Turkey Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Turkey Private Equity Market Overview:

The Turkey private equity market size reached USD 6,903.83 Million in 2024. The market is projected to reach USD 14,663.39 Million by 2033, exhibiting a growth rate (CAGR) of 8.73% during 2025-2033. The market is driven by regulatory reforms, a growing tech-driven population, and expanding export sectors. Macroeconomic stabilization and policy support attract foreign means while entrepreneurial momentum accelerates deal activity, further increasing the Turkey private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,903.83 Million |

| Market Forecast in 2033 | USD 14,663.39 Million |

| Market Growth Rate 2025-2033 | 8.73% |

Turkey Private Equity Market Trends:

Tech‑Enabled and Export‑Driven Investments

Turkey private equity market growth is being propelled by investments in technology-led and export-oriented companies. The country’s digital readiness and youthful demographic are drawing private equity toward fintech, e‑commerce, gaming, and AI-enabled enterprises. With early-stage tech investments totaling over $1.1 billion across 469 deals in 2024, the ecosystem is vibrant and dynamic. Simultaneously, strong performance in automotive and industrial exporting sectors attracts foreign capital seeking scalable assets. Regulatory liberalization and investor-friendly incentives further boost capital inflows. These dual forces, digital innovation and international trade, are transforming Turkey into a compelling regional private equity destination.

To get more information on this market, Request Sample

Rising Deal Volume and Sector Diversification

Turkey’s private equity activity surged in 2024 with disclosed M&A deals reaching $5.3 Billion and an estimated total of $10.1 Billion including undisclosed deals. Deal sizes remain moderate, prompting widespread use of co-investments and syndication across consumer goods, logistics, telecom, and healthcare sectors. The fragmented nature of these industries provides ample consolidation opportunities, enabling PE firms to extract value via operational improvements. Enhanced regulatory clarity and financing options further drive deal momentum. These trends underpin growing geographic and sector diversification, reinforcing Turkey private equity market growth across domestic and regional dimensions.

Turkey Private Equity Market Segmentation:

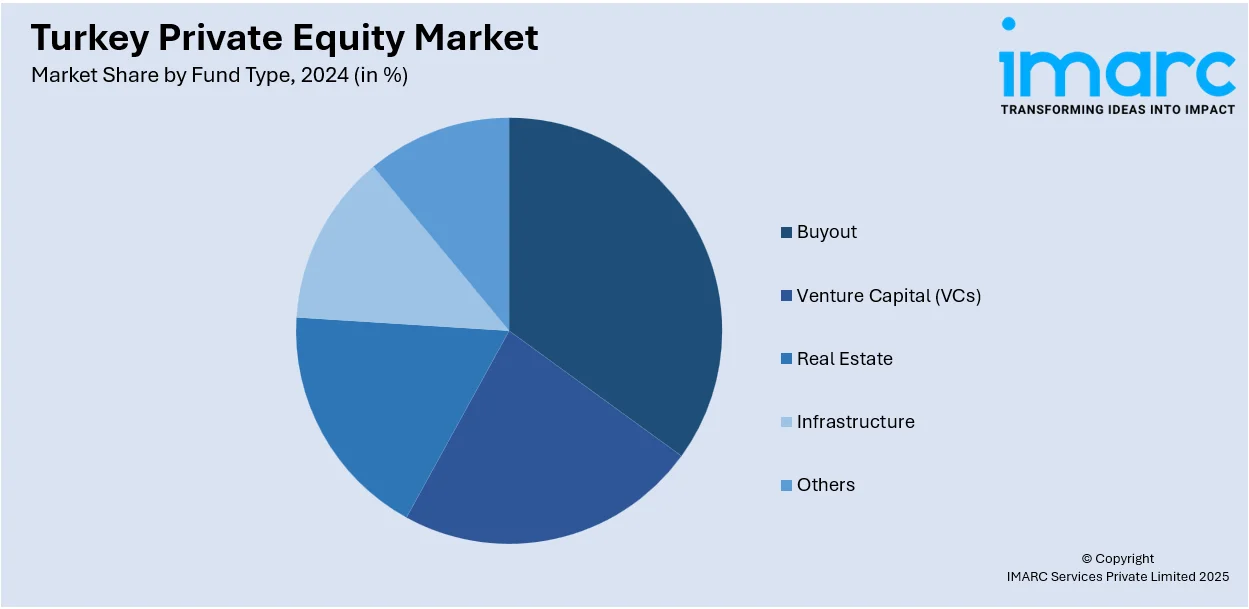

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Private Equity Market News:

- In May 2025, Lycian Capital Partners, a Turkey-focused private equity firm backed by Azimut Group, announced its second investment from its debut fund. The firm, which focuses on mid-market Turkish businesses in sectors including consumer, manufacturing, and technology, acquired a stake in a sportswear retailer jointly with another PE firm. This milestone reflects Lycian’s progression through its inaugural fund and its deepening commitment to supporting growth-oriented, scalable enterprises in Turkey’s evolving private equity ecosystem.

- In March 2025, Mediterra Capital secured a significant limited partner commitment from the Türkiye Development Fund for its €165 million Mediterra Capital Partners III, focused on lower mid‑market Turkish firms. Cornerstone investors including IFC, EBRD, and FMO joined at the first close, each contributing €20‑25 million. The fund targets majority stakes in technology‑driven, consumer‑oriented, and export‑focused businesses across Turkey, including Anatolia. The institutional backing aims to catalyze capital inflows, support sustainable growth strategies, and strengthen gender and ESG integration in the country’s private equity ecosystem.

Turkey Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey private equity market on the basis of fund type?

- What is the breakup of the Turkey private equity market on the basis of region?

- What are the various stages in the value chain of the Turkey private equity market?

- What are the key driving factors and challenges in the Turkey private equity market?

- What is the structure of the Turkey private equity market and who are the key players?

- What is the degree of competition in the Turkey private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)