Turkey Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Region, 2026-2034

Turkey Mushroom Market Summary:

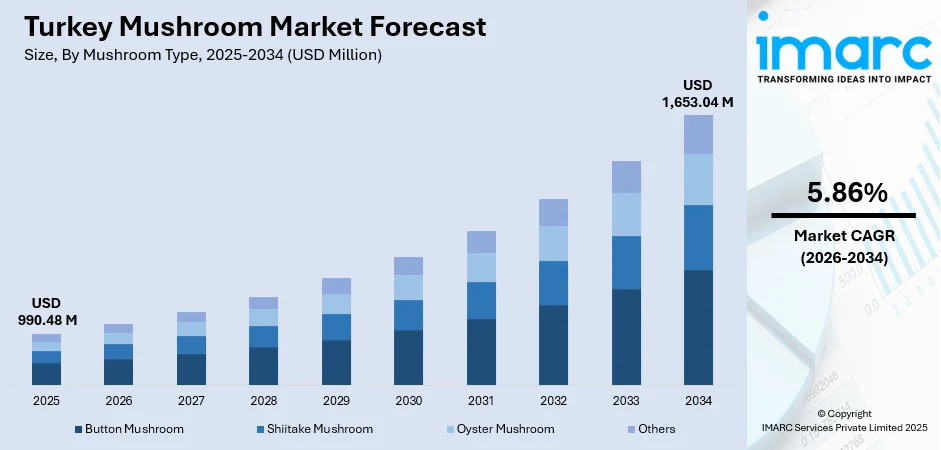

The Turkey mushroom market size was valued at USD 990.48 Million in 2025 and is projected to reach USD 1,653.04 Million by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

The Turkey mushroom market is witnessing steady expansion as health-conscious consumers increasingly incorporate nutrient-rich foods into their diets. Growing urbanization and evolving dietary preferences are driving mushroom consumption across households and culinary establishments. The expanding organized retail infrastructure and modern supermarket networks are enhancing product accessibility for consumers nationwide. Additionally, rising awareness about the nutritional benefits of mushrooms, including their high protein and low-calorie content, is influencing purchasing decisions. The food processing sector continues to integrate mushrooms into ready-to-eat meals and convenience products, further strengthening Turkey mushroom market share.

Key Takeaways and Insights:

- By Mushroom Type: Button mushroom dominates the market with approximately 41% revenue share in 2025, driven by its versatile culinary applications, mild flavor profile, widespread consumer familiarity, and year-round availability across retail channels.

- By Form: Fresh mushroom leads the market with approximately 62% revenue share in 2025, owing to consumer preference for natural produce, enhanced nutritional retention, and growing demand for minimally processed ingredients in home cooking.

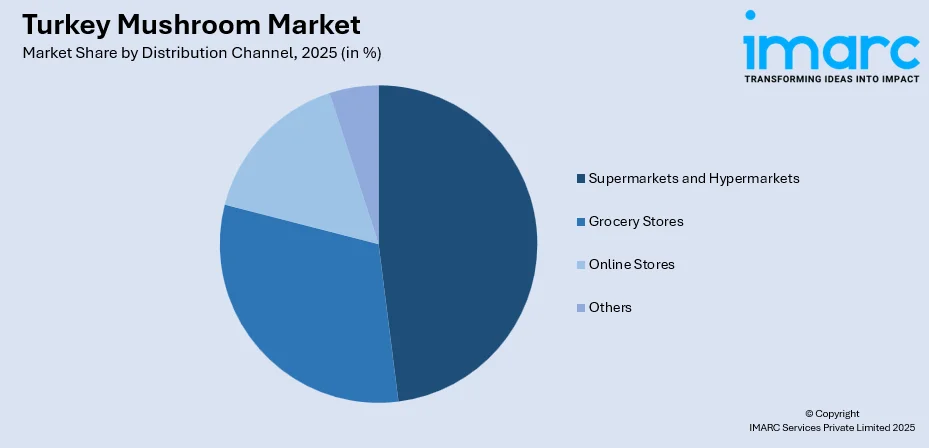

- By Distribution Channel: Supermarkets and hypermarkets hold the largest share at approximately 48% in 2025, attributed to convenient one-stop shopping experiences, product variety, and competitive pricing strategies attracting urban consumers.

- By End Use: Food processing industry represents the leading segment with approximately 33% market share in 2025, supported by rising demand for convenience foods and increasing integration of mushrooms in packaged meal solutions.

- Key Players: The Turkey mushroom market exhibits moderate competitive intensity, with domestic cultivators and regional producers competing across quality segments while focusing on sustainable farming practices and product diversification strategies.

To get more information on this market Request Sample

The Turkey mushroom market is expanding as consumers embrace healthier dietary choices and seek plant-based alternatives in their meals. The country's favorable agricultural conditions, particularly in the Antalya region, support substantial domestic cultivation capabilities. Growing interest in functional foods and immunity-boosting ingredients has elevated mushrooms as a preferred dietary component. The hospitality and foodservice sectors are increasingly featuring mushrooms in diverse culinary preparations, from traditional Turkish cuisine to contemporary dishes. For instance, researchers at Isparta Applied Sciences University identified four new mushroom species from the Entoloma genus in southern Turkey during December 2024, highlighting the country's rich mycological biodiversity and its potential for expanded cultivation varieties. The ongoing development of modern retail infrastructure and digital commerce platforms continues to improve consumer access to fresh and processed mushroom products across urban and rural markets.

Turkey Mushroom Market Trends:

Rising Health Consciousness and Functional Food Demand

Turkish consumers are increasingly focusing on healthier eating habits as part of preventive wellness practices, boosting interest in nutrient-rich natural foods. Mushrooms, valued for their protein content, antioxidants, and low-calorie profile, are becoming popular functional ingredients in everyday diets. This trend is especially noticeable in urban areas, where individuals seek wholesome alternatives to processed products. As awareness of their nutritional benefits grows, demand for both fresh mushrooms and value-added mushroom foods continues to strengthen across the market.

Expansion of Plant-Based and Vegetarian Dietary Preferences

Shifting dietary habits toward plant-based, vegetarian, and flexitarian lifestyles are playing a significant role in shaping the Turkey mushroom market. Mushrooms, known for their savory umami flavor and meat-like texture, are increasingly used as natural substitutes in a wide range of meals. This transition is encouraging manufacturers and foodservice providers to innovate with mushroom-based dishes that appeal to environmentally conscious consumers seeking sustainable protein sources. As these preferences expand, mushrooms gain greater prominence in modern and traditional cuisine alike.

Growth of E-Commerce and Digital Grocery Platforms

The accelerating adoption of online grocery shopping is reshaping how mushrooms are distributed and purchased across Turkey. Digital retail channels provide easy access to a broad selection of mushroom varieties, including premium, organic, and specialty options that may be limited in physical stores. This shift is particularly driven by younger consumers who value convenience, product diversity, and home delivery. As e-commerce platforms expand their reach, direct-to-consumer models gain traction, widening mushroom availability beyond major metropolitan regions.

Market Outlook 2026-2034:

The Turkey mushroom market is positioned for sustained expansion throughout the forecast period, supported by favorable consumption trends and infrastructure development. The expanding organized retail sector, coupled with increasing investments in cold chain logistics, is expected to enhance product availability and quality. Consumer awareness regarding nutritional benefits will continue driving household consumption, while the foodservice industry's growing integration of mushrooms into diverse menu offerings presents additional revenue opportunities. The market generated a revenue of USD 990.48 Million in 2025 and is projected to reach a revenue of USD 1,653.04 Million by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

Turkey Mushroom Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Mushroom Type | Button Mushroom | 41% |

| Form | Fresh Mushroom | 62% |

| Distribution Channel | Supermarkets and Hypermarkets | 48% |

| End Use | Food Processing Industry | 33% |

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

Button mushroom dominates the Turkey mushroom market with a 41% share in 2025.

Button mushrooms maintain their leading position in the Turkish market owing to their widespread culinary acceptance and versatile applications. Their mild, earthy flavor profile makes them suitable for diverse cooking methods, from traditional Turkish dishes to contemporary recipes. The variety's year-round availability through established cultivation networks ensures a consistent supply to meet consumer demand across retail and foodservice channels.

The consumer preference for button mushrooms reflects their familiarity and accessibility in everyday cooking. These mushrooms feature prominently in salads, soups, sautés, and various hot preparations that form staples of Turkish cuisine. The established production infrastructure in key agricultural regions supports competitive pricing, making button mushrooms an affordable protein alternative for health-conscious households seeking nutritious meal components.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

Fresh mushroom leads the Turkey mushroom market with a 62% share in 2025.

Fresh mushrooms command the largest market share as Turkish consumers increasingly prioritize natural, minimally processed food products. The preference for fresh produce aligns with traditional culinary practices that emphasize ingredient quality and freshness. Modern retail infrastructure developments, including improved cold chain logistics and refrigerated display systems, have enhanced fresh mushroom availability and extended shelf life across distribution networks.

The growing health consciousness among Turkish consumers further reinforces demand for fresh mushrooms, which retain optimal nutritional values compared to processed alternatives. Supermarkets and hypermarkets have expanded their fresh produce sections to accommodate consumer expectations, offering diverse varieties and quality grades. This emphasis on freshness supports premium positioning and drives value growth within the overall mushroom category.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

Supermarkets and hypermarkets hold the largest share at 48% in the Turkey mushroom market in 2025.

Supermarkets and hypermarkets serve as the primary distribution channel for mushrooms in Turkey, benefiting from extensive store networks and consumer foot traffic. These retail formats offer convenient one-stop shopping experiences where consumers can purchase fresh mushrooms alongside other grocery items. The organized retail sector's investment in proper storage facilities and refrigerated sections ensures product quality and extended freshness.

The competitive pricing strategies employed by modern retail chains make mushrooms accessible to broader consumer segments. Private label offerings and promotional activities drive volume sales while maintaining category margins. The expanding footprint of organized retail in secondary cities and suburban areas continues to increase mushroom accessibility, supporting overall market penetration and consumption growth.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

Food processing industry accounts for the highest revenue with a 33% share in the Turkey mushroom market in 2025.

The food processing industry represents the largest end-use segment as manufacturers integrate mushrooms into diverse product formulations. Rising demand for convenience foods and ready-to-eat meals drives industrial mushroom procurement for soups, sauces, frozen preparations, and packaged meal solutions. The sector benefits from consistent supply arrangements with cultivators, ensuring stable raw material availability for production planning.

Food processors increasingly value mushrooms for their flavor enhancement properties and nutritional contributions to formulated products. The growing consumer preference for natural ingredients over artificial additives encourages manufacturers to incorporate mushrooms as functional components. This industrial demand provides stability to cultivation operations and supports investments in production capacity expansion.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara’s strong urbanization, high-income population, and dense foodservice sector significantly boost mushroom consumption. The region’s supermarkets, restaurants, and hotel chains create steady demand for fresh and specialty varieties. Advanced cold-chain logistics and well-developed wholesale networks support efficient distribution. Rising interest in healthy eating among Istanbul residents also drives growth in organic, exotic, and value-added mushroom products, strengthening overall market expansion.

Central Anatolia’s mushroom market is driven by expanding indoor cultivation facilities, strong retail penetration, and growing consumer preference for nutritious foods. Ankara’s sizable population and vibrant foodservice industry contribute to consistent demand. Government support for agricultural modernization encourages local mushroom farming. Increasing awareness of mushrooms as affordable, protein-rich ingredients further boosts household usage, while rising interest in processed and packaged mushroom products supports market diversification.

The Mediterranean Region benefits from a thriving tourism and hospitality industry that fuels high mushroom consumption in hotels, restaurants, and resorts. Its fertile agricultural environment supports expanding cultivation of both button and specialty varieties. Growing health consciousness among urban consumers increases household purchases. The presence of strong export-oriented agribusinesses also promotes investment in modern cultivation technologies, enhancing supply quality and strengthening regional market growth.

The Aegean Region’s mushroom market is supported by dynamic culinary tourism, strong restaurant culture, and increasing demand for fresh produce in coastal cities. The region’s mild climate and agricultural know-how contribute to the development of controlled-environment mushroom farms. Consumers show rising interest in organic and gourmet varieties, driven by wellness-focused dietary trends. Retail chains and local markets ensure wide availability, encouraging steady consumption across households and foodservice operators.

Southeastern Anatolia’s market is driven by expanding urban centers, government-backed agricultural development programs, and gradual improvements in cold-chain infrastructure. As dietary habits evolve, mushrooms are gaining popularity as nutritious, versatile ingredients. Growing supermarket penetration increases accessibility, while local producers increasingly adopt modern cultivation systems. The region’s rising young population is also contributing to shifting eating patterns, supporting greater household and foodservice demand for mushroom products.

The Black Sea Region benefits from a strong agricultural base, high local consumption of fresh produce, and growing interest in healthier diets. Humid climatic conditions support small and mid-scale mushroom farming. Local cuisines incorporating mushrooms help maintain steady demand. Expanding retail networks and improved logistics make a wider range of varieties available. Increasing tourism in coastal towns also stimulates foodservice-driven consumption of fresh and specialty mushroom products.

Eastern Anatolia’s mushroom market growth stems from rising urbanization, increased adoption of greenhouse and controlled-environment cultivation, and supportive rural development initiatives. As consumers shift toward healthier food choices, mushrooms gain traction as affordable sources of nutrients. Retail expansion in emerging cities improves product accessibility. Additionally, small-scale farming cooperatives are adopting modern techniques to boost supply, while growing foodservice establishments contribute to sustained regional demand.

Market Dynamics:

Growth Drivers:

Why is the Turkey Mushroom Market Growing?

Increasing Health Awareness and Nutritional Benefits Recognition

The growing public awareness about health and nutrition, particularly concerning the prevention and management of chronic diseases, is significantly driving mushroom consumption in Turkey. Mushrooms are increasingly recognized as functional foods offering immune support, anti-inflammatory properties, and essential nutrients including B-vitamins, selenium, and dietary fiber. This health-focused trend is shaping consumer choices toward natural, nutrient-dense food options. Turkish health authorities have intensified efforts to address non-communicable diseases through public awareness campaigns and preventive healthcare initiatives. The Turkey health and wellness market size reached USD 49.48 Billion in 2024. Looking forward, the market is expected to reach USD 76.03 Billion by 2033, exhibiting a growth rate (CAGR) of 4.39% during 2025-2033. The widespread identification of chronic health conditions is influencing dietary habits, with consumers progressively incorporating mushrooms as part of healthier lifestyle choices. This shift toward preventive nutrition continues to strengthen mushroom demand across demographic segments.

Expanding Organized Retail and Modern Distribution Infrastructure

The rapid expansion of supermarkets, hypermarkets, and modern retail chains throughout Turkey is enhancing mushroom accessibility and driving market growth. The Turkey retail market size reached USD 391.2 Billion in 2024. Looking forward, the market is expected to reach USD 868.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Modern retail formats offer controlled storage environments, proper refrigeration facilities, and efficient inventory management that ensure product quality and freshness. The organized retail sector's expansion into secondary cities and suburban areas is broadening consumer access to diverse mushroom varieties. Retail chains are increasingly dedicating shelf space to fresh produce sections, featuring mushrooms prominently alongside other vegetables. The competitive dynamics among retailers encourage promotional activities and attractive pricing strategies that stimulate consumer trial and repeat purchases. This retail infrastructure development continues to support market penetration across geographic regions.

Growing Food Processing Industry and Culinary Innovation

The expanding food processing sector in Turkey is creating substantial demand for mushrooms as key ingredients in manufactured food products. Rising consumer preference for convenience foods, ready-to-eat meals, and time-saving culinary solutions is driving manufacturers to incorporate mushrooms into diverse product formulations. The food industry's focus on natural ingredients and clean label products further supports mushroom utilization. Culinary innovation across the hospitality and foodservice sectors is elevating mushroom applications beyond traditional preparations. Restaurants, hotels, and catering establishments are featuring mushrooms in contemporary dishes that appeal to health-conscious consumers. This broadening of culinary applications introduces mushrooms to new consumption occasions and expands the addressable market.

Market Restraints:

What Challenges the Turkey Mushroom Market is Facing?

Perishability and Short Shelf Life Constraints

Fresh mushrooms have inherently limited shelf life, requiring careful handling, proper refrigeration, and efficient distribution systems. This perishability creates challenges for supply chain management, particularly in reaching remote or underserved markets where cold chain infrastructure remains underdeveloped. Product wastage and quality deterioration during transit can affect retailer margins and consumer satisfaction.

Limited Consumer Awareness of Specialty Varieties

While button mushrooms enjoy widespread recognition, consumer familiarity with specialty and gourmet mushroom varieties remains relatively limited in Turkey. Many consumers are unaware of the distinct flavors, nutritional profiles, and culinary applications of oyster, shiitake, and other mushroom types. This knowledge gap restricts market diversification and premium product adoption.

Infrastructure Limitations in Cold Chain Logistics

Inadequate cold chain infrastructure in certain regions poses challenges for maintaining mushroom quality throughout the distribution network. Temperature fluctuations during transportation and storage can accelerate spoilage and reduce product appeal. Addressing these logistical constraints requires substantial investments in refrigerated facilities and transportation equipment.

Competitive Landscape:

The Turkey mushroom market is characterized by a fragmented competitive structure comprising numerous domestic cultivators, regional producers, and integrated food processors. Market participants compete on parameters including product freshness, quality consistency, pricing strategies, and distribution reach. The concentration of production in specific agricultural regions has fostered specialized farming expertise and established supply networks serving both domestic consumption and export markets. Competitive dynamics are evolving as participants invest in cultivation technologies, quality assurance systems, and value-added processing capabilities. Market players are increasingly focusing on sustainable farming practices and certification standards to differentiate their offerings. Strategic partnerships between cultivators and retail chains are becoming more prevalent, ensuring consistent product availability and quality standards that strengthen competitive positioning.

Recent Developments:

- In April 2024, the Yeşilüzümlü Mushroom Festival celebrated the prized morel mushroom in the village of Üzümlü near Fethiye. The annual event featured local food preparations, traditional crafts, regional wine tastings, and folk dancing performances, attracting both domestic visitors and international tourists. The festival highlighted Turkey's culinary heritage and the cultural significance of wild mushroom foraging traditions.

Turkey Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey mushroom market size was valued at USD 990.48 Million in 2025.

The Turkey mushroom market is expected to grow at a compound annual growth rate of 5.86% from 2026-2034 to reach USD 1,653.04 Million by 2034.

Button mushroom, holding the largest revenue share of 41%, remains the dominant variety in Turkey's mushroom market, driven by its versatile culinary applications, consumer familiarity, and consistent availability through established retail channels.

Key factors driving the Turkey mushroom market include increasing health awareness and nutritional benefits recognition, expanding organized retail infrastructure, growing food processing industry demand, rising plant-based dietary preferences, and enhanced distribution through e-commerce platforms.

Major challenges include the inherent perishability and short shelf life of fresh mushrooms, limited cold chain infrastructure in certain regions, restricted consumer awareness of specialty mushroom varieties, and the need for continued investment in quality storage and transportation facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)