Turkey Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Turkey Meat Market Summary:

The Turkey meat market size was valued at USD 13.16 Billion in 2025 and is projected to reach USD 19.97 Billion by 2034, growing at a compound annual growth rate of 4.74% from 2026-2034.

The market is driven by increasing consumer preference for protein-rich diets, rising urbanization, and growing demand for convenience food products. The expanding foodservice sector and quick-service restaurant chains emphasizing poultry-based menu offerings are significantly contributing to market expansion. Additionally, advancements in meat processing and cold chain logistics are enhancing product availability and quality across distribution networks. Health-conscious consumers are increasingly favoring lean meat options, driving demand for chicken and other poultry products.

Key Takeaways and Insights:

-

By Type: Raw dominates the market with a share of 59% in 2025, driven by strong consumer preference for fresh, minimally processed products and adherence to traditional home-cooking practices.

-

By Product: Chicken leads the market with a share of 48% in 2025, owing to its affordability compared to red meat alternatives, versatility in cuisine, and growing health-conscious consumer preferences favoring lean protein sources.

-

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 44% in 2025, driven by one-stop shopping convenience, competitive pricing, wide product availability, and robust food safety measures attracting frequent shoppers.

-

Key Players: The Turkey meat market exhibits a moderately competitive landscape, with domestic and regional producers emphasizing product innovation, quality differentiation, and strategic distribution network expansion to strengthen market presence and cater to evolving consumer demand.

The Turkey meat market is experiencing sustained growth driven by fundamental shifts in consumer dietary patterns and preferences. Rising urbanization and increasing disposable incomes are enabling consumers to prioritize protein-rich food options, with meat products becoming central to daily dietary requirements. As per sources, Turkey’s chicken meat production rose 13.9 %, while the number of slaughtered chickens increased 10.4 % year-on-year, reflecting strong domestic demand. Moreover, the expanding middle-class population is demonstrating heightened awareness regarding nutritional value and food quality, leading to increased demand for premium and fresh meat products. Additionally, the proliferation of modern retail formats and the growing foodservice sector are creating robust distribution channels that enhance product accessibility. Government initiatives supporting livestock development and cold chain infrastructure are further strengthening the supply chain ecosystem. Consumer preference for halal-certified meat products and traditional preparation methods continues to influence purchasing decisions, while the emergence of online grocery platforms is transforming how consumers access meat products.

Turkey Meat Market Trends:

Growing Preference for Lean and Healthy Protein Options

Consumers in Turkey are increasingly prioritizing health and wellness in their dietary choices, driving a notable shift toward lean protein sources. This trend is particularly pronounced among urban populations where lifestyle diseases and obesity concerns are prompting healthier food selections. Poultry meat, especially chicken, is gaining preference over red meat alternatives due to its lower fat content and perceived health benefits. According to sources, in November 2024, Beypilic and Marel launched a state-of-the-art greenfield poultry facility in Bolu, Türkiye, featuring two 15,000 bph lines to meet rising domestic and export demand. Furthermore, the fitness and wellness movement are further accelerating this transition, with health-conscious consumers actively seeking protein-rich options that support their nutritional goals.

Expansion of Modern Retail and E-Commerce Channels

The retail landscape for meat products in Turkey is undergoing significant transformation with the rapid expansion of supermarkets, hypermarkets, and online grocery platforms. Modern retail formats are offering consumers enhanced shopping experiences with superior product quality assurance, diverse selections, and competitive pricing. The emergence of e-commerce platforms and online meat delivery services is revolutionizing consumer purchasing behavior, particularly in metropolitan areas where convenience is paramount. According to reports, in 2025, Uber acquired an 85 % stake in Turkish food delivery platform Trendyol GO, enhancing meat and grocery delivery services nationwide, serving 90,000 restaurants and 19,000 couriers. Moreover, these digital channels are enabling producers and retailers to reach broader consumer bases while maintaining product freshness through advanced cold chain logistics.

Rising Demand for Processed and Ready-to-Cook Meat Products

Changing lifestyles and time constraints are driving increased demand for processed and ready-to-cook meat products among the consumers. Working professionals and dual-income households are seeking convenient meal solutions that minimize preparation time without compromising on taste and nutrition. This trend is spurring innovation in product offerings, with manufacturers introducing marinated, pre-seasoned, and portion-controlled meat products. As per sources, in 2025, Keskinoğlu introduced new chicken products with MAP packaging at WorldFood Istanbul, enhancing freshness, hygiene, and convenience to meet rising demand for ready-to-cook meat in Turkey. Further, the foodservice sector is also contributing to this trend, with quick-service restaurants and casual dining establishments featuring diverse meat-based menu items.

Market Outlook 2026-2034:

The Turkey meat market revenue is projected to witness steady growth during the forecast period, supported by favorable demographic trends and evolving consumer preferences. Increasing population, rising urbanization rates, and expanding middle-class disposable incomes are expected to sustain demand for meat products. The market is anticipated to benefit from continued investments in cold chain infrastructure, modern retail expansion, and processing facility upgrades. Government policies promoting livestock development and food security are likely to create a supportive regulatory environment. The market generated a revenue of USD 13.16 Billion in 2025 and is projected to reach a revenue of USD 19.97 Billion by 2034, growing at a compound annual growth rate of 4.74% from 2026-2034.

Turkey Meat Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Raw | 59% |

| Product | Chicken | 48% |

| Distribution Channel | Supermarkets and Hypermarkets | 44% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Raw

- Processed

Raw dominates with a market share of 59% of the total Turkey meat market in 2025.

Raw continues to lead the Turkey meat market due to consumer preferences for fresh and unprocessed meat products. Traditional cuisine includes home cooking using fresh ingredients, resulting in an ongoing demand for raw meat in Turkey. Consumers in Turkey have been found to have a keen liking for buying their meat from butcher shops, wet markets, and meat sections in supermarkets, where they get an opportunity to see the quality of meat. The importance of traditional meat cooking processes has contributed to the leadership position attained by this market.

Raw benefits from established supply chains connecting livestock producers to retail outlets and traditional butcher shops across urban and rural areas. Consumer trust in fresh meat products, combined with the ability to customize cuts and portions according to specific culinary requirements, reinforces purchasing patterns. The segment is witnessing gradual modernization with improved packaging, cold chain handling, and traceability systems being implemented by organized retailers. As per sources, in July 2025, Turkey’s Ministry of Agriculture made QR codes displaying inspection data mandatory at all retail food outlets, including butcher shops and markets, enhancing transparency and consumer trust. Moreover, growing quality consciousness among consumers is driving demand for premium fresh meat products with certifications ensuring safety and authenticity standards.

Product Insights:

- Chicken

- Beef

- Mutton

- Others

Chicken leads with a share of 48% of the total Turkey meat market in 2025.

Chicken leads the product categories, driven by its favorable positioning as an affordable, versatile protein source appealing to the budget-conscious consumers across Turkey. Chicken meat offers significant price advantages compared to beef and mutton alternatives while delivering comparable nutritional benefits, making it particularly attractive during economic fluctuation periods. Health-conscious consumers increasingly favor chicken for its lower fat content and lean protein profile. The segment benefits from well-established domestic production infrastructure ensuring consistent market supply.

The culinary versatility of chicken supports its dominant position, as it integrates seamlessly into diverse Turkish recipes ranging from traditional kebabs to contemporary fusion dishes and international cuisines. The segment benefits from efficient vertically integrated production systems enabling consistent supply availability and competitive consumer pricing throughout the year. In May 2025, Smithfield Foods’ Farmland brand launched a new campaign and introduced Premium Ground Chicken varieties and Julienne Turkey, expanding its value-added chicken portfolio across select retail channels. Furthermore, growing institutional demand from restaurants, quick-service establishments, hotels, and food service operations further reinforces chicken's market leadership position across both retail and commercial channels.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 44% share of the total Turkey meat market in 2025.

Supermarkets and hypermarkets dominate the distribution landscape, offering consumers comprehensive shopping experiences with diverse meat product selections under one roof. These modern retail formats provide superior product quality assurance through temperature-controlled storage and display systems, attracting quality-conscious consumers. Competitive pricing strategies, promotional offers, and loyalty programs implemented by organized retailers enhance consumer value propositions. The convenience of dedicated parking, extended operating hours, and integrated payment systems supports consumer preference for these channels.

Modern channels are investing in enhanced meat sections featuring fresh counters, pre-packaged options, and specialty product ranges to cater to diverse consumer preferences. Strategic locations in urban centers and suburban areas ensure accessibility for target consumer segments. These retailers are implementing advanced inventory management and supply chain systems to maintain product freshness and availability. The integration of online ordering and home delivery services by major supermarket and hypermarket chains is creating omnichannel shopping experiences that further strengthen their market position.

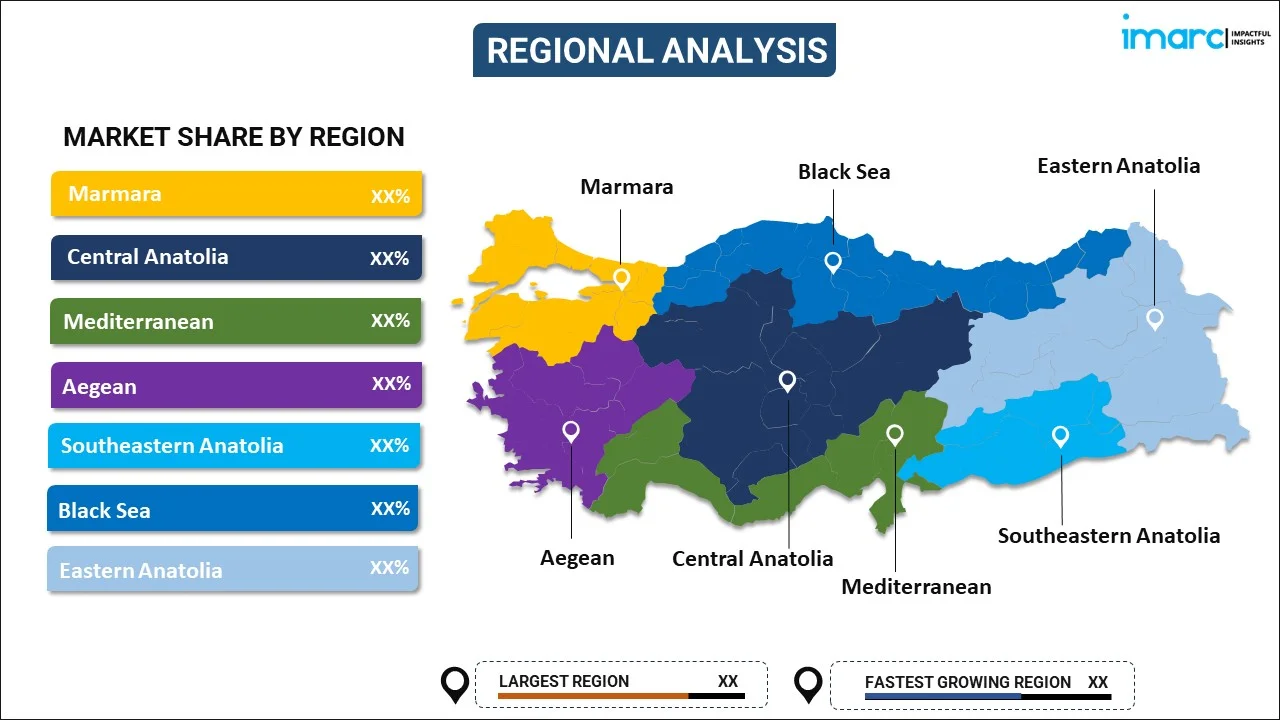

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

Marmara dominates the Turkey meat market owing to its concentration of population centers including Istanbul, substantial purchasing power, and advanced retail infrastructure. The region benefits from superior cold chain logistics, diverse distribution channels, and proximity to major processing facilities. Strong institutional demand from hospitality and food service sectors further reinforces regional market leadership.

Central Anatolia represents a significant meat market driven by traditional livestock raising heritage and growing urban centers including Ankara. The region demonstrates strong demand for red meat products aligned with local culinary traditions. Expanding modern retail presence in regional cities enhances product accessibility, while agricultural expertise supports local production capacity meeting regional consumption requirements.

Mediterranean exhibits robust meat market dynamics supported by flourishing tourism activity and expanding coastal urban populations. Seasonal demand variations correspond with tourist influx periods, creating opportunities for hospitality-oriented suppliers. Agricultural productivity in the region supports diverse livestock operations, while port infrastructure facilitates efficient supply chain management for both domestic distribution and imported products.

Aegean maintains notable meat market presence driven by prosperous coastal cities, tourism-related hospitality demand, and quality-conscious consumer preferences. The region demonstrates affinity for premium meat products and traditional specialty items reflecting local culinary heritage. Developed retail infrastructure in urban centers supports diverse distribution channels, while agricultural traditions sustain regional livestock production capabilities.

Southeastern Anatolia presents distinctive market characteristics shaped by cultural traditions emphasizing meat-centric cuisine and established livestock production heritage. The region demonstrates strong preferences for traditional meat varieties and preparation methods. Growing urban development in regional centers is expanding modern retail presence, while agricultural expertise supports sheep and cattle production meeting local consumption patterns.

Blacksea exhibits unique meat market dynamics influenced by geographic characteristics, traditional dietary preferences, and distinctive culinary heritage. Regional consumers demonstrate preferences for specific meat varieties aligned with local recipes and preparation traditions. Retail modernization in coastal cities is expanding distribution options, while challenging terrain creates logistics considerations affecting supply chain efficiency in inland areas.

Eastern Anatolia represents an emerging meat market characterized by traditional livestock raising practices and evolving retail infrastructure development. The region maintains strong cultural connections to pastoral traditions supporting local meat production. Growing urbanization in regional centers is gradually expanding modern retail accessibility, while geographic challenges influence distribution logistics and product availability patterns throughout the territory.

Market Dynamics:

Growth Drivers:

Why is the Turkey Meat Market Growing?

Rising Urbanization and Changing Dietary Patterns

Rapid urbanization across Turkey is fundamentally transforming dietary patterns and food consumption behaviours. As populations migrate from rural areas to urban centers, exposure to diverse food options and modern retail formats increases, driving demand for convenient and quality meat products. According to reports, Türkiye’s population reached 85.7 Million in 2024, with 93.4% residing in residing in city centers and district municipalities, underscoring accelerating urban concentration and metropolitan-driven consumption patterns. Moreover, urban lifestyles characterized by busy schedules and dual-income households are creating preference for readily available protein sources. The expanding middle class in metropolitan areas demonstrates growing purchasing power and willingness to spend on quality food products. Urbanization is also accelerating the adoption of modern cooking appliances and techniques, influencing meat product preferences and consumption patterns.

Expansion of Foodservice and Quick-Service Restaurant Sector

The expanding foodservice sector is emerging as a significant growth driver for the Turkey meat market. Quick-service restaurant chains are increasingly emphasizing meat-based menu offerings to cater to evolving consumer preferences. The growing dining-out culture, particularly among younger demographics, is creating substantial institutional demand for quality meat products. International franchise expansion and domestic chain growth are intensifying competition and driving menu innovation. Casual dining establishments and traditional restaurants continue to feature meat-centric dishes as primary offerings. The hospitality industry's recovery and expansion are further contributing to institutional demand of meat. As per sources, in 2024, Türkiye welcomed a record 52.6 Million foreign tourists, generating $61.1 Billion in revenue, marking an all-time high and boosting demand in the country’s hospitality and foodservice sectors.

Infrastructure Development and Cold Chain Modernization

Significant investments in infrastructure development, particularly cold chain logistics, are enhancing meat distribution capabilities across Turkey. Government initiatives supporting transportation network expansion and storage facility upgrades are improving supply chain efficiency. Modern cold storage facilities and refrigerated transport systems are enabling producers to maintain product quality throughout the distribution process. Advanced logistics infrastructure is facilitating market access for producers while ensuring consistent product availability for consumers. These developments are reducing post-harvest losses and improving food safety standards across the value chain.

Market Restraints:

What Challenges the Turkey Meat Market is Facing?

Feed Cost Volatility and Input Price Fluctuations

Fluctuating feed costs represent a significant challenge for meat producers, impacting profitability and pricing strategies. Feed expenses constitute a substantial portion of livestock production costs, making producers vulnerable to agricultural commodity price variations. Global grain market dynamics and currency fluctuations influence feed input costs, creating uncertainty in production economics. These cost pressures can limit producer capacity for investment in quality improvements and expansion initiatives.

Fragmented Supply Chain and Quality Inconsistencies

The presence of numerous small-scale producers and traditional supply channels creates fragmentation within the meat value chain. This fragmentation can result in quality inconsistencies and challenges in implementing standardized food safety protocols. Limited cold chain infrastructure in certain regions affects product quality during transportation and storage. The coexistence of organized and unorganized retail channels creates differentiated consumer experiences and price variations across market segments.

Regulatory Compliance and Certification Requirements

Evolving food safety regulations and certification requirements create compliance burdens for market participants. Meeting stringent quality standards requires investments in facilities, testing capabilities, and documentation systems. Smaller producers may face challenges in achieving required certifications, limiting their market access to organized retail channels. Regulatory changes necessitate ongoing adaptation and investment by industry stakeholders to maintain market participation.

Competitive Landscape:

The Turkey meat market exhibits a moderately fragmented competitive structure characterized by the presence of established domestic producers, regional players, and traditional market participants. Leading market participants are focusing on vertical integration strategies encompassing livestock farming, processing, and distribution to ensure quality control and cost efficiency. Product differentiation through premium offerings, organic certifications, and value-added products is emerging as a key competitive strategy. Market players are investing in modern processing facilities and cold chain infrastructure to enhance operational capabilities. Strategic partnerships with retail chains and foodservice operators are strengthening distribution networks and market reach.

Turkey Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey meat market size was valued at USD 13.16 Billion in 2025.

The Turkey meat market is expected to grow at a compound annual growth rate of 4.74% from 2026-2034 to reach USD 19.97 Billion by 2034.

Raw held the largest Turkey meat market share driven by strong consumer preference for fresh, unprocessed products and the cultural emphasis on traditional cooking practices centered on home-prepared meals nationwide.

Key factors driving the Turkey meat market include rising urbanization, increasing disposable incomes, growing health consciousness favoring protein-rich diets, expansion of modern retail channels, foodservice sector growth, and infrastructure development.

Major challenges include feed cost volatility affecting production economics, fragmented supply chains creating quality inconsistencies, regulatory compliance requirements, cold chain infrastructure gaps in certain regions, and competition from alternative protein sources.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)