companies generate consumer anxiety regarding digital platform security, potentially undermining trust essential for insurance relationship establishment and maintenance.

Customer Resistance to Automated Decision-Making Processes

Insurance customers frequently express discomfort with automated underwriting, claims adjudication, and coverage determination algorithms that lack transparent decision logic and provide limited recourse for outcomes perceived as unfair or inaccurate. Traditional insurance relationships involve personal agent interactions allowing customers to explain unique circumstances, request exception considerations, and receive guidance navigating complex policy provisions that automated systems cannot easily accommodate.

Competitive Landscape:

The Turkey insurtech market manifests diverse competitive dynamics as established multinational insurance conglomerates, domestic insurance leaders, specialized technology service providers, and venture-backed startups compete and collaborate across various market segments. Traditional insurers pursue multi-year digital transformation programs modernizing legacy systems, implementing data analytics capabilities, and developing customer-facing applications while leveraging established brand recognition, distribution networks, and regulatory relationships that provide competitive advantages over new market entrants. These incumbents increasingly adopt partnership strategies with specialized technology providers rather than attempting comprehensive in-house development, recognizing that external innovation ecosystems offer superior capabilities in specific domains requiring specialized expertise.

Recent Developments:

-

In November 2024, Allianz Türkiye, in collaboration with Indeez and Sigortaladim.com, launched the InsureMyTesla motor insurance product in Istanbul. The offering provides comprehensive EV coverage, including wall-mounted charging station protection, cyber risk coverage, on-site charging service, and a fully digital insurance experience for users.

Turkey Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey insurtech market size was valued at USD 175.54 Million in 2025.

The Turkey insurtech market is expected to grow at a compound annual growth rate of 29.86% from 2026-2034 to reach USD 1,843.07 Million by 2034.

Health holds the largest market share of 25.76%, driven by escalating healthcare costs, expanding private insurance participation, digital health platform integration requirements, telemedicine adoption acceleration, and consumer demand for instant claims processing and mobile health management applications.

Key factors driving the Turkey insurtech market include insurance digital transformation imperative, escalating consumer expectations for mobile experiences, supportive regulatory frameworks encouraging innovation, and widespread cloud computing adoption enabling scalable infrastructure deployment without prohibitive investments.

Major challenges include legacy system integration complexity, data privacy and cybersecurity vulnerabilities creating trust issues, customer resistance to automated decision-making lacking transparent logic, technical talent scarcity, and regulatory compliance burdens.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)