Turkey Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2026-2034

Turkey Plywood Market Summary:

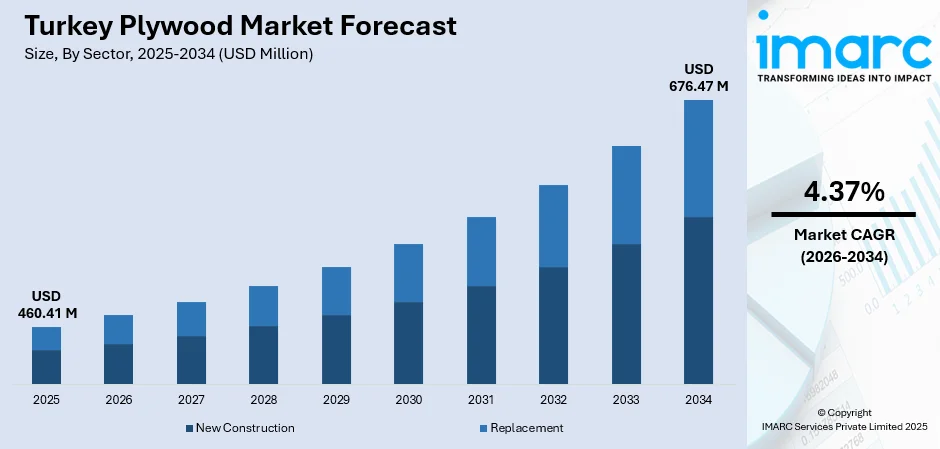

The Turkey plywood market size was valued at USD 460.41 Million in 2025 and is projected to reach USD 676.47 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

The Turkey plywood market is witnessing robust expansion as the country advances its infrastructure modernization agenda and strengthens its position as a regional construction hub. Sustained government investments in transportation networks, including highway expansions and airport developments, are driving consistent demand for construction-grade plywood. Additionally, the thriving hospitality and tourism sectors are creating significant opportunities for interior applications, while growing furniture manufacturing and retail expansion further bolster the Turkey plywood market share.

Key Takeaways and Insights:

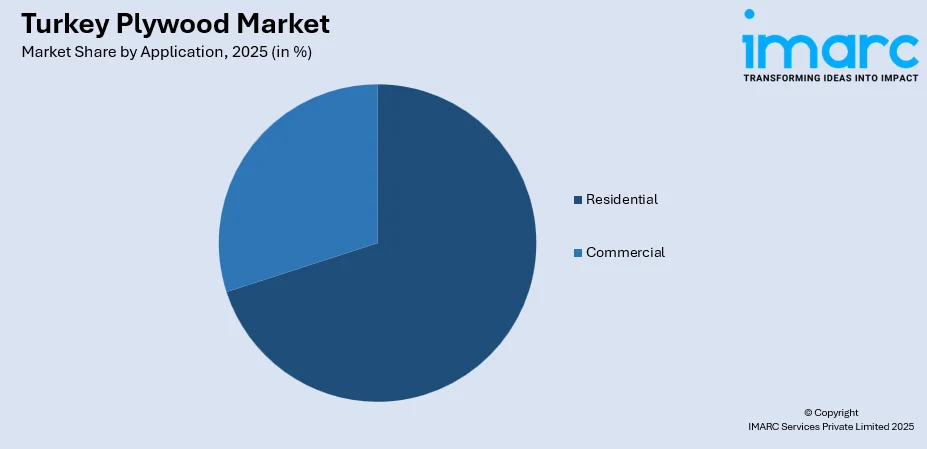

- By Application: Residential dominates the market with a share of 70.06% in 2025, driven by ongoing urban housing development and renovation activities across major Turkish metropolitan areas.

- By Sector: New Construction leads the market with a share of 64.96% in 2025, supported by extensive infrastructure projects and post-earthquake reconstruction efforts throughout the country.

- Key Players: The Turkey plywood market features a competitive landscape with domestic manufacturers competing alongside international suppliers, focusing on quality improvements, sustainable sourcing practices, and expanding distribution networks to capture market share across residential and commercial segments.

To get more information on this market Request Sample

The Turkey plywood market is experiencing steady growth as construction activities intensify across the country. The government's commitment to infrastructure development, evidenced by programs targeting expansion of the divided road network to over 38,060 kilometers and highway network exceeding 8,325 kilometers by 2053, creates substantial demand for construction materials, including plywood. Turkey’s advantageous location between Europe and Asia, along with its involvement in key regional trade routes, continues to support steady market expansion. Ongoing infrastructure development across airports, transportation networks, and commercial facilities is driving consistent demand for construction materials. Within this environment, plywood remains widely used for formwork, temporary structures, and interior finishing, reinforcing its importance in Turkey’s construction and industrial sectors.

Turkey Plywood Market Trends:

Expansion of Transportation Infrastructure Networks

Turkey is accelerating transportation infrastructure development to enhance national and regional connectivity. The government aims to expand the total road network to approximately 50,000 kilometers by 2025, prioritizing east-west corridors, north-south axes, and border connections. Istanbul Airport's EUR 656.5 million capital expenditure program in 2024 introduced Europe's first triple-parallel runway configuration while targeting 85 million passenger capacity by 2025. These transportation projects generate consistent demand for plywood in formwork applications, temporary construction structures, and interior finishing of passenger terminals and logistics facilities, supporting Turkey plywood market growth.

Thriving Hospitality and Tourism Industry Development

Turkey’s tourism sector continues to experience strong momentum, attracting a growing number of international travelers and supporting higher revenue generation across the country. This steady expansion of the hospitality industry boosts the need for plywood in hotel construction, resort development, and restaurant interior design. Leading global hotel brands are actively broadening their presence in the market by adding new properties. Ongoing renovation cycles, modernization efforts, and distinctive brand-driven design requirements ensure consistent plywood usage across guest rooms, lobbies, dining spaces, and conference areas.

Rising Adoption of Sustainable Construction Materials

The construction industry is increasingly prioritizing environmentally responsible building materials, creating opportunities for sustainable plywood products. Turkey's 2053 net-zero pledge and the Building Sector Decarbonization Roadmap are compelling developers to adopt eco-friendly construction practices. Mandatory green-cement procurement requirements effective from January 2025 signal broader regulatory shifts toward sustainable materials. Plywood manufacturers are responding by pursuing Forest Stewardship Council certification, implementing low-emission adhesive technologies, and adopting sustainable forestry practices to meet evolving market demands and regulatory standards.

Market Outlook 2026-2034:

The Turkey plywood market outlook remains positive as multiple growth catalysts converge to support sustained expansion. The construction sector's continued recovery, supported by post-earthquake reconstruction efforts and government infrastructure programs, provides a stable demand foundation. Residential construction remains the primary consumption driver, while commercial and institutional projects offer additional growth opportunities. Turkey's growing furniture manufacturing industry creates consistent demand for high-quality plywood materials. The market generated a revenue of USD 460.41 Million in 2025 and is projected to reach a revenue of USD 676.47 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

Turkey Plywood Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Residential | 70.06% |

| Sector | New Construction | 64.96% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The residential segment dominates with a market share of 70.06% of the total Turkey plywood market in 2025.

The residential segment maintains its leading position driven by Turkey's ongoing urbanization and housing development initiatives. Turkey’s residential construction sector represents a major share of overall building activity, keeping plywood demand strong for flooring, wall paneling, cabinetry, and furniture in homes and apartments. The country’s young population and expanding middle class continue to drive housing needs in major cities such as Istanbul, Ankara, and Izmir, supporting steady and ongoing consumption of plywood in residential projects.

The commercial segment represents significant growth potential as retail expansion, hospitality development, and office construction continue across Turkey. The Turkey retail market size reached USD 391.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 868.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. This is driving the demand for commercial plywood applications in shopping malls, boutiques, and retail outlets. Plywood serves essential functions in commercial environments for shelving, counters, partitions, wall cladding, and display units, with frequent renovations and store redesigns supporting ongoing material consumption.

Sector Insights:

- New Construction

- Replacement

The new construction sector leads with a share of 64.96% of the total Turkey plywood market in 2025.

New construction dominates the market as Turkey continues its ambitious infrastructure and building development programs. The construction industry achieved robust growth in 2024, supported by investments in industrial construction, housing projects, and earthquake reconstruction efforts. The Asian Infrastructure Investment Bank approved USD 200 Million in September 2024 to support earthquake-affected area reconstruction, while the World Bank approved USD 600 Million in June 2024 for infrastructure resilience development. These substantial investments create consistent demand for plywood in formwork, structural applications, and interior finishing across new building projects.

The replacement sector maintains steady demand as property owners and businesses undertake renovation and modernization projects. Turkey's established building stock requires periodic maintenance, upgrades, and interior refreshes, creating ongoing plywood consumption for refurbishment activities. The hospitality industry's emphasis on maintaining modern, attractive facilities drives replacement demand, while residential renovation trends support plywood sales for home improvement projects. This segment benefits from the growing DIY culture and increasing homeowner investments in property upgrades.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The Marmara Region’s strong industrial base, dense population, and rapid urban development significantly drive plywood demand. Large-scale residential and commercial projects, expanding logistics hubs, and continuous infrastructure upgrades support sustained consumption. The region’s thriving manufacturing and furniture industries further boost plywood usage for interior applications, packaging, and construction purposes. High renovation activity in Istanbul also contributes to ongoing market growth, ensuring consistent material requirements.

Central Anatolia’s plywood demand is propelled by expanding residential construction, industrial zone development, and rising commercial real estate activity. Ankara’s government-led infrastructure projects and growth in educational and health facilities fuel consumption. The region’s furniture and carpentry sectors also rely heavily on plywood for cabinetry and interior elements. Increasing urbanization and housing modernization efforts continue to strengthen plywood usage across both public and private construction projects.

The Mediterranean Region experiences strong plywood demand due to dynamic tourism-driven construction, including hotels, resorts, and dining establishments. Rapid urban expansion in coastal cities, combined with continuous renovation of hospitality properties, drives steady material usage. Growing agricultural processing facilities and logistics networks also contribute to demand for industrial and structural plywood. Warm-climate architectural styles with extensive interior woodwork further support market growth across the region.

In the Aegean Region, plywood demand is supported by a vibrant tourism economy, active residential development, and extensive renovation of holiday homes and hospitality properties. Coastal cities prioritize aesthetic interiors, strengthening the use of plywood in furniture, paneling, and decorative applications. Expanding industrial estates and logistics infrastructure also stimulate construction activity. The region’s strong furniture manufacturing base continues to create consistent demand for high-quality plywood materials.

Southeastern Anatolia’s plywood market is influenced by expanding infrastructure projects, urban transformation programs, and industrial development initiatives. Growth in agricultural processing, logistics facilities, and new housing projects fuels steady plywood consumption. Government-led modernization efforts in transportation and public buildings also contribute to increased usage. The region’s evolving furniture manufacturing sector further supports demand for plywood in cabinetry, shelving, and interior finishing.

The Black Sea Region benefits from active housing construction, port development projects, and steady growth in agricultural and forestry-related industries. Plywood demand is supported by extensive use in traditional housing styles, interior furnishing, and local carpentry work. Infrastructure upgrades, including roads and logistics terminals, drive additional consumption. The region’s furniture workshops and wood-based manufacturing clusters further strengthen ongoing plywood requirements.

Eastern Anatolia’s plywood demand is driven by government-supported infrastructure development, new housing initiatives, and urban renewal programs across emerging cities. Cold-climate construction practices increase the use of plywood in insulation support, roofing elements, and interior structures. Expanding public services—including healthcare, education, and transportation facilities—further stimulate consumption. Growing small-scale furniture production and carpentry activities also maintain steady market demand.

Market Dynamics:

Growth Drivers:

Why is the Turkey Plywood Market Growing?

Robust Construction Industry Expansion and Infrastructure Investment

Turkey's construction industry continues to demonstrate strong growth, providing the primary foundation for plywood market expansion. The sector achieved substantial growth in 2024, supported by government infrastructure programs and private sector investments. The Turkey construction market size reached USD 117.75 Billion in 2024. The market is projected to reach USD 227.56 Billion by 2033, exhibiting a growth rate (CAGR) of 6.81% during 2025-2033. The government’s ongoing focus on strengthening transportation infrastructure, including continued expansion of road networks, supports steady demand for construction materials. Large-scale projects involving high-speed rail, highways, and airport development rely on plywood for formwork, temporary structures, and various interior finishing needs, driving consistent usage across the construction sector.

Flourishing Tourism and Hospitality Sector

Turkey's tourism industry has emerged as a significant driver of plywood demand, achieving record performance in 2024. The country welcomed 62.23 million visitors, generating USD 61.1 billion in tourism revenue, surpassing government targets and establishing new all-time highs. This tourism boom is catalyzing substantial investment in hospitality infrastructure, with international hotel chains expanding their Turkish portfolios. The Turkey’s hospitality sector continues to expand, supported by rising tourism activity, growing international hotel presence, and ongoing investment in new properties. Plywood plays a crucial role in hotel construction and interior design, providing key materials for wall paneling, ceilings, partitions, furniture, and decorative elements. Frequent renovation cycles and brand-driven customization needs across hotels and resorts ensure steady and long-term plywood demand in the market.

Growing Furniture Manufacturing and Retail Sector Expansion

Turkey's furniture industry and expanding retail sector create significant plywood demand across multiple applications. The furniture market generates substantial revenue, with wood remaining the dominant material segment due to Turkey's abundant forest resources covering approximately 27.6% of the country's land area. Turkey’s expanding retail sector is fueling strong demand for plywood in a wide range of commercial interior applications. Shopping malls, supermarkets, boutiques, and franchise stores rely on plywood for shelving, counters, partitions, wall cladding, and display units. The country’s growing role as a prominent furniture producer and exporter further strengthens domestic plywood consumption, as manufacturers depend on high-quality plywood for crafting durable, attractive furniture products.

Market Restraints:

What Challenges is the Turkey Plywood Market Facing?

Raw Material Price Volatility and Supply Chain Constraints

The Turkey plywood market faces challenges from fluctuating timber and adhesive prices that impact production costs and profit margins. Global supply chain disruptions have extended lead times for raw materials, creating inventory management challenges. Manufacturers must navigate these price uncertainties while maintaining competitive pricing for end customers, potentially compressing margins during periods of elevated input costs.

Currency Fluctuations and Economic Uncertainty

Ongoing Turkish Lira depreciation affects plywood import costs and overall market dynamics. Currency volatility increases the cost of imported plywood products and raw materials, while high inflation rates impact consumer purchasing power and construction budgets. These economic factors create planning challenges for manufacturers, distributors, and end-users across the plywood value chain, potentially moderating demand growth.

Environmental Regulations and Compliance Requirements

Increasing environmental standards and sustainability requirements present compliance challenges for plywood manufacturers. Regulations regarding formaldehyde emissions, sustainable forestry practices, and carbon footprint reduction require investments in cleaner production technologies and certified sourcing. While these requirements ultimately benefit market development, the transition period involves additional costs and operational adjustments for industry participants.

Competitive Landscape:

The Turkey plywood market exhibits a fragmented competitive structure with numerous domestic manufacturers competing alongside imported products from regional and international suppliers. Market participants are focusing on product quality improvements, expanding distribution networks, and developing specialized plywood grades for specific applications. Competition centers on price competitiveness, delivery reliability, and technical support services. Companies are investing in production capacity expansion and modernization to meet growing domestic demand while pursuing export opportunities. Strategic partnerships between manufacturers and construction companies are becoming increasingly common, while sustainability certifications are emerging as competitive differentiators for market positioning.

Recent Developments:

- In May 2025, TAV Airports Holding announced plans to invest USD 362 million in Almaty Airport development from 2025 to 2029, encompassing runway reconstruction, terminal upgrades, cargo facility enhancements, and airport hotel construction, demonstrating continued infrastructure investment supporting construction material demand.

- In February 2025, Georgia-Pacific announced an investment of USD 14 million to modernize its Prosperity plywood mill, focusing on efficiency improvements and equipment upgrades to increase production output and enhance product durability, reflecting global plywood industry investment trends.

- In February 2025, Accor completed the management takeover of The Grand Tarabya in Istanbul for rebranding as Fairmont following extensive renovations, highlighting continued international hospitality investment in Turkey's tourism infrastructure.

Turkey Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey plywood market size was valued at USD 460.41 Million in 2025.

The Turkey plywood market is expected to grow at a compound annual growth rate of 4.37% from 2026-2034 to reach USD 676.47 Million by 2034.

The residential segment held the largest share at 70.06% in 2025, driven by ongoing urban housing development, renovation activities across major metropolitan areas, and Turkey's growing middle-class population seeking quality home interiors and furniture solutions.

Key factors driving the Turkey plywood market include robust construction industry expansion supported by government infrastructure programs, flourishing tourism and hospitality sector development creating demand for interior applications, growing furniture manufacturing industry, and expanding retail sector requiring commercial interior solutions.

Major challenges include raw material price volatility affecting production costs, currency fluctuations impacting import expenses and overall market dynamics, supply chain constraints creating inventory management difficulties, and increasing environmental regulations requiring compliance investments in sustainable production practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)