Turkey IoT (Internet of Things) Market Size, Share, Trends and Forecast by Component, Application, Vertical, and Region, 2025-2033

Turkey IoT (Internet of Things) Market Overview:

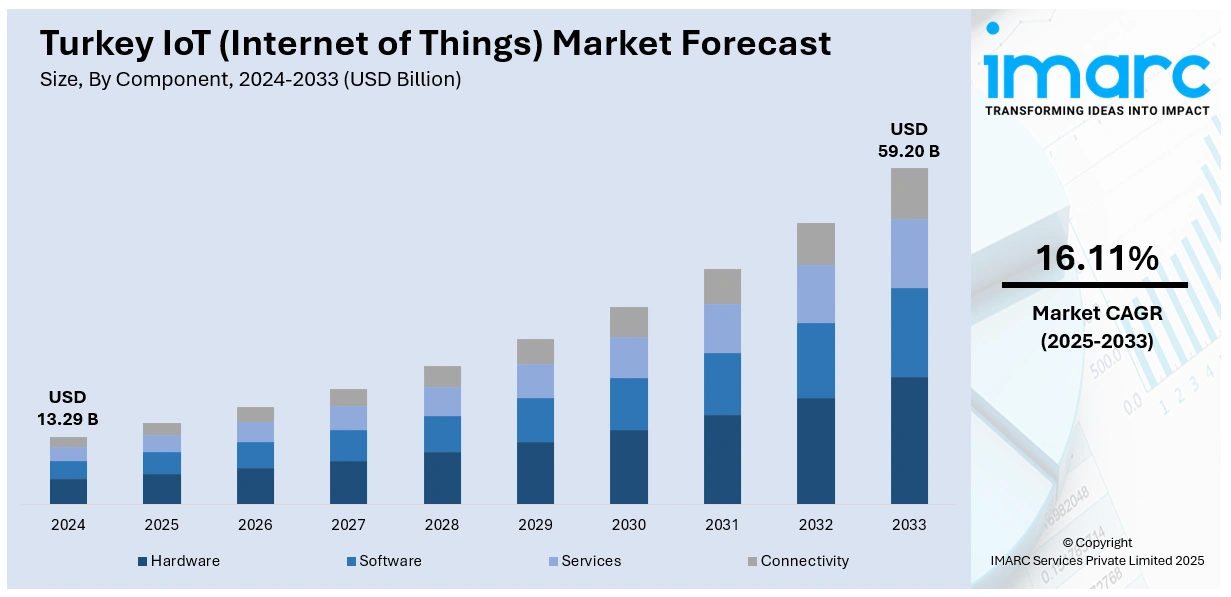

The Turkey IoT (Internet of Things) market size reached USD 13.29 Billion in 2024. The market is projected to reach USD 59.20 Billion by 2033, exhibiting a growth rate (CAGR) of 16.11% during 2025-2033. The market is advancing steadily as industries adopt connected devices across manufacturing, smart cities, healthcare, agriculture, and logistics. The integration of artificial intelligence and machine learning within IoT systems is enhancing real‑time monitoring, automation, and analytical capabilities. The government’s digital transformation initiatives combined with expanding 5G infrastructure and smart urban projects are driving market momentum. Despite concerns over data security and interoperability, innovation continues to flourish. These developments collectively influence the evolving Turkey IoT (Internet of Things) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.29 Billion |

| Market Forecast in 2033 | USD 59.20 Billion |

| Market Growth Rate 2025-2033 | 16.11% |

Turkey IoT (Internet of Things) Market Trends:

Evolving Connectivity Backbone

Turkey is reinforcing its national communications infrastructure to support the next phase of technological advancement on the Internet of Things landscape. The foundation of this effort is the country’s commitment to strengthening independent data transmission capabilities, ensuring uninterrupted services across remote and urban areas alike. A critical milestone in this trajectory occurred in July 2024, with the launch of Türksat 6A, the nation’s first domestically produced communication satellite. The initiative significantly enhances coverage and capacity, enabling broader integration of IoT systems across sectors such as energy, transportation, and environmental monitoring. This advancement also contributes to national data security, reducing reliance on external technologies and infrastructures. With improved satellite support, IoT devices deployed across Turkey can operate with higher efficiency and lower latency, particularly in previously underserved regions. These infrastructure developments form a crucial component of the expanding Turkey IoT (Internet of Things) market growth, as dependable connectivity becomes central to achieving scale. The emphasis on nationally developed systems reflects a strategic priority to ensure technological self-reliance while accelerating digital transformation across industries.

To get more information on this market, Request Sample

Integration of AI and Edge Intelligence

Turkey is embracing the integration of artificial intelligence within its IoT environment, particularly in domains such as smart infrastructure and industrial automation. This evolution is driven by public initiatives in major urban centers, where AI‑powered IoT applications are being employed for real‑time functions including traffic control, waste monitoring, and security operations. A noteworthy milestone was recorded in January 2025, when multiple Plan‑S IoT Connecta satellites were launched to enable enhanced connectivity and edge‑level data processing for IoT devices. This event underscores how satellite‑enabled infrastructure is extending operational capability to remote sensors and edge nodes, reducing latency and reinforcing system resilience. As Turkey continues to embed AI into IoT networks, devices are becoming increasingly capable of local decision‑making and predictive actions. This alignment of intelligence and connectivity is driving a shift toward more autonomous, proactive IoT ecosystems. Notably, the growing emphasis on intelligent edge solutions reflects a core dimension of Turkey IoT (Internet of Things) market trends, enabling smarter services across diverse sectors.

Acceleration of Automotive IoT Applications

The automotive sector in Turkey is increasingly adopting Internet of Things solutions, enabling connected vehicle services that improve efficiency, monitoring, and user experience across the transport ecosystem. This shift reflects a move toward greater digital integration, with telematics, remote diagnostics, and vehicle-to-infrastructure communication gaining traction. A significant milestone occurred in March 2025, when industry reports confirmed the integration of IoT-based predictive maintenance systems into a notable share of commercial vehicle fleets operating in urban environments. This innovation allows fleets to anticipate maintenance needs based on real-time operational data, reducing downtime and improving operational readiness. Such technologies are being deployed with growing assurance, and they signal a broader embrace of connectivity within Turkey’s transport infrastructure. As smart vehicle systems become more embedded across supply chains and logistics networks, they reinforce the momentum seen in connected ecosystems. This development underscores a pivotal driver of Turkey IoT (Internet of Things) market, as the automotive domain becomes both a key adopter and contributor to broader IoT deployment patterns in the country.

Turkey IoT (Internet of Things) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application and vertical.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity.

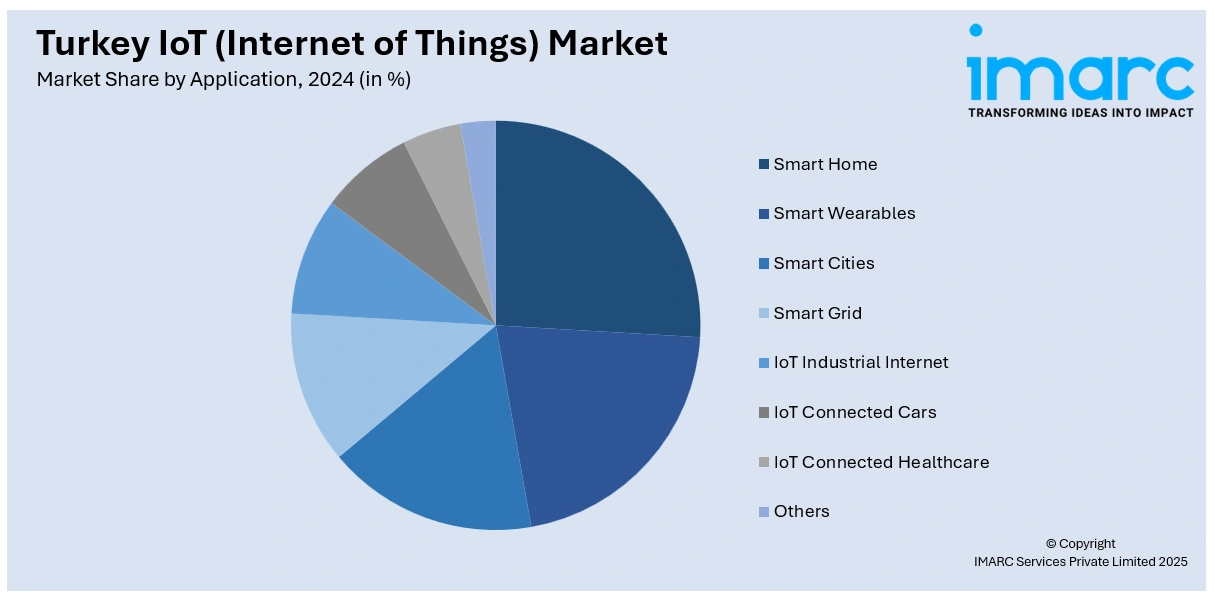

Application Insights:

- Smart Home

- Smart Wearables

- Smart Cities

- Smart Grid

- IoT Industrial Internet

- IoT Connected Cars

- IoT Connected Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart home, smart wearables, smart cities, smart grid, IoT industrial internet, IoT connected cars, IoT connected healthcare, and others.

Vertical Insights:

- Healthcare

- Energy

- Public and Services

- Transportation

- Retail

- Individuals

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes healthcare, energy, public and services, transportation, retail, individuals, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey IoT (Internet of Things) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| Applications Covered | Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, Others |

| Verticals Covered | Healthcare, Energy, Public and Services, Transportation, Retail, Individuals, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey IoT (Internet of Things) market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey IoT (Internet of Things) market on the basis of component?

- What is the breakup of the Turkey IoT (Internet of Things) market on the basis of application?

- What is the breakup of the Turkey IoT (Internet of Things) market on the basis of vertical?

- What is the breakup of the Turkey IoT (Internet of Things) market on the basis of region?

- What are the various stages in the value chain of the Turkey IoT (Internet of Things) market?

- What are the key driving factors and challenges in the Turkey IoT (Internet of Things) market?

- What is the structure of the Turkey IoT (Internet of Things) market and who are the key players?

- What is the degree of competition in the Turkey IoT (Internet of Things) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey IoT (Internet of Things) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey IoT (Internet of Things) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey IoT (Internet of Things) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)