Turkey Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Turkey Medical Tourism Market Overview:

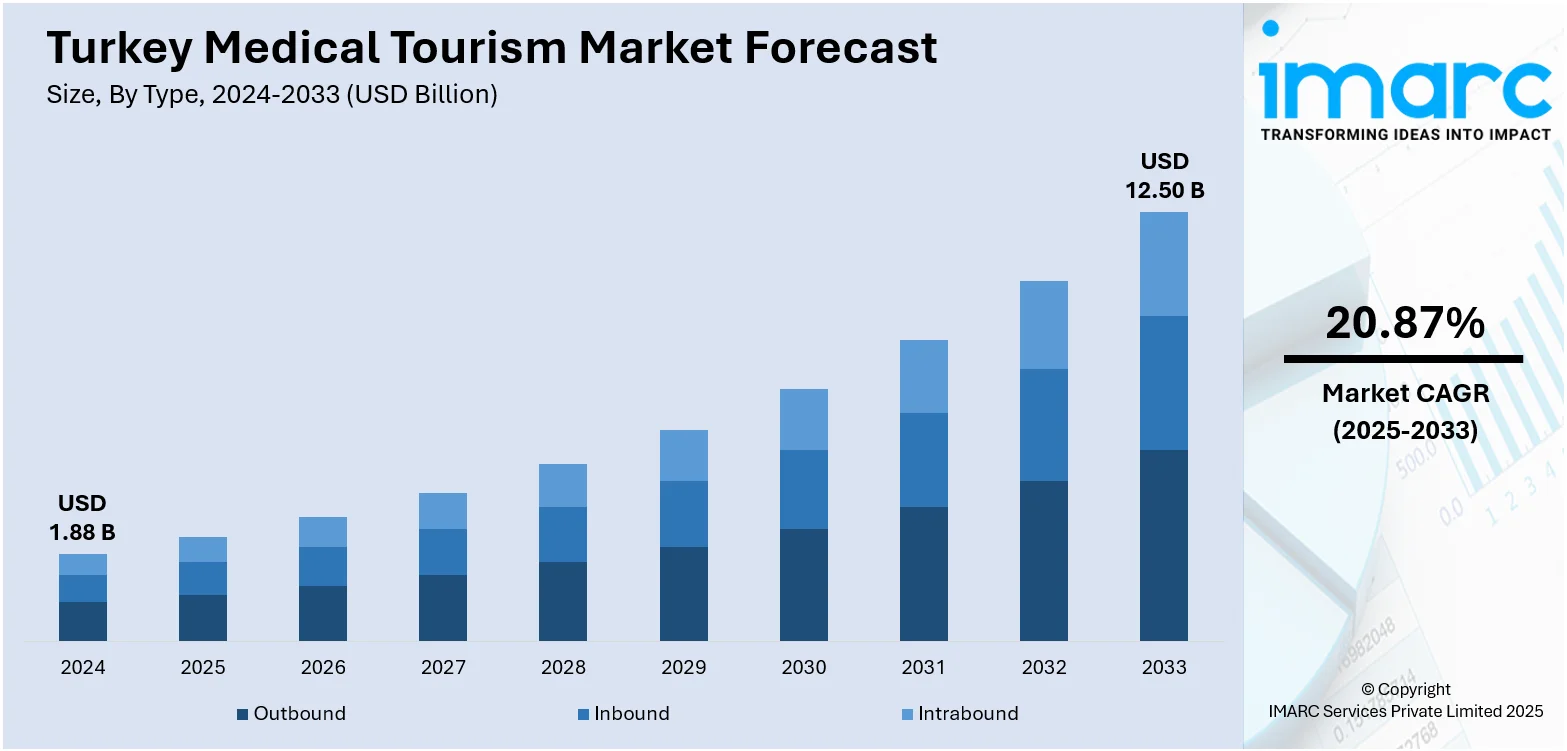

The Turkey medical tourism market size reached USD 1.88 Billion in 2024. Looking forward, the market is projected to reach USD 12.50 Billion by 2033, exhibiting a growth rate (CAGR) of 20.87% during 2025-2033. The market is driven by Turkey’s globally recognized expertise in elective and transplant surgeries, supported by internationally accredited hospitals. Government-led infrastructure investments and airport-based medical access enhance international patient flow. Cost efficiency, multilingual service models, and streamlined recovery logistics are further augmenting the Turkey medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.88 Billion |

| Market Forecast in 2033 | USD 12.50 Billion |

| Market Growth Rate 2025-2033 | 20.87% |

Turkey Medical Tourism Market Trends:

Surgical Expertise Across Aesthetic, Ophthalmic, and Transplant Procedures

Turkey has become a global hub for high-quality surgical procedures, particularly in aesthetics, ophthalmology, and organ transplants. Clinics in Istanbul, Ankara, and Izmir offer services such as hair transplants, rhinoplasty, LASIK eye surgery, and kidney or liver transplants at significantly lower costs than in Europe and the U.S., while maintaining internationally recognized quality standards. In 2025, Türkiye announced its ambition to expand its footprint in the global medical tourism market, with 2024 revenues reaching USD 3 Billion from 2 Million international patients. This marks significant growth from USD 203 Million in 2003 to USD 2.2 Billion in 2022, driven by affordable procedures and 40+ internationally accredited hospitals. To attract more health tourists, Türkiye is combining medical services with leisure offerings. Surgeons are often trained abroad and participate in global medical conferences, ensuring adherence to the latest practices. Institutions like Acıbadem, Memorial, and Florence Nightingale Hospitals have earned Joint Commission International (JCI) accreditations, attracting patients from the UK, Germany, Russia, and the Middle East. Turkey’s strong reputation in hair transplantation—driven by procedural efficiency, high success rates, and bundled care packages—has made it a top destination in that segment alone. Hospitals provide multilingual staff, transparent pricing, and concierge support that simplifies the entire patient journey, from pre-operative consultation to post-surgical recovery. International patients receive hotel-clinic transfers, priority scheduling, and aftercare planning, supported by tech-enabled systems and telemedicine tools. This comprehensive approach to complex and elective surgeries reinforces Turkey medical tourism market growth and its standing as a leader in procedure-focused health travel.

To get more information on this market, Request Sample

Cost Efficiency and High-Volume Global Patient Handling

Turkey offers an exceptional value proposition through its cost efficiency across a wide range of treatments, including dental implants, IVF, orthopedic surgery, and bariatric procedures without compromising clinical outcomes. Patients from Western Europe, the Balkans, North Africa, and Central Asia seek Turkish care due to savings of 50–70% on procedures compared to their domestic markets. Recent industry reports highlighted the growing trend of medical tourism in Türkiye, particularly among Americans seeking affordable elective procedures such as hair transplants, which cost approximately USD 2,120 in Türkiye versus up to USD 12,500 in the U.S. The average medical tourist stays in Türkiye for 12–19 days, blending recovery with sightseeing. Clinics now provide all-inclusive packages, and U.S. patients reportedly make up over 50% of clientele at major facilities. Hospitals manage high volumes of international patients with structured scheduling systems, multilingual care teams, and fast-track admission pathways, ensuring short waiting times. Bundled pricing models covering diagnostics, surgery, accommodations, and local transport simplify planning and cost comparison for medical travelers. Turkey’s large and competitive private healthcare sector contributes to price stabilization and quality differentiation, enabling patients to select services aligned with their budget and expectations. Many clinics also partner with international insurance firms or financing companies, reducing barriers to access for non-local patients. Coupled with strong international marketing and digital health consultations, Turkey’s healthcare ecosystem is designed to accommodate tens of thousands of global patients monthly. This scale-driven efficiency ensures operational consistency and reinforces Turkey’s status as a cost-effective, reliable medical tourism destination.

Turkey Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

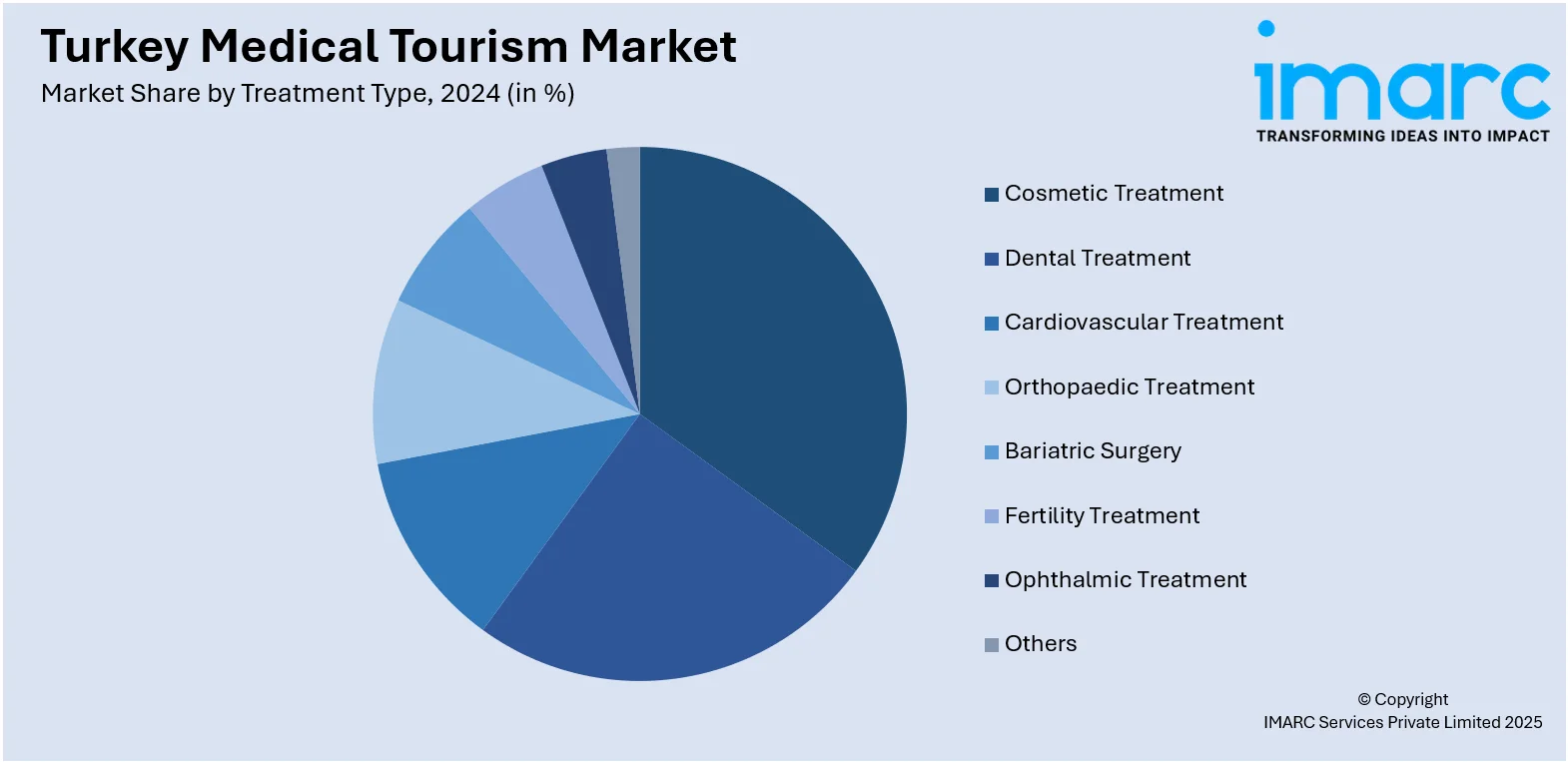

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Medical Tourism Market News:

- On April 30, 2025, Türkiye introduced new regulations to elevate safety and quality standards in its medical tourism sector, requiring all health institutions and intermediaries to integrate with the “HealthTürkiye” digital platform. The reforms mandate complication insurance for surgeries, 24/7 multilingual call centers, and accreditation by Türkiye’s Health Care Quality and Accreditation Institute (TUSKA).

Turkey Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey medical tourism market on the basis of type?

- What is the breakup of the Turkey medical tourism market on the basis of treatment type?

- What is the breakup of the Turkey medical tourism market on the basis of region?

- What are the various stages in the value chain of the Turkey medical tourism market?

- What are the key driving factors and challenges in the Turkey medical tourism market?

- What is the structure of the Turkey medical tourism market and who are the key players?

- What is the degree of competition in the Turkey medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)