Turkey Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2026-2034

Turkey Office Furniture Market Summary:

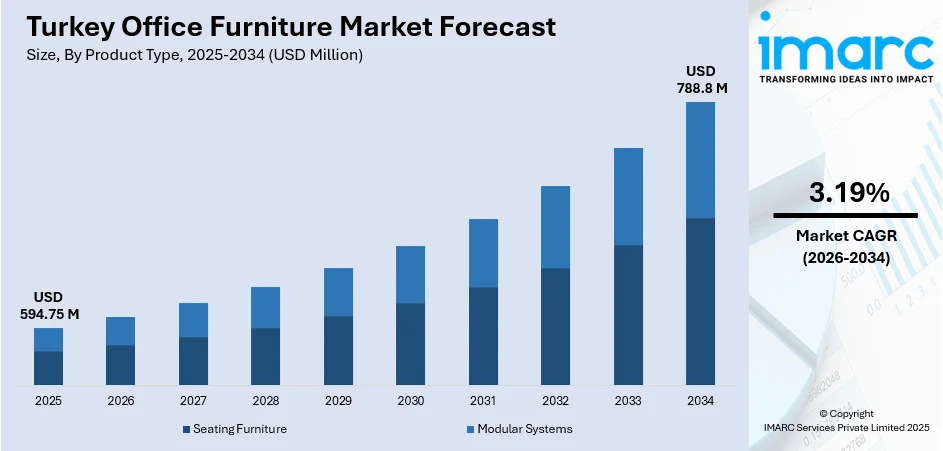

The Turkey office furniture market size was valued at USD 594.75 Million in 2025 and is projected to reach USD 788.8 Million by 2034, growing at a compound annual growth rate of 3.19% from 2026-2034.

The Turkey office furniture market is gaining strong momentum as companies accelerate flexible workplace initiatives and expand modern office environments. The growing demand for ergonomic seating solutions, supportive government policies, and improved commercial infrastructure are strengthening adoption. Advancements in sustainable manufacturing practices, rising urbanization, and increasing interest in adaptable workspaces are reshaping office design patterns, positioning the region as an emerging hub for next-generation office furniture solutions, and driving the Turkey office furniture market share.

Key Takeaways and Insights:

- By Product Type: Seating furniture dominates the market with a share of 65% in 2025, driven by the increasing need for ergonomic chairs that promote employee comfort and productivity during extended working hours.

- By Material Type: Wood leads the market with a share of 45% in 2025, supported by consumer preferences for durable, aesthetically appealing wooden furniture that complements both traditional and contemporary office interiors.

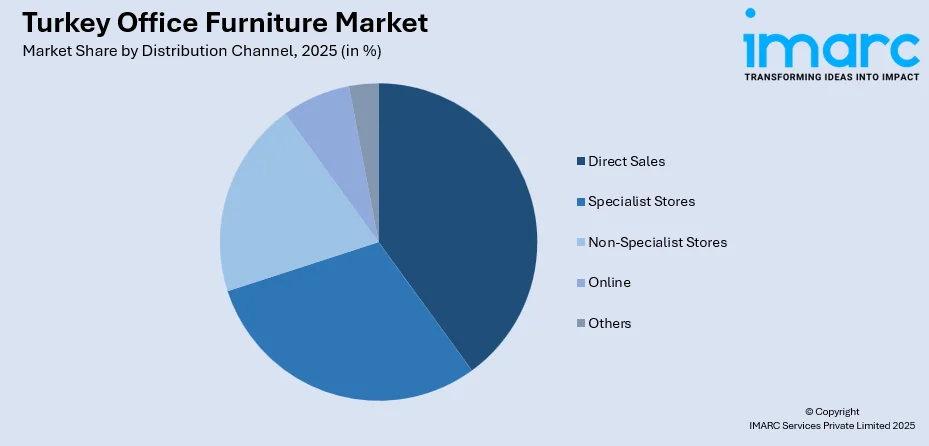

- By Distribution Channel: Direct sales holds the largest share at 40% in 2025, reflecting the strong preference for business-to-business procurement channels that enable customized bulk orders and professional consultations.

- By Price Range: Low-priced segment represents the largest category with 45% market share in 2025, driven by cost-conscious small and medium enterprises seeking affordable yet functional office furniture solutions.

- Key Players: The Turkey office furniture market features a competitive landscape with domestic manufacturers competing alongside international brands across price segments. Companies are focusing on product diversification, design innovation, and strategic partnerships to strengthen their market positions.

To get more information on this market Request Sample

The Turkey office furniture market is advancing as businesses, entrepreneurs, and commercial establishments embrace modern workspace solutions. The country's strategic position as a furniture manufacturing hub, with over 45,000 manufacturers and exports to several countries, provides a strong foundation for domestic market growth. In January 2025, Turkey's Trade Minister announced an ambitious target of achieving USD 12 billion in furniture exports, reflecting the sector's expanding global reach and domestic production capabilities. The rise of hybrid work arrangements has accelerated demand for adaptable furniture solutions that cater to both corporate offices and home workspaces. Companies are increasingly investing in ergonomic seating and modular systems to enhance employee well-being and workplace productivity, which is supporting the Turkey office furniture market growth.

Turkey Office Furniture Market Trends:

Rising Adoption of Ergonomic Office Solutions

The demand for ergonomic office furniture is rising steadily across Turkey as companies place greater emphasis on employee health and productivity. Businesses are investing in adjustable workstations, ergonomically designed chairs, and supportive accessories to reduce physical strain during long working hours. The growing adoption of remote and hybrid work arrangements has further increased the need for comfortable seating solutions in both office and home settings, highlighting the impact of well-designed workspaces on employee satisfaction, efficiency, and retention.

Growth of Sustainable and Eco-Friendly Furniture

Turkish consumers and businesses are becoming increasingly conscious of environmental sustainability in their furniture purchasing decisions. Manufacturers are responding by adopting eco-friendly production processes, using recycled materials, and developing products with reduced environmental impact. The Turkish government has implemented regulations promoting sustainable practices in the furniture industry, mandating manufacturers to use eco-friendly materials and adopt production processes that minimize waste generation. This shift toward green furniture aligns with global environmental standards and appeals to environmentally conscious corporate buyers seeking to meet their sustainability targets.

Expansion of E-Commerce Distribution Channels

The e-commerce sector is transforming the distribution landscape for office furniture in Turkey, enabling manufacturers and retailers to reach broader customer bases. The Turkey e-commerce market size reached USD 235.1 Billion in 2024. Looking forward, the market is expected to reach USD 1,774.5 Billion by 2033, exhibiting a growth rate (CAGR) of 25.18% during 2025-2033. Online platforms offer consumers extensive product ranges, price comparisons, and customer reviews, simplifying purchasing decisions. This digital transformation allows businesses and individual consumers to access office furniture conveniently, with manufacturers investing in user-friendly websites, efficient logistics, and enhanced customer service capabilities.

Market Outlook 2026-2034:

The Turkey office furniture market is poised for steady expansion as commercial real estate development accelerates and workplace modernization initiatives gain momentum across the country. Istanbul's Grade A office supply has exceeded 7.18 million square meters of gross leasable area by mid-2025, indicating robust commercial infrastructure growth. The integration of smart furniture technologies and the continued emphasis on employee well-being will shape future product development and design innovation. The market generated a revenue of USD 594.75 Million in 2025 and is projected to reach a revenue of USD 788.8 Million by 2034, growing at a compound annual growth rate of 3.19% from 2026-2034.

Turkey Office Furniture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Seating Furniture | 65% |

| Material Type | Wood | 45% |

| Distribution Channel | Direct Sales | 40% |

| Price Range | Low | 45% |

Product Type Insights:

- Seating Furniture

- Modular Systems

The seating furniture segment dominates with a market share of 65% of the total Turkey office furniture market in 2025.

The seating furniture segment's leadership position reflects the fundamental importance of comfortable and supportive seating in modern office environments. Businesses across Turkey are recognizing that quality seating directly impacts employee productivity, health outcomes, and workplace satisfaction. The segment encompasses executive chairs, task chairs, ergonomic seating solutions, and collaborative seating options designed for various workplace configurations. Rising awareness of occupational health concerns, particularly musculoskeletal disorders associated with prolonged sitting, has prompted organizations to prioritize ergonomic chair investments that support proper posture and reduce workplace injuries.

The growing adoption of hybrid work models has expanded demand for seating furniture suitable for both corporate offices and home workspaces. Companies are investing in versatile seating solutions that can accommodate different work styles and collaborative activities. Manufacturers are responding with innovative designs combining functionality with aesthetics, featuring adjustable lumbar support, height-adjustable armrests, and breathable mesh materials. Premium seating products are gaining traction among larger corporations seeking to enhance employer attractiveness and talent retention through superior workplace amenities.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

The wood segment leads with a share of 45% of the total Turkey office furniture market in 2025.

Wooden office furniture maintains its dominant position due to Turkey's abundant access to high-quality timber resources and the material's enduring appeal in professional settings. The country's forests provide essential raw materials, including walnut, beech, and oak, supporting a robust domestic manufacturing base. Wooden furniture is favored for its durability, aesthetic versatility, and ability to complement both traditional and contemporary office designs. Turkish manufacturers have developed expertise in crafting wooden furniture that combines classical craftsmanship with modern functionality.

Sustainability considerations are increasingly influencing consumer preferences within the wooden furniture segment. Manufacturers are sourcing certified sustainable wood and implementing eco-friendly production processes to meet growing environmental consciousness among buyers. The adaptability of wooden furniture to various finishes, colors, and design styles enables manufacturers to serve diverse customer preferences ranging from minimalist modern designs to ornate executive furniture. This material's perceived quality and longevity continue to justify premium pricing in the market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Specialist Stores

- Non-Specialist Stores

- Online

- Others

The direct sales channel exhibits a clear dominance with a 40% share of the total Turkey office furniture market in 2025.

Direct sales remain the preferred distribution channel for office furniture in Turkey, particularly for corporate and institutional buyers seeking customized bulk procurement solutions. This channel enables manufacturers to establish direct relationships with businesses, providing tailored consultations, product customization, and comprehensive after-sales support. Large enterprises and government organizations frequently utilize direct procurement processes that allow for specification of exact requirements, negotiation of volume discounts, and coordination of delivery and installation services.

The direct sales model supports the growing trend toward turnkey office solutions, where manufacturers collaborate with interior designers and facility managers to create comprehensive workspace environments. Real estate developers increasingly partner with furniture manufacturers to offer integrated office furniture packages for new commercial properties, streamlining the procurement process for incoming tenants.

Price Range Insights:

- Low

- Medium

- High

The low-price segment holds the largest share at 45% of the total Turkey office furniture market in 2025.

The low-price segment's substantial market share reflects the cost-sensitive nature of small and medium enterprises that constitute a significant portion of Turkey's business landscape. These businesses prioritize functional, affordable furniture solutions that meet basic operational requirements without straining limited budgets. Manufacturers have developed extensive product lines targeting this segment, offering standardized designs that achieve economies of scale in production while maintaining acceptable quality standards.

Economic conditions and currency fluctuations influence purchasing decisions toward lower price points, as businesses seek to manage capital expenditures prudently. The segment also captures demand from startups and emerging businesses establishing initial office setups with limited investment capital. Competition within this segment drives continuous innovation in manufacturing efficiency and material utilization.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara, with Istanbul as a major business hub, drives office furniture demand through rapid commercial expansion, corporate office setups, and co-working space growth. High concentration of multinational firms and startups fuels demand for modern, ergonomic furniture solutions. Continuous renovation of corporate offices and adoption of smart office designs further support sales. The region’s strong logistics and distribution networks ensure wide availability, reinforcing market growth.

Central Anatolia, anchored by Ankara, sees growing office furniture demand from government offices, corporate headquarters, and institutional facilities. Expanding administrative infrastructure and public sector projects drive procurement of desks, storage solutions, and seating systems. The rise of private enterprises and co-working spaces in urban centers supports modern office setups. Local manufacturing hubs also supply customized furniture, meeting diverse corporate requirements and sustaining regional market growth.

The Mediterranean Region benefits from tourism-driven office infrastructure, hospitality administration, and expanding commercial centers. Offices in cities such as Antalya and Adana require functional and aesthetically appealing furniture for administrative, hotel, and retail operations. Rising small and medium enterprise (SME) presence, coupled with flexible workspaces, encourages investment in modular and ergonomic office solutions. Growing retail and service sectors further reinforce demand for office furniture.

In the Aegean Region, office furniture demand is propelled by expanding business districts, service-oriented enterprises, and growing tourism administration. Urban centers like Izmir drive the need for ergonomic, modern office solutions for corporate offices and startups. Renovation and modernization of office spaces, adoption of smart work environments, and the growth of SMEs contribute to consistent market expansion. Local manufacturers also cater to regional customization needs.

Southeastern Anatolia’s market growth is supported by urban development, new commercial projects, and expanding government offices. Rising entrepreneurship and the growth of small- and medium-sized enterprises stimulate demand for practical and cost-effective office furniture. Infrastructure improvements, including business centers and co-working hubs, further encourage modern office setups. Increasing awareness of ergonomic and modular furniture solutions in both public and private sectors strengthens market growth.

The Black Sea Region experiences office furniture demand from municipal offices, local enterprises, and educational institutions. Expanding business parks, administrative buildings, and service centers drive procurement of desks, chairs, and storage systems. SMEs and growing local industries seek durable and functional furniture for operational efficiency. Renovation of existing offices and adoption of ergonomic designs in urban hubs further contribute to steady regional market expansion.

Eastern Anatolia’s office furniture market is shaped by government infrastructure projects, administrative expansion, and the establishment of new business centers. Urbanization and growing small business activities increase demand for functional and affordable office furniture solutions. Modernization of municipal offices, schools, and service institutions, combined with a focus on ergonomic and space-saving designs, further drives market growth, while local suppliers provide region-specific solutions to meet evolving requirements.

Market Dynamics:

Growth Drivers:

Why is the Turkey Office Furniture Market Growing?

Expansion of Commercial Real Estate Development

Turkey’s commercial real estate sector is undergoing rapid expansion, driving steady demand for office furniture to outfit new workspaces. Modern office buildings and business parks require complete furniture solutions, from executive suites to open-plan workstations. Collaboration between real estate developers, interior designers, and furniture manufacturers ensures turnkey setups that meet contemporary workplace standards. The growth of technology parks, innovation centers, and entrepreneurship hubs further fuels demand for furniture designed to support collaborative and creative work environments.

Rising Adoption of Remote and Hybrid Work Models

The growing adoption of remote and hybrid work models has broadened the demand for office furniture, extending its reach well beyond conventional corporate settings. Flexible work practices have created new demand for home office furniture, including compact desks, ergonomic chairs, and space-efficient storage solutions suitable for residential setups. Simultaneously, organizations are redesigning conventional office spaces to support activity-based working, driving the adoption of versatile and modular furniture systems that accommodate collaborative, dynamic, and adaptable workplace needs.

Government Support for Furniture Industry Development

The Turkish government provides active support to the furniture industry through export incentives, trade promotion initiatives, and participation in international exhibitions. These policies enhance manufacturing competitiveness, encourage investment in production capabilities, and strengthen the domestic industry’s position in global markets. Government backing ensures a reliable supply for local consumption, fosters innovation in design and production, and contributes to sustainable industry growth, reinforcing the sector’s role as a strategic component of broader economic development plans.

Market Restraints:

What Challenges the Turkey Office Furniture Market is Facing?

High Production Costs and Raw Material Prices

Rising labor costs and fluctuating raw material prices present ongoing challenges for furniture manufacturers in Turkey. The sector's labor-intensive nature makes it particularly vulnerable to wage increases, impacting production economics and final product pricing. Supply chain disruptions and global commodity price volatility affect access to quality materials, creating pressure on profit margins and potentially reducing investment in product development and innovation.

Economic Volatility and Currency Fluctuations

Turkey's macroeconomic environment, characterized by periodic currency fluctuations and inflation pressures, creates uncertainty for both manufacturers and buyers. These economic conditions influence consumer purchasing power, business investment decisions, and import costs for machinery and components. Currency depreciation can increase the cost of imported materials while creating pricing pressures in the domestic market.

Infrastructure Gaps in Regional Markets

While major urban centers offer robust commercial infrastructure, regional disparities in transportation networks and logistics capabilities affect market reach in peripheral areas. Manufacturers face challenges in efficiently serving customers across geographically dispersed markets, potentially increasing distribution costs and limiting penetration in underserved regions. These infrastructure constraints can restrict market expansion opportunities.

Competitive Landscape:

The Turkey office furniture market features a competitive environment comprising domestic manufacturers and international brands serving diverse customer segments. Local companies leverage proximity to customers, understanding of regional preferences, and established distribution networks to maintain strong market positions. Competition intensifies across product innovation, design capabilities, pricing strategies, and service quality. Manufacturers are investing in technology upgrades, sustainable production practices, and expanded product portfolios to differentiate offerings. Strategic partnerships between furniture companies and commercial real estate developers create integrated solutions that enhance competitive positioning.

Recent Developments:

- In January 2025, Turkey's Trade Minister Ömer Bolat announced at the International Istanbul Furniture Fair that the country aims to achieve USD 12 billion in furniture exports, highlighting the sector's growing international competitiveness. The minister confirmed increased export funding support, rising from TL 24.7 billion in 2023 to TL 33 billion for 2024.

- In January 2024, the International Istanbul Furniture Fair attracted 167,500 visitors from 156 countries, with over 25,000 foreign buyers attending the event held at Tüyap Fair and Congress Center and Istanbul Expo Center. The fair featured more than 1,000 exhibitors showcasing approximately 3,000 brands across 250,000 square meters of exhibition space.

Turkey Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Stores, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey office furniture market size was valued at USD 594.75 Million in 2025.

The Turkey office furniture market is expected to grow at a compound annual growth rate of 3.19% from 2026-2034 to reach USD 788.8 Million by 2034.

Seating furniture, holding the largest revenue share of 65% in 2025, remains pivotal for Turkey's office furniture market, driven by growing emphasis on employee comfort, ergonomic design requirements, and workplace productivity enhancement across corporate and home office environments.

Key factors driving the Turkey office furniture market include expanding commercial real estate development, rising adoption of remote and hybrid work models, government support initiatives, growing emphasis on ergonomic workplace solutions, and increasing demand for sustainable furniture options.

Major challenges include high production costs and raw material price fluctuations, economic volatility and currency pressures, infrastructure gaps in regional markets, supply chain constraints, and intense price competition within the low-price segment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)