Turkey Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Turkey Steel Tubes Market Overview:

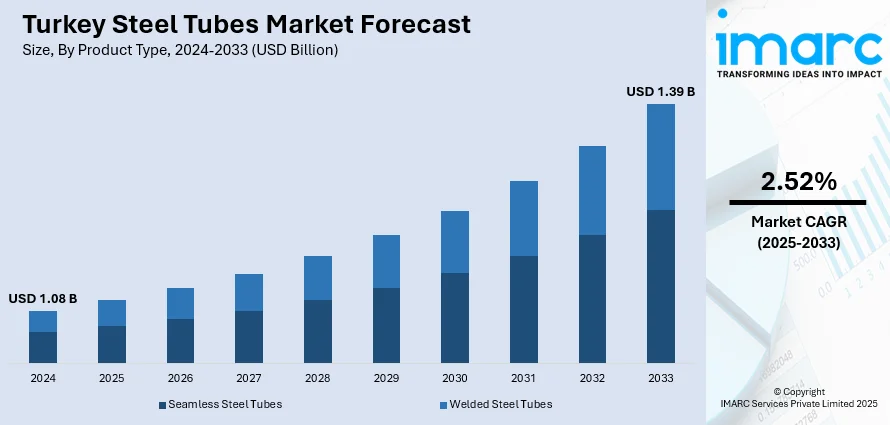

The Turkey steel tubes market size reached USD 1.08 Billion in 2024. The market is projected to reach USD 1.39 Billion by 2033, exhibiting a growth rate (CAGR) of 2.52% during 2025-2033. The market is experiencing steady growth, driven by rising demand across construction, automotive, and oil & gas industries. Technological developments in manufacturing and requirements for durable, corrosion-resistant products continue to spur market growth. Infrastructural spending and growing industrial activity also accelerate adoption. Players are also placing emphasis on product innovation and geographical expansion to consolidate their positions. With changing industry dynamics, stakeholders are adapting strategically in response to shifting needs, boosting the overall competitiveness of Turkey steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.08 Billion |

| Market Forecast in 2033 | USD 1.39 Billion |

| Market Growth Rate 2025-2033 | 2.52% |

Turkey Steel Tubes Market Trends:

Strong Export Volume Sets the Tone

In April 2025, Turkey’s welded pipe exports for February totaled 132,845 metric tons, marking a measurable rebound compared to the prior month. That upward trend isn’t just a blip it’s part of a steady realignment in Turkey’s role in the global steel tubes market. Europe remains a key destination, with rising demand from Italy and Germany signaling broader recovery in construction and energy sectors. Turkish producers are now tapping into this resurgence more efficiently, thanks to shorter delivery routes, cost advantages, and favorable trade positioning. This rebound also reflects internal improvements in production agility and export logistics, which are helping suppliers meet surging international orders without major bottlenecks. As global infrastructure projects gain momentum particularly in water systems, industrial piping, and energy transmission Turkey’s steel tube sector is stepping into a stronger, more consistent rhythm. Export figures like these set a clear tone: momentum is returning, and with it, renewed confidence in long-term performance. All signs point to a promising phase for Turkey steel tubes market growth, particularly as demand stabilizes across multiple key regions.

To get more information on this market, Request Sample

Production Leadership Drives Broader Market Strength

In March 2024, Turkey’s production of tubes, pipes, and hollow steel profiles reached millions of tons, placing it firmly at the forefront of regional output, ahead of countries like Saudi Arabia and the UAE. This milestone reflects the strength of Turkey’s manufacturing infrastructure and its ability to meet both domestic and international demand with confidence. A growing number of public infrastructure initiatives ranging from transportation to water networks are fueling consistent demand at home, while export channels remain robust and responsive. The country’s well-developed production ecosystem supports rapid delivery timelines, cost-effective scaling, and dependable quality attributes that continue to attract global buyers. This sustained leadership is a strong signal to market observers: Turkey isn’t just participating in the regional market it’s actively shaping its direction. As strategic projects accelerate across Europe, North Africa, and Central Asia, Turkey is positioned to supply with speed and scale. All these indicators point toward a healthy, forward-moving trajectory for Turkey steel tubes market trends.

Policy Measures Strengthen Local Manufacturing Confidence

In October 2024, Turkey officially enacted anti-dumping duties on steel imports from several key countries, including China, Russia, India, and Japan. The decision, backed by the Trade Ministry, aimed to counteract unfair pricing practices and create more breathing room for local manufacturers. These tariffs, applied tons of imported steel, have started to create a positive ripple effect across domestic markets. With fewer underpriced imports flooding in, Turkish producers are seeing stronger order books and better utilization of in-country capacity. The shift is reinforcing investor confidence and helping stabilize pricing in ways that support long-term planning. For many manufacturers, the move has rebalanced market dynamics creating a healthier environment to scale output, especially for infrastructure and utility-related steel tubing. More stable conditions also encourage reinvestment in machinery and innovation, laying a foundation for future competitiveness. All told, this decisive policy step is viewed as a strategic win that supports ongoing industrial development and reinforces the upward trajectory of Turkey steel tubes market.

Turkey Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

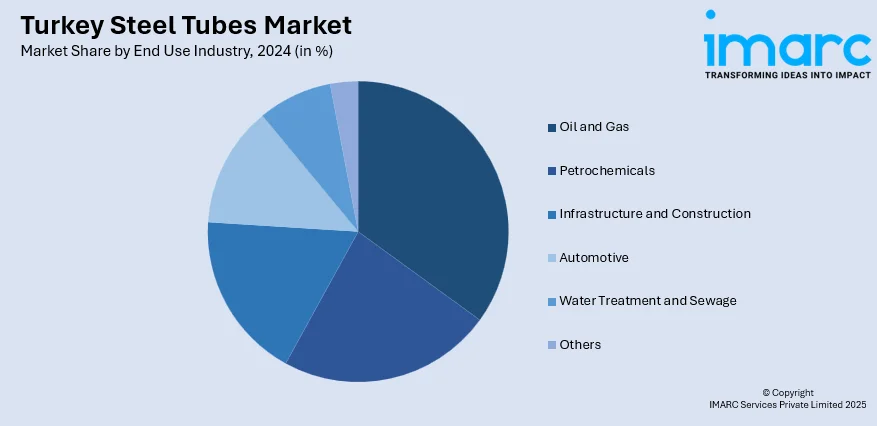

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include the Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Steel Tubes Market News:

- January 2025: Turkey has become a strategic hub for YC Inox Company Limited, as the Taiwan-based stainless-steel manufacturer inaugurates its new industrial stainless steel pipe facility in the country. Trial production began early this year, with full-scale operations expected soon. This move complements YC Inox’s existing cutting and structural pipe activities in Turkey. The expansion underscores the company’s long-term commitment to the region and highlights Turkey’s growing importance in the global stainless steel manufacturing landscape.

- January 2025: Turkey is positioned to benefit from American GLGH Steel’s acquisition of Romania’s Artrom Steel Tubes S.A., a prominent seamless steel pipe manufacturer. This strategic move will help Artrom expand into new European and North American markets. The acquisition highlights opportunities for increased collaboration and trade between Turkey and the region’s steel industries. With Romania’s advanced manufacturing and Turkey’s growing steel sector, this partnership may strengthen regional supply chains and open new avenues for Turkish companies seeking international expansion in steel manufacturing.

Turkey Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey steel tubes market on the basis of product type?

- What is the breakup of the Turkey steel tubes market on the basis of material type?

- What is the breakup of the Turkey steel tubes market on the basis of end use industry?

- What is the breakup of the Turkey steel tubes market on the basis of region?

- What are the various stages in the value chain of the Turkey steel tubes market?

- What are the key driving factors and challenges in the Turkey steel tubes market?

- What is the structure of the Turkey steel tubes market and who are the key players?

- What is the degree of competition in the Turkey steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)