Turkey Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Turkey Paper Packaging Market Overview:

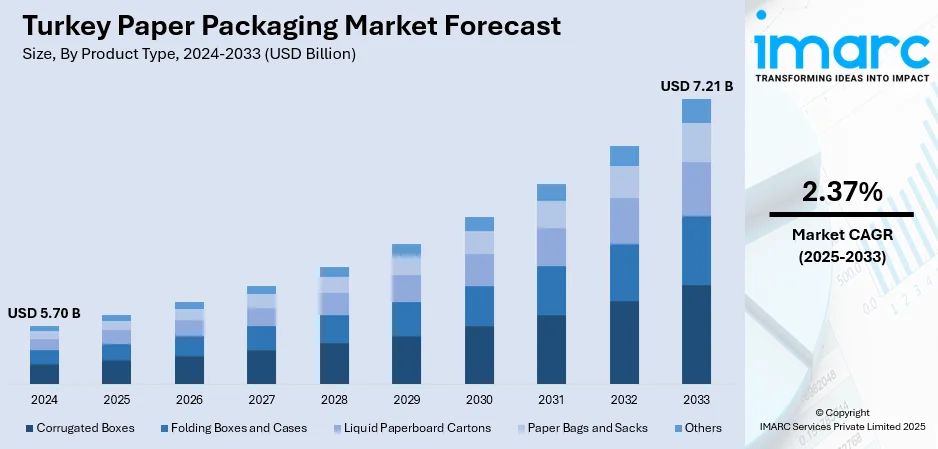

The Turkey paper packaging market size reached USD 5.70 Billion in 2024. The market is projected to reach USD 7.21 Billion by 2033, exhibiting a growth rate (CAGR) of 2.37% during 2025-2033. The market is growing rapidly, driven by the expansion of e‑commerce has increased the need for durable, lightweight, and customizable packaging such as corrugated boxes and branded cartons, supporting both product protection and brand visibility. At the same time, rising environmental awareness and stricter regulations on single‑use plastics are pushing businesses toward recyclable, biodegradable, and sustainable paper-based solutions. Additionally, digitalization through automation and artificial intelligence (AI) is enhancing production efficiency, quality, and innovation, making it a preferred choice across retail, food, and consumer goods industries thus aiding the Turkey paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.70 Billion |

| Market Forecast in 2033 | USD 7.21 Billion |

| Market Growth Rate 2025-2033 | 2.37% |

Turkey Paper Packaging Market Trends:

Booming E‑commerce & Retail Packaging Demand

The rapid expansion of e‑commerce in Turkey has created a strong demand for durable, lightweight, and customizable packaging. As more businesses shift to online platforms, the demand for corrugated boxes, paper bags, and branded cartons has increased substantially. Paper packaging is favored because it protects products during shipping while allowing for effective brand presentation, helping businesses stand out in a competitive marketplace. Additionally, retail outlets increasingly prefer paper-based solutions for their sustainable appeal and versatility across food, apparel, and consumer goods. This surge in e‑commerce has also led to heightened emphasis on packaging that balances protection with presentation, influencing suppliers to innovate and deliver cost‑effective, adaptable solutions. Ultimately, the growth of online retail and changing consumer purchasing habits continue to drive Turkey paper packaging market growth.

To get more information on this market, Request Sample

Sustainability Trends & Regulatory Pressure

Environmental awareness among Turkish consumers has greatly intensified the demand for eco‑friendly packaging, making paper-based solutions increasingly attractive to businesses and end users. According to Turkey’s Ministry of Environment and Urbanization, the 2019 ban on free plastic bags reduced their usage by over 77%, saving 150,000 tons of plastic and preventing 6,000 tons of CO₂ emissions within the first 11 months. This landmark success reflects a broader shift toward sustainability and reinforces regulatory momentum for replacing single‑use plastics with recyclable, biodegradable, and compostable alternatives. Such measures are prompting manufacturers to innovate with recycled fibers, non‑wood pulp, and other eco‑conscious materials. For companies, sustainable packaging has evolved beyond mere compliance to a strategic move for strengthening brand reputation and appealing to eco‑conscious consumers. As regulations tighten and awareness grows, paper packaging emerges as a natural, future‑ready solution for Turkey’s evolving market.

Digitalization & Production Efficiency via AI & Automation

Another significant Turkey paper packaging market trend is the transformation driven by digitalization & production efficiency via AI and automation. Manufacturers are adopting advanced technologies such as automation, artificial intelligence, and data-driven analytics to improve production efficiency and maintain consistent quality. These innovations streamline operations by reducing downtime, optimizing resource use, and enabling real-time adjustments in manufacturing processes. Enhanced digital tools also support the development of innovative designs and materials, allowing producers to respond quickly to shifting market needs. This emphasis on efficiency improves the industry's capacity to produce high-quality goods more quickly and precisely while simultaneously reducing operating expenses. By leveraging smart technologies, companies can adapt more easily to changing demands while maintaining a competitive edge. This technological evolution is transforming how paper packaging is designed, produced, and delivered, ensuring long‑term growth for the sector.

Turkey Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

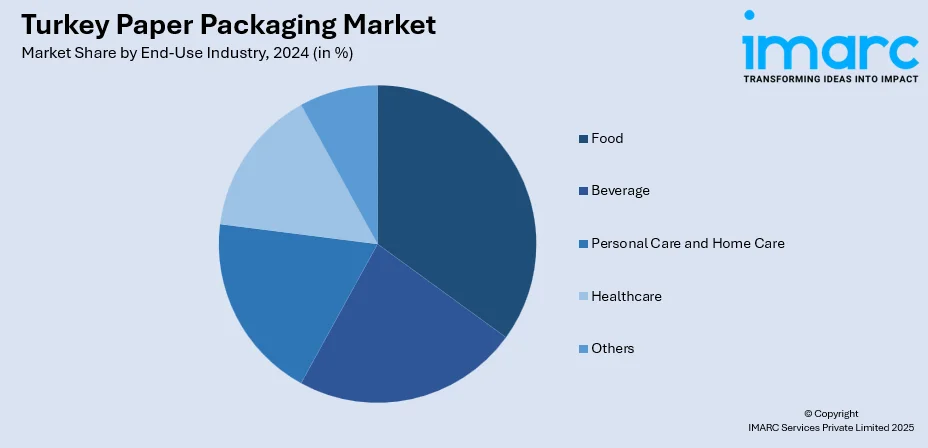

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Paper Packaging Market News:

- In September 2024, Felix Schoeller, a leading speciality paper manufacturer, announced plans to establish a new Competence Center in Istanbul to serve Turkey and the Middle East. Set to open on January 1, 2025, the hub will provide direct services and consulting for the company’s premium speciality papers. This strategic move aims to strengthen customer support, enhance regional presence, and expand Felix Schoeller’s offerings in these growing markets.

- In June 2025, Rondo Ganahl AG, an Austrian company, completely left the Turkish market when it sold its corrugated packaging facility in Istanbul to a regional manufacturer. Acquired in 2013 as MKB Oluklu Mukavva Kutu ve Ambalaj, the site contributed positively to Rondo’s operations but faced spatial constraints. Citing Turkey’s strained economy, high inflation, and union demands, Rondo will now focus on optimizing resources and strengthening competitiveness at its sites in Austria, Romania, Germany, and Hungary.

Turkey Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey paper packaging market on the basis of product type?

- What is the breakup of the Turkey paper packaging market on the basis of grade?

- What is the breakup of the Turkey paper packaging market on the basis of packaging level?

- What is the breakup of the Turkey paper packaging market on the basis of end-use industry?

- What is the breakup of the Turkey paper packaging market on the basis of region?

- What are the various stages in the value chain of the Turkey paper packaging market?

- What are the key driving factors and challenges in the Turkey paper packaging market?

- What is the structure of the Turkey paper packaging market and who are the key players?

- What is the degree of competition in the Turkey paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)