Turkey Paper Bags Market Size, Share, Trends and Forecast by Product Type, Material Type, Thickness, Distribution Channel, End-Use Industry, and Region, 2026-2034

Turkey Paper Bags Market Summary:

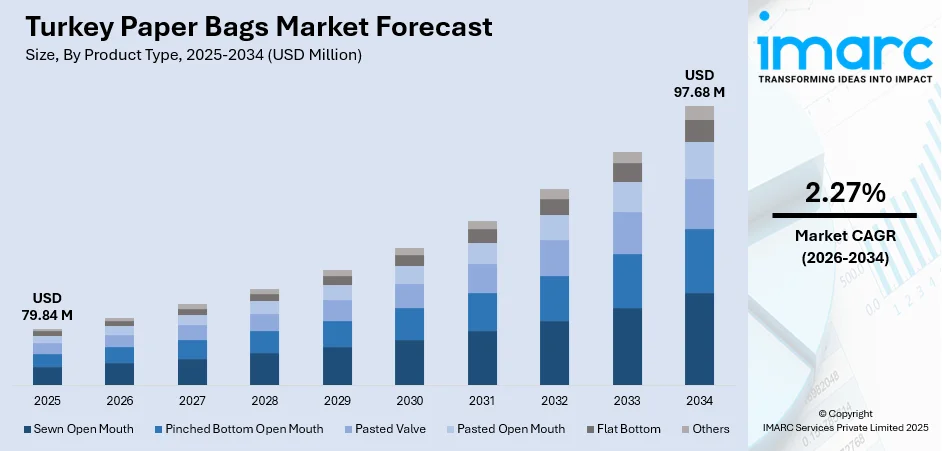

The Turkey paper bags market size was valued at USD 79.84 Million in 2025 and is projected to reach USD 97.68 Million by 2034, growing at a compound annual growth rate of 2.27% from 2026-2034.

The market growth is primarily driven by stringent government regulations on single-use plastics. Turkey's expanding e-commerce sector and flourishing retail industry are fueling demand for sustainable packaging alternatives, while rising environmental consciousness among consumers accelerates adoption across food service, retail, and logistics sectors. The convergence of regulatory momentum, digital commerce expansion, and sustainability preferences is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants across the Turkey paper bags market share.

Key Takeaways and Insights:

- By Product Type: Flat bottom bags dominate the market with a share of 35% in 2025, driven by their superior stability, enhanced brand presentation opportunities, and widespread adoption across retail and food service applications.

- By Material Type: Brown kraft paper leads the market with a share of 80% in 2025, owing to its natural appearance, superior strength, cost-effectiveness, and strong alignment with eco-conscious consumer preferences.

- By Thickness: 2 ply segment represents the largest segment with a market share of 40% in 2025, attributed to optimal balance between durability and cost-efficiency across diverse packaging applications.

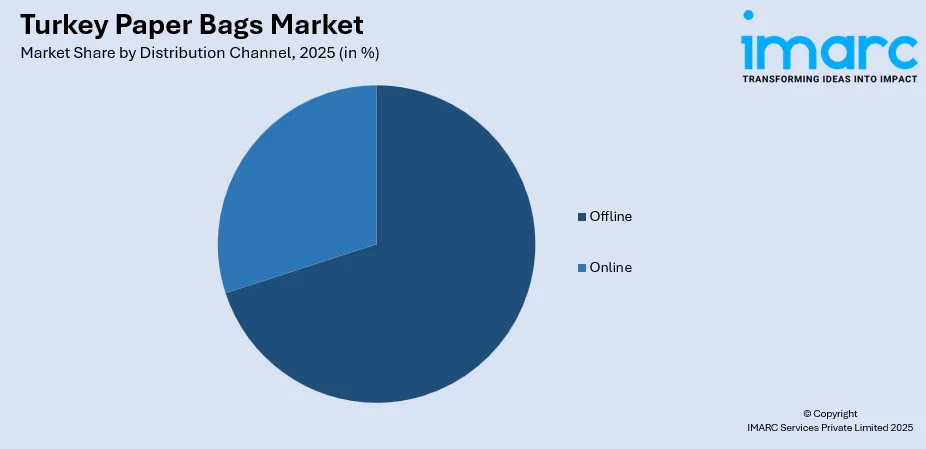

- By Distribution Channel: Offline channels exhibit clear dominance with a 70% share in 2025, supported by established retail networks, immediate product availability, and strong customer relationships in traditional markets.

- By End-Use Industry: Food and beverages accounts for the highest revenue with approximately 40% share in 2025, driven by increasing demand for hygienic, sustainable packaging solutions in quick-service restaurants, bakeries, and food delivery services.

- Key Players: The Turkey paper bags market exhibits moderate competitive intensity, characterized by the presence of established domestic manufacturers alongside international packaging companies. Market participants compete across quality, customization capabilities, sustainability certifications, and pricing strategies to capture diverse end-user segments ranging from premium retail to industrial applications.

To get more information on this market, Request Sample

Turkey's paper bags market represents a dynamic segment within the broader sustainable packaging landscape, benefiting from the country's strategic position bridging European and Asian markets. In September 2024, Felix Schoeller, a leading specialty paper manufacturer, announced plans to establish a new Competence Center in Istanbul to serve Turkey and the Middle East, scheduled to open in January 2025, demonstrating growing international interest in the Turkish market. The packaging industry continues evolving with local manufacturers integrating regional aesthetics, including Turkish motifs and calligraphic designs, while exploring innovative materials derived from agricultural waste, complementing environmental objectives while developing rural resource utilization. This blend of regulatory support, cultural relevance, and sustainability innovation positions Turkey's paper bags sector for continued expansion throughout the forecast period.

Turkey Paper Bags Market Trends:

Sustainability Momentum and Regulatory Influence

Turkey's paper bag market has been significantly shaped by a rising dedication to sustainability, propelled by the government's move to eliminate free plastic bags and promote reusable alternatives. National environmental movements within the umbrella of a larger zero-waste effort have assisted in transforming both consumer and business attitudes toward paper and biodegradable packaging. Retailers increasingly utilize these bags not merely as utilitarian packaging but also as brand statements indicating support for environmentally friendly practices, further harmonizing contemporary packaging trends with long-standing traditions honoring resource preservation.

E-Commerce Expansion and Evolving Retail Practices

Turkey's e-commerce and retail boom has transformed paper bag utilization, harmonizing packaging characteristics with the demands of digital commerce. In 2024, Turkey's e-commerce sector grew by 61.7%, reaching a total transaction volume of 3 trillion TRY, according to the Ministry of Trade. As online shopping deepens in consumer culture, brands have upgraded paper bag designs to be strong enough for delivery yet remain lightweight and cost-effective. This development mirrors a general movement toward designs optimized for logistics, marketing, and sustainability, turning paper bags into an essential component of Turkey's contemporary retail landscape.

Regional Innovation, Design, and Cultural Relevance

One of the unique drivers fueling the Turkey paper bags market growth is the blend of regional aesthetics with innovation. Local producers and packaging ateliers are fusing tradition with modern trends, adding Turkish motifs, delicate patterns, or calligraphic prints onto paper bag designs for boutique shops and craft brands. Beyond aesthetic design, there is innovation in materials, with some manufacturers exploring fibers sourced from non-wood sources such as agricultural waste, complementing environmental objectives while developing rural resource utilization. Consumers in traditional markets and contemporary malls alike value paper bags that express cultural identity while meeting modern eco-awareness and retail brand requirements.

Market Outlook 2026-2034:

The Turkey paper bags market demonstrates robust growth potential throughout the forecast period, underpinned by regulatory enforcement and evolving consumer preferences toward sustainable packaging. The market generated a revenue of USD 79.84 Million in 2025 and is projected to reach a revenue of USD 97.68 Million by 2034, growing at a compound annual growth rate of 2.27% from 2026-2034. Continued government support through zero-waste initiatives and extended producer responsibility frameworks will sustain market momentum, while increasing international manufacturer interest signals confidence in long-term growth trajectories.

Turkey Paper Bags Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Flat Bottom | 35% |

| Material Type | Brown Kraft | 80% |

| Thickness | 2 Ply | 40% |

| Distribution Channel | Offline | 70% |

| End-Use Industry | Food and Beverages | 40% |

Product Type Insights:

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

- Flat Bottom

- Others

The flat bottom segment dominates with a market share of 35% of the total Turkey paper bags market in 2025.

Flat bottom paper bags have emerged as the leading product type in Turkey's paper bags market, offering superior stability and presentation capabilities that make them ideal for retail, food service, and branded packaging applications. These bags feature a rectangular base that allows them to stand upright on shelves and counters, enhancing product visibility and consumer convenience. The design accommodates larger volumes while maintaining structural integrity, making them particularly suitable for bakery products, takeaway meals, and premium retail items where brand presentation is paramount.

The segment's market leadership is attributable to its versatility across multiple end-use industries and the growing demand for aesthetically appealing sustainable packaging. Turkish manufacturers have invested in advanced production technologies to offer customization options including various sizes, printing capabilities, and reinforced handles. The flat bottom design facilitates efficient packing and storage during transportation, reducing logistics costs while maintaining product protection. As retailers increasingly prioritize packaging that combines functionality with brand storytelling, flat bottom bags continue to gain prominence across Istanbul's modern malls, traditional bazaars, and emerging quick-service restaurant chains throughout Turkey.

Material Type Insights:

- Brown Kraft

- White Kraft

The brown kraft segment leads the market with a share of 80% of the total Turkey paper bags market in 2025.

Brown kraft paper has established overwhelming dominance in Turkey's paper bags market due to its natural appearance, superior mechanical strength, and strong alignment with sustainability messaging. Produced from unbleached wood pulp through the kraft process, this material retains its natural brown color while offering excellent tear resistance and durability. The manufacturing process requires fewer chemicals than bleached alternatives, enhancing its environmental credentials and appealing to increasingly eco-conscious Turkish consumers and businesses seeking to demonstrate sustainability commitments.

The segment benefits from cost advantages compared to white kraft alternatives, making it accessible across diverse market segments from premium boutiques to mass-market retail. Turkish manufacturers such as TürkKraft and local specialty paper producers offer brown kraft paper bags suitable for packaging animal feed, cement, food products, and various agricultural goods where durability and tear-resistance are essential. The material's natural aesthetic has become synonymous with eco-friendly branding, with retailers across Turkey utilizing brown kraft bags to emphasize their commitment to environmental responsibility while benefiting from the material's excellent printability for custom branding applications.

Thickness Insights:

- 1 Ply

- 2 Ply

- 3 Ply

- > 3 Ply

The 2 ply segment holds the largest share of 40% of the total Turkey paper bags market in 2025.

The 2 ply thickness segment has achieved market leadership by offering an optimal balance between structural strength and cost efficiency, meeting the requirements of diverse packaging applications across Turkey's retail and food service sectors. This configuration provides sufficient durability for carrying moderate loads while maintaining the flexibility and lightweight characteristics essential for everyday consumer use. The 2 ply design delivers adequate protection for food products, retail merchandise, and general consumer goods without the additional material costs associated with heavier multi-ply alternatives, making it the preferred choice for businesses seeking to balance quality with budget considerations.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Online

- Offline

The offline distribution channel accounts for the largest revenue share of approximately 70% in the Turkey paper bags market in 2025.

Offline distribution channels maintain dominant market position in Turkey's paper bags sector, driven by established B2B relationships between manufacturers and end-users across retail, food service, and industrial applications. Traditional distribution networks enable manufacturers to provide personalized service, technical support, and customization options that strengthen long-term customer relationships. The Marmara region, particularly Istanbul, hosts the highest concentration of packaging distributors and manufacturers, facilitating efficient supply chain operations across Turkey's major consumption centers. While e-commerce channels are experiencing rapid growth, offline channels continue to dominate due to the bulk nature of paper bag procurement, the need for product sampling and quality verification, and the importance of face-to-face negotiations for large-volume orders.

End-Use Industry Insights:

- Food and Beverages

- Pharmaceutical

- Retail

- Construction

- Chemicals

- Others

The food and beverages segment dominates with a market share of 40% of the total Turkey paper bags market in 2025.

The food and beverages industry has emerged as the largest end-use segment for paper bags in Turkey, driven by the sector's substantial scale and increasing preference for sustainable, hygienic packaging solutions. Quick service restaurants have a strong demand for paper-based packaging for hamburgers, wraps, traditional bakery items, and takeaway meals. The segment's growth is further propelled by the proliferation of food delivery platforms like Trendyol and Yemeksepeti, which have garnered millions of users and are facilitating seamless connections between restaurants and consumers seeking convenient dining options.

Paper bags serve multiple functions within the food and beverages sector, including primary product packaging, delivery containers, and branded carrier bags that enhance customer experience while communicating sustainability values. Turkish food service operators increasingly favor paper bags due to their grease resistance capabilities, breathability for fresh products, and alignment with consumer expectations for environmentally responsible packaging that maintains food quality during transportation.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara region dominates Turkey's paper bags market, driven by Istanbul's position as the country's commercial and manufacturing hub. The region hosts the highest concentration of packaging companies, with over 529 packaging manufacturers and producers located in Istanbul and the broader Marmara area according to industry directories. Istanbul's status as Turkey's most populous city with its extensive retail infrastructure, thriving food service sector, and concentration of international and domestic businesses creates substantial demand for paper bag products. Major cities including Bursa, Kocaeli, and Eskişehir contribute additional manufacturing capacity, with companies like Saica Pack operating facilities in Istanbul headquarters and regional plants serving diverse industry needs.

Central Anatolia represents a significant market for paper bags driven by Ankara's position as Turkey's administrative capital and second-largest city, alongside emerging manufacturing centers in Konya and Kayseri. The region benefits from its strategic central location facilitating distribution across the country, while government institutions and a large population of university students and civil servants generate consistent retail packaging demand. Growing organized industrial zones and defense sector establishments around Ankara contribute to increased packaging requirements across commercial and institutional segments.

The Mediterranean region presents substantial growth opportunities for paper bags driven by Antalya's dominant tourism industry welcoming approximately sixteen million visitors annually, alongside agricultural processing activities in Adana and Mersin. The hospitality sector's extensive hotel, restaurant, and retail infrastructure creates significant demand for branded packaging solutions, while the region's citrus processing and food production industries require durable packaging for product distribution. Seasonal tourism fluctuations influence demand patterns, with peak consumption occurring during summer months.

The Aegean region demonstrates strong paper bags market potential centered on Izmir, Turkey's third-largest city and a major export hub contributing approximately six percent of national industrial output. The region's textile manufacturing heritage in Denizli and Izmir creates demand for premium retail packaging, while its agricultural sector producing olives, figs, and cotton generates industrial packaging requirements. Izmir's developed port infrastructure and free trade zones facilitate international trade activities requiring diverse packaging solutions across quality segments.

Southeastern Anatolia is experiencing accelerated paper bags market development driven by the transformative Southeastern Anatolia Project expanding agricultural irrigation and processing capabilities across nine provinces. Gaziantep has emerged as the region's industrial powerhouse with significant textile and food processing sectors, while Şanlıurfa's agricultural output expansion creates growing packaging demand. The region's exports have expanded substantially over the past two decades, with food processing and textile industries driving increased requirement for quality packaging solutions.

The Black Sea region contributes to Turkey's paper bags market through its distinctive agricultural economy centered on hazelnut production in Giresun and tea cultivation in Rize, both requiring specialized packaging for domestic distribution and export. Samsun and Trabzon serve as regional commercial centers with developing retail infrastructure generating consistent packaging demand. The region's fishing industry and food processing activities, particularly in preserved fish and dairy products, create additional demand for food-grade paper packaging solutions suitable for regional distribution networks.

Eastern Anatolia represents an emerging market for paper bags with development driven by improving infrastructure connectivity and expanding retail networks in provincial centers including Erzurum, Van, and Malatya. The region's agricultural sector, particularly apricot production in Malatya which accounts for nearly half of Turkey's total output, generates specialized packaging requirements for fruit distribution. While industrial development remains limited compared to western regions, government investment in transportation infrastructure and organized industrial zones is gradually improving market accessibility and commercial activity levels.

Market Dynamics:

Growth Drivers:

Why is the Turkey Paper Bags Market Growing?

Stringent Government Regulations and Zero Waste Initiatives

Turkey’s push toward cleaner habits has pushed paper bags into everyday life. The rules around plastic bags are strict, and retailers I’ve spoken with say the shift happened faster than they expected. The Ministry of Environment and Urbanization reports that plastic bag use dropped by more than 77% in the first eleven months after the policy took effect. That change saved about 150,000 tons of plastic and kept nearly 6,000 tons of CO₂ out of the air. These results encouraged more stores, food outlets, and small businesses to switch to paper options, giving the market steady and predictable growth.

Rapid E-Commerce Expansion and Digital Retail Transformation

Turkey's e-commerce boom is creating substantial demand for durable, sustainable packaging solutions that protect products during delivery while communicating brand values. According to the Ministry of Trade's 2025 report, Turkey's e-commerce sector grew by 61.7% in 2024, reaching a total transaction volume of 3 trillion TRY, with quick commerce expanding by 98.1% compared to the previous year. This digital transformation has fundamentally altered packaging requirements, with brands upgrading paper bag designs to be strong enough for delivery yet lightweight and cost-effective. Leading platforms are driving demand for branded paper packaging that enhances unboxing experiences. The convergence of online retail growth, delivery logistics optimization, and consumer preference for sustainable packaging positions paper bags as essential components of Turkey's evolving digital commerce ecosystem.

Rising Environmental Consciousness and Sustainability Preferences

Environmental awareness among Turkish consumers has intensified significantly, making paper-based solutions increasingly attractive to businesses and end users seeking to align with sustainability objectives. The dramatic behavioral shift following regulatory intervention demonstrates consumer receptivity to sustainable alternatives when properly supported by policy frameworks. For companies, sustainable packaging has evolved beyond mere compliance to become a strategic differentiator for strengthening brand reputation and appealing to eco-conscious consumers. Turkish retailers increasingly utilize paper bags not merely as utilitarian packaging but as statements indicating support for environmentally friendly practices, with the natural brown kraft aesthetic becoming synonymous with authentic sustainability messaging across traditional markets and contemporary retail environments.

Market Restraints:

What Challenges the Turkey Paper Bags Market is Facing?

Raw Material Cost Fluctuations and Supply Chain Pressures

The Turkey paper bags market faces significant challenges from volatile raw material costs and supply chain uncertainties affecting kraft paper pricing and availability. Currency fluctuations, global pulp market dynamics, and increasing energy costs impact production economics, compelling manufacturers to balance quality maintenance with cost management strategies. These pressures can compress profit margins and affect pricing competitiveness in a market where cost sensitivity influences purchasing decisions across diverse end-user segments.

Competition from Alternative Sustainable Packaging Materials

Paper bags face growing competition from other sustainable packaging alternatives including reusable fabric bags, biodegradable plastics, and innovative materials derived from agricultural waste. While paper maintains strong positioning due to recyclability and biodegradability, competing solutions offer distinct advantages such as water resistance, reusability, and extended durability that appeal to specific market segments. Manufacturers must continuously innovate to maintain competitive positioning against emerging alternatives.

Economic Volatility and Inflation Impact on Consumer Spending

Turkey's high inflation environment and economic challenges affect consumer spending patterns and business investment decisions across the packaging value chain. With inflation reaching historically elevated levels, businesses face pressure to minimize costs while consumers become more price-sensitive in purchasing decisions. This economic context can constrain premium paper bag adoption and influence buyers toward lower-cost alternatives, potentially slowing market growth in certain segments.

Competitive Landscape:

The Turkey paper bags market exhibits moderate competitive intensity characterized by the presence of established domestic manufacturers alongside international packaging companies expanding their regional footprint. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing advanced sustainability features and customization capabilities to value-oriented products targeting cost-conscious consumers across diverse end-use industries. The competitive landscape is increasingly shaped by sustainability certifications, digital printing capabilities for brand customization, and operational efficiency improvements that enable competitive pricing while maintaining quality standards. Domestic manufacturers benefit from proximity to customers, local market understanding, and established distribution relationships, while international entrants bring technological expertise and global best practices to the Turkish market.

Turkey Paper Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom, Others |

| Material Types Covered | Brown Kraft, White Kraft |

| Thickness Covered | 1 Ply, 2 Ply, 3 Ply, > 3 Ply |

| Distribution Channels Covered | Online, Offline |

| End-Use Industries Covered | Food and Beverages, Pharmaceutical, Retail, Construction, Chemicals, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey paper bags market size was valued at USD 79.84 Million in 2025.

The Turkey paper bags market is expected to grow at a compound annual growth rate of 2.27% from 2026-2034 to reach USD 97.68 Million by 2034.

The flat bottom segment dominated the market with a 35% share in 2025, driven by superior stability, enhanced brand presentation capabilities, and widespread adoption across retail and food service applications.

Key factors driving the Turkey paper bags market include stringent government regulations on single-use plastics including the 2019 ban that reduced plastic bag usage by 77%, rapid e-commerce expansion with 61.7% sector growth in 2024, rising environmental consciousness among consumers, and the Zero Waste Project's influence on institutional adoption

Major challenges include raw material cost fluctuations and supply chain pressures affecting kraft paper pricing, competition from alternative sustainable packaging materials including reusable bags and biodegradable plastics, and economic volatility with high inflation impacting consumer spending patterns and business investment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)