Turkey Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, and Seed Treatment, and Region, 2025-2033

Turkey Seeds Market Overview:

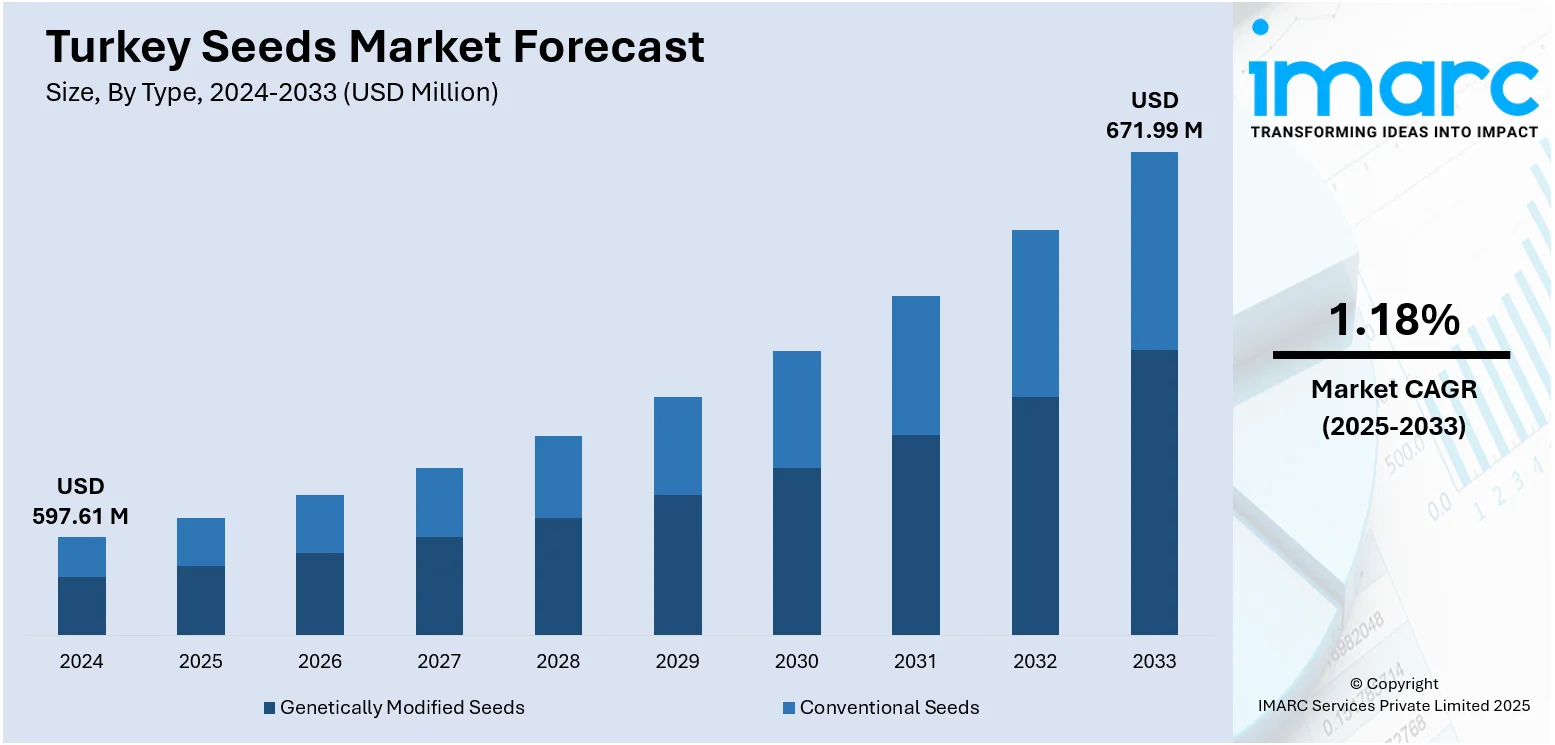

The Turkey seeds market size reached USD 597.61 Million in 2024. The market is projected to reach USD 671.99 Million by 2033, exhibiting a growth rate (CAGR) of 1.18% during 2025-2033. The market is driven by rising demand for high-yield, disease-resistant crop varieties, government initiatives supporting modern farming techniques, and increasing adoption of hybrid and genetically modified seeds. Growing export opportunities, coupled with advancements in seed technology, are further boosting market expansion. Additionally, changing dietary preferences and the push for sustainable agriculture contribute to growth, positively influencing Turkey seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 597.61 Million |

| Market Forecast in 2033 | USD 671.99 Million |

| Market Growth Rate 2025-2033 | 1.18% |

Turkey Seeds Market Trends:

Strengthening Domestic Seed Self‑Sufficiency

In May 2024, the Minister of Agriculture and Forestry confirmed that 97 percent of all agricultural seeds used in the country are produced domestically. This milestone exemplifies how Turkey has built a resilient seed ecosystem, supported by institutions like TAGEM and a robust registration platform cataloging over 1,000 varieties. Seed variety registration expanded swiftly with 51 new varieties added across key crops such as bread wheat, barley, sunflower, chickpeas, potatoes and oilseeds. Those developments reflect not only variety diversification but also extensive breeding efforts under national breeding programmes. Certification systems and licensing procedures have grown more reliable, creating uniform standards and better access for farmers. As a result, growers increasingly benefit from certified, locally adapted seed options tailored to regional agro‑climates. This mature infrastructure reduces reliance on imported seeds and enhances domestic agronomic stability. Overall, this underscores the structural foundation of Turkey’s expanding seed ecosystem, paving the way for reliable supply and long‑term viability. These developments highlight how Turkey seeds market growth is anchored in domestic self‑sufficiency, expanding export competitiveness, and certified variety expansion.

To get more information on this market, Request Sample

Export-Led Expansion of Seed Production

In December 2024, national reporting revealed that Turkey’s seed sector achieved hundreds of millions in export earnings, signaling growing international demand. That performance places Turkey firmly among seed-exporting nations, supplying over 117 international markets with domestically produced seed varieties. Hosted events such as the World Seed Congress in Istanbul further elevated Turkey’s global visibility and facilitated partnerships with international seed networks. This export momentum reflects both improved production scale and rising confidence in Turkish seed quality and adaptability. The government's new crop production model, introduced in years, prioritizes sustainable intensification and diversification ranging from cereals to horticultural seed lines supporting supply chain modernization and logistic efficiency. Together, these dynamics propel international trade while reinforcing domestic capacity. The combined effect of strong export momentum and evolving strategic production policies positions the sector for broader reach and deeper market integration. These powerful forces are shaping Turkey seeds market trends, positioning the country as a rising seed sector leader with sustainable and globally respected capabilities.

Development of Certified and Diverse Seed Varieties

In 2024, Turkey experienced significant advancements in certified seed production, with its crop portfolio expanding to include a broad array of crops ranging from cereals, vegetables, and industrial plants to assorted seedlings for fruit and flower crops. This progress is a testimony to continued efforts by national breeding organizations and certification agencies to uphold and enhance the quality and performance standards of seeds. Seed variety diversity available currently spans staple crops like wheat and sunflower to pulses and specialty vegetables suited for various regional climates. Certification processes are more stringent, guaranteeing consistent germination rates and seed health, raising farmer confidence and uptake. Through increased quantity and availability of certified seeds, Turkey enhances the resilience and productivity of its agricultural sector. These initiatives contribute to a more sustainable seed sector with the ability to supply domestic needs while preparing Turkey for seed production and distribution expansion in the years to come. Overall, this wide diversification and certification build a strong base for the country's farm-based future.

Turkey Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

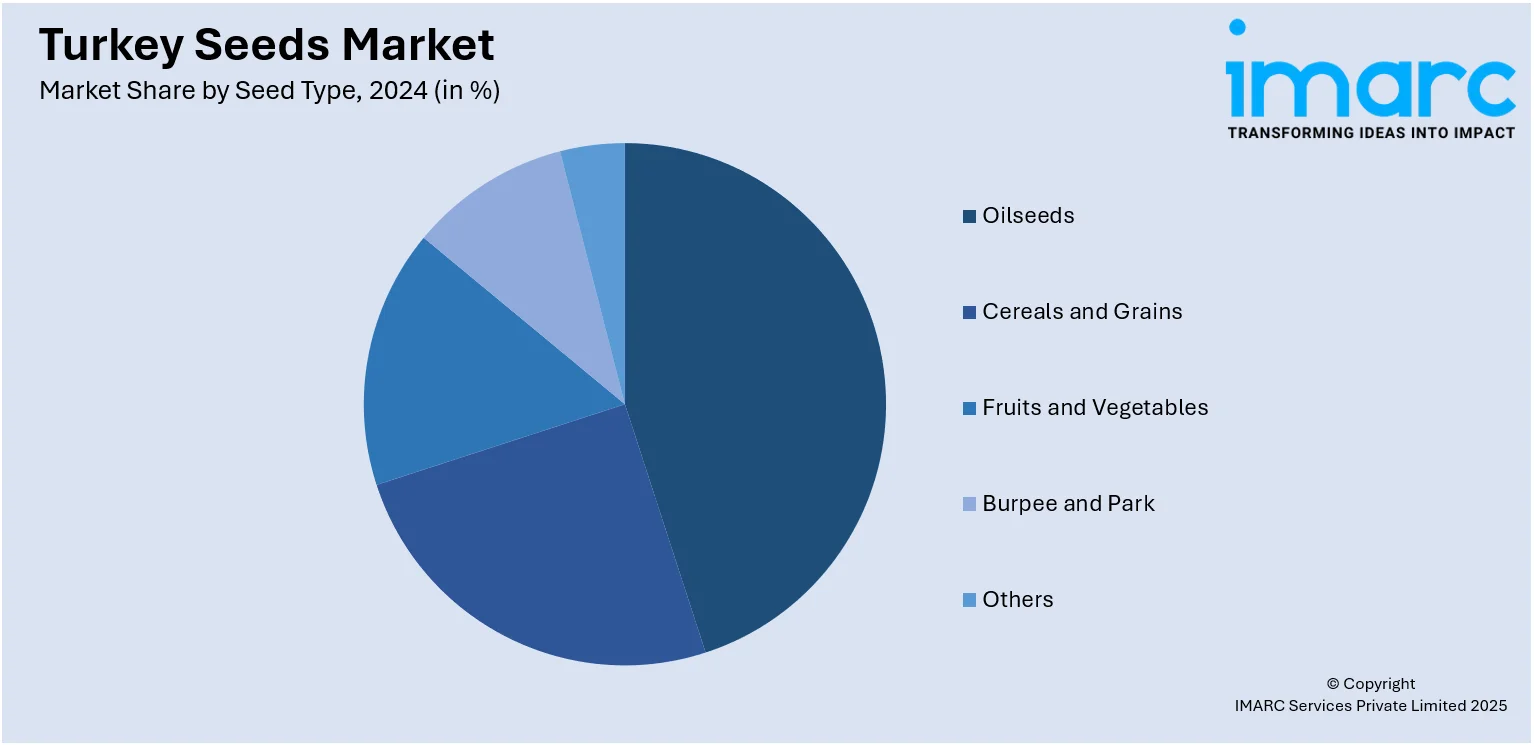

Seed Type Insights:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include the Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey seeds market on the basis of type?

- What is the breakup of the Turkey seeds market on the basis of seed type?

- What is the breakup of the Turkey seeds market on the basis of traits?

- What is the breakup of the Turkey seeds market on the basis of availability?

- What is the breakup of the Turkey seeds market on the basis of seed treatment?

- What is the breakup of the Turkey seeds market on the basis of region?

- What are the various stages in the value chain of the Turkey seeds market?

- What are the key driving factors and challenges in the Turkey seeds market?

- What is the structure of the Turkey seeds market and who are the key players?

- What is the degree of competition in the Turkey seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey seeds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)